Current Report Filing (8-k)

November 13 2014 - 4:53PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act

Date of Report (Date of earliest event reported): November 13, 2014

AMERICAN REALTY INVESTORS, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Nevada

|

001-15663

|

75-2847135

|

|

(State or other

jurisdiction of incorporation)

|

(Commission

File No.)

|

(I.R.S. Employer

Identification No.)

|

| |

|

|

| |

|

|

1603 LBJ Freeway, Suite 800

Dallas, Texas

|

75234

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code 469-522-4200

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Section 2 – Financial Information

Item 2.02. Results of Operations and Financial Condition

On November 13, 2014, American Realty Investors, Inc. (“ARL” or the “Company”) announced its operational results for the quarter ended September 30, 2013. A copy of the announcement is attached as Exhibit “99.1.”

The information furnished pursuant to Item 2.02 in this Form 8-K, including Exhibit “99.1” attached hereto, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that Section, unless we specifically incorporate it by reference in a document filed under the Securities Act of 1933 or the Securities Exchange Act of 1934. We undertake no duty or obligation to publicly update or revise the information furnished pursuant to Item 2.02 of this Current Report on Form 8-K.

Section 9 – Financial Statements and Exhibits

Item 9.01. Financial Statements and Exhibits

The following exhibit is furnished with this Report:

|

Exhibit

Designation

|

Description of Exhibit

|

|

99.1*

|

Press Release dated November 13, 2014.

|

|

_____________________

*Furnished herewith.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the undersigned hereunto duly authorized.

| |

AMERICAN REALTY INVESTORS, INC. |

|

| |

|

|

|

|

Dated: November 13, 2014

|

By:

|

/s/ Gene S. Bertcher |

|

| |

|

Gene S. Bertcher, Executive Vice |

|

| |

|

President and Chief Financial Officer |

|

| |

|

|

|

EXHIBIT "99.1"

|

NEWS RELEASE

FOR IMMEDIATE RELEASE

|

Contact:

American Realty Investors, Inc.

Investor Relations

Gene Bertcher (800) 400-6407

investor.relations@americanrealtyinvest.com

|

American Realty Investors, Inc. Reports Third Quarter 2014 Results

Dallas (November 13, 2014) — American Realty Investors, Inc. (NYSE:ARL), a Dallas-based real estate investment company, today reported results of operations for the third quarter ended September 30, 2014. ARL announced today that the Company reported net loss applicable to common shares of $1.7 million or $0.13 per diluted earnings per share, as compared to a net loss applicable to common shares of $7.0 million or $0.62 per diluted earnings per share for the same period ended 2013.

Management's efforts to enhance the value of our overall portfolio has resulted in the continuing improvement in the Company's results of operations. We continue to see growth in the multifamily market with increasing rents, stable operating expenses, and an occupancy rate over 93%. We are diligent in our mission to provide high-quality living opportunities to our tenants.

In our commercial portfolio, we are seeing the benefit of our efforts with new leases executed and increasing rents as first year concessions expire. We believe that we will continue to see growth in our commercial portfolio as the economic conditions improve and we capitalize on the influx of attractive prospects in the pipeline.

Our ability to take advantage of lower-interest rate mortgages available has reduced our monthly obligations and increased cash flow within our multifamily portfolio.

The positive results of operations has allowed the Company to invest in mortgage receivables in various multifamily projects not under the Company's ownership. We will continue to invest in the multifamily market, as conditions are optimal for achieving a high return on our investment.

Rental and other property revenues were slightly lower for the three months ended September 30, 2014, as compared to the same period in the prior year. This was mainly attributable to our commercial portfolio, which was lower in the current period related to some prior year larger square-foot tenants downsizing or moving out and first year lease specials for new tenants. Rental revenue from our apartment portfolio increased in the current period as we continue to excel with high occupancy rates and increasing rental rates.

Property operating expenses were $10.8 million for the three months ended September 30, 2014, representing an increase of $0.4 million as compared to the same period in the previous year. Operating expenses have remained consistent with prior periods due to labor efficiencies and improvements in preventative maintenance across the portfolio, with only an increase in real estate taxes as a result of the increase in the value of our portfolio and some non-recurring repair projects completed in the current period.

Interest income was $5.1 million for the three months ended September 30, 2014, representing an increase of $1.3 million as compared to the same period in the prior year. During the current quarter, we invested $17.3 million in mortgage receivables which would increase the basis for our interest income.

About American Realty Investors, Inc.

American Realty Investors, Inc., a Dallas-based real estate investment company, holds a diverse portfolio of equity real estate located across the U.S., including office buildings, apartments, shopping centers and developed and undeveloped land. The Company invests in real estate through direct ownership, leases and partnerships and invests in mortgage loans on real estate. The Company also holds mortgage receivables. For more information, visit the Company's website at www.americanrealtyinvest.com.

|

AMERICAN REALTY INVESTORS, INC.

|

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

|

(unaudited)

|

|

| |

|

For the Three Months Ended

|

|

|

For the Nine Months Ended

|

|

| |

|

September 30,

|

|

|

September 30,

|

|

| |

|

2014

|

|

|

2013

|

|

|

2014

|

|

|

2013

|

|

| |

|

(dollars in thousands, except per share amounts)

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rental and other property revenues (including $175 and $165 for the three months and $525

and $497 for the nine months ended 2014 and 2013, respectively, from related parties)

|

|

$ |

19,326 |

|

|

$ |

19,530 |

|

|

$ |

57,986 |

|

|

$ |

57,810 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property operating expenses (including $171 and $178 for the three months and $484 and

$550 for the nine months ended 2014 and 2013, respectively, from related parties)

|

|

|

10,766 |

|

|

|

10,387 |

|

|

|

30,677 |

|

|

|

29,107 |

|

|

Depreciation and amortization

|

|

|

4,463 |

|

|

|

4,053 |

|

|

|

13,099 |

|

|

|

11,820 |

|

|

General and administrative (including $926 and $878 for the three months and $2,686 and

$2,765 for the nine months ended 2014 and 2013, respectively, from related parties)

|

|

|

1,590 |

|

|

|

1,867 |

|

|

|

6,770 |

|

|

|

5,911 |

|

|

Provision on impairment of notes receivable and real estate assets

|

|

|

- |

|

|

|

1,125 |

|

|

|

- |

|

|

|

1,926 |

|

|

Net income fee to related party

|

|

|

(186 |

) |

|

|

55 |

|

|

|

514 |

|

|

|

159 |

|

|

Advisory fee to related party

|

|

|

2,225 |

|

|

|

2,584 |

|

|

|

6,670 |

|

|

|

7,625 |

|

|

Total operating expenses

|

|

|

18,858 |

|

|

|

20,071 |

|

|

|

57,730 |

|

|

|

56,548 |

|

|

Operating income (loss)

|

|

|

468 |

|

|

|

(541 |

) |

|

|

256 |

|

|

|

1,262 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expenses):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income (including $4,699 and $3,718 for the three months and $14,693 and $10,574

for the nine months ended 2014 and 2013, respectively, from related parties)

|

|

|

5,106 |

|

|

|

3,778 |

|

|

|

15,264 |

|

|

|

10,831 |

|

|

Other income

|

|

|

1,332 |

|

|

|

59 |

|

|

|

1,738 |

|

|

|

2,734 |

|

|

Mortgage and loan interest (including $978 and $1,168 for the three months and $2,709 and

$2,849 for the nine months ended 2014 and 2013, respectively, from related parties)

|

|

|

(9,053 |

) |

|

|

(9,130 |

) |

|

|

(26,573 |

) |

|

|

(27,152 |

) |

|

Deferred borrowing costs amortization

|

|

|

(848 |

) |

|

|

(247 |

) |

|

|

(2,078 |

) |

|

|

(2,672 |

) |

|

Loan charges and prepayment penalties

|

|

|

(1,044 |

) |

|

|

(49 |

) |

|

|

(2,626 |

) |

|

|

(4,166 |

) |

|

Loss on sale of investments

|

|

|

- |

|

|

|

(275 |

) |

|

|

- |

|

|

|

(283 |

) |

|

Earnings from unconsolidated subsidiaries and investees

|

|

|

320 |

|

|

|

69 |

|

|

|

266 |

|

|

|

256 |

|

|

Litigation settlement

|

|

|

(86 |

) |

|

|

(2,739 |

) |

|

|

3,666 |

|

|

|

(2,727 |

) |

|

Total other expenses

|

|

|

(4,273 |

) |

|

|

(8,534 |

) |

|

|

(10,343 |

) |

|

|

(23,179 |

) |

|

Loss before gain on land sales, non-controlling interest, and taxes

|

|

|

(3,805 |

) |

|

|

(9,075 |

) |

|

|

(10,087 |

) |

|

|

(21,917 |

) |

|

Gain on land sales

|

|

|

40 |

|

|

|

598 |

|

|

|

634 |

|

|

|

563 |

|

|

Net loss from continuing operations before taxes

|

|

|

(3,765 |

) |

|

|

(8,477 |

) |

|

|

(9,453 |

) |

|

|

(21,354 |

) |

|

Income tax benefit

|

|

|

786 |

|

|

|

402 |

|

|

|

5,030 |

|

|

|

8,561 |

|

|

Net loss from continuing operations

|

|

|

(2,979 |

) |

|

|

(8,075 |

) |

|

|

(4,423 |

) |

|

|

(12,793 |

) |

|

Discontinued operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) from discontinued operations

|

|

|

477 |

|

|

|

1,021 |

|

|

|

(454 |

) |

|

|

(970 |

) |

|

Gain on sale of real estate from discontinued operations

|

|

|

1,769 |

|

|

|

127 |

|

|

|

14,826 |

|

|

|

25,429 |

|

|

Income tax expense from discontinued operations

|

|

|

(786 |

) |

|

|

(402 |

) |

|

|

(5,030 |

) |

|

|

(8,561 |

) |

|

Net income from discontinued operations

|

|

|

1,460 |

|

|

|

746 |

|

|

|

9,342 |

|

|

|

15,898 |

|

|

Net income (loss)

|

|

|

(1,519 |

) |

|

|

(7,329 |

) |

|

|

4,919 |

|

|

|

3,105 |

|

|

Net (income) loss attributable to non-controlling interest

|

|

|

200 |

|

|

|

903 |

|

|

|

(1,170 |

) |

|

|

(803 |

) |

|

Net income (loss) attributable to American Realty Investors, Inc.

|

|

|

(1,319 |

) |

|

|

(6,426 |

) |

|

|

3,749 |

|

|

|

2,302 |

|

|

Preferred dividend requirement

|

|

|

(427 |

) |

|

|

(613 |

) |

|

|

(1,653 |

) |

|

|

(1,839 |

) |

|

Net income (loss) applicable to common shares

|

|

$ |

(1,746 |

) |

|

$ |

(7,039 |

) |

|

$ |

2,096 |

|

|

$ |

463 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share - basic

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss from continuing operations

|

|

$ |

(0.24 |

) |

|

$ |

(0.68 |

) |

|

$ |

(0.59 |

) |

|

$ |

(1.34 |

) |

|

Net income from discontinued operations

|

|

|

0.11 |

|

|

|

0.06 |

|

|

|

0.76 |

|

|

|

1.38 |

|

|

Net income (loss) applicable to common shares

|

|

$ |

(0.13 |

) |

|

$ |

(0.62 |

) |

|

$ |

0.17 |

|

|

$ |

0.04 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share - diluted

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss from continuing operations

|

|

$ |

(0.24 |

) |

|

$ |

(0.68 |

) |

|

$ |

(0.59 |

) |

|

$ |

(1.34 |

) |

|

Net income from discontinued operations

|

|

|

0.11 |

|

|

|

0.06 |

|

|

|

0.76 |

|

|

|

1.38 |

|

|

Net income (loss) applicable to common shares

|

|

$ |

(0.13 |

) |

|

$ |

(0.62 |

) |

|

$ |

0.17 |

|

|

$ |

0.04 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares used in computing earnings per share

|

|

|

13,619,647 |

|

|

|

11,525,389 |

|

|

|

12,231,146 |

|

|

|

11,525,389 |

|

|

Weighted average common shares used in computing diluted earnings per share

|

|

|

13,619,647 |

|

|

|

11,525,389 |

|

|

|

12,231,146 |

|

|

|

11,525,389 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amounts attributable to American Realty Investors, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss from continuing operations

|

|

$ |

(2,779 |

) |

|

$ |

(7,172 |

) |

|

$ |

(5,593 |

) |

|

$ |

(13,596 |

) |

|

Net income from discontinued operations

|

|

|

1,460 |

|

|

|

746 |

|

|

|

9,342 |

|

|

|

15,898 |

|

|

Net income (loss) applicable to American Realty Investors, Inc.

|

|

$ |

(1,319 |

) |

|

$ |

(6,426 |

) |

|

$ |

3,749 |

|

|

$ |

2,302 |

|

|

AMERICAN REALTY INVESTORS, INC.

|

|

|

CONSOLIDATED BALANCE SHEETS

|

|

|

(unaudited)

|

|

| |

|

|

|

|

|

|

| |

|

September 30,

|

|

|

December 31,

|

|

| |

|

2014

|

|

|

2013

|

|

| |

|

(dollars in thousands, except

share and par value amounts)

|

|

|

Assets

|

|

|

|

|

|

|

|

Real estate, at cost

|

|

$ |

745,544 |

|

|

$ |

799,698 |

|

|

Real estate held for sale at cost, net of depreciation ($2,066 for 2014 and $2,390 for 2013)

|

|

|

44,288 |

|

|

|

16,427 |

|

|

Real estate subject to sales contracts at cost, net of depreciation ($2,212 for 2014 and $1,949 for 2013)

|

|

|

19,594 |

|

|

|

27,598 |

|

|

Less accumulated depreciation

|

|

|

(125,352 |

) |

|

|

(143,429 |

) |

|

Total real estate

|

|

|

684,074 |

|

|

|

700,294 |

|

|

Notes and interest receivable

|

|

|

|

|

|

|

|

|

|

Performing (including $147,978 in 2014 and $145,754 in 2013 from related parties)

|

|

|

163,335 |

|

|

|

153,275 |

|

|

Non-performing

|

|

|

3,151 |

|

|

|

3,140 |

|

|

Less allowance for doubtful accounts (including $15,537 in 2014 and $15,809 in 2013 from related parties)

|

|

|

(18,279 |

) |

|

|

(19,600 |

) |

|

Total notes and interest receivable

|

|

|

148,207 |

|

|

|

136,815 |

|

|

Cash and cash equivalents

|

|

|

4,383 |

|

|

|

16,437 |

|

|

Restricted cash

|

|

|

28,813 |

|

|

|

32,929 |

|

|

Investments in unconsolidated subsidiaries and investees

|

|

|

4,137 |

|

|

|

3,789 |

|

|

Receivable from related party

|

|

|

22,930 |

|

|

|

14,086 |

|

|

Other assets

|

|

|

43,442 |

|

|

|

38,972 |

|

|

Total assets

|

|

$ |

935,986 |

|

|

$ |

943,322 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Shareholders’ Equity

|

|

|

|

|

|

|

|

|

|

Liabilities:

|

|

|

|

|

|

|

|

|

|

Notes and interest payable

|

|

$ |

597,469 |

|

|

$ |

618,930 |

|

|

Notes related to assets held for sale

|

|

|

42,883 |

|

|

|

17,100 |

|

|

Notes related to subject to sales contracts

|

|

|

18,769 |

|

|

|

23,012 |

|

|

Deferred revenue (including $74,303 in 2014 and 2013 from sales to related parties)

|

|

|

76,148 |

|

|

|

76,148 |

|

|

Accounts payable and other liabilities (including $10,634 in 2014 and $15,394 in 2013 to related parties)

|

|

|

55,917 |

|

|

|

73,271 |

|

| |

|

|

791,186 |

|

|

|

808,461 |

|

| |

|

|

|

|

|

|

|

|

|

Shareholders’ equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock, Series A: $2.00 par value, authorized 15,000,000 shares, issued and outstanding

2,461,252 shares in 2014 and 3,353,954 shares in 2013 (liquidation preference $10 per share),

including 900,000 shares in 2014 and 2013 held by ARL or subsidiaries. Series K: $2.00 par value,

authorized, issued and outstanding 0 shares in 2014 and 135,000 shares in 2013 (liquidation

preference $22 per share)

|

|

|

3,126 |

|

|

|

4,908 |

|

|

Common stock, $0.01 par value, authorized 100,000,000 shares; issued 14,443,404 shares in 2014

and 11,941,174 shares in 2013; outstanding 14,027,619 shares in 2014 and 11,525,389 shares in 2013;

including 140,000 shares held by TCI (consolidated) in 2014 and 229,214 shares held by TCI

(consolidated) in 2013.

|

|

|

141 |

|

|

|

115 |

|

|

Treasury stock at cost; 415,785 shares in 2014 and 2013

|

|

|

(6,395 |

) |

|

|

(6,395 |

) |

|

Paid-in capital

|

|

|

108,844 |

|

|

|

102,974 |

|

|

Retained earnings

|

|

|

(8,046 |

) |

|

|

(11,795 |

) |

|

Total American Realty Investors, Inc. shareholders' equity

|

|

|

97,670 |

|

|

|

89,807 |

|

|

Non-controlling interest

|

|

|

47,130 |

|

|

|

45,054 |

|

|

Total equity

|

|

|

144,800 |

|

|

|

134,861 |

|

|

Total liabilities and equity

|

|

$ |

935,986 |

|

|

$ |

943,322 |

|

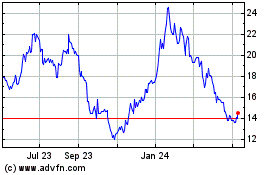

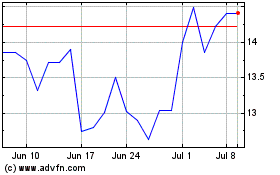

American Realty Investors (NYSE:ARL)

Historical Stock Chart

From Mar 2024 to Apr 2024

American Realty Investors (NYSE:ARL)

Historical Stock Chart

From Apr 2023 to Apr 2024