UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 18, 2014

NN, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

0-23486 |

|

62-1096725 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 2000 Waters Edge Drive, Johnson City, Tennessee |

|

37604 |

| (Address of principal executive offices) |

|

(Zip Code) |

(423) 743-9151

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| ITEM 7.01 |

REGULATION FD DISCLOSURE |

Attached as Exhibit 99.1 to this Current Report on Form 8-K is

a PowerPoint presentation, which provides an update to investors. The attached presentation updates NN, Inc.’s previously provided investor presentation.

The information presented in Item 7.01 to this Current Report on Form 8-K is being furnished in accordance with Rule 101(e)(1) under

Regulation FD and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and will not be incorporated by reference into any registration statement filed under the Securities

Act of 1933, as amended, unless specifically identified therein as being incorporated by reference.

| ITEM 9.01 |

FINANCIAL STATEMENTS AND EXHIBITS |

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Investor Presentation of NN, Inc. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

Date: November 18, 2014

|

|

|

| NN, INC. |

|

|

| By: |

|

/s/ William C. Kelly, Jr. |

| Name: |

|

William C. Kelly, Jr. |

| Title: |

|

Vice President and

Chief Administrative Officer |

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Investor Presentation of NN, Inc. |

|

| Exhibit 99.1

|

Exhibit 99.1

Investor Presentation

November 19-20, 2014

Forward Looking Statement

Except for specific

historical information, many of the matters discussed in this presentation may express or imply projections of revenues or expenditures, statements of plans and objectives or future operations or statements of future economic performance. These, and

similar statements, are forward-looking statements concerning matters that involve risks, uncertainties and other factors which may cause the actual performance of NN, Inc. and its subsidiaries to differ materially from those expressed or implied by

this discussion. All forward-looking information is provided by the Company pursuant to the safe harbor established under the Private Securities Litigation Reform Act of 1995 and should be evaluated in the context of these factors. Forward-looking

statements generally can be identified by the use of forward-looking terminology such as “assumptions”, “target”, “guidance”, “outlook”, “plans”, “projection”, “may”,

“will”, “would”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “potential” or “continue” (or the negative or other derivatives of each of these

terms) or similar terminology. Factors which could materially affect actual results include, but are not limited to: general economic conditions and economic conditions in the industrial sector, inventory levels, regulatory compliance costs and the

Company’s ability to manage these costs, start-up costs for new operations, debt reduction, competitive influences, risks that current customers will commence or increase captive production, risks of capacity underutilization, quality issues,

availability and price of raw materials, currency and other risks associated with international trade, the Company’s dependence on certain major customers, and the successful implementation of the global growth plan including development of new

products. Similarly, statements made herein and elsewhere regarding pending or completed acquisitions are also forward-looking statements, including statements relating to the anticipated closing date of an acquisition, the Company’s ability to

obtain required regulatory approvals or satisfy closing conditions, the costs of an acquisition and the Company’s source(s) of financing, the future performance and prospects of an acquired business, the expected benefits of an acquisition on

the Company’s future business and operations and the ability of the Company to successfully integrate recently acquired businesses.

For additional information concerning such risk factors and cautionary statements, please see the section titled “Risk Factors” in the Company’s periodic reports filed with

the Securities and Exchange Commission, including, but not limited to, the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2013. Except as required by law, we undertake no obligation to update or revise any

forward-looking statements we make in our press releases, whether as a result of new information, future events or otherwise

Vision & Mission

Our mission is to

provide high-quality products and superior customer service that continuously exceed our customers’ expectations while providing enhanced value for our stakeholders.

Our vision is to be the leading manufacturer of high-performance precision components.

A History of Growth

Estimated revenue of $700M

Traded on Nasdaq (NNBR)

Global reach, local depth

25 manufacturing

facilities with operations in 10 countries

Approximately 4,200 employees

Continuous investment in technology leadership

Supplying to diversified blue chip customers in over 30 countries

1980Metal Bearing1999Components2000 2001 2003 2005 2006 2014…

Industrial Veenendaal SNR Ball Whirlaway V-S Chelsea

NN founded Molding Euroball Delta Rubber RFK Autocam

in Erwin, TN Assets Corporation Industries Grinding

Corporation Company

NN, Inc. President & CEO

Richard D.

Holder

Highly successful history of growing profitable organizations by acquisition, organic growth, and

adjacent market growth

Joins NN from Eaton Corporation where he held several leadership positions most

recently serving as President of Eaton Electrical Components Group

Held leadership positions at US Airways,

AlliedSignal and Parker Hannifin Corporation prior to joining Eaton

Served 10 years in USMC

The New NN – Global Market Leader

NN is a

$700+ million public company with three platforms

Metal Bearing Components

Autocam Precision Components

Plastics and Rubber Components

NN has a world

leading market position in Metal Bearing Components

Top 3 in precision balls, Number 1 in tapered rollers

Low number of competitors; high market share; high barrier to entry

Stable market position throughout the cycle; organic growth limited due to high, stable market shares

The Autocam Precision Components platform has high growth opportunities

Top 3 in existing precision markets

Highly disaggregated global market

Few global

players at the high precision range are in an excellent position to gain market share

NN’s

Plastic & Rubber Components group specializes in high-precision plastic injection and rubber molded products for auto and industrial markets

Global reach is critical in our product platforms and with production in 10 countries, NN is able to serve all key customers.

NN is now top 3 globally in both Metal Bearing Components and Precision Metal Components

The New NN – Global Market Leader

Metal

Bearing Components

Steel Balls Tapered Rollers Cylindrical Rollers Bearing Cages Miscellaneous stamped metal

products

Autocam Precision Components

Complex, high precision components for :

Fuel

systems

Steering systems

Transmissions

HVAC compressors

Power tools

Plastic & Rubber Components

Bearing

seals

Custom molded rubber seals Plastic retainers Precision plastic components

Global Footprint

—Metal Bearing Components

—Autocam Precision Components —Plastic & Rubber Components —Corporate Headquarters

Established global presence with profitable operations in North America, Europe, Brazil and China

Megatrends

New Capital Cycle: the manufacturing

world is coming off of a low period in capital investment. As customers consider make vs. buy decisions, NN is positioned to become the feeder company of choice in our markets.

Tier 1 and Tier 2 auto suppliers are concentrating on purchasing with fewer, larger suppliers.

Offshore sourcing is changing as logistics are becoming a growing factor. Supply Chain localization is gaining momentum with all manufacturers. Healthy U.S. automotive industry is

providing opportunities for growth.

China is now the world’s largest market for personal cars.

Rigorous global gas mileage requirements assure growing demand for NN products

Megatrends—High Growth Product Segments

GDI

HP Diesel VCT/VVT Multi-Speed Trans EPS

MPG Increase + 15 —20% (1) + 20 —30% (1) + 4

—6% (2) + 5 —10% (3) + 3 —5% (4)

Content Per Vehicle

Impact + $54 (1) + $89 (1) + $10 (2) + $20 (3) + $4 (4)

Market Growth > 17% CAGR > 10% CAGR > 10% CAGR > 15% CAGR >10% CAGR

Key Regions/Markets

Technologies needed on a global scale to meet fuel economy regulations Conversion/implementation rates will outpace market growth All of these technologies require numerous high precision

metal components

Source: Based on IHS Automotive and internal estimates

| (1) |

|

Relative to base engine with MPFI fuel system |

| (3) |

|

Relative to base 5-speed transmission |

| (2) |

|

Relative to base engine without VVT/VCT |

| (4) |

|

Relative to base Hydraulic Power Steering system |

GDI: Increased APC Content per Vehicle

MPFI V6

GDI V6

Precision Turned Part content:

$6.00 per vehicle

Precision Turned Part content:

| 1 |

|

High pressure fuel pump |

$60 per vehicle

Technology requires more precision, tighter tolerances

GDI will have a VERY long life: 10-15+ years (MPFI lived for 30+ years)

GDI Fuel System

Our Future Vision: 2018

$800+ million in revenue

$270 million in revenue from acquisitions – $280 million already completed

$145 million from organic and adjacent market growth based on enhanced R&D and market presence

Improving segment operating margins

Metal Bearing Components: 13.5%

Precision Metal

Components: 12.0%

Plastic and Rubber Components: 8.5%

Established global presence with profitable operations in North America, Europe, Brazil and China

Road to $800M

Outpace the Market with Expanded

Focus and Investment

$ Millions

European Economic

$800 $800 $800 Recovery

$700

Organic Growth

3% per Year

$600

$540

$500

Adjacent Markets

$450

5% per Year

$400 $390

$373

$300

Acquisitions

$260 million in Sales

$200

$100

$0

2013 Base 2018 SP

2013 Base 2018 SP

NN will be growing revenue at 26% CAGR over the Strategic Plan Years

The New NN – Products & Geography

Engine Components Fuel Systems

End Product Cooling System Fans Driveline

Use

Transmission

Plastic & Rubber

Components

9%

Precision

21%

Metal

Product Mix Components

70%

Metal Bearing

Components

South

America

Asia

3%

10%

Geography 47% North

Europe America

40%

Fuel Systems Power Steering

Electric Motors Powertrain

Precision

Metal

Components

100%

Asia

7%

Europe

16%

58% North

America

South 19%

America

+

Engine Components Steering

Fuel Systems Transmission

Plastic & Rubber

Components

6%

43% Metal Bearing

Precision 51% Components

Metal

Components

Asia

South 7%

America

11%

50% North

America

Europe 32%

Improved balance among geographic focus and product mix

The New NN – Customers & Markets

Nexteer

Timken

Iljin

2% 1%

GKN 3%

3%

HILITE

6%

SKF

Top Ten (Copeland) Emerson 6% 36%

Customers

7%

Schaeffler/

INA/FAG

7% 7%

ZF

NTN/SNR

Aerospace

<1% <1% Consumer / Other

HVAC 4%

Commercial 5%

Vehicles 5%

End Markets

General 25%

Industrial 59%

Light Auto

Brose

Hitachi

Continental 3%

3%

4% Bosch

Denso 3% 19%

Delphi 7%

6%

TRW 11%

7% Fiat

8%

GM

Cummins

Other

Commercial

Vehicles 4%

9%

87%

Light Auto

+

TRW

Cummins

HILITE 3%

3%

Emerson 3%

SKF

(Copeland) 4% 22%

Schaeffler/ 4%

INA/FAG

4%

ZF

4% 8%

5%

NTN/SNR Bosch

Fiat

Consumer2% Other

Commercial

Vehicles 3%

8%

General

Industrial 17%

70%

Light Auto

Diversified customer base with enhanced end market focus

NN Today & Future Vision

Mix Shift

2014

Revenue = $680M*

Consumer Other

Heavy Truck 2%

3%

7%

General

Industrial 16%

72%

Light

Auto

2018

Revenue = $800M

Other

Consumer

3%

7%

Heavy

Truck 15%

50% Light

Auto

25%

General

Industrial

*Proforma full year consolidated revenue

Creating an Integrated Company

Corporate Identity

One corporate identity

Redesigned website

and Branding Common customer solutions

Operational Top Down Strategy

New Supply Chain

Operations

Excellence Financial and Business Systems Consolidation

Level 3: Offset Economic Costs

Functional Quality: Drive a Zero Defect Culture

Excellence Safety: Drive a Zero Incident Culture

Delivery: Exceed Customers’ Expectations

Enhanced R&D Efforts

Established 3 R&D

Centers of Excellence

Adjacent markets

(e.g. spherical rollers, welded cages)

Game changing manufacturing processes

(e.g. ball

cells, robotics)

Enhanced quality

(e.g. noise reduced product)

Results of 5 Year Strategic Plan – First 9 Months

In January of 2014, NN announced its strategic plan with $270 million of planned acquisitions plus organic and adjacent market growth.

By September of 2014, we had completed 4 acquisitions totaling $280 million in revenue – 3 years ahead of schedule.

Meanwhile, the NN stock price has appreciated 50% since we announced the strategy in January.

We are in the process of updating the strategic plan.

NN, Inc. is now a $700 million public company with two industry-leading platforms in metal bearing components and

precision metal components (rebranded as NN Autocam Precision Components Group).

Financial Strategy / Policy

Build upon a strong,

global operating platform while maintaining financial strength and flexibility Financial policy:

Maintain

healthy leverage over business cycles and strategic growth period: Debt to EBITDA 2.0x – 3.0x, < 4.0x at peak

Cash flow priorities:

1) Debt repayment to

achieve target leverage

2) Capex to achieve operational excellence and growth

3) Stable common dividends to shareholders (< 20% free cash flow).

4) Strategic acquisitions financed by debt and equity issuance to maintain leverage target

Generate above-market-average revenue growth and capture market share in key areas of new technology over Strategic Plan

period

Improve market mix by decreasing auto exposure from 70% to 50%

Increase industrial /aerospace/medical offerings in existing product lines

Expand segment gross and operating margins (optimize mix, operational improvement, cost reductions) Continue to invest in

R&D

Continue to pursue selective strategic acquisitions to diversify end markets and expand global reach,

within leverage targets

2015 Updated Forecast

Metrics Forecasted Target

Analysis

Solid core growth tempered by foreign

Revenue $690— $710 Million currency exchange (FX) translation, and

slowing European and Brazilian economies.

Margins remain in line, we are pulling

EBITDA

$110— $120 Million forward strategic investments as we

continue to invest in our future.

Capital Investment remains a key

Capital Spending $45— $55 Million

component

of our growth strategy.

Cash Available for

$25— $35 Million Excess cash flow remains strong.

Debt Repayment

* Includes all completed acquisitions, organic growth and adjacent market growth per NN’s long-range strategic plan. EBITDA estimate assumes full realization of synergies and full

integration of new operations.

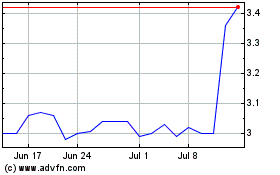

NN (NASDAQ:NNBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

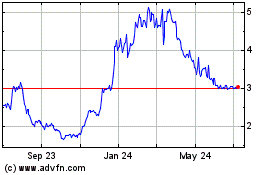

NN (NASDAQ:NNBR)

Historical Stock Chart

From Apr 2023 to Apr 2024