UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________

FORM 8-K

________________________________________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 17, 2014

________________________________________________

Advanced Energy Industries, Inc.

(Exact name of registrant as specified in its charter)

________________________________________________

|

| | | | |

Delaware | | 000-26966 | | 84-0846841 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

|

| | | | | |

1625 Sharp Point Drive, Fort Collins, Colorado | | 80525 | |

(Address of principal executive offices) | | (Zip Code) | |

|

| | | |

(970) 221-4670 |

(Registrant's telephone number, including area code) |

| | | |

Not applicable |

(Former name or former address, if changed since last report) |

________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(b), (e) On November 17, 2014, Advanced Energy Industries, Inc. (“AEI”) and Danny C. Herron, Chief Financial Officer (“Herron”), entered into an executive transition and separation agreement (the “Transition Agreement”), providing for the termination of Herron’s employment with AEI following a transition period.

Transition Period

Pursuant to the Transition Agreement, Herron will continue to serve as AEI’s Chief Financial Officer, the company’s principal financial officer, until March 10, 2015, unless (i) Herron’s employment is voluntarily terminated by him, terminated earlier by AEI’s acceleration of the termination date or terminated earlier for Cause (as defined in the Transition Agreement), or (ii) AEI extends the termination date by up to thirty (30) days after March 10, 2015.

Mr. Herron will continue to receive his current base salary and benefits during the transition period while Chief Financial Officer.

Payments

Subject to the conditions set forth in the Transition Agreement, AEI will pay Herron the following amounts (collectively, the “Payments”): (i) an amount equal to $575,000 within thirty (30) days after termination of his employment and an additional amount equal to $100,000 within sixty (60) days after termination of his employment, and (ii) a severance amount equal to $108,130 over the four (4) month period following his termination of employment.

The Transition Agreement includes Herron’s release of claims against AEI as of the date of the Transition Agreement, and receipt of the Payments is subject to Herron’s provision to AEI of a full release of claims as of the expiration of the transition period or within twenty-one (21) days thereafter.

Incentive Compensation

Pursuant to the Transition Agreement, Herron will not be eligible for any award under AEI’s Short Term Incentive Plan, and all performance units and performance stock options granted to Herron under the 2012-2014 Long Term Incentive Plan that were unvested as of the date of the Transition Agreement were cancelled.

Other Agreements

The Transition Agreement also includes Herron’s commitments in respect of (i) reasonable assistance to AEI for twelve (12) months after the transition period to answer questions and participate in discussions related to AEI, (ii) non-disparagement of AEI and its affiliates and employees, (iii) confidentiality, (iv) non-solicitation, and (v) non-competition.

Herron has the right to revoke the Transition Agreement by written notice to AEI within seven (7) days after signing the Transition Agreement.

The foregoing summary description of the Transition Agreement is qualified in its entirety by reference to the full text of the Transition Agreement, which is attached as Exhibit 10.1 and incorporated by reference herein.

(c) On November 18, 2014, AEI announced the promotion of Bill Trupkiewicz to Chief Accounting Officer. Mr. Trupkiewicz, age 51, has been Vice President and Corporate Controller of AEI since March 2014. Prior to joining AEI, Mr. Trupkiewicz held a number of senior finance and accounting positions with JBS USA Holdings, Inc. and its predecessor companies since October 1994, serving most recently as Corporate Controller, Chief Accounting Officer and Secretary from July 2007 through January 2014. JBS USA Holdings, Inc., a subsidiary of the Brazilian company JBS S.A., is a global leader in beef and pork processing. Mr. Trupkiewicz is a Certified Public Accountant.

Item 8.01 Other Events.

On November 18, 2014, AEI issued a press release announcing that Herron will step down as Chief Financial Officer following a transition period. A copy of the press release is attached hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

|

| | | |

| Exhibits |

| | |

10.1 |

| | Executive Transition and Separation Agreement, dated November 17, 2014 |

99.1 |

| | Press release dated November 18, 2014 by Advanced Energy Industries, Inc. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| | | |

| | /S/ Thomas O. McGimpsey |

Date: November 18, 2014 | | Thomas O. McGimpsey |

| | Executive Vice President, General Counsel & Corporate Secretary |

EXHIBIT INDEX

|

| | |

Exhibit Number | | Description |

10.1 | | Executive Transition and Separation Agreement, dated November 17, 2014 |

99.1 | | Press release dated November 18, 2014 by Advanced Energy Industries, Inc. |

EXECUTIVE TRANSITION AND SEPARATION AGREEMENT

This Executive Transition and Separation Agreement (“Agreement”), dated as of November 17, 2014, is by and between Advanced Energy Industries, Inc., a Delaware corporation (“AEI”) and Danny C. Herron, an individual (“Executive” and, together with AEI, the “Parties”).

RECITALS

A.Executive is employed full time as the Chief Financial Officer of AEI.

B.Executive serves at the pleasure of the Board of Directors (“Board”) and the President & Chief Executive Officer (“CEO”), and his employment may be terminated by AEI or by Executive at any time.

C.The Parties desire to provide for a transition period and termination of Executive’s employment with AEI in an amicable and orderly way, and to settle any and all disputes, known and unknown, in accordance with the terms and conditions set forth in this Agreement.

In consideration of the foregoing and the promises contained in this Agreement, the Parties hereby agree as follows:

I. DEFINITIONS

The following definitions shall be applicable for the purposes of this Agreement:

A.“Agreement” has the meaning set forth in the Preamble.

B.“AEI” has the meaning set forth in the Preamble.

C.“Board” has the meaning set forth in the Recitals.

D.“Cause” is defined as: (i) Executive’s failure to perform his duties and responsibilities as described in Section II.B.(i) under this Agreement or refusal to carry out any lawful directions of the Board or the CEO, provided that Executive is given notice of such failure and a reasonable period not to exceed 5 days to correct or cure such failure or refusal and Executive fails to cure such failure; (ii) Executive’s gross negligence, dishonesty, willful misconduct or knowing violation of Securities and Exchange Commission (“SEC”) rules and regulations; (iii) Executive’s conviction of or pleading guilty or nolo contendere to a crime (other than a misdemeanor traffic related offense); or (iv) fraud, embezzlement or misappropriation of property by Executive.

E.“Claims” unless specifically limited, means any debt, obligation, demand, cause of action, judgment, controversy or claim of any kind whatsoever, whether sounding in contract, statute, tort, fraud, misrepresentation, discrimination, retaliation, claim for attorney fees or costs, or any other legal theory; claims under Title VII of the Civil Rights Act of 1964, as amended; claims under the Genetic Information Nondiscrimination Act, claims under the Civil Rights Act of 1991; claims under 42 U.S.C. § 1981, § 1981a, § 1983, § 1985, or § 1988; claims under the Family and Medical Leave Act of 1993; claims under the Americans with Disabilities Act of 1990, as amended; claims under the Rehabilitation Act of 1973, as amended; claims under the Fair Labor Standards Act of 1938, as amended; claims under the Employee Retirement Income Security Act of 1974, as amended; claims under the Age Discrimination in Employment Act, as amended, the Colorado Anti-Discrimination Act; and claims under any other applicable federal, state or local statute, regulation, common law or decision concerning discrimination, pay, benefits, or any other aspect of employment or any other matter.

The defined term “Claims” does not include claims by Executive for: (i) unemployment insurance; (ii) worker’s compensation benefits; (iii) state disability compensation; (iv) previously vested benefits under any employer-sponsored benefits plan; (v) unpaid overtime or violations of minimum wage obligations under the federal Fair Labor Standards Act, 29 U.S.C. Sections 201 et seq. or applicable state law; (vi) continued benefits in accordance with the

Consolidated Omnibus Budget Reconciliation Act of 1985; (vii) enforcement of the terms of this Agreement; or (viii) any other rights that cannot by law be released by private agreement.

F.“Company” means AEI and any current or former parent, subsidiary, predecessor, entity, division, or affiliated company of AEI, or successor or assign of any of the foregoing, or any benefit plan maintained by any of the foregoing, and the current and former directors, officers, employees, shareholders and agents of any or all of the foregoing, unless otherwise specifically stated in this Agreement.

G.“Effective Date” means the first date upon which all of the following have occurred: (i) Executive has timely executed this Agreement, (ii) the Agreement has been received by the General Counsel of AEI at 1625 Sharp Point Drive, Fort Collins, CO 80525, (iii) an authorized representative of AEI has executed the Agreement, and (iv) the revocation period set forth in Section II.F. of this Agreement has expired without revocation by Executive.

H.“Executive” shall mean the Executive and Executive’s heirs, executors, administrators, agents, attorneys, representatives or assigns.

I.“Termination Date” has the meaning set forth in Section II.B(iii).

J.“Transition Period” means the period commencing on the Effective Date and ending on the Termination Date.

II. COVENANTS

A.Consideration To Executive. Provided that Executive has fully complied with his obligations hereunder through the Termination Date, AEI shall pay to Executive the Separation Payment and the Severance Payment set forth in Addendum A hereto according to the schedule set forth in Addendum A.

B.Transition Period and Termination.

| |

(i) | The Transition Period. During the Transition Period, the Executive shall continue to serve actively in the position of Chief Financial Officer of AEI, in good faith and in full compliance with AEI’s policies, procedures and internal controls. During the Transition Period, Executive must use commercially reasonable best efforts to fulfill his standard duties, provide a written transition plan reasonably satisfactory to the Board and CEO, engage in any dispute negotiations with third parties as requested by the CEO, fulfill all SEC-related duties related to the annual audit and the signing/filing of the AEI Form 10-K and any other required filings, and any additional duties requested in good faith by the CEO of AEI or the Board from time to time. |

| |

(ii) | Base Salary. Executive’s annual base salary during the Transition Period while serving as the Chief Financial Officer shall be the same as Executive’s annual base salary immediately prior to the Transition Period. This Agreement shall not be deemed a contract of employment. |

| |

(iii) | Termination. Unless terminated earlier for Cause or voluntarily by Executive, Executive’s employment shall terminate March 10, 2015, provided however, that the CEO may, by written notice to Executive, accelerate such termination and end the Transition Period as early as the CEO so determines, or delay such termination by up to no more than 30 days after March 10, 2015 (the “Termination Date”). |

| |

(iv) | Effect of Termination. In the event that (a) Executive continues employment with AEI though March 10, 2015 (or such permitted accelerated or delayed date) or is terminated by AEI without Cause prior to such time, (b) Executive uses his commercially reasonable best efforts to cause the AEI Form 10-K to be timely signed and filed (unless waived by the AEI as a condition precedent related to early termination), and (c) Executive fully complies with all of his obligations in this Agreement and under law, Executive shall be eligible for the benefits and payments set forth on Addendum A to this Agreement. In the event that Executive’s employment is terminated for Cause, Executive will not be entitled to receive the benefits or payments set forth on Addendum A to this Agreement. If Executive voluntarily terminates his employment with AEI for any reason, he will not be entitled, to the extent not already paid, to any of the benefits or payments set forth in Addendum A or the continued payment of the base compensation set forth in Section II.B.(ii) of this Agreement. |

| |

C. | Release Of Claims By Executive. |

| |

(i) | Release. As a material inducement to AEI to enter into this Agreement, Executive, as a free and voluntary act, hereby forever releases and discharges the Company for any Claims of any kind whatsoever, which may have arisen on or prior to Executive’s execution of this Agreement, including but not limited to (a) Claims relating in any way to Executive’s employment with AEI and/or the employment opportunities that were provided and/or denied to Executive, (b) Claims relating in any way to the separation of Executive’s employment with AEI, (c) Claims related to Executive’s compensation provided by AEI, (d) Claims related to AEI’s Long-Term Incentive Plan (“LTIP”) (other than LTIP awards that are vested and/or exercisable as of the Effective Date) or Short-Term Incentive Plan (“STIP”), (e) Claims related to the Executive Change in Control Agreement dated August 14, 2010, as amended (“Executive Change in Control Agreement”), or (f) Claims related to any other matter, cause or thing whatsoever which may have occurred between Executive and the Company on or prior to Executive’s execution of this Agreement. Executive’s acknowledges and agrees that he will no longer be an eligible participant under AEI’s STIP, LTIP or any other incentive plan. |

| |

(ii) | Waiver of Rights following Termination Date. As a material inducement to AEI to enter into this Agreement, Executive agrees to provide AEI with an executed Confidential General Release (“Release”) in form and substance as set forth in Addendum B, no earlier than the Termination Date and no later than 21 days after the Termination Date, which Release is a condition of payment of the Separation Payment and Severance Payment set forth on Addendum A. |

Executive acknowledges that different or additional facts may be discovered in addition to what he now knows or believes to be true with respect to the matters herein released, and Executive agrees that this Agreement shall be and remain in effect in all respects as a complete and final release of the matters released, notwithstanding any such different or additional facts. Executive represents and warrants that he has not previously filed or joined in any claims that are released herein and that he has not given or sold any portion of any claims released herein to anyone else.

| |

(iii) | Release Applies To Representative Actions. The above release applies to any Claims brought by any person or agency on behalf of Executive, or any class or representative action pursuant to which Executive may have any right or benefit. Executive waives his right to and promises not to accept any recoveries, benefits or injunctive relief which may be obtained on Executive’s behalf by any other person or agency or in any class or representative action that may include or encompass any of the released Claims, and Executive assigns any such recovery or benefit to AEI. |

D. Waiver Of Right To Seek Individual Relief. Executive represents, as a material term of this Agreement, that there are no charges or disputes pending before any governmental agency or forum for which approval by the agency or forum is required for dismissal. Executive further waives the right to individual relief in connection with any charges filed or to be filed before or otherwise investigated by any governmental agency regarding any conduct that occurred on or prior to Executive’s execution of this Agreement.

E. Reasonable Assistance with Matters. Executive shall, from time to time over the twelve (12) months following the Termination Date, as reasonably requested by AEI, answer questions and participate in discussions related to AEI.

F. Compliance With Older Workers Benefit Protection Act. Executive acknowledges that he is not entitled to the consideration being provided to him under this Agreement unless Executive enters into this Agreement, including the releases of Claims contained in this Agreement. Executive acknowledges that he is waiving claims under the Age Discrimination in Employment Act, as amended, that arose on or prior to his execution of this Agreement. Executive also acknowledges that he is being given twenty-one (21) days to consider this Agreement, and that he has carefully read and understands all of the provisions of this Agreement. Executive is hereby advised in writing to consult with an attorney prior to signing this Agreement. Executive acknowledges that his decision to execute this Agreement is knowing and voluntary. Executive has the right to revoke this Agreement within seven (7) days after signing this Agreement by sending a letter by certified mail indicating his intention to revoke to Tom McGimpsey located at 1625 Sharp Point Drive, Fort Collins, CO 80525. The waiver of claims under the Age Discrimination in Employment Act, as amended, shall not become effective until the expiration of the revocation period set forth above.

G. Confidentiality Of Agreement, Non-Disparagement, and Restrictive Covenants.

| |

(i) | Except as otherwise specifically provided in this Agreement, Executive will not disclose any of the negotiations leading to the making of this Agreement or any of the terms or provisions of this Agreement to any other person or entity other than Executive’s spouse, tax accountant, executive coach, attorney, or taxing authority (each, a “Permitted Recipient”). Executive represents and warrants that he has not made any disclosure of any of the terms or provisions of this Agreement or any of the negotiations leading to the making of this Agreement to any other person or entity, except to a Permitted Recipient. |

| |

(a) | Executive acknowledges that AEI may be required to file this Agreement, or disclose its material terms, in reports filed with the SEC, and Executive shall cooperate with AEI in connection with any such reports. |

| |

(b) | It shall not be a breach of this Agreement for Executive to disclose the terms and provisions of this Agreement in response to any lawful court order or subpoena, provided Executive first gives AEI as much notice as is possible of the existence of the subpoena or court order so that AEI can object to the court order or subpoena. |

| |

(ii) | Non-Disparagement. Executive agrees not to make, or cause or attempt to cause any other person to make any statement, written or oral, or convey any information about AEI which is disparaging or which in any way reflects negatively upon AEI, its management team, board of directors, employees or affiliates. Executive and AEI agree that nothing in this Agreement is meant to preclude AEI or Executive from fully and truthfully cooperating with any government investigation or inquiry. |

| |

(iii) | Executive acknowledges and agrees that he continues to be bound by the restrictive covenants set forth in the Key Employee Agreement (defined below) including but not limited to confidentiality of AEI information, non-solicitation and non-competition. |

H. Other Agreements. Executive and AEI entered into a Key Employee Agreement To Protect Confidential Information, Assign Inventions, and Prevent Unfair Competition And Unfair Solicitation (“Key Employee Agreement”) at the inception of Executive’s employment with AEI and in consideration of Executive’s then new employment with AEI. Executive and AEI entered into the Executive Change In Control Agreement on or about August 14, 2010. Each of the Parties hereby agrees and confirms that it or he did not intend for the Executive Change In Control Agreement to modify or supersede the Key Employee Agreement, or any term or provision of the Key Employee Agreement. Accordingly, as a material term of this Agreement, each of the Parties agrees that the Executive Change in Control Agreement did not in fact modify or supersede the Key Employee Agreement, or any term or provision of the Key Employee Agreement. Executive and AEI agree that this Agreement supersedes any severance policy provisions found in the Corporate Policy Manual.

Executive further agrees, as a material term of this Agreement, that any rights Executive may now or in the future have under the Executive Change In Control Agreement are hereby superseded by this Agreement and waived by Executive, and from and after the Effective Date Executive shall be not be entitled to any benefits under the Executive Change in Control Agreement. Executive acknowledges and agrees that the Key Employee Agreement is in full force and effect and is not superseded or modified by this Agreement. Any obligations of Executive under this Agreement shall be in addition to, and not in limitation of, any obligations of Executive under the Key Employment Agreement.

I. Executive’s Resignation. As a free and voluntary act, Executive agrees to resign from AEI effective on the Termination Date. Unless otherwise agreed to in writing by AEI, Executive further agrees that he has no right to employment or consulting or contracting employment with AEI at any time now (except as expressly set forth herein) or after the Termination Date.

J. Executive’s Agreement To Resign From All Executive and Board Positions. As a free and voluntary act, Executive agrees to, and hereby does, resign from all officer and director positions he holds at AEI as of the Termination Date. Executive shall execute any documents or take any other action in furtherance of this undertaking as may be reasonably requested by AEI. If Executive does not comply with this covenant within 10 days after written request, the Executive grants to AEI a durable power-of- attorney to sign, execute and delivery any required filings to effect such resignation.

III. ADDITIONAL PROVISIONS

A.Voluntary Agreement. Executive acknowledges that he is only entitled to the consideration specified in this Agreement as the result of his execution of this Agreement and that Executive’s execution of the Agreement is knowing and voluntary.

B.Severability. In case any one or more of the provisions of this Agreement shall be found to be invalid, illegal or unenforceable in any respect, the validity, legality and enforceability of the remaining provisions contained in this Agreement shall not in any way be affected or impaired. Further, any provision found to be invalid, illegal or unenforceable shall be deemed, without further action on the part of the Parties to this Agreement, to be modified, amended and/or limited to the minimum extent necessary to render such clauses and/or provisions valid and enforceable.

C.Entire Agreement. This Agreement, together with the Key Employee Agreement, constitutes the entire agreement between the Parties with respect to the subject matter of this Agreement, and may be amended, modified or superseded only by a written agreement signed by each Party. No prior, contemporaneous or future oral statements shall modify or otherwise affect the terms and provisions of this Agreement.

D.Choice Of Law. This Agreement shall be construed in accordance with the substantive laws of the state of Colorado without regard to its conflict of laws principles.

E.No Admission Of Liability. AEI denies that AEI took any improper action against Executive or that it violated any federal, state, or local law or common law principle in its treatment or compensation of him. This Agreement shall not be admissible in any proceeding as evidence of any improper conduct by AEI, its officer, directors, employees or affiliates.

F.Assignment. Neither party may assign its rights or obligations under this Agreement to any other party without the prior written consent of the other party to this Agreement. As an exception to this provision, AEI may assign this Agreement to an affiliated entity or a successor (including, without limitation, a purchaser of more than fifty percent (50%) of Advanced Energy Industries, Inc.’s assets) without Executive’s prior approval.

G.Authority. Executive and the undersigned representative of AEI both separately represent and warrant that they each, respectively, have the right and authority to execute this Agreement, and that they each, respectively, have not sold, assigned, transferred, conveyed or otherwise disposed of any Claims or potential Claims relating to any matter covered by this Agreement.

H.Binding Effect. This Agreement is binding upon the Parties, their heirs, representatives, executors, administrators, successors, and assigns.

I.Drafting Of Agreement. The Parties each acknowledge that they each, respectively, have had the opportunity to retain counsel of their own choosing concerning the making and entering into this Agreement; that they have read and fully understand the terms of this Agreement and have had the opportunity to have it reviewed and approved by their counsel of choice, with adequate opportunity and time for such review and that they are fully aware of its contents and of its legal effect. The parties further agree that this Agreement shall not be construed against any Party on the grounds that such Party drafted this Agreement. Instead, this Agreement shall be interpreted as though drafted equally by both of the Parties.

YOUR SIGNATURE BELOW ACKNOWLEDGES THAT YOU HAVE READ THIS AGREEMENT CAREFULLY IN ITS ENTIRETY, THAT YOU KNOW AND UNDERSTAND ITS CONTENTS AND THAT YOU ENTER INTO THIS AGREEMENT FREELY AND AS A VOLUNTARY ACT.

|

| |

Executive

/s/ Danny C. Herron___________ Danny C. Herron Executive

Dated: November 17, 2014 | Advanced Energy Industries, Inc.

/s/ Thomas O. McGimpsey____________ Executive Vice President, General Counsel & Corporate Secretary Authorized Officer

Dated: November 17, 2014 |

ADDENDUM A

TO EXECUTIVE TRANSITION AND SEPARATION AGREEMENT

BETWEEN ADVANCED ENERGY INDUSTRIES, INC. AND EXECUTIVE

Advanced Energy Industries, Inc. shall provide the following consideration to Executive pursuant to Section II.A. of the Agreement.

| |

1. | A payment equal to $575,000.00 payable at the next regular payroll cycle after the Termination Date and a second payment equal to $100,000 payable within 60 days after his Termination Date (collectively, the “Separation Payment”). |

| |

2. | The Separation Payment is subject to recoupment by AEI if: (a) the AEI financial statements become the subject of a material restatement within three (3) years of Executive’s Termination Date due to an error that was caused, or contributed to, by Executive’s negligence, fraud or willful misconduct, including without limitation, any negligence, fraud or willful misconduct in Executive’s management, oversight and supervision; or (b) Executive materially breaches the Agreement. To the extent the Separation Payment is characterized as a bonus, it is subject to recoupment under applicable law, including without limitation Section 954 of the Dodd-Frank Act and Section 304 of the Sarbanes-Oxley Act. Executive acknowledges that, in the event grounds exist for recoupment of the Separation Payment, any amounts subject to recoupment may be set off from amounts otherwise owed by AEI to Executive. The term “material restatement” used in this paragraph is not intended to apply to a retrospective revision of the company’s audited financial statements due to a subsequent change in accounting principle, subsequent occurrence of discontinued operations or as a result of subsequent change in segment reporting. |

| |

3. | Subject to the terms of this Agreement, AEI agrees to make a severance payment equal to $108,130.00 (the “Severance Payment”). The Severance Payment will paid in four (4) monthly installment payments with 25% paid each month or $27,032.50. These payments will be made on the normal payroll cycle for each of the 4 months following Executive’s Termination Date. |

| |

4. | The Separation Payment and Severance Payment are subject to appropriate taxes and withholding allowances. |

| |

5. | In addition to the release and waiver of certain claims set forth in Section II.C.(i)(d) of the Agreement, Executive acknowledges and agrees that (a) Executive is not eligible for an STIP award or other annual bonus with respect to the 2014 performance year or any future year, and (b) any LTIP award granted or portion thereof, that has not vested or is not exercisable (i.e., Executive is not eligible for the LTIP grants related to the 2014 performance year or any future year) as of the Effective Date shall be forfeited without further action by AEI. |

For the avoidance of doubt, Executive’s unvested and forfeited/cancelled LTIP awards are set forth in Attachment A.

| |

6. | AEI Severance Policy Waiver. Executive acknowledges and agrees that this Agreement supersedes any other AEI severance policy as provided to employees generally under the current Corporate Policy Manual and will be in satisfaction and in lieu of any other severance (including but not limited to statutory or contractual severance), notice period, wrongful termination damages or any other claims or rights Executive may have arising out of the termination of Executive’s employment. |

|

| |

I accept the terms and conditions of this Addendum:

/s/_Danny C. Herron______________ Danny C. Herron Executive Date: November 17, 2014 | Advanced Energy Industries, Inc.

By: /s/ Thomas O. McGimpsey________ Its: Executive Vice President, General Counsel & Corporate Secretary Date: November 17, 2014 |

Attachment A to Addendum A

Unvested and Forfeited/Cancelled LTIP and other equity Awards

|

| | | | |

Grant Date | Plan/Type | Price | Unvested | Comments |

| | | | |

02/15/2011 | 2008/ISO | $14.5200 | 6,563.00 | Eligible to vest on 2/15/2014 if still employed |

04/28/2011 | 2008/ISO | $14.2100 | 331.00 | Eligible to vest on 4/28/15 if still employed |

| | | | |

04/28/2011 | 2008/NQ | $14.2100 | 6,232.00 | Eligible to vest on 4/28/15 if still employed |

07/22/2011 | 2008/NQ | $12.4400 | 6,563.00 | Eligible to vest on 7/22/15 if still employed |

10/26/2011 | 2008/NQ | $9.5100 | 3282.00 | Eligible to vest on 10/26/2015 if still employed |

01/03/2012 | 2008/NQ | $11.0200 | Up to 50,906.00 | Waived and cancelled as of the Effective Date |

| | | | |

02/15/2011 | 2008/RSU | N/A | 938.00 | Eligible to vest on 2/15/2014 if still employed |

04/28/2011 | 2008/RSU | N/A | 938.00 | Eligible to vest on 4/28/15 if still employed |

07/22/2011 | 2008/RSU | N/A | 938.00 | Eligible to vest on 7/22/15 if still employed |

10/26/2011 | 2008/RSU | N/A | 469.00 | Eligible to vest on 10/26/2015 if still employed |

02/01/2013 | 2008/RSU | N/A | Up to 59,392.00 | Waived and cancelled as of the Effective Date |

| | | | |

ADDENDUM B

TO EXECUTIVE TRANSITION AND SEPARATION AGREEMENT

BETWEEN ADVANCED ENERGY INDUSTRIES, INC. AND EXECUTIVE

In consideration of the Separation Payment and the Severance Payment set forth on Addendum A to the Executive Transition and Separation Agreement (hereinafter the “Agreement”) made and entered into by and between Danny C. Herron, an individual (hereinafter the “Executive”) and Advanced Energy Industries, Inc., a Delaware corporation (“AEI”) on the _____ day of ___________, 2014, Executive hereby executes this Confidential General Release (hereinafter the “Release”):

Whereas, the recitals and definitions from the Agreement are incorporated herein by reference;

| |

1. | Waiver of Rights. As a material inducement to AEI to enter into the Agreement, Executive, as a free and voluntary act, hereby forever releases and discharges the Company for any Claims of any kind whatsoever, which may have arisen on or prior to Executive’s execution of this Release, including but not limited to (a) Claims relating in any way to Executive’s employment with AEI and/or the employment opportunities that were provided and/or denied to Executive, (b) Claims relating in any way to the separation of Executive’s employment with AEI, (c) Claims related to Executive’s compensation provided by AEI, (d) Claims related to AEI’s Long-Term Incentive Plan (“LTIP”) (other than LTIP awards that are vested and/or exercisable as of the Effective Date) or Short-Term Incentive Plan (“STIP”), (e) Claims related to the Executive Change in Control Agreement dated August 14, 2010, as amended, or (f) Claims related to any other matter, cause or thing whatsoever which may have occurred between Executive and the Company on or prior to Executive’s execution of this Release. |

Executive acknowledges that different or additional facts may be discovered in addition to what he now knows or believes to be true with respect to the matters herein released, and Executive agrees that this Release shall be and remain in effect in all respects as a complete and final release of the matters released, notwithstanding any such different or additional facts. Executive represents and warrants that he has not previously filed or joined in any claims that are released herein and that he has not given or sold any portion of any claims released herein to anyone else.

2. Release Applies To Representative Actions. The above release applies to any Claims brought by any person or agency on behalf of Executive, or any class or representative action pursuant to which Executive may have any right or benefit. Executive promises not to accept any recoveries or benefits which may be obtained on Executive’s behalf by any other person or agency or in any class or representative action that may include or encompass any of the released Claims, and Executive assigns any such recovery or benefit to AEI.

3. Waiver Of Right To Seek Individual Relief. Executive represents, as a material term of this Release, that there are no charges or disputes pending before any governmental agency or forum for which approval by the agency or forum is required for dismissal. Executive further waives the right to individual relief in connection with any charges filed or to be filed before or otherwise investigated by any governmental agency regarding any conduct that occurred on or prior to Executive’s execution of this Release.

4. Confidentiality. Executive agrees to keep the terms of this Release confidential and not to disclose the terms of this Release to anyone except to Executive’s spouse, attorneys, tax consultants or as otherwise required by law, and agrees to take all steps necessary to assure confidentiality by those recipients of this information.

5. Voluntary Action; Non-Reliance. Executive hereby agrees and acknowledges that Executive has carefully read this Release, fully understands what this Release means, is signing this Release knowingly and voluntarily, that no other promises or agreements have been made to Executive other than those set forth in the Agreement

or this Release, and that Executive has not relied on any statement by anyone associated with the AEI that is not contained in the Agreement or this Release in deciding to sign this Release.

6. Governing Law. This Release will be governed by the laws of the State of Colorado without regard to its conflicts of laws principles.

7. Compliance With Older Workers Benefit Protection Act. Executive acknowledges that he is not entitled to the consideration being provided to him under the Agreement unless Executive executes the Agreement and this Release. Executive acknowledges that he is waiving claims under the Age Discrimination in Employment Act, as amended, that arose on or prior to his execution of this Release. Executive also acknowledges that he was given at least twenty-one (21) days to consider this Release, and that he has carefully read and understands all of the provisions of this Release. Executive is hereby advised in writing to consult with an attorney prior to signing this Release. Executive acknowledges that his decision to execute this Release is knowing and voluntary. Executive has the right to revoke this Release within seven (7) days after signing this Release by sending a letter by certified mail indicating his intention to revoke to Tom McGimpsey located at 1625 Sharp Point Drive, Fort Collins CO 80525. The waiver of claims under the Age Discrimination in Employment Act, as amended, shall not become effective until the expiration of the revocation period set forth above.

|

| |

____________________ Danny C. Herron Executive Date: _______________ | |

Press Release

|

| | | |

CONTACTS: | | | |

Danny Herron | | Annie Leschin | |

Advanced Energy Industries, Inc. | | Advanced Energy Industries, Inc. | |

970.407.6570 | | 970.407.6555 | |

danny.herron@aei.com | | ir@aei.com | |

|

|

Advanced Energy Industries Announces CFO Transition |

Fort Collins, Colo., November 18, 2014 - Advanced Energy Industries, Inc. (NASDAQ: AEIS), a leader in precision power conversion, today announced that Danny Herron, EVP and Chief Financial Officer, will step down after a transition period to pursue other opportunities. The company has initiated a search for his successor and Mr. Herron has agreed to continue in his role for such transition period.

“In the more than four years that Danny has been with Advanced Energy, he has been instrumental in helping us execute on our strategic priorities and driving operational excellence.” said Yuval Wasserman, President and Chief Executive Officer. “We are grateful for his years of service and wish him success in his future endeavors.”

“Being part of Advanced Energy’s transformation has been professionally rewarding. I am confident that the team will continue to drive shareholder value and wish them continued success,” said Mr. Herron.

Bill Trupkiewicz, the company’s VP and Corporate Controller has been promoted to chief accounting officer.

About Advanced Energy

Advanced Energy (Nasdaq: AEIS) is a global leader in innovative power and control technologies for high-growth, precision power conversion solutions. Advanced Energy is headquartered in Fort Collins, Colorado, with dedicated support and service locations around the world. For more information, go to www.advanced-energy.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Exchange Act of 1934, including, but not limited to, statements regarding the CFO transition. These forward-looking statements are based on Advanced Energy’s current assumptions, expectations and beliefs and involve substantial risks and uncertainties that may cause results, performance or achievement to materially differ from those expressed or implied by these forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to: the Company’s ability to identify and hire a highly qualified Chief Financial Officer, cooperation by the parties during the process, potential disruption to the Company’s operations and management that could result from the transition and a transition period that could be shorter or longer in duration. Other risks are described in Advanced Energy's Form 10-K, Forms 10-Q and other reports and statements filed with the Securities and Exchange Commission. These reports and statements are available on the SEC's website at www.sec.gov. Copies may also be obtained from Advanced Energy's website at www.advancedenergy.com or by contacting Advanced Energy's investor relations at 970-407-6555. Forward-looking statements are made and based on information available to the company on the date of this press release. The company assumes no obligation to update the information in this press release.

###

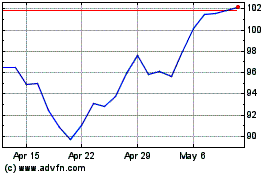

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

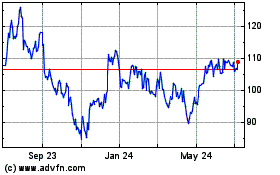

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Apr 2023 to Apr 2024