UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

ACT OF 1934

|

Date

of Report (Date of earliest event reported) November 7, 2014

|

AMCON

DISTRIBUTING COMPANY

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

1-15589

|

|

47-0702918

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

7405 Irvington Road, Omaha NE 68122

|

|

|

(Address of principal executive offices) (Zip Code)

|

|

|

|

|

|

|

402-331-3727

|

|

|

(Registrant’s telephone number, including area code)

|

|

|

|

|

|

|

Not Applicable

|

|

|

(Former name or former address, if changed since last report)

|

Check the

appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

⃞

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

⃞

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

⃞

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

⃞

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

On November 7, 2014, the Company issued a press release announcing

financial results for its fiscal year ended September 30, 2014. A copy

of the press release is attached to this report as an exhibit.

The information in this report (including the exhibit) shall not be

deemed to be "filed" for the purposes of Section 18 of the Securities

Exchange Act of 1934, as amended, or otherwise subject to the

liabilities of that Section. The information set forth in this report

(including the exhibit) shall not be incorporated by reference into any

registration statement or other document pursuant to the Securities Act

of 1933, as amended, except as shall be expressly set forth by specific

reference in such filing.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

|

EXHIBIT NO.

|

DESCRIPTION

|

|

|

|

99.1

|

Press release, dated November 7, 2014, issued by AMCON Distributing

Company announcing financial results for fiscal year ended September

30, 2014.

|

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

AMCON DISTRIBUTING COMPANY

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

|

November 7, 2014

|

|

|

/s/ Andrew C. Plummer

|

|

|

|

|

|

|

|

|

|

|

|

|

Name:

|

Andrew C. Plummer

|

|

|

|

|

Title:

|

Vice President & Chief Financial Officer

|

3

Exhibit 99.1

AMCON

Distributing Company Reports Fully Diluted Earnings Per Share of $6.75

for the Fiscal Year Ended September 30, 2014

OMAHA, Neb.--(BUSINESS WIRE)--November 7, 2014--AMCON Distributing

Company (“AMCON”) (NYSE MKT:DIT), an Omaha, Nebraska based consumer

products company is pleased to announce fully diluted earnings per share

of $6.75 on net income available to common shareholders of $4.8 million

for the fiscal year ended September 30, 2014. AMCON earned $2.57 per

fully diluted share on net income available to common shareholders of

$1.8 million for the fourth fiscal quarter ended September 30, 2014.

“We are pleased with our results for fiscal 2014. Our relentless focus

on customer service and reliability has enabled us to maintain our

leadership position in the convenience distribution industry,” said

Christopher H. Atayan, AMCON’s Chairman and Chief Executive Officer. He

further noted, “We believe our focused strategic plan and customer

centric philosophy are essential elements critical to navigating this

challenging business environment. Our objective is to deliver attractive

risk adjusted rates of return on the capital we employ. To support this

objective we continue to invest in foodservice and information

technology which drives the profitability of our customers.”

The wholesale distribution segment reported revenues of $1.2 billion and

operating income before depreciation and amortization of $15.6 million

for fiscal 2014, and revenues and operating income before depreciation

and amortization of $328.0 million and $4.6 million, respectively, for

the fourth fiscal quarter of fiscal 2014. The retail health food segment

reported revenues of $34.3 million and operating income before

depreciation and amortization of $1.3 million for fiscal 2014, and

revenue of $8.1 million and operating income before depreciation and

amortization of $0.2 million for the fourth fiscal quarter of 2014.

“Our emphasis on building long term relationships continues to provide

us with a significant competitive advantage,” said Kathleen Evans,

President of AMCON’s Wholesale Distribution Segment. Evans continued,

“This is clearly evident based on our positive fall trade show response

which will provide considerable momentum as we enter fiscal 2015. We are

very excited about the completion of our plant expansion in Rapid City,

South Dakota that will serve our foodservice growth plans in the region.”

“The Retail Health Food industry continues to grow. However, with this

growth there has been substantial new competition enter our markets

which has pressured revenues,” said Eric Hinkefent, President of AMCON’s

Retail Health Food segment. “We have taken an aggressive approach to

rationalize our operating expenses in light of the competitive

environment and are looking at alternative ways to maintain our

margins,” added Hinkefent.

“We are very focused on increasing our shareholders’ equity per share

and maintaining high levels of balance sheet liquidity. Debt reduction

is an important priority for us because it improves our debt to equity

ratio. At September 30, 2014 our shareholders’ equity was $55.4 million,

resulting in adjusted book value per share of $80.62. We turned our

inventory twenty-six times and consolidated debt was reduced to $19.2

million. This was after share repurchases and plant expansions totaling

$5.5 million,” said Andrew Plummer, AMCON’s Chief Financial Officer.

“The Rapid City plant expansion brings a number of important benefits

including increased efficiencies and the enhanced ability to service the

thriving foodservice sector. We continue to place a high priority on the

development of information technology for internal and external

purposes. These are important investments in the future of our

business,” added Plummer.

AMCON is a leading wholesale distributor of consumer products, including

beverages, candy, tobacco, groceries, foodservice, frozen and chilled

foods, and health and beauty care products with locations in Illinois,

Missouri, Nebraska, North Dakota, South Dakota and Tennessee. AMCON also

operates sixteen (16) health and natural product retail stores in the

Midwest and Florida. The retail stores operate under the names

Chamberlin's Market & Cafe www.chamberlins.com and Akin’s

Natural Foods Market www.akins.com

This news release contains forward-looking statements that are

subject to risks and uncertainties and which reflect management's

current beliefs and estimates of future economic circumstances, industry

conditions, Company performance and financial results. A number of

factors could affect the future results of the Company and could cause

those results to differ materially from those expressed in the Company's

forward-looking statements including, without limitation, availability

of sufficient cash resources to conduct its business and meet its

capital expenditures needs and the other factors described under Item

1.A. of the Company’s Annual Report on Form 10-K. Moreover, past

financial performance should not be considered a reliable indicator of

future performance. Accordingly, the Company claims the protection of

the safe harbor for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995 with respect to all such

forward-looking statements.

Visit AMCON Distributing Company's web site at: www.amcon.com

|

AMCON Distributing Company and Subsidiaries

|

|

|

|

CONSOLIDATED BALANCE SHEETS

|

|

|

|

|

|

|

|

September 30,

|

|

|

|

2014

|

|

2013

|

|

ASSETS

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

Cash

|

|

$

|

99,922

|

|

|

$

|

275,036

|

|

|

Accounts receivable, less allowance for doubtful accounts of $0.8

million at 2014 and $1.1 million at 2013

|

|

|

33,286,932

|

|

|

|

28,383,205

|

|

|

Inventories, net

|

|

|

43,635,266

|

|

|

|

46,125,187

|

|

|

Deferred income taxes

|

|

|

1,606,168

|

|

|

|

1,831,933

|

|

|

Prepaid and other current assets

|

|

|

5,034,570

|

|

|

|

5,001,992

|

|

|

Total current assets

|

|

|

83,662,858

|

|

|

|

81,617,353

|

|

|

Property and equipment, net

|

|

|

13,763,140

|

|

|

|

13,088,859

|

|

|

Goodwill

|

|

|

6,349,827

|

|

|

|

6,349,827

|

|

|

Other intangible assets, net

|

|

|

4,455,978

|

|

|

|

4,820,978

|

|

|

Other assets

|

|

|

448,149

|

|

|

|

497,882

|

|

|

|

|

$

|

108,679,952

|

|

|

$

|

106,374,899

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

Accounts payable

|

|

$

|

16,412,895

|

|

|

$

|

15,859,636

|

|

|

Accrued expenses

|

|

|

6,891,308

|

|

|

|

6,714,444

|

|

|

Accrued wages, salaries and bonuses

|

|

|

2,647,969

|

|

|

|

2,754,136

|

|

|

Income taxes payable

|

|

|

1,603,614

|

|

|

|

1,922,351

|

|

|

Current maturities of long-term debt

|

|

|

341,190

|

|

|

|

998,788

|

|

|

Total current liabilities

|

|

|

27,896,976

|

|

|

|

28,249,355

|

|

|

Credit facility

|

|

|

15,081,783

|

|

|

|

14,841,712

|

|

|

Deferred income taxes

|

|

|

3,484,204

|

|

|

|

3,327,010

|

|

|

Long-term debt, less current maturities

|

|

|

3,735,702

|

|

|

|

4,076,892

|

|

|

Other long-term liabilities

|

|

|

139,003

|

|

|

|

239,396

|

|

|

Series A cumulative, convertible preferred stock, $.01 par value

100,000 shares authorized and issued, and a total liquidation

preference of $2.5 million at both September 2014 and September 2013

|

|

|

2,500,000

|

|

|

|

2,500,000

|

|

|

Series B cumulative, convertible preferred stock, $.01 par value

80,000 shares authorized, 16,000 shares issued and outstanding at

September 30, 2014 and September 30, 2013, and a total liquidation

preference of $0.4 million at both September 2014 and September 2013

|

|

|

400,000

|

|

|

|

400,000

|

|

|

|

|

|

|

|

|

Commitments and contingencies

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders’ equity:

|

|

|

|

|

|

Preferred stock, $0.01 par value, 1,000,000 shares authorized,

116,000 shares outstanding and issued in Series A and B referred to

above

|

|

|

—

|

|

|

|

—

|

|

|

Common stock, $0.01 par value, 3,000,000 shares authorized, 602,411

shares issued and outstanding at September 2014 and 623,115 shares

issued and outstanding at September 2013

|

|

|

6,677

|

|

|

|

6,543

|

|

|

Additional paid-in capital

|

|

|

13,571,909

|

|

|

|

12,502,135

|

|

|

Retained earnings

|

|

|

47,829,201

|

|

|

|

43,532,812

|

|

|

Treasury stock at cost

|

|

|

(5,965,503

|

)

|

|

|

(3,300,956

|

)

|

|

Total shareholders’ equity

|

|

|

55,442,284

|

|

|

|

52,740,534

|

|

|

|

|

$

|

108,679,952

|

|

|

$

|

106,374,899

|

|

|

|

|

|

|

|

|

|

|

|

|

AMCON Distributing Company and Subsidiaries

|

|

|

|

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

|

|

|

|

|

|

Fiscal Years Ended September

|

|

|

|

2014

|

|

2013

|

|

Sales (including excise taxes of $387.8 million and $386.4 million,

respectively)

|

|

$

|

1,236,755,388

|

|

|

$

|

1,211,052,634

|

|

|

Cost of sales

|

|

|

1,160,248,793

|

|

|

|

1,133,695,309

|

|

|

Gross profit

|

|

|

76,506,595

|

|

|

|

77,357,325

|

|

|

Selling, general and administrative expenses

|

|

|

64,723,824

|

|

|

|

63,880,109

|

|

|

Depreciation and amortization

|

|

|

2,386,402

|

|

|

|

2,412,613

|

|

|

|

|

|

67,110,226

|

|

|

|

66,292,722

|

|

|

Operating income

|

|

|

9,396,369

|

|

|

|

11,064,603

|

|

|

Other expense (income):

|

|

|

|

|

|

Interest expense

|

|

|

935,360

|

|

|

|

1,108,146

|

|

|

Other (income), net

|

|

|

(130,519

|

)

|

|

|

(277,215

|

)

|

|

|

|

|

804,841

|

|

|

|

830,931

|

|

|

Income from operations before income tax expense

|

|

|

8,591,528

|

|

|

|

10,233,672

|

|

|

Income tax expense

|

|

|

3,632,000

|

|

|

|

4,375,000

|

|

|

Net income

|

|

|

4,959,528

|

|

|

|

5,858,672

|

|

|

Preferred stock dividend requirements

|

|

|

(195,105

|

)

|

|

|

(205,218

|

)

|

|

Net income available to common shareholders

|

|

$

|

4,764,423

|

|

|

$

|

5,653,454

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share available to common shareholders:

|

|

$

|

7.81

|

|

|

$

|

9.08

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share available to common shareholders:

|

|

$

|

6.75

|

|

|

$

|

7.79

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic weighted average shares outstanding

|

|

|

610,392

|

|

|

|

622,904

|

|

|

Diluted weighted average shares outstanding

|

|

|

735,227

|

|

|

|

751,812

|

|

|

|

|

|

|

|

|

|

|

|

|

AMCON Distributing Company and Subsidiaries

|

|

|

|

|

|

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

|

|

|

|

|

|

Fiscal Years Ended September

|

|

|

|

2014

|

|

2013

|

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

|

|

|

|

|

Net income

|

|

$

|

4,959,528

|

|

|

$

|

5,858,672

|

|

|

Adjustments to reconcile income from operations to net cash flows

from operating activities:

|

|

|

|

|

|

Depreciation

|

|

|

2,021,402

|

|

|

|

2,047,613

|

|

|

Amortization

|

|

|

365,000

|

|

|

|

365,000

|

|

|

Gain on sale of property and equipment

|

|

|

(59,449

|

)

|

|

|

(56,829

|

)

|

|

Equity-based compensation

|

|

|

1,406,033

|

|

|

|

1,303,310

|

|

|

Deferred income taxes

|

|

|

382,959

|

|

|

|

(221,694

|

)

|

|

Recoveries for losses on doubtful accounts

|

|

|

(317,000

|

)

|

|

|

(55,000

|

)

|

|

Provision (recoveries) for losses on inventory obsolescence

|

|

|

44,695

|

|

|

|

(91,494

|

)

|

|

Other

|

|

|

(8,045

|

)

|

|

|

(93,328

|

)

|

|

Changes in assets and liabilities:

|

|

|

|

|

|

Accounts receivable

|

|

|

(4,586,727

|

)

|

|

|

4,353,630

|

|

|

Inventories

|

|

|

3,403,156

|

|

|

|

(7,669,072

|

)

|

|

Prepaid and other current assets

|

|

|

(32,578

|

)

|

|

|

1,474,710

|

|

|

Other assets

|

|

|

49,733

|

|

|

|

232

|

|

|

Accounts payable

|

|

|

591,478

|

|

|

|

(1,391,539

|

)

|

|

Accrued expenses and accrued wages, salaries and bonuses

|

|

|

(238,994

|

)

|

|

|

181,294

|

|

|

Income taxes payable

|

|

|

(318,737

|

)

|

|

|

(272,615

|

)

|

|

Net cash flows from operating activities

|

|

|

7,662,454

|

|

|

|

5,732,890

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

|

|

|

|

|

Purchase of property and equipment

|

|

|

(2,796,326

|

)

|

|

|

(2,113,426

|

)

|

|

Proceeds from sales of property and equipment

|

|

|

192,373

|

|

|

|

179,662

|

|

|

Acquisitions

|

|

|

(996,803

|

)

|

|

|

—

|

|

|

Net cash flows from investing activities

|

|

|

(3,600,756

|

)

|

|

|

(1,933,764

|

)

|

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

|

|

|

|

|

Net borrowings on bank credit agreements

|

|

|

240,071

|

|

|

|

487,980

|

|

|

Principal payments on long-term debt

|

|

|

(998,788

|

)

|

|

|

(1,182,829

|

)

|

|

Repurchase of common stock and Series B Convertible Preferred Stock

|

|

|

(2,664,547

|

)

|

|

|

(2,572,085

|

)

|

|

Dividends paid on convertible preferred stock

|

|

|

(195,105

|

)

|

|

|

(205,218

|

)

|

|

Dividends on common stock

|

|

|

(468,034

|

)

|

|

|

(469,895

|

)

|

|

Withholdings on the exercise of equity-based awards

|

|

|

(150,409

|

)

|

|

|

(73,430

|

)

|

|

Net cash flow from financing activities

|

|

|

(4,236,812

|

)

|

|

|

(4,015,477

|

)

|

|

Net change in cash

|

|

|

(175,114

|

)

|

|

|

(216,351

|

)

|

|

Cash, beginning of year

|

|

|

275,036

|

|

|

|

491,387

|

|

|

Cash, end of year

|

|

$

|

99,922

|

|

|

$

|

275,036

|

|

|

|

|

|

|

|

|

Supplemental disclosure of cash flow information:

|

|

|

|

|

|

Cash paid during the year for interest

|

|

$

|

946,881

|

|

|

$

|

1,115,991

|

|

|

Cash paid during the year for income taxes

|

|

|

3,567,778

|

|

|

|

4,867,986

|

|

|

|

|

|

|

|

|

Supplemental disclosure of non-cash information:

|

|

|

|

|

|

Equipment acquisitions classified as accounts payable

|

|

$

|

34,985

|

|

|

$

|

73,204

|

|

|

Issuance of common stock in connection with the vesting and exercise

of equity-based awards

|

|

|

1,154,869

|

|

|

|

1,389,258

|

|

|

Conversion by holders of Series B Convertible Preferred Stock to

common stock

|

|

|

—

|

|

|

|

100,000

|

|

|

Common stock acquired with other consideration

|

|

|

—

|

|

|

|

760,871

|

|

|

|

|

|

|

|

|

|

|

|

|

AMCON Distributing Company and Subsidiaries

|

|

|

|

|

|

|

|

|

|

|

|

FISCAL YEAR 2014

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(dollars in thousands, except per share data)

|

|

First

|

|

Second

|

|

Third

|

|

Fourth

|

|

|

|

|

|

|

|

|

|

|

|

Sales

|

|

$

|

305,626

|

|

|

$

|

272,422

|

|

|

$

|

322,648

|

|

|

$

|

336,060

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

19,641

|

|

|

|

17,620

|

|

|

|

19,295

|

|

|

|

19,951

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations before income tax expense

|

|

|

2,253

|

|

|

|

995

|

|

|

|

2,250

|

|

|

|

3,093

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

|

1,288

|

|

|

|

531

|

|

|

|

1,260

|

|

|

|

1,880

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock dividend requirements

|

|

|

(49

|

)

|

|

|

(48

|

)

|

|

|

(49

|

)

|

|

|

(49

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income available to common shareholders

|

|

$

|

1,239

|

|

|

$

|

483

|

|

|

$

|

1,211

|

|

|

$

|

1,831

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share available to common shareholders

|

|

$

|

1.99

|

|

|

$

|

0.79

|

|

|

$

|

2.00

|

|

|

$

|

3.04

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share available to common shareholders

|

|

$

|

1.73

|

|

|

$

|

0.72

|

|

|

$

|

1.73

|

|

|

$

|

2.57

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FISCAL YEAR 2013

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(dollars in thousands, except per share data)

|

|

First

|

|

Second

|

|

Third

|

|

Fourth

|

|

|

|

|

|

|

|

|

|

|

|

Sales

|

|

$

|

302,218

|

|

|

$

|

274,568

|

|

|

$

|

316,031

|

|

|

$

|

318,235

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

19,230

|

|

|

|

18,297

|

|

|

|

19,811

|

|

|

|

20,020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations before income tax expense

|

|

|

2,533

|

|

|

|

2,125

|

|

|

|

2,887

|

|

|

|

2,689

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

|

1,463

|

|

|

|

1,214

|

|

|

|

1,632

|

|

|

|

1,549

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock dividend requirements

|

|

|

(59

|

)

|

|

|

(48

|

)

|

|

|

(49

|

)

|

|

|

(49

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income available to common shareholders

|

|

$

|

1,403

|

|

|

$

|

1,166

|

|

|

$

|

1,584

|

|

|

$

|

1,500

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share available to common shareholders

|

|

$

|

2.26

|

|

|

$

|

1.87

|

|

|

$

|

2.54

|

|

|

$

|

2.41

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share available to common shareholders

|

|

$

|

1.90

|

|

|

$

|

1.63

|

|

|

$

|

2.19

|

|

|

$

|

2.07

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Company’s quarterly earnings per share are based on weighted average

shares outstanding for the quarter; therefore the sum of the quarters

may not equal the full year earnings per share amount.

AMCON Distributing Company and Subsidiaries

GAAP Reconciliation and Management Explanation of Non-GAAP Financial

Measures

The financial measure of adjusted book value per share included in this

press release (“adjusted book value per share”) has been determined by

methods other than in accordance with U.S. generally accepted accounting

principles (“GAAP”). Management believes that this non-GAAP financial

measurement reflects an additional way of viewing aspects of the

Company’s business that, when viewed together with its financial results

computed in accordance with GAAP, provides a more complete understanding

of factors affecting historical financial performance of the Company.

This measure is important to investors interested in determining the

amount of book value per share if all potentially dilutive shares were

exercised or converted. This non-GAAP financial measurement is not

intended to be a substitute for the comparable GAAP measurements and

should be read only in conjunction with our consolidated financial

statements prepared in accordance with GAAP.

The Company has defined the non-GAAP financial measure of adjusted book

value per share as follows:

-

“Adjusted book value per share” is defined as total shareholders’

equity increased by the impact of proceeds from the exercise of all

stock options, conversion of convertible preferred stock and vesting

of restricted stock units divided by total common shares outstanding

plus common shares issuable upon the exercise of all stock options,

conversion of convertible preferred stock and vesting of restricted

stock units.”

|

|

|

September 2014

|

|

Number of common shares outstanding at September 30, 2014

|

|

|

602,411

|

|

Total shareholders’ equity at September 30, 2014

|

|

$

|

55,442,284

|

|

|

|

|

|

Book value per share at September 30, 2014

|

|

$

|

92.03

|

|

|

|

|

|

|

|

September 2014

|

|

Number of common shares outstanding at September 30, 2014

|

|

|

602,411

|

|

Add: common shares potentially issuable for stock options,

convertible preferred stock, and unvested restricted stock units /1/

|

|

|

173,208

|

|

|

|

|

775,619

|

|

|

|

|

|

Total shareholders’ equity at September 30, 2014

|

|

$

|

55,442,284

|

|

Equity impact if all potential common shares were converted /1/

|

|

|

7,089,656

|

|

|

|

$

|

62,531,940

|

|

|

|

|

|

Adjusted book value per share at September 30, 2014

|

|

$

|

80.62

|

|

|

|

|

|

/1/

|

|

Assumes the exercise of all vested and unvested stock options,

conversion of all preferred stock, and vesting of all outstanding

restricted stock units at September 30, 2014.

|

|

|

|

|

CONTACT:

AMCON Distributing Company

Christopher H. Atayan,

402-331-3727

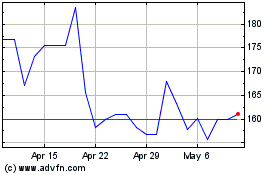

AMCON Distributing (AMEX:DIT)

Historical Stock Chart

From Mar 2024 to Apr 2024

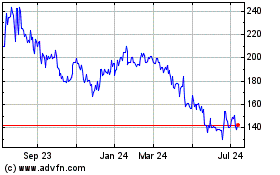

AMCON Distributing (AMEX:DIT)

Historical Stock Chart

From Apr 2023 to Apr 2024