UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

Date of Report (Date of Earliest Event Reported):

|

|

November 18, 2014

|

Juniper Networks, Inc.

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

001-34501

|

770422528

|

_____________________

(State or other jurisdiction

|

_____________

(Commission

|

______________

(I.R.S. Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

1194 North Mathilda Avenue, Sunnyvale, California

|

|

94089

|

_________________________________

(Address of principal executive offices)

|

|

___________

(Zip Code)

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

|

(408) 745-2000

|

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On November 10, 2014, pursuant to a Current Report on Form 8-K and the press released furnished as Exhibit 99.1 thereto, Juniper Networks, Inc. (the "Company") announced that Rami Rahim had been appointed as Chief Executive Officer of the Company.

Employment Offer Letter

On November 18, 2014, in connection with Mr. Rahim’s appointment as Chief Executive Officer, the Company and Mr. Rahim entered into an employment offer letter (the "Agreement"). The Agreement has no specified term, and Mr. Rahim’s employment with the Company will be on an at-will basis.

The material terms of the Agreement are summarized below.

Base Salary

Mr. Rahim will receive an annual base salary of $1,000,000, subject to annual review.

Annual Cash Incentive Bonus

Mr. Rahim will be eligible for incentive compensation as a participant in the Company’s Executive Annual Incentive Bonus Plan for its executive officers with an annualized bonus target of 175% of base salary. However, Mr. Rahim’s 2014 target incentive under the plan will be calculated based on (i) ten months with an annualized bonus target of 150% of base salary and (ii) two months with an annualized bonus target of 175% of base salary.

Price Vested Shares

In order to create increased alignment between executive compensation and company performance, as measured by stock price, on November 21, 2014, Mr. Rahim will receive a performance-contingent RSU award (the "Price Vested Shares") for an aggregate number of shares of the Company’s common stock (the "Common Stock") having a value of $5,000,000, calculated based on the average closing price of the Common Stock over the 90 days preceding the date of grant. The Price Vested Shares shall vest as follows: (i) 33% of the Price Vested Shares will vest immediately if the ASP (as defined below) equals or exceeds $29.00 between November 1, 2015 and October 31, 2017; (ii) 67% of the Price Vested Shares (minus any portion of which have previously vested under clause (i) above) will vest immediately if the ASP equals or exceeds $32.50 between November 1, 2016 and October 31, 2018; and (iii) 100% of the Price Vested Shares (minus any portion of which have previously vested under clauses (i) or (ii) above) vest immediately if the ASP equals or exceeds $40.00 between November 1, 2017 and October 31, 2019. For purposes hereof, "ASP" means the average closing market price of the Common Stock over a period of 60 consecutive trading days.

2015 Equity Awards

The Agreement also specified the equity awards Mr. Rahim will receive in 2015 as part of the Company’s annual executive compensation cycle. Subject to grant by the Compensation Committee of the Board (the "Compensation Committee"), in February 2015, Mr. Rahim will receive equity awards with a total aggregate value of $6,750,000. The allocation of value between restricted stock units, price vested awards, performance shares or other types of equity awards will be based on the same proportions used for awards made to the Company’s Grade 16 and 15 officers in February 2015, and the vesting schedules for such equity awards will be the same as established for awards made to the Company’s Grade 16 and 15 officers in February 2015. The conversion of such dollar values into a number of shares of Common Stock will be based on the same per share price determined by the Compensation Committee for the equity awards made to other Section 16 officers in February 2015.

Expenses

The Company will also reimburse Mr. Rahim for reasonable and actual out-of-pocket expenses of up to $10,000 associated with review of his employment offer by his legal and financial advisors.

The foregoing description of the Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the Agreement, which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Mr. Rahim’s bonuses and equity awards will be subject to the Company’s "clawback" policies as in effect from time to time.

Severance and Change in Control Agreements

On November 19, 2014, the Company entered into its standard form severance agreement with Mr. Rahim, which was filed as Exhibit 10.10 to the Company’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission (the "SEC") on November 10, 2014, and is incorporated by reference herein. Mr. Rahim’s severance agreement will expire on January 1, 2017.

In addition, on November 19, 2014, the Company entered into its change of control agreement (the "Change of Control Agreement") with Mr. Rahim. The Change of Control Agreement will expire on January 1, 2016.

Upon a change of control of the Company, provided that Mr. Rahim signs a release of claims and complies with certain post-termination non-solicitation and non-competition provisions, Mr. Rahim will receive change of control benefits if either (i) between the date that is four months following a change of control and the date that is twelve months following a change of control he terminates his employment for Good Reason (as defined below), or (ii) within twelve months following a change of control the Company terminates his employment for other than Cause (as defined below). The change of control benefits consist of (i) a cash payment equal to his annual base salary and target bonus for the fiscal year in which the change of control or Mr. Rahim’s termination occurs, whichever is greater; (ii) $36,000 in lieu of continuation of benefits; and (iii) acceleration of his then unvested equity awards that vest based on time and, with respect to equity awards that vest wholly or in part based on factors other than time, such as performance, (a) any portion for which the measurement or performance period or performance measures have been completed shall immediately vest and become exercisable (and any rights of repurchase by the Company or restriction on sale shall lapse), and (b) the remaining portions shall immediately vest or become exercisable in an amount equal to the number that would be calculated if the performance measures were achieved at the target level; provided however, that if there is no "target" number, then the number that vests shall be 100% of the amounts that could vest with respect to that measurement period.

For purposes hereof, "Cause" means (i) an act of personal dishonesty taken by Mr. Rahim in connection with his responsibilities as an employee and intended to result in his substantial personal enrichment; or (ii) his being convicted of, or pleading nolo contendere to a felony; or (iii) a willful act by Mr. Rahim which constitutes gross misconduct and which is injurious to the Company; or (iv) following delivery to Mr. Rahim of a written demand for performance from the Company which describes the basis for the Company’s reasonable belief that he has not substantially performed his duties, continued violations by him of his obligations to the Company which are demonstrably willful and deliberate on his part. For purposes hereof, "Good Reason" means Mr. Rahim’s termination of employment, if one or more of the following events occur without his written consent: (i) a material reduction of his duties, title, authority or responsibilities, relative to his duties, title, authority or responsibilities as in effect immediately prior to such reduction; or (ii) a substantial reduction of the facilities and perquisites (including office space and location) available to him immediately prior to such reduction; or (iii) a reduction by the Company in his base compensation or total target cash compensation as in effect immediately prior to such reduction; or (iv) a material reduction by the Company in the kind or level of benefits to which he was entitled immediately prior to such reduction with the result that his overall benefits package is significantly reduced; or (v) his relocation to a facility or a location more than 40 miles from his then present location.

The foregoing description of the Change of Control Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the form of Change of Control Agreement, which was filed as Exhibit 10.2 to the Company’s Quarterly Report on Form 10-Q filed with the SEC on November 8, 2013, and is incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit No. Description

10.1 Employment Offer Letter, dated November 18, 2014 between Juniper Networks, Inc. and Rami Rahim

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Juniper Networks, Inc.

|

|

|

|

|

|

|

|

November 24, 2014

|

|

By:

|

|

/s/ Mitchell L. Gaynor

|

|

|

|

|

|

|

|

|

|

|

|

Name: Mitchell L. Gaynor

|

|

|

|

|

|

Title: Executive Vice President and General Counsel

|

Exhibit Index

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

10.1

|

|

Employment Offer Letter, dated November 18, 2014 between Juniper Networks, Inc. and Rami Rahim

|

Exhibit 10.1

November 16, 2014

Rami Rahim

On behalf of the Board of Directors, I am delighted you have accepted the position of Chief

Executive Officer of Juniper Networks, Inc. (“Juniper” or the “Company”). This letter will confirm

the terms of your compensation.

Position: As Chief Executive Officer you will serve with all of the authority and responsibilities

provided in the Bylaws of the Company as customarily associated with that position, reporting to

the Company’s Board of Directors (the “Board”). You have also been elected as a director to the

Board of Directors.

Base Salary: In consideration of your services, you will be paid by an annual base salary of

$1,000,000, which will be paid semi-monthly in the amount of $41,166.67, less applicable taxes,

deductions and remittances, in accordance with the Company’s normal payroll processing.

Annual Cash Incentive Bonus: You will be eligible to participate in Juniper Executive Annual

Incentive Bonus Plan with an annualized bonus target of 175% of base salary (for 2014, your

incentive bonus will be calculated based on 10 months at 150% and 2 months at 175%). The Board, or

a committee thereof, shall establish your performance targets under the plan. The plan and funding

schedule is subject to change at any time during the plan year.

Equity Awards: You will be granted under the 2006 Equity Incentive Plan (“Plan”) in February 2015

equity awards having a total aggregate value of $6,750,000. The allocation of that value between

RSUs, price vested awards, performance shares or other types of equity awards will be based on the

same proportions used for awards made to the Company’s Grade 16 and 15 executive officers at the

same time. The vesting schedules for these awards will be the same as established for awards made

to the Company’s Grade 16 and 15 executive officers at the same time. The conversion of such

dollar values into a number of shares of Common Stock will be based on the same per share price

determined by the Compensation Committee of the Board of Directors for the equity awards made to

other Section 16 officers in February 2015.

Price Vested Shares: On November 21, 2014, you will be granted under the terms of the Plan a price

vested performance share award (the “Price Vested Shares”) for an aggregate number of shares of

Juniper Common Stock having a value of $5,000,000, calculated based on the average closing price of

Juniper common stock over the 90 days preceding the date of grant. The Price Vested Shares shall

vest as follows: immediately as to 33% of the applicable number of shares if between November 1,

2015 and October 31, 2017, the Company’s 60-trading-day average closing market stock price is

$29.00 or more; and 67% (excluding any shares already vested) if between November 1, 2016 and

October 31, 2018, the Company’s 60-trading-day average closing market stock price is $32.50 or

more; and 100% (excluding any shares already vested) if between November 1, 2017 and October 31,

2019, the Company’s 60-trading-day average closing market stock price is $40.00 or more. The

60-trading-day average closing market stock means the average closing market price of Juniper

Common Stock (as reported by the Wall Street Journal) over a period of 60 consecutive trading days.

A trading day means a day on which trading is open on the New York Stock Exchange. This award will

be on the applicable form of price vested award agreement approved by the General Counsel. Except

as provided under the Change in Control Agreement between the Company and you, in no event shall

the PVAs become vested for any shares after the cessation of Continuous Status as an Employee or

Consultant as defined in the Plan and award agreement.

409A: Notwithstanding anything to the contrary in this agreement, if you are a “specified employee”

within the meaning of Internal Revenue Code Section 409A (“Section 409A”) at the time of your

termination (other than due to death) or resignation, then the severance payable to you, if any,

pursuant to this agreement, when considered together with any other severance payments or

separation benefits that are considered deferred compensation under Section 409A (together, the

“Deferred Compensation Separation Benefits”) that are payable within the first six (6) months

following your termination of employment, will become payable on the first payroll date that occurs

on or after the date six (6) months and one (1) day following the date of your termination of

employment. All subsequent Deferred Compensation Separation Benefits, if any, will be payable in

accordance with the payment schedule applicable to each payment or benefit. Notwithstanding

anything herein to the contrary, if you died following your termination but prior to the six (6)

month anniversary of your termination, then any payments delayed in accordance with this paragraph

will be payable in a lump sum as soon as administratively practicable after the date of your death

and all other Deferred Compensation Separation Benefits will be payable in accordance with the

payment schedule applicable to each payment or benefit. Each payment and benefit payable under

this agreement is intended to constitute separate payments for purposes of Section 1.409A-2(b)(2)

of the Treasury Regulations.

Any amount paid under this agreement that satisfies the requirements of the “short-term

deferral” rule set forth in Section 1.409A-1(b)(4) of the Treasury Regulations shall not constitute

Deferred Compensation Separation Benefits for purposes of the first paragraph above.

Any amount paid under this agreement that qualifies as a payment made as a result of an

involuntary separation from service pursuant to Section 1.409A-1(b)(9)(iii) of the Treasury

Regulations that do not exceed the Section 409A Limit shall not constitute Deferred Compensation

Separation Benefits for purposes of the first paragraph above. “Section 409A Limit” will mean the

lesser of two (2) times: (i) your annualized compensation based upon the annual rate of pay paid to

your during your taxable year preceding your taxable year of your termination of employment as

determined under, and with such adjustments as are set forth in, Treasury Regulation

1.409A-1(b)(9)(iii)(A)(1) and any Internal Revenue Service guidance issued with respect thereto; or

(ii) the maximum amount that may be taken into account under a qualified plan pursuant to Section

401(a)(17) of the Code for the year in which your employment is terminated.

The foregoing provisions are intended to comply with the requirements of Section 409A so that

none of the severance payments and benefits to be provided hereunder will be subject to the

additional tax imposed under Section 409A, and any ambiguities herein will be interpreted to so

comply. The Company and your agree to work together in good faith to consider amendments to this

agreement and to take such reasonable actions which are necessary, appropriate or desirable to

avoid imposition of any additional tax or income recognition prior to actual payment to you under

Section 409A.

Arbitration: Any claim, dispute or controversy arising out of this Agreement, the interpretation,

validity or enforcement of this Agreement or the alleged breach thereof shall be submitted by the

parties to final, binding and confidential arbitration by the American Arbitration Association

(“AAA”), in San Francisco, California, conducted before a single arbitrator under the

then-applicable AAA rules. By agreeing to this arbitration procedure, you and the Company waive

the right to resolve any such dispute, claim or demand through a trial by jury or judge or by

administrative proceeding. You will have the right to be represented by legal counsel at any

arbitration proceeding. The arbitrator shall: (a) have the authority to compel adequate discovery

for the resolution of the dispute and to award such relief as would otherwise be available under

applicable law in a court proceeding; and (b) issue a written statement signed by the arbitrator

regarding the disposition of each claim and the relief, if any, awarded as to each claim, the

reasons for the award, and the arbitrator’s essential findings and conclusions on which the award

is based. The Company shall pay all AAA arbitration fees, except the amount of such fees

equivalent to the filing fee you would have paid if the claim had been litigated in court. Nothing

in this offer letter is intended to prevent either you or the Company from obtaining injunctive

relief in court to prevent irreparable harm pending the conclusion of any arbitration, including

but not limited to any disputes or claims relating to or arising out of the misuse or appropriation

of the Company’s trade secrets or confidential and proprietary information. Judgment may be

entered on the award of the arbitration in any court having jurisdiction.

At-Will Employment: Your employment with Juniper will be voluntarily entered into and will be for

no specified period. As a result, you will be free to resign at any time, for any reason or for no

reason, as you deem appropriate. Juniper will have a similar right and may conclude its employment

relationship with you at any time, with or without cause.

Entire Agreement and Miscellaneous: This agreement, together with all exhibits and agreements

incorporated by reference herein, forms your complete and exclusive agreement with the Company

concerning the subject matter hereof. The terms in this agreement supersede any other

representations or agreements made to you by any party, whether oral or written. This agreement is

to be governed by the laws of the state of California without reference to conflicts of law

principles. In case any provision contained in this agreement shall, for any reason, be held

invalid or unenforceable in any respect, such invalidity or unenforceability shall not affect the

other provisions of this agreement, and such provision will be reformed, construed and enforced so

as to render it valid and enforceable consistent with the general intent of the parties insofar as

possible under applicable law. With respect to the enforcement of this agreement, no waiver of any

right hereunder shall be effective unless it is in writing. This agreement may be executed in more

than one counterpart, and signatures transmitted via facsimile shall be deemed equivalent to

originals.

Juniper will also reimburse you for reasonable and actual out-of-pocket expenses of up to $10,000

associated with review of this offer by your legal and financial advisers.

You may accept this offer by signing below and returning a copy to Mitch Gaynor.

On behalf of the Board and the entire Juniper community, we look forward to working together

with you as a director and Chief Executive Officer.

Very truly yours,

/s/ David Schlotterbeck

David Schlotterbeck

Chairman of the Compensation Committee

Juniper Networks, Inc.

I accept the terms of this letter.

| |

|

|

| /s/ Rami Rahim |

|

11/18/2014 |

Rami Rahim

|

|

Date |

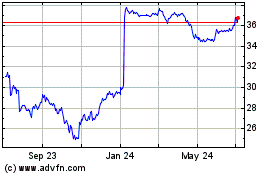

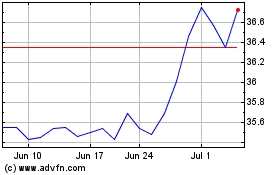

Juniper Networks (NYSE:JNPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Juniper Networks (NYSE:JNPR)

Historical Stock Chart

From Apr 2023 to Apr 2024