Current Report Filing (8-k)

November 17 2014 - 4:51PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

Current Report

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 17, 2014

Argo Group International Holdings, Ltd.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Bermuda |

|

1-15259 |

|

98-0214719 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 110 Pitts Bay Road

Pembroke HM 08

Bermuda |

|

P.O. Box HM 1282

Hamilton HM FX

Bermuda |

| (Address, Including Zip Code,

of Principal Executive Offices) |

|

(Mailing Address) |

Registrant’s telephone number, including area code: (441) 296-5858

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| ITEM 7.01. |

REGULATION FD DISCLOSURE. |

Argo Group International Holdings, Ltd. (“Argo Group”) may make

presentations to members of the investment community from time to time using the the presentation materials attached hereto as Exhibit 99.1 to this Current Report on Form 8-K.

Note: The information in this report and Exhibit 99.1 attached hereto are furnished pursuant to Item 7.01 and shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section. This report will not be deemed an admission as to the materiality of any information in the report that is required to be

disclosed solely by Regulation FD.

FORWARD-LOOKING STATEMENTS

This press release contains certain statements that are “forward-looking statements” within the meaning of Section 27A of the Securities Act of

1933 and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements are qualified by the inherent risks and uncertainties surrounding future expectations generally and also may materially differ from actual future

experience involving any one or more of such statements. For a more detailed discussion of such risks and uncertainties, see Argo Group’s filings with the SEC. The inclusion of a forward-looking statement herein should not be regarded as a

representation by Argo Group that Argo Group’s objectives will be achieved. Argo Group undertakes no obligation to publicly update forward-looking statements, whether as a result of new information, future events or otherwise.

| ITEM 9.01. |

FINANCIAL STATEMENTS AND EXHIBITS. |

(d) Exhibits:

| 99.1 |

Argo Group International Holdings, Ltd. Presentation |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

ARGO GROUP INTERNATIONAL HOLDINGS, LTD. |

|

|

|

|

|

|

|

|

By: |

|

/s/ Jay S. Bullock |

| Dated: November 17, 2014 |

|

|

|

Name: |

|

Jay S. Bullock |

|

|

|

|

Title: |

|

Executive Vice President and Chief Financial Officer |

2

|

|

| 3Q

2014 Investor Presentation November 2014

Exhibit 99.1 |

|

|

|

Forward-Looking Statements

2.

This presentation contains “forward-looking statements” which are made pursuant to the

safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The

forward-looking statements are based on the Company's current expectations and beliefs

concerning future developments and their potential effects on the Company. There can be no

assurance that actual developments will be those anticipated by the Company. Actual results may

differ materially from those projected as a result of significant risks and uncertainties,

including non-receipt of the expected payments, changes in interest rates, effect of the

performance of financial markets on investment income and fair values of investments, development

of claims and the effect on loss reserves, accuracy in projecting loss reserves, the impact of

competition and pricing environments, changes in the demand for the Company's products, the

effect of general economic conditions, adverse state and federal legislation, regulations and

regulatory investigations into industry practices, developments relating to existing

agreements, heightened competition, changes in pricing environments, and changes in asset

valuations. The Company undertakes no obligation to publicly update any forward-looking

statements as a result of events or developments subsequent to the

presentation. |

|

|

|

3.

Argo Group at a Glance

Exchange / Ticker:

NASDAQ / “AGII”

Share Price:

$55.29

Market Capitalization:

$1.4 billion

Annual Dividend / Yield:

$0.72 per share / 1.3%

Gross Written Premium:

$1.9 billion

Capital:

$2.0 billion

Analyst Coverage:

Raymond James (Outperform) –

Greg Peters

Sterne Agee (Buy) –

Dan Farrell

William Blair (Outperform) –

Adam Klauber

Compass Point (Neutral) –

Ken Billingsley

Dowling & Partners (Neutral) –

Aaron Woomer

KBW (Market Perform) –

Brett Shirreffs

Macquarie (Neutral) –

Amit Kumar

Atlanta

Bermuda

Boston

Brussels

Chicago

Dallas

Denver

Dubai

Houston

Irvine

London

Los Angeles

Malta

New York

Paris

Peoria

Portland

Richmond

Rio de Janeiro

Rockwood

San Antonio

San Francisco

Sao Paulo

Scottsdale

Seattle

Singapore

Zurich

Note: Market information as of November 5, 2014 and annual performance figures as

of TTM September 30, 2014. |

|

|

|

4.

Leading Specialty Franchise

Global underwriter of specialty insurance &

reinsurance

Strategically located in major insurance centers

•

U.S., Bermuda and London

Established presence in attractive markets

•

Leader in U.S. Excess & Surplus Lines

•

Top Quartile Lloyd’s Syndicate by stamp

•

Strong core Commercial Specialty franchise

•

Flexible reinsurance & excess casualty platform

•

Primary presence in Brazil

Diversified by geography, product & distribution

Broad and strong producer relationships

•

Retailers, wholesalers and brokers (Lloyd’s, Re)

“A”

(excellent) A.M. Best rating

Primary

Insurance

Reinsurance

Property

Casualty

GWP by Business Type

GWP by Business Mix

Argo Franchise Overview

~40%

~60%

~90%

~10% |

|

|

|

5.

Maximize

Shareholder

value

through

growth in

Book Value

per Share

Sustainable competitive advantage

•

Niche markets

•

Underwriting expertise

•

Superior customer service

•

Product innovation

Profitable organic & strategic growth

•

Profitable through cycles

•

Key underwriters/teams

•

Deals that meet stringent criteria

Deep, tenured management team

Active capital management

Strategy Aligned Toward Shareholder Value |

|

|

|

6.

*Excludes GWP recorded in runoff and corporate & other.

Evolution of Growth and Diversification

2001

•

Acquired Colony

and Rockwood

•

Founded Trident

(Public Entity)

2005

•

Sold Risk

Management

business

2007

•

Rebranded Argo Group

•

Completed acquisition

•

Formed Argo Re

Syndicate 1200

2011

•

Established local

presence in Brazil

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

’14/3Q

TTM

BVPS

$27.60

$30.46

$35.52

$41.05

$39.62

$47.00

$52.55

$50.54

$55.22

$58.96

$62.99

Total Capital (Millions)

$717

$860

$992

$1,754

$1,763

$1,975

$1,986

$1,840

$1,915

$1,966

$2,008

$622

$788

$903

$1,056

$1,153

$1,182

$1,605

$1,987

$1,530

$1,544

$1,744

$1,888

$1,892

400

800

1,200

1,600

2,000

Total

Risk Management (sold renewal rights in 2005)

International Specialty

Syndicate 1200

Commercial Specialty

Excess & Surplus Lines

15%

30%

32%

22%

2008

•

Acquired Lloyd’s

in Bermuda |

|

|

|

7.

Argo Group Business Mix ($1.9B in GWP)

GWP by Segment

Excess &

Surplus Lines

Commercial

Specialty

Syndicate

1200

International

Specialty

30%

15%

32%

GWP by Product

GWP by Geography

United

States

London

Bermuda

22%

15%

Excess &

Surplus Lines

32%

Other

Commercial

Specialty

Property

Public Entity

20%

5%

6%

Marine &

Aerospace

Surety 3%

Alteris

Mining 4%

Emerging Mkts 9%

6%

Emerging Markets 5%

54%

11%

30%

GWP by Business Type

Primary

Insurance

Reinsurance

*Data is based on TTM as of September 30, 2014. Excludes GWP recorded in runoff

and corporate & other. ~90%

~10% |

|

|

|

8.

Multi-Channel Distribution Strategy

Retail Broker

/

Agent

General

Agency

Wholesale

Broker

Lloyd’s

Market

Reinsurance

Broker

Rockwood

X

Argo Insurance

X

Trident

X

Surety

X

X

Commercial Programs

X

Alteris

X

Contract

X

Transportation

X

Casualty

X

E&O

X

X

D&O

X

X

Environmental

X

Allied Medical

X

X

Specialty Property

X

Liability

X

Property

X

Aviation

X

Marine

X

Excess Casualty

X

X

Professional Liability

X

X

Emerging Markets

X

X

Reinsurance

X |

|

|

|

9.

Maximizing

Shareholder

Value

–

BVPS

Growth

2002

Reported

Book

Value

1

Cumulative Dividends

Price/Book

2

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

3Q ‘14

$21.27

$24.75

$27.60

$30.46

$35.52

$41.05

$39.62

$47.00

$52.55

$50.54

$55.22

$58.96

$62.99

$21.27

$24.75

$27.60

$30.46

$35.52

$42.55

$41.12

$48.50

$54.49

$52.92

$58.03

$62.36

$66.89

1.1x

1.1x

1.2x

1.6x

1.7x

1.2x

0.9x

0.8x

0.7x

0.7x

0.6x

0.8x

0.8x

(1)

Book value per common share:

(2) Price / book calculated at 52-week high and most recent book value per

share. Stock price adjusted for PXRE merger for 2006 and prior years.

-

Adjusted for June 2013 stock dividend

-

2008-2011

restated

to

reflect

adoption

of

ASU

2010-26

(related

to

accounting

for

costs

associated

with

acquiring

or

renewing

insurance

contracts);

2007

and

prior

not

restated

-

2006 and prior years adjusted for PXRE merger

-

2003-2006

includes

impact

of

Series

A

Mandatory

Convertible

Preferred

on

an

as-if

converted

basis.

Preferred

stock

fully

converted

into

common

shares

as

of

Dec.

31,

2007 |

|

|

|

10.

Substantial Growth and Financial Strength

Scale

2002

2006

TTM 3Q '14

'02-3Q'14 Factor

Gross Written Premiums

$622.1

$1,155.6

$1,893.3

3.0x

Net Written Premiums

484.0

847.0

1,363.2

2.8x

Net Earned Premiums

378.4

813.0

1,341.0

3.5x

Financial Strength

2002

2006

TTM 3Q '14

'02-3Q'14 Factor

Total Assets

$2,208.9

$3,721.5

$6,388.6

2.9x

Total Investments

1,181.3

2,514.1

4,111.7

3.5x

Shareholder's Equity

327.7

847.7

1,626.9

5.0x

Total Capital

327.7

992.0

2,007.8

6.1x

Debt / Total Capital

0.0%

14.5%

19.0%

A.M. Best Rating

A

A

A |

|

|

|

11.

Combined Ratio

93.7%

-2.6%

91.1%

Combined Ratio

95.9%

-7.1%

88.8%

Combined Ratio

98.0%

2.3%

100.3%

Combined Ratio

90.0%

-4.7%

85.3%

3Q YTD YoY Net Earned Premium & Combined Ratio

Consolidated NEP up 3.9% and Combined Ratio down 2.3% in 3Q YTD

2014 vs. 3Q YTD 2013

Excess & Surplus Lines

Commercial Specialty

International Specialty

Syndicate 1200

$334.4

$363.9

$100

$200

$300

$400

3Q '13 YTD

3Q '14 YTD

$225.1

$215.5

$50

$100

$150

$200

$250

3Q '13 YTD

3Q '14 YTD

$106.6

$112.6

$25

$50

$75

$100

$125

$150

3Q '13 YTD

3Q '14 YTD

$295.6

$305.9

$100

$150

$200

$250

$300

$350

3Q '13 YTD

3Q '14 YTD |

|

|

|

$101.4

$112.7

$98.3

$64.7

$71.0

$74.4

$83.2

$96.3

$80.7

All data in millions except for ratio calculations. TTM = trailing twelve

months. Excess & Surplus Lines Segment (32% of TTM

GWP) 88.9%

89.3%

99.6%

97.4%

95.5%

91.9%

93.3%

85.3%

88.1%

About Us

•

Leader in U.S. Excess & Surplus Lines

•

Strong relationships with national,

local and regional wholesale brokers

•

Seasoned U/W expertise is a competitive

advantage

•

Target all sizes of non-standard (hard-to-place)

risks, with focus on small/medium accounts

•

Underwrites on both admitted & non-admitted

basis and across all business enterprises via

two brands:

GWP by Business Unit (TTM 9/30/14)

Casualty 35%

Transportation 7%

Environmental 5%

Allied Medical 6%

Management Liability 7%

Property 11%

Contract 24%

Errors & Omissions 5%

Combined Ratio

PTOI

Gross Written Premium

PTOI

(1)

& Combined Ratio

2006

2013

2011

2010

2009

2008

2012

2007

3Q’14

(2)

2013

2011

2010

2009

2008

2006

2012

2007

3Q‘14

(3)

(1)

PTOI = Pre-Tax Operating Income. Excludes interest expense.

(2)

Data is based on year-to-date as of September 30, 2014.

(3)

Data is based on trailing twelve months as of September 30, 2014.

$753.2

$726.5

$684.3

$642.3

$522.6

$478.9

$513.5

$594.2

$613.7

•

Colony Specialty

•

Argo Pro

12. |

|

|

|

13.

97.4%

95.5%

91.9%

88.1%

85.3%

2010

2011

2012

2013

3Q 2014 YTD

New segment

management

team is formed

Year of

restructuring

and strategy

enhancement

Year of execution

on the newly

restructured

platform

Continued

execution and

combined ratio

improvement

Restructuring initiatives and strategy enhancement has enabled

Argo to become an industry-leading E&S underwriter

E&S Operating Platform Enhancement |

|

|

|

14.

Commercial Specialty Segment (22% of GWP)

About Us

•

Business primarily placed through

retail

distribution partners

•

Argo Insurance –

Designs customized

commercial insurance programs for grocers, dry

cleaners, restaurants and other specialty retail

clients

•

Trident

–

2

largest

provider

of

insurance

to

small and midsize U.S. public entities

•

Rockwood

–

2

largest

provider

of

commercial

insurance to coal mining industry

•

Alteris

–

fee based business where Argo or

others accept the risk

GWP by Business Unit (TTM 9/30/14)

U.S. Retail (Argo Insurance) 17%

Restaurants 6%

Grocery 7%

Dry Cleaners 2%

Other Industries 3%

Public Entity

(Trident) 21%

Surety 12%

Mining

(Rockwood) 19%

Other 4%

Alteris Managed Premium 27%

Transportation 3%

State Workers’

Comp Funds 19%

Self Insured Public Entity 5%

89.4%

88.7%

95.6%

98.1%

108.3%

115.1%

96.5%

100.3%

97.8%

Gross Written Premium

PTOI

(1)

& Combined Ratio

(1)

PTOI = Pre-Tax Operating Income. Excludes interest expense.

(2)

Data is based on year-to-date as of September 30, 2014.

(3)

Data is based on trailing twelve months as of September 30, 2014.

$389.1

$420.7

$510.9

$475.7

$428.1

$428.8

$437.0

$419.1

$417.0

$50.4

$61.3

$43.0

$45.8

$36.3

$1.4

($18.9)

$25.2

$11.6

2013

2011

2010

2009

2008

2006

2012

2007

3Q‘14

(3)

2006

2013

2011

2010

2009

2008

2012

2007

3Q’14

(2)

Combined Ratio

PTOI

All data in millions except for ratio calculations. TTM = trailing twelve

months. nd

nd |

|

|

|

15.

131.7%

115.2%

Syndicate 1200 Segment (30% of GWP)

General Liability 13%

Prof. Indemnity 13%

Int’l Casualty Treaty 3%

Directors & Officers 3%

Other 2%

About Us

•

Well-established multi-class

platform at Lloyd’s of London

•

Ranks among the largest

Syndicates at Lloyd’s by Stamp

Capacity

•

Lloyd’s market ratings:

•

‘A’

(Excellent) by A.M. Best

•

‘A+’

(Strong) by S&P

GWP by Business Unit (TTM 9/30/14)

Property 46%

Liability 35%

Specialty 15%

Aerospace 4%

Property Fac 18%

Personal Accident 12%

N. Am. & Int’l Binders 10%

Other 7%

95.8%

112.3%

96.2%

92.4%

Offshore Energy 7%

Onshore Energy 3%

Cargo 3%

Yachts & Hulls 2%

91.1%

Gross Written Premium

PTOI

(1)

& Combined Ratio

(1)

PTOI = Pre-Tax Operating Income. Excludes interest expense.

(2)

Data is based on year-to-date as of September 30, 2014.

(3)

Data is based on trailing twelve months as of September 30, 2014.

$282.9

$706.0

$389.9

$438.5

$533.4

$583.9

$569.0

($5.2)

$30.0

($27.7)

($63.8)

$31.8

$40.6

$37.1

2013

2011

2010

2009

2008

2012

3Q‘14

(3)

2013

2011

2010

2009

2008

2012

3Q’14

(2)

Combined Ratio

PTOI

All data in millions except for ratio calculations. TTM = trailing twelve

months. |

|

|

|

16.

International Specialty Segment (15% of GWP)

About Us

•

Established primary operations in Brazil

•

Established operations in Euro zone

•

Established regional office in Dubai

GWP by Business Unit (TTM 9/30/14)

Excess Casualty 22%

Professional Liability 12%

Brazil 24%

Marine Cargo 10%

Property & Engineering 3%

Motor 5%

Financial Lines 6%

Reinsurance 42%

Other Assumed Re 4%

Property Risk XS 3%

Property Pro Rata 6%

Property Cat 30%

177.5%

71.7%

52.3%

77.9%

97.1%

95.5%

88.8%

Gross Written Premium

PTOI

(1)

& Combined Ratio

(1)

PTOI = Pre-Tax Operating Income. Excludes interest expense.

(2)

Data is based on year-to-date as of September 30, 2014.

(3)

Data is based on trailing twelve months as of September 30, 2014.

$126.4

$162.9

$188.9

$198.2

$260.2

$290.6

$292.1

$23.6

$50.3

$36.7

($67.7)

$15.7

$14.6

$18.7

2013

2011

2010

2009

2008

2012

3Q’14

(2)

2013

2011

2010

2009

2008

2012

3Q‘14

(3)

Combined Ratio

PTOI

•

Bermuda team underwrites:

•

Distributes through brokers

•

Property cat, short tail per risk and

proportional treaty reinsurance worldwide

•

Excess casualty and professional liability for

Fortune 1000 accounts

•

Building diversity through international

expansion:

All data in millions except for ratio calculations. TTM = trailing twelve

months. |

|

|

|

17.

(1)

Calculated using an assumed tax rate of 20%.

(2)

Defined as Losses & LAE / (Earned Premiums less Other Reinsurance-Related

Expenses). (3)

Defined as Underwriting, Acquisition and Insurance Expenses / (Earned Premiums

less Other Reinsurance-Related Expenses). 3Q 2014 Operating Results

3Q 2014

3Q 2013

Year to Date

3Q 2014

Year to Date

3Q 2013

Gross Written Premiums

$497.2

$495.1

$1,480.4

$1,475.5

Net Written Premiums

380.5

374.5

1,055.6

1,043.7

Earned Premiums

337.6

330.5

999.4

962.2

Losses and Loss Adjustment Expenses

191.9

190.9

559.5

554.1

Other Reinsurance-Related Expenses

0.0

4.6

0.0

14.4

Underwriting, Acquisition and Insurance Expenses

133.8

126.7

399.3

378.0

Underwriting Income

$11.9

$8.3

$40.6

$15.7

Net Investment Income

20.8

24.1

64.7

77.3

Fee Income, net

1.6

0.3

0.1

0.5

Interest Expense

4.9

5.1

15.0

15.1

Operating Income

$29.4

$27.6

$90.4

$78.4

Net Realized Investment Gains and Other

12.9

9.1

42.5

29.6

Foreign Currency Exchange (Gain) Loss

(6.0)

3.8

(2.8)

(5.2)

Income Before Taxes

$48.3

$32.9

$135.7

$113.2

Provision for Income Taxes

3.6

1.9

12.2

17.8

Net Income

$44.7

$31.0

$123.5

$95.4

Operating Income per Common Share (Diluted)

1

$0.89

$0.80

$2.72

$2.24

Net Income per Common Share (Diluted)

$1.69

$1.12

$4.63

$3.41

Loss Ratio

2

56.8%

58.6%

56.0%

58.4%

Expense Ratio

3

39.6%

38.9%

40.0%

39.9%

Combined Ratio

96.4%

97.5%

96.0%

98.3%

All data in millions except for per share data and ratio calculations.

|

|

|

|

18.

*Duration includes cash & equivalents

As of September 30, 2014

Conservative Investment Strategy

17%

•

Duration of 2.5 years*

•

Average rating of ‘A1/A+’

•

Book yield of 2.7%*

•

Very liquid

•

Conservatively managed

Portfolio Characteristics

*Book yield is pre-tax & includes all fixed maturities

18.

Equity Investments by Sector

9% Health Care

Energy

25%

7% Financials

5% Industrials

9% Technology

7% Funds

4% Materials

7% Discretionary

Consumer

Staples

25%

Total:

$0.5b

Fixed Maturities by Type

11% Short Term

Corporate

42%.

13% Gov.

18% Structured

State/Muni

16%.

Total:

$3.2b*

*$2.8 billion in fixed maturities, $0.4 billion in short term

2% Utilities & Telecom

Asset Allocation

10% Other

Fixed

69%

Maturities.

9% Short Term

12% Equities

Total:

$4.1b

$77m of cash & cash equivalents not included above

$77m of cash & cash equivalents not included above

|

|

|

|

19.

YTD

2010-3Q '14

2010

2011

2012

2013

3Q 2014

YTD Total

Total Shares Outstanding

31,206,796

31,285,469

31,384,271

34,066,889

34,268,995

Less: Treasury Shares

3,363,560

4,971,305

6,459,613

7,558,345

8,440,355

Net Shares

27,843,236

26,314,164

24,924,658

26,508,544

25,828,640

Shares Repurchased

3,217,561

1,607,745

1,488,308

1,098,732

882,010

8,294,356

As % of Beg. Net Shares

10%

6%

6%

4%

3%

27%

Avg. Repurchase Price per Share

$33.05

$30.69

$29.89

$41.02

$47.78

$34.65

Total Repurchased ($m)

$106.3

$49.3

$44.5

$45.1

$42.1

$287.4

Dividends per Share

$0.48

$0.48

$0.48

$0.60

$0.51

$2.55

Dividend Payments ($m)

$15.3

$14.2

$13.4

$16.1

$13.3

$72.3

Repurchases + Dividends ($m)

$121.7

$63.6

$57.9

$61.1

$55.4

$359.7

Note: Not adjusted for June 2013 stock dividend.

Active Capital Management

Through share repurchases and dividends, we have returned $360 million of capital

and repurchased 27% of shares outstanding from 2010 through 3Q 2014

|

|

|

|

20.

Source: SNL Financial (as of 11/5/14).

Note:

Peer

Group

consists

of:

Allied

World,

American

Financial,

Arch

Capital,

Aspen,

AXIS

Capital,

Endurance,

Global

Indemnity,

HCC,

Markel,

Navigators, OneBeacon, RLI Corp, Selective Group, W.R. Berkley.

Stock Price Performance –

Last 2 Years

(10.0%)

+0.0%

+10.0%

+20.0%

+30.0%

+40.0%

+50.0%

+60.0%

+70.0%

+80.0%

+90.0%

Nov

-12

Jan

-13

Mar-13

May-13

Jul

-13

Sep-13

Nov

-13

Jan

-14

Mar-14

May-14

Jul

-14

Sep-14

Nov

-14

Argo Group

Peer Group

S&P 500

+43%

+82%

+40% |

|

|

|

21.

0.88x

1.21x

0.33x

Difference

Source: SNL Financial (as of 11/5/14).

Note: Price to book is average price/book across all peer companies based on

latest reported book value. Peer Group consists of: Allied World,

American Financial, Arch Capital, Aspen, AXIS Capital, Endurance, Global

Indemnity, HCC, Markel, Navigators, OneBeacon, RLI Corp, Selective Group,

W.R. Berkley. Compelling Valuation vs. Peer Group

Price/Book

Jan-00

Nov-14

Argo

0.70x

0.88x

Peer Avg.

1.17x

1.21x

Difference

0.47x

0.33x

-

0.2x

0.4x

0.6x

0.8x

1.0x

1.2x

1.4x

1.6x

1.8x

2.0x

Jan-00

Jan-02

Jan-04

Jan-06

Jan-08

Jan-10

Jan-12

Jan-14

Argo

Peer Group |

|

|

|

22.

Well Positioned for Value Creation in 2014 and Beyond

•

Compelling investment case

•

Stock trading at a discount to book value and below peers

•

Upside potential as past and ongoing efforts continue

•

Significant changes to premium composition completed

•

Results of re-underwriting and efficiency efforts are emerging in

financials •

Continue to employ and attract some of the best talent in the industry

•

Brazil has traction and is beginning to scale

•

Incremental yield improvements can have a favorable impact on ROE

•

Moderate financial leverage

•

Strong balance sheet with adequate reserves and excellent asset quality

We

believe

that

Argo

Group

has

potential

to

generate

substantial

value

for

new

and

existing

investors |

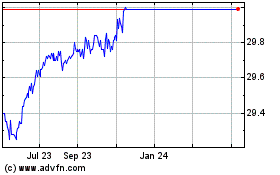

Argo (NYSE:ARGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

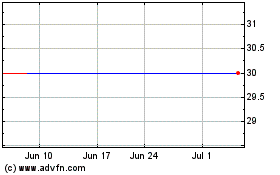

Argo (NYSE:ARGO)

Historical Stock Chart

From Apr 2023 to Apr 2024