UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

December 11, 2014

Date of Report (Date of earliest event reported)

ADVANCED

MICRO DEVICES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-07882 |

|

94-1692300 |

| (State of

Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification Number) |

One AMD Place

P.O. Box 3453

Sunnyvale,

California 94088-3453

(Address of principal executive offices) (Zip Code)

(408) 749-4000

(Registrant’s telephone number, including area code)

N/A

(Former Name or

Former Address, if Changed Since Last Report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01. |

Entry into a Material Definitive Agreement. |

On December 11, 2014, Advanced Micro Devices, Inc., a

Delaware corporation (the “Company”), and AMD International Sales & Service, Ltd., a Delaware corporation and wholly-owned subsidiary of the Company (together with the Company, the “Borrowers”), entered into a First

Amendment to Loan and Security Agreement (the “First Amendment”) by and among the Borrowers, the financial institutions party thereto as lenders (the “Lenders”) and Bank of America, N.A., a national banking association, as agent

for the Lenders (the “Agent”), which modifies that certain Loan and Security Agreement, dated as of November 12, 2013 (the “Loan Agreement”), by and among the Borrowers, the Lenders and the Agent.

The First Amendment amends the Loan Agreement to reduce the minimum amount of domestic cash or cash equivalents held in certain accounts of the Borrowers from

$500,000,000 to $250,000,000, which the Borrowers are required to hold in order to avoid triggering certain financial covenants and other restrictive terms contained in the Loan Agreement, as well as to change certain financial and other

definitions.

The First Amendment was designed to provide the Company with greater operational flexibility.

The Borrowers did not pay any amendment fees to the Lenders in connection with the First Amendment.

The preceding description of the First Amendment is qualified in its entirety by reference to the entire text of the First Amendment, filed as Exhibit 10.1 to

this Current Report on Form 8-K and incorporated herein by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

|

|

|

| Exhibit No. |

|

Description |

|

|

| 10.1 |

|

First Amendment to Loan and Security Agreement, dated as of December 11, 2014, by and among the Company, AMD International Sales & Service, Ltd., the financial institutions party thereto as lenders and Bank of America,

N.A. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| Date: December 17, 2014 |

|

|

|

ADVANCED MICRO DEVICES, INC. |

|

|

|

|

|

|

|

|

By: |

|

/s/ Devinder Kumar |

|

|

|

|

Name: |

|

Devinder Kumar |

|

|

|

|

Title: |

|

Senior Vice President and Chief Financial Officer |

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Description |

|

|

| 10.1 |

|

First Amendment to Loan and Security Agreement, dated as of December 11, 2014, by and among Advanced Micro Devices, Inc., AMD International Sales & Service, Ltd., the financial institutions party thereto as lenders and Bank

of America, N.A. |

Exhibit 10.1

FIRST AMENDMENT TO

LOAN

AND SECURITY AGREEMENT

THIS FIRST AMENDMENT TO LOAN AND SECURITY AGREEMENT (this “Amendment”), dated as of

December 11, 2014, is by and among ADVANCED MICRO DEVICES, INC., a Delaware corporation (“Parent”), AMD INTERNATIONAL SALES & SERVICE, LTD., a Delaware corporation (“AMDISS”; together

with Parent each, individually, a “Borrower” and, collectively, the “Borrowers”), the Lenders party hereto, and BANK OF AMERICA, N.A., as administrative agent (in such capacity, the “Agent”).

Capitalized terms used herein and not otherwise defined herein shall have the meanings ascribed thereto in the Loan Agreement (defined below).

W I T N E S S E T H

WHEREAS, the Borrowers, certain banks and financial institutions from time to time party thereto (the “Lenders”), and

the Agent are parties to that certain Loan and Security Agreement dated as of November 12, 2013 (as amended, modified, extended, restated, replaced, or supplemented from time to time, the “Loan Agreement”);

WHEREAS, the Borrowers have requested that the Required Lenders amend certain provisions of the Loan Agreement; and

WHEREAS, the Required Lenders are willing to make such amendments to the Loan Agreement, in accordance with and subject to the terms

and conditions set forth herein.

NOW, THEREFORE, in consideration of the agreements hereinafter set forth, and for other good and

valuable consideration, the receipt and adequacy of which are hereby acknowledged, the parties hereto agree as follows:

ARTICLE I

AMENDMENTS TO LOAN AGREEMENT

1.1 Amendment to Definition of “Adjusted EBITDA”. The definition of “Adjusted EBITDA” set forth in

Section 1.1 of the Loan Agreement is hereby amended and restated in its entirety to read as follows:

Adjusted

EBITDA: determined on a consolidated basis for Parent and Subsidiaries, net income for the relevant period, calculated before giving effect to the following, to the extent included in determining net income: (a) interest expense,

(b) provision for income taxes, (c) depreciation and amortization expense, (d) gains or losses arising from the sale of capital assets, (e) gains arising from the write-up of assets, (f) any extraordinary gains

(provided, that, an extraordinary gain shall not be excluded from Adjusted EBITDA if such extraordinary gain is directly related to an extraordinary loss that was recognized in the calculation of net income during the most recently completed

four Fiscal Quarters, but only to the extent of such extraordinary loss), (g) non-cash charges reducing net income (excluding accrued expenses and any losses from the write-down of accounts or inventory), provided that if any such

non-

cash charges represent an accrual or reserve for potential cash items in any future period, the cash payment in respect thereof in such future period shall be subtracted from Adjusted EBITDA to

such extent, (h) cash severance costs incurred in the Fiscal Quarter ending on or about December 27, 2014, or any Fiscal Quarter thereafter, and (i) amounts associated with restructuring, sale, integration, reorganization, or other

similar activities in connection with the sale of Real Estate or moving leased locations, in each case accounted for in the Fiscal Quarter ending on or about December 27, 2014, or any Fiscal Quarter thereafter. Anything in this definition to

the contrary notwithstanding, any income or loss from the early extinguishment or modification of Borrowed Money shall be excluded in the determination of net income.

1.2 Amendment to Definition of “Borrowed Money”. The definition of “Borrowed Money” set forth in

Section 1.1 of the Loan Agreement is hereby amended and restated in its entirety to read as follows:

Borrowed Money: with respect to any Person, without duplication, its (a) Debt that (i) arises from the lending

of money by any other Person to such Person, (ii) is evidenced by notes, drafts, bonds, debentures, credit documents or similar instruments, (iii) accrues interest or is a type upon which interest charges are customarily paid (excluding

trade payables owing in the Ordinary Course of Business), or (iv) was issued or assumed as full or partial payment for Property; (b) Capital Leases; (c) reimbursement obligations with respect to letters of credit; and

(d) guaranties of any Debt of the foregoing types owing by another Person.

1.3 Amendment to Definition of “Cash Dominion

Period”. The definition of “Cash Dominion Period” set forth in Section 1.1 of the Loan Agreement is hereby amended by replacing each instance of “$500,000,000” appearing therein with “$250,000,000”.

1.4 Amendment to Definition of “Domestic Cash Trigger Period”. The definition of “Domestic Cash Trigger

Period” set forth in Section 1.1 of the Loan Agreement is hereby amended by replacing each instance of “$500,000,000” appearing therein with “$250,000,000”.

1.5 Amendment to Definition of “Fixed Charges”. The definition of “Fixed Charges” set forth in

Section 1.1 of the Loan Agreement is hereby amended by replacing the phrase “interest expense (other than payment-in-kind)” with the phrase “Cash Interest Expense”.

1.6 Amendment to Definitions. Section 1.1 of the Loan Agreement is hereby amended by adding the following

definitions in appropriate alphabetical order:

Cash Interest Expense: determined on a consolidated basis for Parent

and Subsidiaries in accordance with GAAP for the relevant period, without duplication, (a) interest expense (other than interest paid-in-kind) minus the sum of (b)(1) interest expense attributable to any non-cash items including the

following, to the extent they are non-cash items: (i) the movement in the mark to market valuation of obligations under Hedging Agreements, (ii) original issue discounts, and (iii) amortization of financing fees, debt issuance costs,

commissions, fees and expenses, or other financing fees, (2) early pay receivable discounts, and (3) accruals related to uncertain tax positions unless and until any such accruals are paid or required to be paid in cash.

2

First Amendment Effective Date: December 11, 2014.

1.7 Amendments to Tax Provisions. Section 5.10 of the Loan Agreement is hereby amended by (a) adding the

following sentence to the end of Section 5.10.1: “For purposes of this Section 5.10, the term “Applicable Law” includes FATCA”, (b) adding the phrase “or W-8BEN-E, as applicable,” after each reference to

W-8BEN in Section 5.10.2(b) of the Loan Agreement, and (c) adding the following as a new Section 5.10.2(e) at the end of Section 5.10.2:

(e) Solely for purposes of determining withholding Taxes imposed under FATCA, from and after the First Amendment Effective

Date, the Borrowers and the Administrative Agent shall treat (and the Lenders hereby authorize the Administrative Agent to treat) this Agreement as not qualifying as a “grandfathered obligation” within the meaning of Treasury Regulation

Section 1.1471- 2(b)(2)(i).

1.8 Amendments to Borrowing Base and Accounts Reporting. Each of Section 8.1 and

Section 8.2.1 of the Loan Agreement is hereby amended by changing the phrase “15th day of each Fiscal Month” to “20th day of each Fiscal Month”.

1.9 Amendments to Environmental Representations. Section 9.1.14 of the Loan Agreement is hereby amended so that it reads in

its entirety as follows:

9.1.14. Compliance with Environmental Laws. Except as could not reasonably be expected to

have a Material Adverse Effect, (a) no Borrower’s past or present operations, Real Estate or other Properties are subject to any federal, state or local investigation to determine whether any remedial action is needed to address any

environmental pollution, hazardous material or environmental clean-up; (b) no Borrower has received any Environmental Notice; and (c) no Borrower has any contingent liability with respect to any Environmental Release, environmental

pollution or hazardous material on any Real Estate now or previously owned, leased or operated by it.

ARTICLE II

CONDITIONS TO EFFECTIVENESS

2.1 Closing Conditions. This Amendment shall become effective as of the day and year set forth above (the “Amendment

Effective Date”) upon satisfaction of the following conditions (in each case, in form and substance reasonably acceptable to the Agent):

(a) Executed Amendment. The Agent shall have received a copy of this Amendment duly executed by each of the Borrowers,

the Lenders and the Agent.

(b) Default. Before and after giving effect to this Amendment, no Default or Event of

Default shall exist.

(c) Fees and Expenses. The Agent shall have received from the Borrowers (or shall be satisfied

with arrangements made for the payment thereof) such fees and expenses that are payable in connection with the consummation of the transactions contemplated hereby, pursuant to the terms of the Loan Agreement, provided, that neither Agent nor any

Lender shall be entitled to a fee in respect of this Amendment.

3

(d) 2014 Tax Forms. Each Foreign Lender shall have delivered to the

Borrowers and the Administrative Agent, on or prior to the Amendment Effective Date, duly completed 2014 versions of IRS Forms W-8BEN-E, W-8ECI or W-8IMY, as applicable (and such additional information and documentation required pursuant to

Section 5.10 of the Loan Agreement), evidencing a complete exemption from United States federal income tax withholding, including FATCA withholding, on payments of interest and other withholdable payments under the Loan Documents.

ARTICLE III

MISCELLANEOUS

3.1

Notice Regarding Concentration Limits. The Agent hereby notifies the Lenders that it intends to increase the concentration limits in clause (c) of the definition of Eligible Accounts for Hewlett-Packard, Lenovo, Sony, and Microsoft, and

their respective Subsidiaries, to each be 35%, respectively, pursuant to the discretion granted to the Agent thereunder. This notice is provided as a courtesy only and shall not be deemed to be a course of dealing so as to require notice of any

future concentration limit increases made pursuant to such discretion.

3.2 Amended Terms. On and after the Amendment

Effective Date, all references to the Loan Agreement in each of the Loan Documents shall hereafter mean the Loan Agreement as amended by this Amendment. Except as specifically amended hereby or otherwise agreed, the Loan Agreement is hereby ratified

and confirmed and shall remain in full force and effect according to its terms.

3.3 Representations and Warranties of

Borrowers. Each of the Borrowers represents and warrants as follows:

(a) It has taken all necessary action to

authorize the execution, delivery and performance of this Amendment.

(b) This Amendment has been duly executed and

delivered by such Borrower and constitutes such Borrower’s legal, valid and binding obligation, enforceable in accordance with its terms, except as enforceability may be limited by bankruptcy, insolvency or similar laws affecting the

enforcement of creditors’ rights generally.

(c) No consent, approval, authorization or order of, or filing,

registration or qualification with, any court or governmental authority or third party is required in connection with the execution, delivery or performance by such Borrower of this Amendment that has not already been obtained or made.

4

(d) The representations and warranties set forth in Section 9 of the Loan

Agreement are true and correct in all material respects as of the date hereof (except for those which expressly relate to an earlier date).

(e) Immediately before and after giving effect to this Amendment, no event has or will have occurred and be continuing which

constitutes a Default or an Event of Default.

3.4 Reaffirmation of Obligations. Each Borrower hereby ratifies the Loan

Agreement and acknowledges and reaffirms (a) that it is bound by all terms of the Loan Agreement and the other Loan Documents applicable to it and (b) that it is responsible for the observance and full performance of its respective

Obligations.

3.5 Loan Document. This Amendment shall constitute a Loan Document under the terms of the Loan Agreement.

3.6 Expenses. The Borrowers agree to pay costs and expenses of the Agent in connection with the preparation, execution and

delivery of this Amendment pursuant to the terms of the Loan Agreement.

3.7 Further Assurances. The Borrowers agree to

promptly take such action, upon the request of the Agent, as is necessary to carry out the provisions of this Amendment.

3.8

Entirety. This Amendment and the other Loan Documents embody the entire agreement among the parties hereto and supersede all prior agreements and understandings, oral or written, if any, relating to the subject matter hereof.

3.9 Counterparts; Telecopy. This Amendment may be executed in any number of counterparts, each of which when so executed and

delivered shall be an original, but all of which shall constitute one and the same instrument. Delivery of an executed counterpart of a signature page of this Amendment or any other document required to be delivered hereunder, by fax transmission or

e-mail transmission (e.g. “pdf” or “tif”) shall be effective as delivery of a manually executed counterpart of this Agreement. Without limiting the foregoing, upon the request of any party, such fax transmission or e-mail

transmission shall be promptly followed by such manually executed counterpart.

3.10 No Actions, Claims, Etc. As of the date

hereof, each of the Borrowers hereby acknowledges and confirms that it has no knowledge of any actions, causes of action, claims, demands, damages and liabilities of whatever kind or nature, in law or in equity, against the Agent, the Lenders, or

the Agent’s or the Lenders’ respective officers, employees, representatives, agents, counsel or directors arising from any action by such Persons, or failure of such Persons to act under the Loan Agreement on or prior to the date hereof.

3.11 GOVERNING LAW. THIS AMENDMENT SHALL BE GOVERNED BY, AND SHALL BE CONSTRUED AND ENFORCED IN ACCORDANCE WITH THE LAWS OF THE

STATE OF CALIFORNIA, WITHOUT GIVING EFFECT TO ANY CONFLICT OF LAW PRINCIPLES EXCEPT FEDERAL LAWS RELATING TO NATIONAL BANKS.

5

3.12 Successors and Assigns. This Amendment shall be binding upon and inure to the

benefit of the parties hereto and their respective successors and assigns.

3.13 Consent to Forum; Service of Process; Waiver of

Jury Trial. The jurisdiction, service of process and waiver of jury trial provisions set forth in Sections 14.15 and 14.16 of the Loan Agreement are hereby incorporated by reference, mutatis mutandis.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

6

IN WITNESS WHEREOF the parties hereto have caused this Amendment to be duly executed on the date

first above written.

|

|

|

|

|

|

|

| BORROWERS: |

|

|

|

ADVANCED MICRO DEVICES, INC., |

|

|

|

|

a Delaware corporation |

|

|

|

|

|

|

|

|

By: |

|

/s/ J. Michael Woollems |

|

|

|

|

Name: J. Michael Woollems |

|

|

|

|

Title: Treasurer |

|

|

|

|

|

|

|

|

|

|

|

AMD INTERNATIONAL SALES & SERVICE, LTD., |

|

|

|

|

a Delaware corporation |

|

|

|

|

|

|

|

|

By: |

|

/s/ J. Michael Woollems |

|

|

|

|

Name: J. Michael Woollems |

|

|

|

|

Title: Secretary |

[AMD – First Amendment to Loan and Security Agreement]

|

|

|

|

|

|

|

| AGENT AND LENDERS: |

|

|

|

BANK OF AMERICA, N.A., in its capacity as Agent |

|

|

|

|

and a Lender |

|

|

|

|

|

|

|

|

By: |

|

/s/ Ron Bornstein |

|

|

|

|

Name: Ron Bornstein |

|

|

|

|

Title: Sr. V.P. |

[AMD – First Amendment to Loan and Security Agreement]

|

|

|

| BARCLAYS BANK PLC, as a Lender |

|

|

| By: |

|

/s/ Luke Syme |

| Name: Luke Syme |

| Title: Assistant Vice President |

[AMD – First Amendment to Loan and Security Agreement]

|

|

|

| CAPITAL ONE BUSINESS CREDIT CORP., |

| as a Lender |

|

|

| By: |

|

/s/ Ron Walker |

| Name: Ron Walker |

| Title: Senior Vice President |

[AMD – First Amendment to Loan and Security Agreement]

|

|

|

| DEUTSCHE BANK AG NEW YORK BRANCH, |

| as a Lender |

|

|

| By: |

|

/s/ Anca Trifan |

| Name: Anca Trifan |

| Title: Managing Director |

|

|

| By: |

|

/s/ Marcus M. Tarkington |

| Name: Marcus M. Tarkington |

| Title: Director |

[AMD – First Amendment to Loan and Security Agreement]

|

|

|

| JPMORGAN CHASE BANK, N.A., as a Lender |

|

|

| By: |

|

/s/ John G. Kowalczuk |

| Name: John G. Kowalczuk |

| Title: Executive Director |

[AMD – First Amendment to Loan and Security Agreement]

|

|

|

| MORGAN STANLEY SENIOR FUNDING, INC., |

| as a Lender |

|

|

| By: |

|

/s/ Scott Jensen |

| Name: Scott Jensen |

| Title: Vice President |

[AMD – First Amendment to Loan and Security Agreement]

|

|

|

| PNC BANK, NATIONAL ASSOCIATION, |

| as a Lender |

|

|

| By: |

|

/s/ Craig T. Sheetz |

| Name: Craig T. Sheetz |

| Title: Vice-President |

[AMD – First Amendment to Loan and Security Agreement]

|

|

|

| WELLS FARGO BANK, NATIONAL ASSOCIATION, |

| as a Lender |

|

|

| By: |

|

/s/ Minna Lee |

| Name: Minna Lee |

| Title: Authorized Signatory |

[AMD – First Amendment to Loan and Security Agreement]

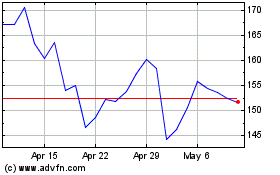

Advanced Micro Devices (NASDAQ:AMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Advanced Micro Devices (NASDAQ:AMD)

Historical Stock Chart

From Apr 2023 to Apr 2024