Current Report Filing (8-k)

December 10 2014 - 7:54AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported) - December 10, 2014 (December 9, 2014)

ALLETE, Inc.

(Exact name of registrant as specified in its charter)

|

| | |

Minnesota | 1-3548 | 41-0418150 |

(State or other jurisdiction of | (Commission File Number) | (IRS Employer |

incorporation or organization) | | Identification No.) |

30 West Superior Street

Duluth, Minnesota 55802-2093

(Address of principal executive offices, including zip code)

(218) 279-5000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

SECTION 7 – REGULATION FD

| |

Item 7.01 | Regulation FD Disclosure |

ALLETE, Inc. (NYSE:ALE) today initiated its 2015 earnings guidance range of $3.00 to $3.20 per share on net income of $140 million to $150 million. The 2015 expectation represents the anticipation of another year of continued earnings growth for ALLETE. Key assumptions impacting 2015 guidance include:

| |

• | Increased cost recovery rider revenue due to a full-year impact from the recently completed Bison 4 wind energy project and from the continuation of the Boswell 4 environmental retrofit project; |

| |

• | Continued strong sales to Minnesota Power’s current industrial customers. Recently received demand nominations indicate Minnesota Power’s taconite customers expect to operate at full demand levels for the first four months of 2015; |

| |

• | The expectation of new industrial electric sales to Magnetation’s recently completed facility, which is anticipated to start operations during the first quarter of 2015 and will consume approximately 20MW of electric load at full production levels; |

| |

• | Higher power marketing sales under the Minnkota Power Sales Agreement which commenced on June 1, 2014. Under this agreement, Minnesota Power sells a portion of its output from Square Butte to Minnkota Power; |

| |

• | The expectation of minimal electricity sales to the Nashwauk Public Utilities Commission for electric service to Essar Steel Minnesota’s taconite mine and processing facility. The city of Nashwauk is a wholesale customer of Minnesota Power. Essar has indicated it plans to begin operations in the second half of 2015; |

| |

• | Higher depreciation and interest expenses primarily related to recent asset additions; |

| |

• | Higher operating and maintenance expenses primarily due to higher transmission and property tax expense, as well operating costs for the recently placed in service Bison 4 wind energy facility. Operating and maintenance costs are also impacted by higher defined benefit plan expense and general inflationary increases in labor, maintenance and material expenses. Increased transmission expense is largely offset by higher transmission revenue; |

| |

• | Minnesota Power anticipates making a decision on the timing of its next general rate case during 2015. For earnings guidance purposes, ALLETE is not including any financial impact from a potential rate case at this time; |

| |

• | Anticipated earnings growth from ALLETE Clean Energy primarily from wind energy facilities that were acquired during 2014. ALLETE Clean Energy will make a decision in early 2015 on its option to acquire the Armenia Mountain wind energy facility. Until approved by regulators, ALLETE’s 2015 earnings guidance will not include any impact from ALLETE Clean Energy’s recently announced agreement to develop a wind facility for Montana-Dakota Utilities; |

| |

• | Earnings per share dilution of 20 cents to 25 cents as a result of equity issuances it has made since the beginning of 2014; |

| |

• | An expected effective tax rate of approximately 15%, which is down from 2014 due to production tax credits related to the Bison 4 wind energy facility. |

Readers are cautioned that forward-looking statements should be read in conjunction with the Company’s disclosures under the heading “Forward-Looking Statements” located on page 2 of this Form 8-K.

ALLETE, Inc. Form 8-K dated December 10, 2014

1

Forward-Looking Statements

Statements in this report that are not statements of historical facts are considered “forward-looking” and, accordingly, involve risks and uncertainties that could cause actual results to differ materially from those discussed. Although such forward-looking statements have been made in good faith and are based on reasonable assumptions, there can be no assurance that the expected results will be achieved. Any statements that express, or involve discussions as to, future expectations, risks, beliefs, plans, objectives, assumptions, events, uncertainties, financial performance, or growth strategies (often, but not always, through the use of words or phrases such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “projects,” “likely,” “will continue,” “could,” “may,” “potential,” “target,” “outlook” or words of similar meaning) are not statements of historical facts and may be forward-looking.

In connection with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, we are providing this cautionary statement to identify important factors that could cause our actual results to differ materially from those indicated in forward-looking statements made by or on behalf of ALLETE in this Form 8-K, in presentations, on our website, in response to questions or otherwise. These statements are qualified in their entirety by reference to, and are accompanied by, the following important factors, in addition to any assumptions and other factors referred to specifically in connection with such forward-looking statements that could cause our actual results to differ materially from those indicated in the forward-looking statements:

| |

• | our ability to successfully implement our strategic objectives; |

| |

• | global and domestic economic conditions affecting us or our customers; |

| |

• | wholesale power market conditions; |

| |

• | federal and state regulatory and legislative actions that impact regulated utility economics, including our allowed rates of return, capital structure, ability to secure financing, industry and rate structure, acquisition and disposal of assets and facilities, operation and construction of plant facilities and utility infrastructure, recovery of purchased power, capital investments and other expenses, including present or prospective environmental matters; |

| |

• | changes in and compliance with laws and regulations; |

| |

• | effects of competition, including competition for retail and wholesale customers; |

| |

• | effects of restructuring initiatives in the electric industry; |

| |

• | changes in tax rates or policies or in rates of inflation; |

| |

• | the impacts on our Regulated Operations segment of climate change and future regulation to restrict the emissions of greenhouse gases; |

| |

• | the impacts of laws and regulations related to renewable and distributed generation; |

| |

• | the outcome of legal and administrative proceedings (whether civil or criminal) and settlements; |

| |

• | weather conditions, natural disasters and pandemic diseases; |

| |

• | our ability to access capital markets and bank financing; |

| |

• | changes in interest rates and the performance of the financial markets; |

| |

• | project delays or changes in project costs; |

| |

• | availability and management of construction materials and skilled construction labor for capital projects; |

| |

• | changes in operating expenses and capital expenditures and our ability to recover these costs; |

| |

• | pricing, availability and transportation of fuel and other commodities and the ability to recover the costs of such commodities; |

| |

• | our ability to replace a mature workforce and retain qualified, skilled and experienced personnel; |

| |

• | effects of emerging technology; |

| |

• | war, acts of terrorism and cyber attacks; |

| |

• | our ability to manage expansion and integrate acquisitions; |

| |

• | our current and potential industrial and municipal customers’ ability to execute announced expansion plans; |

| |

• | population growth rates and demographic patterns; and |

| |

• | zoning and permitting of land held for resale, real estate development or changes in the real estate market. |

Additional disclosures regarding factors that could cause our results or performance to differ from those anticipated by this report are discussed in Item 1A under the heading “Risk Factors” beginning on page 28 of ALLETE’s Annual Report on Form 10-K for the year ended December 31, 2013. Any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which that statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for management to predict all of these factors, nor can it assess the impact of each of these factors on the businesses of ALLETE or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement. Readers are urged to carefully review and consider the various disclosures made by ALLETE in this Current Report on Form 8‑K and in other reports filed with the SEC that attempt to identify the risks and uncertainties that may affect ALLETE’s business.

ALLETE, Inc. Form 8-K dated December 10, 2014

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

ALLETE, Inc.

|

| | |

| | |

December 10, 2014 | | /s/ Steven W. Morris |

| | Steven W. Morris |

| | Controller |

ALLETE, Inc. Form 8-K dated December 10, 2014

3

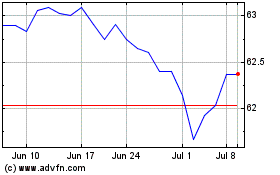

Allete (NYSE:ALE)

Historical Stock Chart

From Mar 2024 to Apr 2024

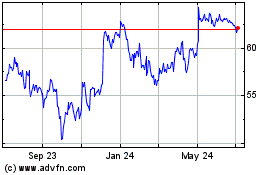

Allete (NYSE:ALE)

Historical Stock Chart

From Apr 2023 to Apr 2024