UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

______________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 19, 2014

ARK RESTAURANTS CORP.

(Exact name of registrant as specified in its

charter)

| New York |

1-09453 |

13-3156768 |

|

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

85 Fifth Avenue

New York, New York 10003

(Address of principal executive

offices, with zip code)

Registrant’s telephone number, including

area code: (212) 206-8800

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| [ ] |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| [ ] |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| [ ] |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| [ ] |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item

2.02 Results of Operations and Financial Condition.

On

December 19, 2014, ARK Restaurants Corp. (the “Company”) issued a press release announcing financial results for the

fourth quarter and full fiscal year ended September 27, 2014. A copy of the press release titled “Ark Restaurants Announces

Financial Results for the Fourth Quarter and Full Year of 2014” is attached hereto as Exhibit 99.1 and is incorporated herein

by reference.

The

press release contains certain non-GAAP Disclosures-Continuing Operations EBITDA-Earnings before interest, taxes, depreciation

and amortization adjusted for non-cash stock option expense and non-controlling interests. Although EBITDA is not a measure of

performance or liquidity calculated in accordance with generally accepted accounting principles (GAAP), the Company believes the

use of this non-GAAP financial measure enhances an overall understanding of the Company’s past financial performance, as

well as providing useful information to the investor because of its historical use by the Company as both a performance measure

and measure of liquidity, and the use of EBITDA by virtually all companies in the restaurant sector as a measure of both performance

and liquidity.

This

information is intended to be furnished under this Item 2.02 of Form 8-K and shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference

in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific

reference in such a filing.

| Item 9.01. |

Financial Statements and Exhibits. |

| |

|

| (d) |

Exhibits |

| |

|

| 99.1 |

Press Release, dated December 19, 2014. |

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

ARK RESTAURANTS CORP. |

|

| |

|

|

|

| |

|

|

|

| |

|

/s/ Michael Weinstein |

|

| |

By: |

Name: Michael Weinstein |

|

| |

|

Title: Chief Executive Officer |

|

| |

|

|

| Date: December 22, 2014 |

|

|

| |

|

|

|

|

EXHIBIT

99.1

Ark Restaurants Announces

Financial Results for the

Fourth Quarter and Full Year of 2014

CONTACT:

Robert Stewart

(212) 206-8800

bstewart@arkrestaurants.com

NEW YORK,

New York – December 19, 2014 -- Ark Restaurants Corp. (NASDAQ:ARKR) today reported financial results for the fourth quarter

and full year ended September 27, 2014.

Total revenues for the

three-month period ended September 27, 2014 were $37,072,000 versus $33,906,000 for the three months ended September 28, 2013.

The three-month period ended September 27, 2014 includes revenues of $3,477,000 related to The Rustic Inn, which was acquired on

February 24, 2014. The three-month period ended September 28, 2013 includes revenues of $1,235,000 related to two properties closed

during the third quarter of fiscal 2014 due to lease expirations.

Total revenues for the

year ended September 27, 2014 were $139,357,000 versus $130,598,000 for the year ended September 28, 2013. The year ended September

27, 2014 includes revenues of $8,753,000 related to The Rustic Inn, which was acquired on February 24, 2014 and $2,621,000 related

to Broadway Burger Bar, which was opened in the Tropicana Hotel and Casino during June 2013. The year ended September 27, 2014

also includes revenues of $3,565,000 related to two properties closed during the third fiscal quarter of 2014 due to lease expirations.

The year ended September 28, 2013 includes revenues of $414,000 related to two properties closed in the first quarter of fiscal

2013 due to lease expirations.

Company-wide same store

sales increased 2.3% for the three-month period ended September 27, 2014 compared to the same three month period last year. For

fiscal 2014 company-wide same store sales increased 0.5% compared to the same period last year.

The Company’s EBITDA,

adjusted for non-cash stock option expense and non-controlling interests, for the three-month period September 27, 2014 was $4,236,000

versus $3,458,000 during the same three-month period last year. Net income for the three-month period ended September 27, 2014

was $2,288,000, or $0.68 per basic share ($0.66 per diluted share), as compared to $1,453,000, or

$0.45 per basic share ($0.43 per diluted share), for the same three-month period

last year.

The Company’s EBITDA,

adjusted for non-cash stock option expense and non-controlling interests, for the year ended September 27, 2014 was $11,814,000

versus $10,703,000 last year. Net income for the year ended September 27, 2014 was $4,915,000, or $1.49 per basic share

($1.43 per diluted share), as compared to $3,824,000, or $1.18 per basic share ($1.13

per diluted share), for the same period last year.

On February 24, 2014,

the Company completed its acquisition of The Rustic Inn Crabhouse (“The Rustic Inn’) in Dania Beach, Florida for a

total purchase price of approximately $7,710,000. The acquisition was financed with a bank loan in the amount of $6,000,000 and

cash from operations.

On July 18, 2014, the

Company, through a wholly-owned subsidiary, Ark Jupiter RI, LLC, entered into an agreement to acquire certain assets and the related

lease for a restaurant and bar located in Jupiter, Florida for approximately $250,000. In connection with this transaction the

Company entered into an amended lease for an initial period expiring through December 31, 2015. The Company has also entered into

an additional lease through 2033 and the Company expects to open a Rustic Inn Crabhouse at this location in January 2015.

As

of September 27, 2014 the Company had cash and cash equivalents totaling $8,662,000. The Company had a seller note from the purchase

of 250,000 shares of treasury stock in December 2011 with an outstanding balance of $177,000 at September 27, 2014. The Company

also had a bank note for the purchase of membership interests in Ark Hollywood/Tampa Investment, LLC and the purchase of The Rustic

Inn with an outstanding balance of $7,140,000 at September 27, 2014.

Ark Restaurants owns

and operates 20 restaurants and bars, 21 fast food concepts and catering operations primarily in New York City, Florida, Washington,

D.C. and Las Vegas, NV. Five restaurants are located in New York City, three are located in Washington, D.C., six are located in

Las Vegas, Nevada, three are located in Atlantic City, New Jersey, one is located at the Foxwoods Resort Casino in Ledyard, Connecticut,

one is located in Boston, Massachusetts and one is located in Dania Beach, Florida. The Las Vegas operations include four restaurants

within the New York-New York Hotel & Casino Resort and operation of the hotel’s room service, banquet facilities, employee

dining room and six food court concepts; one bar within the Venetian Casino Resort, as well as two food court concepts and one

restaurant within the Planet Hollywood Resort and Casino. In Atlantic City, New Jersey, the Company operates a restaurant and a

bar in the Resorts Atlantic City Hotel and Casino and a restaurant in the Tropicana Hotel and Casino. The operations at the Foxwoods

Resort Casino include one fast food concept and one restaurant. In Boston, Massachusetts, the Company operates a restaurant in

the Faneuil Hall Marketplace. The Florida operations include The Rustic Inn in Dania Beach, Florida and the operation of five fast

food facilities in Tampa, Florida and seven fast food facilities in Hollywood, Florida, each at a Hard Rock Hotel and Casino operated

by the Seminole Indian Tribe at these locations.

Except for historical

information, this news release contains forward-looking statements, within the meaning of Section 27A of the Securities Act of

1933 and Section 21E of the Securities Exchange Act of 1934. These statements involve unknown risks, and uncertainties that may

cause the Company’s actual results or outcomes to be materially different from those anticipated and discussed herein. Important

factors that might cause such differences are discussed in the Company’s filings with the Securities and Exchange Commission.

The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new

information, future events or otherwise. Actual results could differ materially from those anticipated in these forward-looking

statements, if new information becomes available in the future.

| ARK RESTAURANTS CORP. | |

| |

| |

| |

|

| Consolidated Statements of Income | |

| |

| |

| |

|

| For the 13 week and 52 week periods ended September 27, 2014 and September 28, 2013 | |

| |

| |

|

| | |

| |

| |

| |

|

| (In Thousands, Except per share amounts) |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| 13 weeks ended | | |

| 13 weeks ended | | |

| 52 weeks ended | | |

| 52 weeks ended | |

| | |

| September 27, | | |

| September 28, | | |

| September 27, | | |

| September 28, | |

| | |

| 2014 | | |

| 2013 | | |

| 2014 | | |

| 2013 | |

| | |

| | | |

| | | |

| | | |

| | |

| TOTAL REVENUES | |

$ | 37,072 | | |

$ | 33,906 | | |

$ | 139,357 | | |

$ | 130,598 | |

| | |

| | | |

| | | |

| | | |

| | |

| COST AND EXPENSES: | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Food and beverage cost of sales | |

| 10,126 | | |

| 8,648 | | |

| 37,091 | | |

| 32,791 | |

| Payroll expenses | |

| 11,438 | | |

| 10,722 | | |

| 44,427 | | |

| 42,488 | |

| Occupancy expenses | |

| 4,473 | | |

| 4,470 | | |

| 17,388 | | |

| 17,533 | |

| Other operating costs and expenses | |

| 4,285 | | |

| 4,287 | | |

| 17,802 | | |

| 17,085 | |

| General and administrative expenses | |

| 2,611 | | |

| 2,228 | | |

| 10,402 | | |

| 9,792 | |

| Depreciation and amortization | |

| 1,235 | | |

| 1,124 | | |

| 4,619 | | |

| 4,303 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total costs and expenses | |

| 34,168 | | |

| 31,479 | | |

| 131,729 | | |

| 123,992 | |

| | |

| | | |

| | | |

| | | |

| | |

| OPERATING INCOME | |

| 2,904 | | |

| 2,427 | | |

| 7,628 | | |

| 6,606 | |

| | |

| | | |

| | | |

| | | |

| | |

| OTHER (INCOME) EXPENSE: | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Interest (income) expense, net | |

| 15 | | |

| 29 | | |

| 156 | | |

| 62 | |

| Other (income) expense, net | |

| (186 | ) | |

| (90 | ) | |

| (488 | ) | |

| (508 | ) |

| Total other income, net | |

| (171 | ) | |

| (61 | ) | |

| (332 | ) | |

| (446 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| INCOME BEFORE PROVISION FOR INCOME TAXES | |

| 3,075 | | |

| 2,488 | | |

| 7,960 | | |

| 7,052 | |

| | |

| | | |

| | | |

| | | |

| | |

| Provision for income taxes | |

| 593 | | |

| 773 | | |

| 1,775 | | |

| 1,941 | |

| | |

| | | |

| | | |

| | | |

| | |

| CONSOLIDATED NET INCOME | |

| 2,482 | | |

| 1,715 | | |

| 6,185 | | |

| 5,111 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income attributable to non-controlling interests | |

| (194 | ) | |

| (262 | ) | |

| (1,270 | ) | |

| (1,287 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| NET INCOME ATTRIBUTABLE TO ARK RESTAURANTS CORP. | |

$ | 2,288 | | |

$ | 1,453 | | |

$ | 4,915 | | |

$ | 3,824 | |

| | |

| | | |

| | | |

| | | |

| | |

| NET INCOME PER ARK RESTAURANTS CORP. COMMON SHARE: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.68 | | |

$ | 0.45 | | |

$ | 1.49 | | |

$ | 1.18 | |

| Diluted | |

$ | 0.66 | | |

$ | 0.43 | | |

$ | 1.43 | | |

$ | 1.13 | |

| | |

| | | |

| | | |

| | | |

| | |

| WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 3,374 | | |

| 3,248 | | |

| 3,296 | | |

| 3,246 | |

| Diluted | |

| 3,481 | | |

| 3,395 | | |

| 3,430 | | |

| 3,371 | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| EBITDA Reconciliation: | |

| | | |

| | | |

| | | |

| | |

| Pre tax income | |

$ | 3,075 | | |

$ | 2,488 | | |

$ | 7,960 | | |

$ | 7,052 | |

| Depreciation and amortization | |

| 1,235 | | |

| 1,124 | | |

| 4,619 | | |

| 4,303 | |

| Interest expense, net | |

| 15 | | |

| 29 | | |

| 156 | | |

| 62 | |

| EBITDA (a) | |

$ | 4,325 | | |

$ | 3,641 | | |

$ | 12,735 | | |

$ | 11,417 | |

| | |

| | | |

| | | |

| | | |

| | |

| EBITDA adjusted for non-cash stock option expense, | |

| | | |

| | | |

| | | |

| | |

| and non-controlling interests: | |

| | | |

| | | |

| | | |

| | |

| EBITDA (as defined) (a) | |

$ | 4,325 | | |

$ | 3,641 | | |

$ | 12,735 | | |

$ | 11,417 | |

| Loss on closure of restaurants | |

| — | | |

| — | | |

| — | | |

| 256 | |

| Net (income) loss attributable to non-controlling interests | |

| (194 | ) | |

| (262 | ) | |

| (1,270 | ) | |

| (1,287 | ) |

| Non-cash stock option expense | |

| 105 | | |

| 79 | | |

| 349 | | |

| 317 | |

| EBITDA, as adjusted | |

$ | 4,236 | | |

$ | 3,458 | | |

$ | 11,814 | | |

$ | 10,703 | |

| (a) | EBITDA is defined as earnings before interest, taxes, depreciation and amortization and cumulative

effect of changes in accounting principle. Although EBITDA is not a measure of performance or liquidity calculated in accordance

with generally accepted accounting principles (GAAP), the Company believes the use of this non-GAAP financial measure enhances

an overall understanding of the Company's past financial performance as well as providing useful information to the investor because

of its historical use by the Company as both a performance measure and measure of liquidity, and the use of EBITDA by virtually

all companies in the restaurant sector as a measure of both performance and liquidity. However, investors should not consider this

measure in isolation or as a substitute for net income (loss), operating income (loss), cash flows from operating activities or

any other measure for determining the Company's operating performance or liquidity that is calculated in accordance with GAAP,

it may not necessarily be comparable to similarly titled measures employed by other companies. A reconciliation of EBITDA to the

most comparable GAAP financial measure, pre-tax income, is included above. |

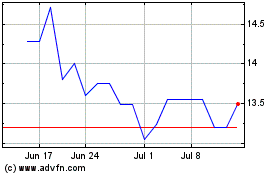

Ark Restaurants (NASDAQ:ARKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ark Restaurants (NASDAQ:ARKR)

Historical Stock Chart

From Apr 2023 to Apr 2024