UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) December 18, 2014

NEOGEN CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| MICHIGAN |

|

0-17988 |

|

38-2367843 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 620 Lesher Place Lansing,

Michigan |

|

48912 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code 517-372-9200

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition

On December 18, 2014, Neogen Corporation issued a press release announcing results of operations for the fiscal quarter and year to date

periods ended November 30, 2014. A copy of the press release is attached as Exhibit 99.1 to this report. This Form 8-K and the attached exhibit shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act

of 1934, as amended, and are not incorporated by reference into any filing of the Registrant, whether made before or after the date of this report, regardless of any general incorporation language in the filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

|

|

| 99.1 |

|

Press Release dated December 18, 2014 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

NEOGEN CORPORATION |

|

|

|

|

(Registrant) |

| Date: December 19, 2014 |

|

|

|

|

|

|

|

|

|

|

/s/ Steven J. Quinlan |

|

|

|

|

Steven J. Quinlan |

|

|

|

|

Vice President & CFO |

Exhibit 99.1

FOR IMMEDIATE RELEASE

| CONTACT: |

Steven J. Quinlan, Vice President and CFO |

Neogen reports 26% increase in net income

LANSING, Mich., Dec. 18, 2014 — Neogen Corporation (NASDAQ: NEOG) announced today that its net income for the second quarter of fiscal 2015, which ended

Nov. 30, increased 26% to $7,806,000, when compared to the prior year’s $6,207,000. Earnings per share in the current quarter were $0.21, compared to $0.17 a year ago. Current year-to-date net income was $16,689,000, or $0.45 per share,

compared to $14,045,000, or $0.38 per share, for the same period a year ago.

Revenues for the second quarter of fiscal 2015 increased 15% to $68,455,000,

from the previous year’s second quarter revenues of $59,599,000. This increase was aided in part by recent acquisitions completed by the company. The quarterly revenue and net income results represent second quarter records for the 32-year-old

company. Year to date, FY 2015 revenues increased 15% to $136,054,000 from FY 2014’s $118,147,000.

“Our second quarter shows Neogen’s

growth strategy continues to provide solid results,” said James Herbert, Neogen’s chief executive officer and chairman. “Today, we are reporting strong second quarter revenue and net income increases, as we expand our core business

and efficiently integrate recent acquisitions. Continuing to effectively utilize this combination of growth strategies expands our future growth opportunities in our diverse global markets.”

The second quarter was the 91st of the past 96 quarters that Neogen reported revenue increases as compared with the previous year — including all

consecutive quarters in the last nine years.

Neogen’s gross margin was 50.0% in its current second quarter, compared to 49.5% for FY 2014’s

second quarter. This increase was largely the result of favorable product mix shifts and improved efficiencies within the company’s Animal Safety segment. Operating income increased 33% in the quarter compared to the prior year, primarily

driven by the increased revenues and improved gross margins. Additionally, operating expense growth was less than the rate of revenue growth. Administrative expense declined during the quarter due in part to lower legal expenses. Operating income as

a percentage of sales increased to 18.8% in the current quarter, as compared to 16.3% in the second quarter of the company’s 2014 fiscal year.

“Reporting a second quarter net income increase in excess of our double-digit revenue increase points to improved efficiencies within our diverse

operations,” said Steve Quinlan, Neogen’s chief financial officer. “With respect to the balance sheet, we were also able to decrease our inventory levels compared to the first quarter of the current fiscal year, as we work through the

inventories acquired in our recent acquisitions. Our strong cash position and no debt give us great flexibility to continue to invest in our businesses going forward.”

Revenues for the company’s Food Safety segment rose 16% during the second quarter, compared to the prior year, aided in part by the Oct. 1, 2014 BioLumix

acquisition. Sales from the company’s Scotland-based European subsidiary increased 20% in the current quarter, as it continued to show strong results in a number of food safety diagnostic product lines, such as allergens and mycotoxins, and

genomic testing services in Europe.

Sales of Neogen’s innovative rapid tests for food allergens continued their strong advance, improving

approximately 11% in the current quarter compared to the prior year’s second quarter. This performance was in part the result of rapidly accelerating consumer demand for gluten-free products, combined with Neogen’s industry-leading simple

and accurate testing products to detect gluten in food and environmental samples. Sales of the company’s gluten detection products have also been augmented by the recent setting of global food industry standards by which a company is entitled

to declare its products as gluten-free.

Sales of Neogen’s general microbiology products increased 36% in current quarter compared to the prior year,

in part due to the BioLumix acquisition. Neogen will integrate the similar BioLumix and Soleris test systems, building upon the strengths of each. The systems offer significant advantages over traditional culture methods to detect the presence of

spoilage organisms, such as yeast and mold.

Current year second quarter revenue increases of 14% for the company’s Animal Safety segment were aided

by the November 2013 acquisition of Prima Tech (veterinary instruments) and January 2014 acquisition of Chem-Tech (agricultural insecticides). The sales performance of the Prima Tech product line in its first year of Neogen ownership led to an

additional earn-out payment to Prima Tech’s former owners, which is reflected as “Other” expense in the following summarized operating data. The Prima Tech product line is used by farmers, ranchers, and veterinarians to inject

animals, provide topical applications, and to use for oral administration.

Second quarter growth included a strong revenue increase from GeneSeek, the

company’s Nebraska-based genomics service laboratory. This increase was due in large part to the increased operational capacity gained by a move into larger and upgraded facilities in May 2014. In the second quarter of the current fiscal year,

GeneSeek processed over 25% more genomic samples than the second quarter of the prior year, and is on pace to well exceed the 1 million samples processed in Neogen’s 2014 fiscal year. GeneSeek’s revenue increase in the current quarter

is also due to increasing acceptance and use of its new genomic profiling products, particularly in bovine testing, a steady increase in the companion animal business, and growth in international markets, especially Europe and Brazil.

Neogen Corporation develops and markets products dedicated to food and animal safety. The company’s Food Safety Division markets dehydrated culture media

and diagnostic test kits to detect foodborne bacteria, natural toxins, food allergens, drug residues, plant diseases and sanitation concerns. Neogen’s Animal Safety Division is a leader in the development of animal genomics along with the

manufacturing and distribution of a variety of animal healthcare products, including diagnostics, pharmaceuticals, veterinary instruments, wound care and disinfectants.

Certain portions of this news release that do not relate to historical financial information constitute forward-looking statements. These forward-looking

statements are subject to certain risks and uncertainties. Actual future results and trends may differ materially from historical results or those expected depending on a variety of factors listed in Management’s Discussion and Analysis of

Financial Condition and Results of Operations in the Company’s most recently filed Form 10-K.

NEOGEN CORPORATION UNAUDITED SUMMARIZED CONSOLIDATED OPERATING DATA

(In thousands, except for per share and percentages)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter ended Nov. 30 |

|

|

Six months ended Nov. 30 |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Food Safety |

|

$ |

32,955 |

|

|

$ |

28,399 |

|

|

$ |

63,918 |

|

|

$ |

58,398 |

|

| Animal Safety |

|

|

35,500 |

|

|

|

31,200 |

|

|

|

72,136 |

|

|

|

59,749 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenue |

|

|

68,455 |

|

|

|

59,599 |

|

|

|

136,054 |

|

|

|

118,147 |

|

| Cost of sales |

|

|

34,247 |

|

|

|

30,108 |

|

|

|

67,770 |

|

|

|

58,292 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross margin |

|

|

34,208 |

|

|

|

29,491 |

|

|

|

68,284 |

|

|

|

59,855 |

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales & marketing |

|

|

12,743 |

|

|

|

11,219 |

|

|

|

24,963 |

|

|

|

21,543 |

|

| Administrative |

|

|

6,094 |

|

|

|

6,280 |

|

|

|

12,107 |

|

|

|

11,815 |

|

| Research & development |

|

|

2,474 |

|

|

|

2,303 |

|

|

|

4,878 |

|

|

|

4,390 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

21,311 |

|

|

|

19,802 |

|

|

|

41,948 |

|

|

|

37,748 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

12,897 |

|

|

|

9,689 |

|

|

|

26,336 |

|

|

|

22,107 |

|

| Other income (expense) |

|

|

(471 |

) |

|

|

39 |

|

|

|

(201 |

) |

|

|

(483 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before tax |

|

|

12,426 |

|

|

|

9,728 |

|

|

|

26,135 |

|

|

|

21,624 |

|

| Income tax |

|

|

4,600 |

|

|

|

3,500 |

|

|

|

9,400 |

|

|

|

7,700 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

7,826 |

|

|

$ |

6,228 |

|

|

$ |

16,735 |

|

|

$ |

13,924 |

|

| Net loss (income) attributable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| to non-controlling interest |

|

$ |

(20 |

) |

|

$ |

(21 |

) |

|

$ |

(46 |

) |

|

$ |

121 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to Neogen Corp |

|

$ |

7,806 |

|

|

$ |

6,207 |

|

|

$ |

16,689 |

|

|

$ |

14,045 |

|

| Net income attributable to Neogen Corp per diluted share |

|

$ |

0.21 |

|

|

$ |

0.17 |

|

|

$ |

0.45 |

|

|

$ |

0.38 |

|

| Other information: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares to calculate per share |

|

|

37,379 |

|

|

|

37,374 |

|

|

|

37,331 |

|

|

|

37,241 |

|

| Depreciation & amortization |

|

$ |

2,657 |

|

|

$ |

2,185 |

|

|

$ |

5,171 |

|

|

$ |

4,214 |

|

| Interest income |

|

|

47 |

|

|

|

28 |

|

|

|

92 |

|

|

|

59 |

|

| Gross margin (% of sales) |

|

|

50.0 |

% |

|

|

49.5 |

% |

|

|

50.2 |

% |

|

|

50.7 |

% |

| Operating income (% of sales) |

|

|

18.8 |

% |

|

|

16.3 |

% |

|

|

19.4 |

% |

|

|

18.7 |

% |

| Revenue increase vs. FY 2014 |

|

|

14.9 |

% |

|

|

|

|

|

|

15.2 |

% |

|

|

|

|

| Net income vs. FY 2014 |

|

|

25.8 |

% |

|

|

|

|

|

|

18.8 |

% |

|

|

|

|

NEOGEN CORPORATION SUMMARIZED CONSOLIDATED BALANCE SHEET DATA

(In thousands)

|

|

|

|

|

|

|

|

|

| |

|

Nov. 30 |

|

|

May 31 |

|

| |

|

2014 |

|

|

2014 |

|

| |

|

(Unaudited) |

|

|

(Audited) |

|

| Assets |

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

| Cash & investments |

|

$ |

94,305 |

|

|

$ |

76,496 |

|

| Accounts receivable |

|

|

52,107 |

|

|

|

51,901 |

|

| Inventory |

|

|

53,497 |

|

|

|

51,178 |

|

| Other current assets |

|

|

5,841 |

|

|

|

9,171 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

205,750 |

|

|

|

188,746 |

|

| Property & equipment, net |

|

|

43,106 |

|

|

|

41,949 |

|

| Goodwill & other assets |

|

|

117,061 |

|

|

|

114,606 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

365,917 |

|

|

$ |

345,301 |

|

| Liabilities & Equity |

|

|

|

|

|

|

|

|

| Current liabilities |

|

$ |

24,114 |

|

|

$ |

24,967 |

|

| Long-term debt |

|

|

— |

|

|

|

— |

|

| Other long-term liabilities |

|

|

15,011 |

|

|

|

14,034 |

|

| Equity: Shares outstanding 36,958 in Nov. & 36,732 in May |

|

|

326,792 |

|

|

|

306,300 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities & equity |

|

$ |

365,917 |

|

|

$ |

345,301 |

|

###

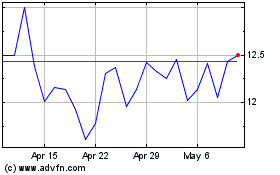

Neogen (NASDAQ:NEOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Neogen (NASDAQ:NEOG)

Historical Stock Chart

From Apr 2023 to Apr 2024