UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The

Securities Exchange Act of 1934

| Date of report (Date of earliest event reported): December 5, 2014 |

| |

| AMERICAN SHARED HOSPITAL SERVICES |

|

(Exact name of registrant

as specified in charter) |

| |

| California |

1-08789 |

94-2918118 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| |

| Four Embarcadero Center, Suite 3700, San Francisco, CA 94111 |

| (Address of principal executive offices) |

| |

|

|

| Registrant’s telephone number, including area code (415) 788-5300 |

| |

| N/A |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01. Entry into a Material Definitive Agreement.

On December 5, 2014, American Shared Hospital Services (the

“Company”), a California corporation entered into an amendment agreement (the “Amendment Agreement”) with

Raymond C. Stachowiak, John F. Ruffle, Mert Ozyurek and David A. Larson, M.D., members of the Company’s board of directors

(together, the “Investors”) to amend the warrants (the “Original Warrants”) issued pursuant to the Note

and Warrant Purchase Agreement between and among the Company and the Investors dated as of October 22, 2014.

Pursuant to the Amendment Agreement (capitalized terms not otherwise

defined in this Form 8-K have the meanings ascribed to such terms in the

Amendment Agreement), the Company and the Investors amended

Section 7(b) of the Original Warrant to remove the anti-dilution provisions relating to certain issuances of common stock or convertible

securities without consideration or at an aggregate offering price that is less than the current market price per common share.

Amended warrants, the terms of which will otherwise be identical to the original warrants, were issued to each of the Investors

in exchange for their original warrants, which were cancelled.

The foregoing summary of the Amendment Agreement does not purport

to be complete and is qualified in its entirety by reference to the full text of the Amendment Agreement, which is attached hereto

as Exhibit 10.1, and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit No. |

Description |

| 10.1 |

Warrant Amendment Agreement dated as of December 5, 2014, by and among the Company and the Investors. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

American Shared Hospital Services |

| |

|

|

| Date: |

December 10, 2014 |

|

By: |

/s/ Ernest A. Bates, M.D. |

| |

|

|

|

Name: |

Ernest A. Bates, M.D. |

| |

|

|

|

Title: |

Chairman and CEO |

Exhibit Index

| Exhibit No. |

|

Description |

| 10.1* |

|

Warrant Amendment Agreement dated as of December 5, 2014, by and among the Company and the Investors. |

| * |

Filed herein. |

|

| |

|

|

|

|

Exhibit 10.1

AMERICAN SHARED HOSPITAL SERVICES

WARRANT AMENDMENT AGREEMENT

This warrant amendment agreement, dated

as of December 5, 2014, (this “Amendment”), is entered into by and among American Hospital Services, a California

corporation (the “Company”), and Raymond C. Stachowiak, John F. Ruffle, Mert Ozyurek and David A. Larson, M.D.

(each an “Investor” and, collectively, the “Investors”);

WHEREAS, the Company entered into the Note

and Warrant Purchase Agreement between and among the Company and the Investors, dated as of October 22, 2014 (the “Purchase

Agreement”);

WHEREAS, the Company issued to the Investors

warrants pursuant to the Purchase Agreement (the “Original Warrant”);

WHEREAS, the Company desires to amend and

restate the Original Warrant issued pursuant to the Purchase Agreement by removing the text of and references to Section 7(b) to

comply with certain rules of the New York Stock Exchange MKT;

WHEREAS, the Company and the Investors agree

that all other terms of the Original Warrant (including its date of issuance, number of underlying shares, exercise price and other

anti-dilution protections) shall remain unchanged and in full force and effect;

NOW THEREFORE, in consideration of the premises

and of the mutual agreements herein contained, each Investor hereby agrees to deliver his Original Warrant to the Company for cancellation

and to accept in exchange an amended and restated warrant in the form of Exhibit A.

The parties have caused this Amendment to

be duly executed and delivered as of the date and year first written above.

| COMPANY: |

|

| |

|

| AMERICAN SHARED HOSPITAL SERVICES |

|

| |

|

| By: |

/s/ Ernest A. Bates, M.D. |

|

| |

|

|

INVESTORS:

| Raymond C. Stachowiak |

|

| By: |

/s/ Raymond C. Stachowiak |

|

| John F. Ruffle |

|

| By: |

/s/ John F. Ruffle |

|

| Mert Ozyurek |

|

| By: |

/s/ Mert Ozyurek |

|

| David A. Larson, M.D. |

|

| By: |

/s/ David A. Larson, M.D. |

|

Exhibit A

AMERICAN SHARED HOSPITAL SERVICES

AMENDED AND RESTATED

WARRANT FOR THE PURCHASE OF SHARES OF

COMMON STOCK OF AMERICAN SHARED HOSPITAL SERVICES

| No. ____ |

Warrant to Purchase

_________ Shares |

THIS SECURITY HAS NOT BEEN REGISTERED

UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”) OR UNDER ANY STATE SECURITIES LAW. IT MAY NOT BE SOLD, OFFERED

FOR SALE, PLEDGED OR HYPOTHECATED EXCEPT PURSUANT TO THE PROVISIONS OF THE ACT AND APPLICABLE STATE SECURITIES LAWS OR AN OPINION

OF COUNSEL SATISFACTORY TO THE COMPANY THAT SUCH SALE, ASSIGNMENT, PLEDGE OR TRANSFER IS IN COMPLIANCE WITH AN AVAILABLE EXEMPTION

UNDER THE ACT AND APPLICABLE STATE SECURITIES LAWS.

This Warrant (“Amended Warrant”)

is issued pursuant to the terms of the Warrant Amendment Agreement dated as of December 5, 2014 among American Shared Hospital

Services (the “Company”) and the other parties thereto, and amends and restates the terms of the warrant issued

to [ ], his successor or permitted assigns (the “Holder”), on October 22, 2014 (the “Original Warrant”)

in connection with the Note and Warrant Purchase Agreement between and among the Company and Raymond C. Stachowiak, John F. Ruffle,

Mert Ozyurek and David A. Larson, M.D., dated as of October 22, 2014.

By accepting this Amended Warrant, the Holder

hereby (i) represents that the Original Warrant has not been transferred and (ii) surrenders to the Company for cancellation the

Original Warrant. The Holder and the Company hereby acknowledge and agree that upon the issuance of this Amended Warrant, all of

the Company’s obligations under such Original Warrant shall be discharged and released in full without any further action

on the part of the Company or the Holder.

FOR VALUE RECEIVED, AMERICAN SHARED HOSPITAL

SERVICES, a California corporation, hereby certifies that the Holder is entitled, subject to the provisions of this Warrant,

to purchase from the Company, at the times specified herein, [ ] fully paid and non-assessable shares of Common Stock of the Company,

no par value per share (the “Common Stock”), at a purchase price per share equal to the Exercise Price (as hereinafter

defined). The number of shares of Common Stock to be received upon the exercise of this Warrant and the price to be paid for a

share of Common Stock are subject to adjustment from time to time as hereinafter set forth.

1. Definitions.

a) The following terms, as used herein, have the following meanings:

“Affiliate” means, with

respect to any Person, any other Person directly or indirectly controlling, controlled by or under common control with such Person.

For the purpose of this definition, the term “control” (including, with correlative meanings, the terms “controlling”,

“controlled by” and “under common control with”), as used with respect to any Person, means

the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of such Person,

whether through the ownership of voting securities, by contract or otherwise.

“Aggregate Offering Price”

shall mean, calculated on a per share of Common Stock basis, (i) in respect of any Common Stock, the consideration received by

the Company for the issuance of such Common Stock and (ii) in respect of any convertible securities (as defined in paragraph 8(b)),

the sum of (A) the consideration received by the Company for the issuance of such convertible securities plus (B) the consideration

payable to the Company upon exercise, exchange or conversion in full of such convertible securities (excluding the forfeiture of

such convertible securities) for the issuance of the underlying shares of Common Stock.

“Board of Directors”

means the board of directors of the Company.

“Business Day” means

any day except a Saturday, Sunday or other day on which commercial banks in the City of New York are authorized by law to close.

“Current Market Price Per Common

Share” means, on any determination date, the average of the Daily Prices per share of Common Stock for the 20 consecutive

trading days immediately prior to such date. If, on any determination date, the shares of Common Stock are not traded on a national

securities exchange or quoted by any regulated quotation service, the Current Market Price Per Common Share shall be the fair market

value per share as determined in good faith by the Board.

“Daily Price” means (i)

if the shares of Common Stock are then listed and traded on a national securities exchange, the closing price on the applicable

day as reported by the principal national securities exchange on which such shares are listed and traded and (ii) if such shares

are not then listed and traded on a national securities exchange, the closing price on such day as quoted by any regulated quotation

service.

“Excluded Securities”

means shares of Common Stock issued or issuable (i) pursuant to the Company’s stock option plan or any similar employee compensation

plan of the Company that is approved by the Board of Directors, (ii) pursuant to the exercise of any convertible securities if

no adjustment was required pursuant to paragraph 7(b) at the time such convertible security was issued, (iii) pursuant to an underwritten

public offering and (iv) as consideration for or to fund the acquisition of any company, business or asset.

“Exercise Price” means

$2.20 per Warrant Share, as the same may be adjusted from time to time as provided in this Warrant.

“Expiration Time” means

5:00 p.m. New York City on October 22, 2017.

“Note and Warrant Purchase Agreement”

means the Note and Warrant Purchase Agreement dated as of the date hereof among the Company and the holders listed on the signature

pages thereto, as the same may be amended from time to time.

“Person” means an individual,

corporation, partnership, limited liability company, association, trust or other entity or organization, including a government

or political subdivision or an agency or instrumentality thereof.

“Warrant Shares” means

the shares of Common Stock deliverable upon exercise of this Warrant, as the same may be adjusted from time to time as provided

in this Warrant.

(b) Capitalized

terms used but not defined in this Warrant shall have the meanings assigned to such terms in the Note and Warrant Purchase Agreement.

2. Exercise

of Warrant.

(a) The

Holder is entitled to exercise this Warrant in whole or in part at any time, or from time to time, commencing on the first anniversary

of the Closing Date and ending at the Expiration Time. To exercise this Warrant, the Holder shall deliver to the Company i) an

executed Warrant Exercise Notice substantially in the form annexed to this Warrant, ii) this Warrant and iii) subject to paragraph

2(e), the applicable Exercise Price. Upon such delivery and payment, the Holder shall be deemed to be the holder of record

of the Warrant Shares subject to such exercise, notwithstanding that the stock transfer books of the Company shall then be closed

or that certificates representing such Warrant Shares shall not then be actually delivered to the Holder.

(b) The

Exercise Price may be paid either by wire transfer of immediately available funds to an account designated by the Company or by

certified or official bank check or bank cashier’s check payable to the order of the Company. The Company shall pay any and

all documentary, stamp or similar issue or transfer taxes payable in respect of the issue or delivery of the Warrant Shares; provided

that the Company shall not be required to pay any taxes that may be payable in respect of any transfer involved in the issuance

and delivery of the Warrant Shares in a name other than that of the Holder.

(c) If

the Holder exercises this Warrant in part, this Warrant shall be surrendered by the Holder to the Company and a new Warrant of

the same tenor and for the unexercised number of Warrant Shares registered in the name of the Holder shall be executed by the Company

as promptly as reasonably practicable.

(d) Upon

surrender of this Warrant in conformity with the foregoing provisions, the Company shall transfer to the Holder appropriate evidence

of ownership of the shares of Common Stock or other securities or property (including any money) to which the Holder is entitled,

registered or otherwise placed in, or payable to the order of, the name or names of the Holder as may be directed in writing by

the Holder, and shall promptly deliver such evidence of ownership and any other securities or property (including any money) to

the Person or Persons entitled to receive the same, together with an amount in cash in lieu of any fraction of a share as provided

in paragraph 5 below.

(e) In

lieu of making a cash payment of the Exercise Price to exercise this Warrant pursuant to paragraph 2(a) (but in all other

respects in accordance with the exercise procedure set forth in paragraph 2(a)), the Holder may elect to convert this Warrant

into shares of Common Stock, in which event the Company will issue to the Holder the number of shares of Common Stock equal to

the amount resulting from the following equation:

X = (A - B) x C where:

A

X = the number of shares of

Common Stock issuable upon exercise pursuant to this paragraph 2(e);

A = the Current Market Price

Per Common Share on the date on which the Holder delivers a Warrant Exercise Notice to the Company pursuant to paragraph 2(a);

B = the Exercise Price; and

C = the number of shares of

Common Stock as to which this Warrant is being exercised pursuant to paragraph 2(a).

If the foregoing calculation results in

zero or a negative number, then no shares of Common Stock shall be issued upon exercise pursuant to this paragraph 2(e).

3. Restrictive

Legend. Certificates representing shares of Common Stock issued pursuant to this Warrant shall bear a legend substantially

in the form of the legend set forth on the first page of this Warrant to the extent that and for so long as such legend is required

pursuant to applicable securities laws.

4. Reservation

of Shares. The Company hereby agrees that at all times there shall be reserved for issuance and delivery upon exercise of this

Warrant such number of its authorized but unissued shares of Common Stock or other securities of the Company from time to time

issuable upon exercise of this Warrant as will be sufficient to permit the exercise in full of this Warrant. All such shares shall

be duly authorized and, when issued upon such exercise, shall be validly issued, fully paid and non-assessable, free and clear

of all liens, security interests, charges and other encumbrances or restrictions on sale and free and clear of all preemptive rights,

in each case except restrictions on transfer contemplated by paragraph 3, to the extent set forth in the Note and Warrant

Purchase Agreement and to the extent created by the Holder.

5. Fractional

Shares. No fractional shares or scrip representing fractional shares shall be issued upon the exercise of this Warrant, and

in lieu of delivery of any such fractional share to which the Holder may be entitled upon any exercise of this Warrant, the Company

shall pay to the Holder an amount in cash equal to such fraction multiplied by the Current Market Price Per Common Share on the

Business Day immediately preceding the date on which the Holder delivers the Warrant Exercise Notice pursuant to paragraph 2(a).

6. Loss

or Destruction of Warrant. Upon receipt by the Company of evidence satisfactory to it (in the exercise of its reasonable discretion)

of the loss, theft, destruction or mutilation of this Warrant, and (in the case of loss, theft or destruction) of reasonably satisfactory

indemnification, and upon surrender and cancellation of this Warrant, if mutilated, the Company shall execute and deliver a new

Warrant of like tenor and date.

7. Anti-dilution

Provisions.

(a) Common

Stock Dividends, Subdivisions or Combinations. If the Company shall at any time after the date hereof (A) declare and pay a

dividend or make a distribution on Common Stock payable in Common Stock, (B) subdivide or split the outstanding shares of Common

Stock into a greater number of shares or (C) combine or reclassify the outstanding shares of Common Stock into a smaller number

of shares, then in each such case:

(i) the

number of Warrant Shares issuable upon exercise of this Warrant thereafter shall be proportionately adjusted so that the exercise

of this Warrant after such event shall entitle the Holder to receive the aggregate number of shares of Common Stock that such Holder

would have been entitled to receive had such Holder exercised this Warrant immediately prior to such event; and

(ii) the

Exercise Price thereafter shall be adjusted to equal the product of the Exercise Price in effect immediately prior to such event

multiplied by a fraction (a) the numerator of which shall be the number of Warrant Shares issuable upon the exercise of this Warrant

immediately prior to such event and (b) the denominator of which shall be the number of Warrant Shares issuable upon the exercise

of this Warrant immediately following such event.

Any adjustment made pursuant to this paragraph

7(a) shall become effective immediately after the applicable record date in the case of a dividend or distribution and immediately

after the applicable effective date in the case of a subdivision, split, combination or reclassification.

(b) [Reserved.]

(c) Consolidation,

Merger or Sale of Assets. In the event of any consolidation of the Company with, or merger of the Company into, any other Person,

any merger of another Person into the Company (other than a merger which does not result in any reclassification, conversion, exchange

or cancellation of outstanding shares of Common Stock) or any sale or transfer of all or substantially all of the assets of the

Company to the Person formed by such consolidation or resulting from such merger, as the case may be, the Holder shall have the

right thereafter to exercise this Warrant for the kind and amount of securities, cash and/or other property receivable upon such

consolidation, merger, sale or transfer by a holder of the number of shares of Common Stock for which this Warrant may have been

exercised immediately prior to such consolidation, merger, sale or transfer. In determining the kind and amount of securities,

cash and/or other property receivable upon such consolidation, merger, sale or transfer, if the holders of Common Stock have the

right to elect as to the consideration to be received upon the consummation of such consolidation, merger, sale or transfer, then

the consideration that the Holder shall be entitled to receive upon exercise shall be deemed to be the kind and amount of consideration

received by the majority of all holders of Common Stock that affirmatively make an election (or of all such holders if none make

an election). Adjustments for events subsequent to the effective date of such a consolidation, merger, sale or transfer of assets

shall be as nearly equivalent as may be practicable to the adjustments provided for in this Warrant. In any such event, effective

provisions shall be made in the certificate or articles of incorporation of the resulting or surviving corporation, in any contract

of sale, merger, conveyance, lease, transfer or otherwise so that the provisions set forth herein for the protection of the rights

of the Holder shall thereafter continue to be applicable; and any such resulting or surviving corporation shall expressly assume

the obligation to deliver, upon exercise, such shares of stock, other securities, cash and property.

(d) Certain

Determinations. For purposes of any computation of any adjustment required under this paragraph 7:

(i) adjustments

shall be made successively whenever any event giving rise to such an adjustment shall occur;

(ii) if

any portion of any consideration to be received by the Company in a transaction giving rise to such an adjustment shall be in a

form other than cash, the fair market value of such non-cash consideration shall be utilized in such computation. Such fair market

value shall be determined by the Board of Directors; provided that if the Holder shall object to any such determination,

the Board of Directors shall retain an independent appraiser reasonably satisfactory to the Holder to determine such fair market

value. The expense of such independent appraiser shall be shared equally by the Company and the Holder. The Holder shall be notified

promptly of any consideration other than cash to be received by the Company and furnished with a description of the consideration

and the fair market value thereof, as determined in accordance with the foregoing provisions;

(iii) such

calculations shall be made to the nearest one-tenth of a cent or to the nearest hundredth of a share, as the case may be; and

(iv) no

adjustment in the Exercise Price or the number of Warrant Shares issuable upon exercise of the Warrant, as the case may be, shall

be required if the amount of such adjustment would be less than one-tenth of a cent or hundredth of a share, as the case may be;

provided that any adjustments which by reason of this paragraph 7(e)(iv) are not required to be made shall be carried

forward and taken into account in any subsequent adjustment.

(e) Certificates

as to Adjustments. Upon the occurrence of each adjustment to the Exercise Price and/or the number of Warrant Shares issuable

upon exercise of this Warrant, the Company shall promptly compute such adjustment in accordance with the terms hereof and furnish

to the Holder a certificate setting forth such adjustment and showing in reasonable detail the facts upon which such adjustment

is based.

(f) Notices.

In the event that the Company shall propose at any time to effect any of the events described in paragraphs (a) through (e)

above that would result in an adjustment to the Exercise Price, the number of Warrant Shares issuable upon exercise of this Warrant

or a change in the type of securities or property to be delivered upon exercise of this Warrant, the Company shall send notice

to the Holder in the manner set forth in paragraph 8. In the case of a dividend or other distribution, such notice shall be

sent at least 10 days prior to the applicable record date and shall specify such record date and the date on which such dividend

or other distribution is to be made. In any other case, such notice shall be sent at least 15 days prior to the effective date

of any such event and shall specify such effective date. In all cases, such notice shall specify such event in reasonable detail,

including the effect on the Exercise Price and the number, kind or class of securities or other property issuable upon exercise

of this Warrant. Failure to furnish any certificate pursuant to paragraph 7(e) or to give any notice pursuant to this paragraph

7(f), or any defect in any such certificate or notice, shall not affect the legality or the validity of the adjustment of the Exercise

Price and/or the number of securities, cash and/or other property issuable upon exercise of this Warrant, or any transaction giving

rise thereto.

8. Notices.

Any notice, demand or delivery authorized by this Warrant shall be in writing and shall be given to the Holder or the Company,

as the case may be, at the respective addresses of the parties as set forth in the Note and Warrant Purchase Agreement, or such

other address (or facsimile number) as shall have been furnished to the party giving or making such notice, demand or delivery.

Each such notice, demand or delivery shall be deemed received on the date of receipt by the recipient thereof if received prior

to 5:00 p.m. in the place of receipt and such day is a Business Day. Otherwise, any such notice, demand or delivery shall be deemed

not to have been received until the next succeeding Business Day.

9. Rights of the Holder. Prior to any exercise

of this Warrant, the Holder shall not, by virtue hereof, be entitled to any rights of a shareholder of the Company, including,

without limitation, the right to vote, to receive dividends or other distributions, to exercise any preemptive right or to receive

any notice of meetings of shareholders or any notice of any proceedings of the Company except as may be specifically provided

for herein.

10. GOVERNING

LAW. THIS WARRANT AND ALL RIGHTS ARISING HEREUNDER SHALL BE CONSTRUED AND DETERMINED IN ACCORDANCE WITH THE INTERNAL LAWS

OF THE STATE OF CALIFORNIA, AND THE PERFORMANCE THEREOF SHALL BE GOVERNED AND ENFORCED IN ACCORDANCE WITH SUCH LAWS.

11. Amendments;

Waivers. Any provision of this Warrant may be amended or waived if, and only if, such amendment or waiver is in writing and

signed, in the case of an amendment, by the Holder and the Company, or in the case of a waiver, by the party against whom the waiver

is to be effective. No failure or delay by either party in exercising any right, power or privilege hereunder shall operate as

a waiver thereof nor shall any single or partial exercise thereof preclude any other or further exercise thereof or the exercise

of any other right, power or privilege. The rights and remedies herein provided shall be cumulative and not exclusive of any rights

or remedies provided by law.

IN WITNESS WHEREOF, the Company has duly

caused this Warrant to be signed by its duly authorized officer and to be dated as of October 22, 2014.

| |

AMERICAN SHARED HOSPITAL SERVICES |

| |

|

|

| |

By: |

|

| |

|

Name: |

| |

|

Title: |

Acknowledged and Agreed:

| [HOLDER] |

|

| |

|

|

| By: |

|

|

| |

Name: |

|

| |

Title: |

|

WARRANT EXERCISE NOTICE

(To be delivered prior to exercise of the

Warrant

by execution of the Warrant Exercise Subscription Form)

| To: | American Shared Hospital Services |

The undersigned hereby notifies you of its

intention to exercise the Warrant to purchase shares of Common Stock, no par value, of American Shared Hospital Services. The undersigned

intends to exercise the Warrant to purchase ___________ shares (the “Warrant Shares”) at $______ per Warrant

Share (the Exercise Price currently in effect pursuant to the Warrant). As indicated below, the undersigned intends to pay the

aggregate Exercise Price for the Warrant Shares by wire transfer of immediately available funds or by certified or official bank

or bank cashier’s check or by reduction in the number of Warrant Shares that would otherwise be issued upon exercise pursuant

to paragraph 2(e) of the Warrant.

Date: _________________

| |

|

| |

(Signature of Owner) |

| |

|

| |

|

| |

(Street Address) |

| |

|

| |

|

| |

(City) |

(State) |

(Zip Code) |

| Payment: | $_____________ wire transfer of immediately available funds

$_____________ certified or official bank or bank cashier’s check

Reduction in number of Warrant Shares |

WARRANT EXERCISE SUBSCRIPTION FORM

(To be executed only upon exercise of the

Warrant

after delivery of Warrant Exercise Notice)

| To: | American Shared Hospital Services |

The undersigned irrevocably exercises the

Warrant for the purchase of ___________ shares (the “Warrant Shares”) of Common Stock, no par value per share,

of American Shared Hospital Services (the “Company”) at $_____ per Warrant Share (the Exercise Price currently

in effect pursuant to the Warrant) and herewith makes payment of $___________ (such payment being made as specified in the undersigned’s

previously-delivered Warrant Exercise Notice), all on the terms and conditions specified in the within Warrant Certificate, surrenders

this Warrant Certificate and all right, title and interest therein to the Company and directs that the Warrant Shares deliverable

upon the exercise of this Warrant be registered or placed in the name and at the address specified below and delivered thereto.

Date: _________________

| |

|

| |

(Signature of Owner) |

| |

|

| |

|

| |

(Street Address) |

| |

|

| |

|

| |

(City) |

(State) |

(Zip Code) |

Securities and/or check to be issued to:_________________________________________________________

Please insert social security or identifying number:________________________________________________

Name:__________________________________________________________________________________

Street Address:___________________________________________________________________________

City, State and Zip Code:____________________________________________________________________

Any unexercised portion of the Warrant evidenced by the within

Warrant to be issued to:

Please insert social security or identifying number:________________________________________________

Name:__________________________________________________________________________________

Street Address:___________________________________________________________________________

City, State and Zip Code:____________________________________________________________________

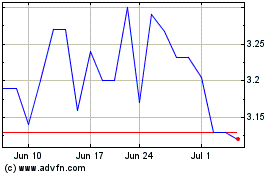

American Shared Hospital... (AMEX:AMS)

Historical Stock Chart

From Mar 2024 to Apr 2024

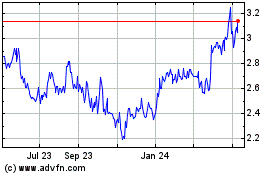

American Shared Hospital... (AMEX:AMS)

Historical Stock Chart

From Apr 2023 to Apr 2024