UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 8, 2014

|

|

ABERCROMBIE & FITCH CO. |

(Exact name of registrant as specified in its charter) |

|

| | | | |

Delaware | | 1-12107 | | 31-1469076 |

(State or other jurisdiction | | (Commission File Number) | | (IRS Employer |

of incorporation) | | | | Identification No.) |

|

|

6301 Fitch Path, New Albany, Ohio 43054 |

(Address of principal executive offices) (Zip Code) |

|

|

(614) 283-6500 |

(Registrant's telephone number, including area code) |

|

|

Not Applicable |

(Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On December 8, 2014, Michael S. Jeffries, Chief Executive Officer of Abercrombie & Fitch Co. (the “Company”), retired from his positions as Chief Executive Officer and director of the Company, effective immediately. His employment with the Company will terminate on December 31, 2014. In connection with his retirement, Mr. Jeffries entered into a Retirement Agreement with the Company, providing him compensation as if his employment had been terminated without cause pursuant to his Employment Agreement dated as of December 9, 2013. In addition to any benefits Mr. Jeffries is entitled to upon retirement, this will result in payments of approximately $5.5 million in cash and benefits continuation. A copy of the Retirement Agreement is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Also on December 8, 2014, the Company's Board of Directors appointed Arthur C. Martinez, Chairman of the Board, to serve as Executive Chairman of the Company, and formed an Office of the Chairman, whose members are Arthur C. Martinez, Jonathan Ramsden, Chief Operating Officer, Christos Angelides, Brand President of Abercrombie & Fitch, and Fran Horowitz, Brand President of Hollister, until a new Chief Executive Officer is appointed. Officers who reported to the former Chief Executive Officer will report to the Executive Chairman, except as determined by the Executive Chairman, until a new Chief Executive Officer is appointed.

In connection with these actions, the Company issued a news release. A copy of the news release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(a) through (c) Not applicable

(d) Exhibits:

The following exhibits are included with this Current Report on Form 8-K:

|

| | |

Exhibit No. | | Description |

10.1 | | Retirement Agreement dated December 8, 2014, between Michael S. Jeffries and Abercrombie & Fitch Co. |

99.1 | | News Release issued by Abercrombie & Fitch Co. on December 9, 2014 |

[Remainder of page intentionally left blank; signature page follows]

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| | ABERCROMBIE & FITCH CO. |

| | | |

Dated: December 9, 2014 | By: | /s/ Robert E. Bostrom |

| | | Robert E. Bostrom |

| | | Senior Vice President, General Counsel and Corporate Secretary |

INDEX TO EXHIBITS

|

| | |

Exhibit No. | | Description |

10.1 | | Retirement Agreement dated December 8, 2014, between Michael S. Jeffries and Abercrombie & Fitch Co. |

99.1 | | News Release issued by Abercrombie & Fitch Co. on December 9, 2014 |

Exhibit 10.1

RETIREMENT AGREEMENT

This RETIREMENT AGREEMENT (“Agreement”) dated this 8th day of December, 2014 between Abercrombie & Fitch Co., an Ohio corporation (the “Company”), and Michael S. Jeffries (the “Executive”).

WHEREAS, the Company and the Executive are subject to an employment agreement dated December 9, 2013 under which the Executive was employed to serve as the Company’s Chairman and Chief Executive Officer (the “Employment Agreement”); and

WHEREAS, the Executive’s employment with the Company will terminate upon his retirement, effective December 31, 2014; and

WHEREAS, the Executive wishes to resign all officer positions with the Company and its subsidiaries and as a member of the Board of Directors of the Company, in all cases effective on the date hereof; and

WHEREAS, the Company and the Executive have agreed that the Executive will be entitled to certain compensation and benefits set forth below upon and following such termination of employment, contingent upon the execution of this Agreement and the Release attached hereto as Exhibit A as set forth herein and nonrevocation of the releases herein and attached hereto;

NOW, THEREFORE, in consideration of the premises and mutual agreements contained herein and in the Employment Agreement, the Company and the Executive agree as follows:

1.The employment relationship between the Executive and the Company will continue until December 31, 2014 (the “Retirement Date”), at which time it shall cease, and December 31, 2014 will be the Termination Date and the last day of the Term for purposes of the Employment Agreement. The Executive hereby resigns, effective on the date hereof, (i) all officer positions with the Company and its subsidiaries, (ii) his membership on the Board of Directors of the Company, and (iii) his membership on any committees of the Company or its subsidiaries.

2.In consideration for the covenants of the Executive and the release of claims by the Executive contained herein, the Company shall pay, or provide benefits to, the Executive as follows, and the following, together with the Company’s obligations in Paragraph 6 and 7 below shall be the Company’s sole obligations to the Executive:

(a)the Company shall pay the Executive the Accrued Compensation (as defined in the Employment Agreement), the Company shall provide the benefits set forth in Section 10(g) of the Employment Agreement, and Section 10(b)(v) of the Employment Agreement shall apply to any long-term incentive awards held by the Executive (and thus, for the avoidance of doubt, all unvested and/or unearned long-term incentive awards held by the Executive will be forfeited on the Retirement Date); and

(b)provided the Executive executes this Agreement and, on December 31, 2014, further executes the general release of claims attached hereto as Exhibit A, and does not revoke the release below or in Exhibit A prior to the end of the applicable seven day statutory revocation period and the Executive complies with the terms of this Agreement, the Company will make the payments and provide the benefits set forth in Section 10(b)(ii) through (iv) of the Employment Agreement. For the avoidance of doubt, the benefits set forth in Section 10(b)(iii) shall continue through the last day of the period during which the Company provides the benefits set forth in Section 10(g) of the Employment Agreement.

3. Subject to Paragraph 5 below, the Executive, on his own behalf and on behalf of his heirs, estate, beneficiaries and assigns, does hereby release the Company, and any of its subsidiaries or affiliates, and each past or present officer, director, agent, employee, shareholder, and insurer of any such entities, from any and all claims made, to be made, or which might have been made of whatever nature, whether known or unknown, from the beginning of time to the date this Agreement is executed, arising out of or as a consequence of his employment with the Company, or arising out of the severance of such employment relationship, or arising out of any act committed or omitted during or after the existence of such employment relationship, all up through and including the date on which this Agreement is executed, including, but not limited to, those which were, could have been or could be the subject of an administrative or judicial proceeding filed by the Executive or on his behalf under federal, state or local law, whether by statute, regulation, in contract or tort, and including, but not limited to, every claim for front pay, back pay, wages, bonus, fringe benefit, any form of discrimination (including but not limited to, every claim of race, color, sex, religion, national origin, disability or age discrimination and any claim under the Age Discrimination in Employment Act (ADEA)), wrongful termination, emotional distress, pain and suffering, breach of contract, compensatory or punitive damages, interest, attorney’s fees, reinstatement or reemployment. If any court rules that such waiver of rights to file, or have filed on his behalf, any administrative or judicial charges or complaints is ineffective, the Executive agrees not to seek or accept any money damages or any other relief upon the filing of any such administrative or judicial charges or complaints. The Executive relinquishes any right to future employment with the Company and the Company shall have the right to refuse to reemploy the Executive without liability. The Executive acknowledges and agrees that even though claims and facts in addition to those now known or believed by him to exist may subsequently be discovered, it is his intention to fully settle and release all such employment-related claims he may have against the Company and the persons and entities described above, whether known, unknown or suspected.

4. The Company acknowledges and agrees that the release contained in Paragraph 3 does not, and shall not be construed to, release or limit the scope of any existing obligation of the Company (i) to pay or provide any compensation or benefit required to be paid or provided under Sections 10(b) or 10(g) of the Employment Agreement, (ii) to indemnify the Executive for his acts as an officer or director of the Company in accordance with the bylaws of the Company and the policies and procedures of the Company that are presently in effect including Section 12 of the Employment Agreement and the Director and Officer Indemnification Agreement between the Company and the Executive (the “Indemnification Agreement”), or (iii) to the Executive and his eligible, participating dependents or beneficiaries under any existing welfare, retirement or

other fringe-benefit plan or program of the Company in which the Executive and/or such dependents are participants. The Company acknowledges and agrees that the release contained in Paragraph 3 does not apply to any post-termination of employment obligations of the Company under Sections 10(b) or 10(g) of the Employment Agreement.

5. The Executive acknowledges that he has been provided at least 21 days to review the Agreement and has been advised to review it with an attorney of his choice. In the event the Executive elects to sign this Agreement prior to this 21-day period, he agrees that it is a knowing and voluntary waiver of his right to wait the full 21 days. The Executive further understands that he has 7 days after the signing hereof to revoke the release set forth in Paragraph 3 above by so notifying the Company in writing, such notice to be received by the General Counsel of the Company within the 7-day period. The Executive further acknowledges that he has carefully read this Agreement, and knows and understands its contents and its binding legal effect. The Executive acknowledges that by signing this Agreement, he does so of his own free will and act and that it is his intention that he be legally bound by its terms.

6. For the avoidance of doubt, the provisions of Section 11 (Employee Covenants), Section 12 (Indemnification) and Section 16 (Section 409A Compliance) of the Employment Agreement shall survive termination of the Executive’s employment in accordance with their terms and are incorporated by reference herein. Section 4(b)(iv) and Section 4(d) of the Amended and Restated Employment Agreement, dated August 15, 2005, between the Company and the Executive (the “2005 Employment Agreement”) shall continue in effect. Sections 10(h), 14, 15 (with respect only to any contest, effort to enforce or dispute relating to this Agreement), 17 and 18 of the Employment Agreement shall continue in effect and are incorporated by reference herein.

7. During Executive’s employment by the Company and at any time following the Retirement Date, (i) the Executive agrees not to make any disparaging communication to any party in relation to the Company, its subsidiaries or any of their respective officers, directors, executive personnel, employees, products or services, or make false or misleading statements regarding any of them to anyone, including but not limited to the Company’s customers, competitors, suppliers, employees, former employees or the press or other media, and (ii) the Company agrees that it will not make, and the Company will instruct its executive officers, its senior human resources officer and its senior public relations officer, not to make any disparaging communication to any party about the Executive or make false or misleading statements about him, except, in either case, if placed under legal compulsion to do so by a court or other governmental authority. Clause (ii) of this Paragraph 7 shall cease to be effective if the Executive fails to further execute, on December 31, 2014, the general release of claims attached hereto as Exhibit A or the Executive revokes the release in Paragraph 3 above or in Exhibit A prior to the end of the applicable seven day statutory revocation period.

8. On or before the Retirement Date (or such other date specified by the Company in a written notice to the Executive), the Executive shall return all property of the Company and its subsidiaries in the Executive’s possession or control, including, but not limited to, the Company’s credit, telephone, identification and similar cards, keys, cellular phones, computer equipment, software and peripherals and originals and copies of books, records, and other information

pertaining to the business of the Company or its subsidiaries. The Executive’s access to Company information and email will be terminated on the date hereof.

9. The Executive shall, at the request of the Company, reasonably cooperate with the Company in the defense and/or investigation of any third party claim, dispute or any investigation or proceeding, whether actual or threatened, including, without limitation, meeting with attorneys and/or other representatives of the Company to provide reasonably requested information regarding same and/or participating as a witness in any litigation, arbitration, hearing or other proceeding between the Company or an affiliate and a third party or any government body with regard to matters related to Executive’s employment period with the Company. The Company shall promptly reimburse the Executive for all reasonable expenses and costs incurred by him in connection with such assistance including, without limitation, reasonable travel expenses.

10. The provisions of this Agreement shall be deemed severable and the invalidity or unenforceability of any provision shall not affect the validity or enforceability of the other provisions hereof.

11. The Company may withhold from any amounts payable under this Agreement such federal, state, local or foreign taxes as shall be required to be withheld therefrom pursuant to any applicable law or regulation.

12. This Agreement shall be governed by and construed and enforced in accordance with the laws of the State of Ohio without giving effect to the conflict of laws principles thereof.

13. This Agreement constitutes the entire agreement between the parties hereto and supersedes all prior agreements, understandings and arrangements, oral or written, between the parties hereto with respect to the subject matter hereof, other than (i) the Indemnification Agreement, (ii) any and all outstanding equity compensation awards that by their terms (after application of Section 10(b)(v) of the Employment Agreement) continue in operation after the Retirement Date, and (iii) Sections 4(b)(iv) and 4(d) of, and Exhibit A to (as previously amended), the 2005 Employment Agreement.

14. This Agreement may be executed and delivered (including by facsimile transmission or pdf) in one or more counterparts, and by the different parties hereto in separate counterparts, each of which when executed and delivered shall be deemed to be an original but all of which taken together shall constitute one and the same agreement.

REMAINDER OF PAGE INTENTIONALLY LEFT BLANK

IN WITNESS WHEREOF, the parties have executed this Agreement on the date first above written.

|

| | | |

| | ABERCROMBIE & FITCH CO. |

| | By: | /s/ Arthur C. Martinez |

| | Name: | Arthur C. Martinez |

| | Title: | Chairman of the Board |

| | | |

| | | |

| | | |

| | | |

| | | /s/ Michael S. Jeffries |

| | | Michael S. Jeffries |

Exhibit A

General Release

This General Release (“Release”) is executed on this 31st day of December, 2014, by Michael S. Jeffries (the “Executive”) pursuant to the Retirement Agreement between Abercrombie & Fitch Co. (the “Company”) and the Executive dated December 8, 2014 (the “Agreement”).

1.As a condition to, and in consideration for, the payments and benefits set forth in Paragraph 2 of the Agreement, subject to Paragraph 3 of this Release below, the Executive, on his own behalf and on behalf of his heirs, estate, beneficiaries and assigns, does hereby release the Company, and any of its subsidiaries or affiliates, and each past or present officer, director, agent, employee, shareholder, and insurer of any such entities, from any and all claims made, to be made, or which might have been made of whatever nature, whether known or unknown, from the beginning of time to the date this Release is executed, arising out of or as a consequence of his employment with the Company, or arising out of the severance of such employment relationship, or arising out of any act committed or omitted during or after the existence of such employment relationship, all up through and including the date on which this Release is executed, including, but not limited to, those which were, could have been or could be the subject of an administrative or judicial proceeding filed by the Executive or on his behalf under federal, state or local law, whether by statute, regulation, in contract or tort, and including, but not limited to, every claim for front pay, back pay, wages, bonus, fringe benefit, any form of discrimination (including but not limited to, every claim of race, color, sex, religion, national origin, disability or age discrimination and any claim under the Age Discrimination in Employment Act (ADEA)), wrongful termination, emotional distress, pain and suffering, breach of contract, compensatory or punitive damages, interest, attorney’s fees, reinstatement or reemployment. If any court rules that such waiver of rights to file, or have filed on his behalf, any administrative or judicial charges or complaints is ineffective, the Executive agrees not to seek or accept any money damages or any other relief upon the filing of any such administrative or judicial charges or complaints. The Executive relinquishes any right to future employment with the Company and the Company shall have the right to refuse to reemploy the Executive without liability. The Executive acknowledges and agrees that even though claims and facts in addition to those now known or believed by him to exist may subsequently be discovered, it is his intention to fully settle and release all such employment-related claims he may have against the Company and the persons and entities described above, whether known, unknown or suspected.

2. The Company acknowledges and agrees that the release contained in Paragraph 1 of this Release does not, and shall not be construed to, release or limit the scope of any existing obligation of the Company (i) to pay or provide any compensation or benefit required to be paid or provided under Sections 10(b) or 10(g) of the Employment Agreement, (ii) to indemnify the Executive for his acts as an officer or director of the Company in accordance with the bylaws of the Company and the policies and procedures of the Company that are presently in effect including Section 12 of the Employment Agreement and the Director and Officer Indemnification Agreement between the Company and the Executive, (iii) to the Executive and his eligible, participating dependents or beneficiaries under any existing welfare, retirement or other fringe-benefit plan or program of the Company in which the Executive and/or such dependents are

participants, or (iv) under the Retirement Agreement between the Company and the Executive dated December 8, 2014. In addition, the Company acknowledges and agrees that the release contained in Paragraph 1 does not apply to any post-termination of employment obligations of the Company under Sections 10(b) or 10(g) of the Employment Agreement.

3. The Executive acknowledges that he has been provided at least 21 days to review the Release and has been advised to review it with an attorney of his choice. In the event the Executive elects to sign this Release prior to this 21-day period, he agrees that it is a knowing and voluntary waiver of his right to wait the full 21 days. The Executive further understands that he has 7 days after the signing hereof to revoke this Release by so notifying the Company in writing, such notice to be received by the General Counsel of the Company within the 7-day period. The Executive further acknowledges that he has carefully read this Release, and knows and understands its contents and its binding legal effect. The Executive acknowledges that by signing this Release, he does so of his own free will and act and that it is his intention that he be legally bound by its terms.

______________________________

Michael S. Jeffries

Exhibit 99.1

ABERCROMBIE & FITCH CO. ANNOUNCES SENIOR LEADERSHIP CHANGES

Michael Jeffries to Retire as CEO

Arthur Martinez Named Executive Chairman; Office of the Chairman Established

Board Conducting Search for New CEO

New Albany, Ohio - December 09, 2014 - Abercrombie & Fitch Co. (NYSE: ANF) today announced that Michael Jeffries is retiring as Chief Executive Officer and a member of the Board of Directors, effective immediately.

Abercrombie & Fitch’s current Non-Executive Chairman of the Board, Arthur Martinez, will become Executive Chairman. The Board has established an Office of the Chairman, consisting of Mr. Martinez, as well as Jonathan Ramsden, Chief Operating Officer, Christos Angelides, Brand President of Abercrombie & Fitch and Fran Horowitz, Brand President of Hollister. The Office of the Chairman, led by Arthur Martinez, will oversee the Company’s strategic direction and be responsible for managing the Company’s day-to-day operations until a new CEO is appointed.

The Board has commenced a search for Michael Jeffries’s successor and has engaged a leading executive search firm to identify and evaluate both internal and external candidates.

Mr. Martinez has served as Non-Executive Chairman of Abercrombie & Fitch since January 2014. He has substantial public company board leadership and senior executive experience in the retail industry. Mr. Ramsden has been with the Company for 6 years, and has served as Chief Operating Officer since January 2014. Mr. Angelides and Ms. Horowitz, both experienced and respected industry executives, joined Abercrombie & Fitch in October 2014 to lead the Company’s Abercrombie & Fitch and Hollister brands, respectively. These recent organizational enhancements, including the creation of the Chief Operating Officer and Brand President roles in 2014, significantly strengthened the Company’s senior leadership team.

“It is impossible to overstate Mike Jeffries’ extraordinary accomplishments in building Abercrombie & Fitch to the iconic status the brand now enjoys. From a standing start two decades ago, his creativity and imagination were the driving forces behind the company’s growth and success. Going forward, we are confident in our talented senior leadership team and the steps we are taking to revitalize our brands and business,” said Mr. Martinez. “We are also confident that our search will identify a new leader with the skills and expertise to enable Abercrombie & Fitch to capitalize fully on its growth opportunities and build shareholder value.”

Mr. Jeffries said, “It has been an honor to lead this extraordinarily talented group of people. I am extremely proud of your accomplishments. I believe now is the right time for new leadership to take the Company forward in the next phase of its development.”

About Abercrombie & Fitch Co.

Abercrombie & Fitch Co. is a leading global specialty retailer of high-quality, casual apparel for Men, Women and kids with an active, youthful lifestyle under its Abercrombie & Fitch, abercrombie, Hollister Co. and Gilly Hicks brands. At the end of the third quarter, the Company operated 834 stores in the United States and 166 stores across Canada, Europe, Asia, Australia and the Middle East. The Company also operates e-commerce websites at www.abercrombie.com, www.abercrombiekids.com, www.hollisterco.com and www.gillyhicks.com.

Investor Contact:

Brian Logan

Abercrombie & Fitch

(614) 283-6877

Investor_Relations@abercrombie.com

Media Contacts:

Dawn Dover

Kekst and Company

(212) 521 4817

(917) 349 5621

dawn-dover@kekst.com

Public Relations

Abercrombie & Fitch

(614) 283-6192

Public_Relations@abercrombie.com

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

A&F cautions that any forward-looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995) contained in this Press Release or made by management or spokespeople of A&F involve risks and uncertainties and are subject to change based on various important factors, many of which may be beyond the Company's control. Words such as "estimate," "project," "plan," "believe," "expect," "anticipate," "intend," and similar expressions may identify forward-looking statements. Except as may be required by applicable law, we assume no obligation to publicly update or revise our forward-looking statements. The following factors, in addition to those included in the disclosure under the heading "FORWARD-LOOKING STATEMENTS AND RISK FACTORS" in "ITEM 1A. RISK FACTORS" of A&F's Annual Report on Form 10-K for the fiscal year ended February 1, 2014, in some cases have affected and in the future could affect the Company's financial performance and could cause actual results for Fiscal 2014 and beyond to differ materially from those expressed or implied in any of the forward-looking statements included in this Press Release or otherwise made by management: changes in economic and financial conditions, and the resulting impact on consumer confidence and consumer spending, could have a material adverse effect on our business, results of operations and liquidity; changing fashion trends and consumer preferences, and the ability to manage our inventory commensurate with customer demand, could adversely impact our sales levels and profitability; fluctuations in the cost, availability and quality of raw materials, labor and transportation, could cause manufacturing delays and increase our costs; a significant component of our growth strategy is international expansion, which requires significant capital investment, adds complexity to our operations and may strain our resources and adversely impact current store performance; our international expansion plan is dependent on a number of factors, any of which could delay or prevent successful penetration into new markets or could adversely affect the profitability of our international operations; we have increased the focus of our growth strategy on direct-to-consumer sales channels and the failure to successfully develop our position in these channels could have an adverse impact on our results of operations; our direct-to-consumer operations are subject to numerous risks that could adversely impact sales, failure to successfully implement certain growth initiatives may have a material adverse effect on our financial condition or results of operations; fluctuations in foreign currency exchange rates could adversely impact our financial condition and results of operations; our business could suffer if our information technology systems are disrupted or cease to operate effectively; comparable sales, including direct-to-consumer, may continue to fluctuate on a regular basis and impact the volatility of the price of our Common Stock; extreme weather conditions may negatively impact our results of operations; our market share may be negatively impacted by increasing competition and pricing pressures from companies with brands or merchandise competitive with ours; our ability to attract customers to our stores depends, in part, on the success of the shopping malls or area attractions in which most of our stores are located; our net sales fluctuate on a seasonal basis, causing our results of operations to be susceptible to changes in Back-to-School and Holiday shopping patterns; our failure to protect our reputation could have a material adverse effect on our brands; we rely on the experience and skills of our senior executive officers, the loss of whom could have a material adverse effect on our business; interruption in the flow of merchandise from our key vendors and international manufacturers could disrupt our supply chain, which could result in lost sales and increased costs; in a number of our European stores, associates are represented by workers' councils and unions, whose demands could adversely affect our profitability or operating standards for our brands; we depend upon independent

third parties for the manufacture and delivery of all our merchandise; our reliance on two distribution centers domestically and four third-party distribution centers internationally makes us susceptible to disruptions or adverse conditions affecting our distribution centers; we rely on third-party vendors as well as other third-party arrangements for many aspects of our business and the failure to successfully manage these relationships could negatively impact our results of operations or expose us to liability for the actions of third-party vendors acting on our behalf; we may be exposed to risks and costs associated with credit card fraud and identity theft that would cause us to incur unexpected expenses and loss of revenues; our facilities, systems and stores, as well as the facilities and systems of our vendors and manufacturers, are vulnerable to natural disasters, pandemic disease and other unexpected events, any of which could result in an interruption to our business and adversely affect our operating results; our litigation exposure could have a material adverse effect on our financial condition and results of operations; our inability or failure to adequately protect our trademarks could have a negative impact on our brand image and limit our ability to penetrate new markets; actions of activist stockholders could have a negative effect on our business; fluctuations in our tax obligations and effective tax rate may result in volatility in our operating results; the effects of war or acts of terrorism could have a material adverse effect on our operating results and financial condition; our inability to obtain commercial insurance at acceptable prices or our failure to adequately reserve for self-insured exposures might increase our expenses and adversely impact our financial results; operating results and cash flows at the store level may cause us to incur impairment charges; we are subject to customs, advertising, consumer protection, privacy, zoning and occupancy and labor and employment laws that could require us to modify our current business practices, incur increased costs or harm our reputation if we do not comply; changes in the regulatory or compliance landscape could adversely affect our business and results of operations; our asset-based revolving credit facility and our Term Loan Facility include financial and other covenants that impose restrictions on our financial and business operations; compliance with changing regulations and standards for accounting, corporate governance and public disclosure could adversely affect our business, results of operations and reported financial results; our inability to successfully implement our long-range strategic plan could have a negative impact on our growth and profitability; our estimates of the expenses that we may incur in connection with the closures of the Gilly Hicks stores could prove to be inaccurate and our inability to transition smoothly to a brand-based organizational model could have a negative impact on our business

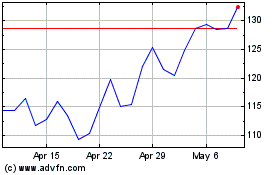

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From Mar 2024 to Apr 2024

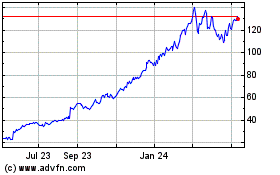

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From Apr 2023 to Apr 2024