UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): November 6, 2014

Amarin Corporation plc

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| England and Wales |

|

0-21392 |

|

Not applicable |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 2 Pembroke House, Upper Pembroke Street 28-32, Dublin 2, Ireland |

|

Not applicable |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: +353 1 6699 020

Not Applicable

Former

name or former address, if changed since last report

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition.

On November 6, 2014, Amarin Corporation plc issued a press release announcing its financial results for the three and nine months ended September 30,

2014 (the “Press Release”). A copy of the Press Release is furnished herewith as Exhibit 99.1.

The information set forth under

Item 2.02 and in Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except

as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press Release, dated November 6, 2014 |

* * *

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

| Date: November 6, 2014 |

|

|

|

Amarin Corporation plc |

|

|

|

|

|

|

|

|

By: |

|

/s/ John Thero |

|

|

|

|

|

|

John Thero |

|

|

|

|

|

|

President and Chief Executive Officer |

Exhibit Index

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press Release, dated November 6, 2014 |

Exhibit 99.1

Amarin Reports Third Quarter 2014 Financial Results

and Provides Update on Operations

- Conference Call Set for 4:30 p.m. EST Today -

BEDMINSTER, N.J., and DUBLIN, Ireland, November 6, 2014 — Amarin Corporation plc (Nasdaq: AMRN), a biopharmaceutical company focused on the

commercialization and development of therapeutics to improve cardiovascular health, today announced financial results for the three and nine months ended September 30, 2014, and provided an update on company operations.

Key Amarin achievements since June 30, 2014 include:

| |

• |

|

Recognized $14.1 million in product revenue from Vascepa® (icosapent ethyl) sales in Q3 2014 compared to $12.6 million in Q2 2014 and $8.4 million in Q3 2013, an

increase of 12% and 68%, respectively |

| |

• |

|

Continued improvement in sales and marketing productivity as SG&A costs intentionally declined approximately $9.0 million in Q3 2014 compared to Q3 2013 while revenues increased |

| |

• |

|

Reduced net cash outflows from operations to $19.9 million in Q3 2014 and $58.7 million for the first nine months of 2014 compared to $44.8 million and $157.2 million in the respective periods of 2013 |

| |

• |

|

Confirmed continued commitment to completing the ongoing REDUCE-IT cardiovascular outcomes study after a substantial scientific and business focused review, based on which Amarin believes that REDUCE-IT is well

positioned to succeed and that continuation is in the best interest of improved patient care and Amarin’s shareholders |

| |

• |

|

Increased normalized prescriptions, based upon data from Symphony Health Solutions, by 20% in Q3 2014 compared to Q2 2014 and by 78% compared to Q3 2013 |

| |

• |

|

Increased Vascepa tier-2 managed care lives covered to over 119 million |

Commenting on Amarin’s

progress, John F. Thero, President and Chief Executive Officer, stated, “Since changing the focus of our sales team earlier this year to increase targeting of the highest potential value physicians, we have witnessed increased Vascepa

prescription growth. Based on the strong efficacy and safety profile of Vascepa and regular reports of improved patient lipid parameters, we are confident that Vascepa revenues will continue to grow.” Mr. Thero added, “The primary

focus of Amarin is to improve patient care, grow revenues and advance REDUCE-IT in a cost-effective, opportunistic manner. Year-to-date results reflect broad progress which compels us to advance further.”

Commercialization update

Normalized prescriptions

(estimated) for the quarter ended September 30, 2014, based on data from Symphony Health Solutions and IMS Health, totaled approximately 132,000 and 113,000, respectively. These prescription levels represent growth of approximately 20% and 22%,

respectively, compared to the quarter ended June 30, 2014, and an increase of approximately 78% and 80%, respectively, compared to the same quarter in 2013.

1

These increases were most significantly driven by increased prescriptions from the physicians who are the highest

past prescribers of Vascepa with increasing contribution from a broader group of physicians. Timing of shipments to wholesalers, upon which revenues are recognized, and prescription levels can vary between periods. Such timing differences

contributed to greater prescription growth than revenue growth in Q3 2014.

The increase in prescriptions during Q3 2014 reflects sales and marketing

activities of both Amarin and its Vascepa co-promotion partner, Kowa Pharmaceuticals America, Inc. (Kowa). Growth was noted from physicians targeted by Amarin sales representatives only, Amarin and Kowa sales representatives jointly and Kowa sales

representatives only.

Amarin’s sales representatives in Q3 continued their approach of relatively high frequency detailing on the benefits of

Vascepa to a select group of the highest potential target physicians. These targets represent both the largest current prescribers of Vascepa and are believed to represent the greatest potential for further Vascepa prescription growth. While Amarin

anticipates the largest portion of its future sales growth to continue to come from efforts of Amarin’s sales representatives, Amarin anticipates increasing contributions to overall Vascepa revenue growth from Kowa’s co-promotion.

Kowa’s sales team is targeting more than twice the number of physicians targeted by Amarin sales representatives. Kowa began promotion of Vascepa in

mid-Q2 2014. As anticipated, by the end of Q3 2014, Kowa’s sales team had called on each of their Vascepa targets an average of approximately two times. As previously stated, Amarin believes detailing efforts for new therapies that treat

chronic asymptomatic conditions typically require five or more calls to significantly affect physician prescribing habits. There are early signs that Kowa is having a positive impact and more is expected from their promotional activities as more

time is invested in educating physicians about Vascepa.

During Q2, the prescription drug that most closely competes with Vascepa saw the launch of a

generic and during Q3, a second generic version of such drug became available. Generic versions of this competitive drug are currently priced such that they are more expensive than Vascepa under most managed care plans. After such generic launch,

formulary access to Vascepa, including tier-2 coverage, continues to improve overall with more than 119 million people in the United States currently insured by managed care plans that cover Vascepa on tier-2, 95% of which is already contracted

for 2015.

We continue to receive positive feedback about the effects of Vascepa, both in patients for whom Vascepa was their first triglyceride lowering

therapy and for patients switched from alternative triglyceride lowering therapies to Vascepa, including patients on statin therapy.

Research & development update

Over 7,100

patients have been enrolled in the REDUCE-IT cardiovascular outcomes study representing approximately 90% of total targeted enrollment with study enrollment targeted to be completed in 2015. The REDUCE-IT study is designed to be completed after

reaching an aggregate number of cardiovascular

2

events. Based on projected event rates, we estimate the REDUCE-IT study can be completed in or about 2017 with results then expected to be available in 2018. Based on the results of REDUCE-IT, we

may seek additional indications for Vascepa beyond the indications studied in the ANCHOR or MARINE trials.

During Q3 2014, we completed a substantial

scientific and business focused analysis, leading to the decision to complete the REDUCE-IT study independent of FDA’s review of the ANCHOR sNDA. The REDUCE-IT study, if successful, presents a major opportunity to improve patient care and

expand Vascepa usage.

As previously announced, in September 2014, we were notified that the Office of New Drugs (OND) within the U.S. Food and Drug

Administration (FDA) denied Amarin’s appeal of the FDA’s rescission of the ANCHOR clinical trial Special Protocol Assessment (SPA) agreement. Based on the FDA’s repeated position in its appeal denials and its internal consultation

with FDA officials at higher levels, we informed the FDA that we do not intend to appeal the SPA rescission further. Following this notification, our regulatory focus has shifted to advancing the ongoing REDUCE-IT outcomes study in pursuit of a

broader indication for Vascepa and to seeking action on the ANCHOR sNDA.

Financial update

Amarin reported cash and cash equivalents of $135.4 million at September 30, 2014, representing a net decrease of $15.1 million from reported cash and

cash equivalents of $150.5 million as of June 30, 2014 and a net decrease of $56.1 million from reported cash and cash equivalents of $191.5 million as of December 31, 2013. Net cash outflows in the nine months ended September 30,

2014 included approximately $33.3 million in sales and marketing related expenses and approximately $20.5 million of costs incurred through our contracted clinical research organization and for clinical trial materials in support of the REDUCE-IT

cardiovascular outcomes study.

The improvement in net cash outflow from operations to $58.7 million in the nine months ended September 30, 2014

compared to $157.2 million in the same period in 2013 reflects our focus on cash preservation and efficient spend targeting to maximize Vascepa revenues and minimize cash burn. It is anticipated that the company will experience fluctuations in

quarterly net cash outflows. Amarin continues to estimate that, during 2014, net cash outflows will be less than $80 million.

Net product revenues for

the three months ended September 30, 2014 and 2013 were $14.1 million and $8.4 million, respectively. Net product revenues for the nine months ended September 30, 2014 and 2013 were $37.7 million and $16.2 million, respectively. These

increases in product revenues are attributable to increases both in new and recurring prescriptions of Vascepa.

Cost of goods sold for the three months

ended September 30, 2014 and 2013 was $5.4 million and $3.7 million, respectively. Cost of goods sold for the nine months ended September 30, 2014 and 2013 was $14.6 million and $7.8 million, respectively. Gross margin improved to 62% and

61% in the three and nine months ended September 30, 2014 compared to 56% and 52% in the three and nine months ended September 30, 2013. The improvement in gross margins in 2014 was primarily driven by lower unit cost active pharmaceutical

ingredient, or API, purchases.

3

Under GAAP, Amarin reported a net loss of $26.1 million in the third quarter of 2014, or basic and diluted loss

per share of $0.15 and $0.17, respectively. This net loss included $1.9 million in non-cash share-based compensation expense, $0.3 million in non-cash warrant compensation income and a $4.5 million gain on the change in fair value of derivatives.

Amarin reported a net loss of $48.9 million in the third quarter of 2013, or basic and diluted loss per share of $0.29. This net loss included $4.3 million in non-cash share-based compensation expense, $0.3 million in non-cash warrant compensation

expense, and a $1.4 million loss on the change in the fair value of derivatives.

For the nine months ended September 30, 2014, Amarin reported a net

loss of $36.7 million, or basic and diluted loss per share of $0.21 and $0.25, respectively. This net loss included $6.3 million in non-cash share-based compensation expense, $0.5 million in non-cash warrant compensation income, a $11.9 million gain

on the change in fair value of derivatives, and a $38.0 million gain on extinguishment of debt. For the nine months ended September 30, 2013, Amarin reported a net loss of $150.8 million, or basic and diluted loss per share of $0.96 and $1.02,

respectively. This net loss included $14.2 million in non-cash share-based compensation expense, $1.2 million in non-cash warrant compensation income, and a $21.1 million gain on the change in the fair value of derivatives.

Excluding non-cash gains or losses for share-based compensation, warrant compensation, change in fair value of derivatives and gain on extinguishment of debt,

non-GAAP adjusted net loss was $28.9 million for the third quarter of 2014, or non-GAAP adjusted basic and diluted loss per share of $0.17, compared to non-GAAP adjusted net loss of $43.0 million for the three months ended September 30, 2013,

or non-GAAP adjusted basic and diluted loss per share of $0.25. Adjusted net loss was $80.8 million for the nine months ended September 30, 2014, or non-GAAP adjusted basic and diluted loss per share of $0.47, compared to adjusted net loss of

$158.8 million for the nine months ended September 30, 2013, or non-GAAP adjusted basic and diluted loss per share of $1.01.

Amarin’s

liabilities as of September 30, 2014, excluding the fair value of the non-cash warrant derivative liability, totaled approximately $254.5 million, which includes $124.9 million for the carrying value of exchangeable debt and $93.8 million for

the carrying value of the hybrid debt-like financing that we entered into in December 2012.

As of September 30, 2014, Amarin had approximately

174.6 million American Depository Shares (ADSs) and ordinary shares outstanding as well as approximately 8.1 million and 11.2 million equivalent shares underlying warrants and stock options, respectively, at average exercise prices of

$1.50 and $5.33, respectively, and 2.3 million equivalent shares underlying restricted or deferred stock units.

Conference call and webcast

information

Amarin will host a conference call at 4:30 p.m. ET (9:30 p.m. UTC/GMT) today, November 6, 2014. The conference

call can be heard live via the investor relations section of the company’s website at www.amarincorp.com, or via telephone by dialing 877-407-8033 within the United States or 201-689-8033 from outside the United States. A replay of the

call will be made available for a period of two weeks following the conference call. To hear a replay of the call, dial 877-660-6853 (inside the United States) or 201-612-7415 (outside the United States). A replay of the call will also be available

through the company’s website shortly after the call. For both dial-in numbers please use conference ID 13592466.

4

Use of non-GAAP adjusted financial information

Included in this press release and the conference call referenced above are non-GAAP adjusted financial information as defined by U.S. Securities and Exchange

Commission Regulation G. The GAAP financial measure most directly comparable to each non-GAAP adjusted financial measure used or discussed, and a reconciliation of the differences between each non-GAAP adjusted financial measure and the comparable

GAAP financial measure, are included in this press release after the condensed consolidated financial statements.

Non-GAAP adjusted net loss was derived

by taking GAAP net loss and adjusting it for non-cash gains or losses for share-based compensation, warrant compensation, and change in value of derivatives. Management believes that these non-GAAP adjusted measures provide investors with a better

understanding of the company’s historical results from its core business operations. While management believes that these non-GAAP adjusted financial measures provide useful supplemental information to investors regarding the underlying

performance of the company’s business operations, investors are reminded to consider these non-GAAP measures in addition to, and not as a substitute for, financial performance measures prepared in accordance with GAAP. Non-GAAP measures have

limitations in that they do not reflect all of the amounts associated with the company’s results of operations as determined in accordance with GAAP. In addition, it should be noted that these non-GAAP financial measures may be different from

non-GAAP measures used by other companies, and management may utilize other measures to illustrate performance in the future.

About Amarin

Amarin Corporation plc is a biopharmaceutical company focused on the commercialization and development of therapeutics to improve cardiovascular health.

Amarin’s product development program leverages its extensive experience in lipid science and the potential therapeutic benefits of polyunsaturated fatty acids. Amarin’s clinical program includes commitment to an ongoing outcomes study.

Vascepa® (icosapent ethyl), Amarin’s first FDA approved product, is a highly-pure, omega-3 fatty acid product available by prescription. For more information about Vascepa visit

www.vascepa.com. For more information about Amarin visit www.amarincorp.com.

About

Vascepa® (icosapent ethyl) capsules

Vascepa® (icosapent ethyl) capsules, known in scientific literature as AMR101, is a highly

pure-EPA omega-3 prescription product in a 1 gram capsule.

Indications and Usage

| |

• |

|

Vascepa (icosapent ethyl) is indicated as an adjunct to diet to reduce triglyceride (TG) levels in adult patients with severe (>500 mg/dL) hypertriglyceridemia. |

5

| |

• |

|

The effect of Vascepa on the risk for pancreatitis and cardiovascular mortality and morbidity in patients with severe hypertriglyceridemia has not been determined. |

Important Safety Information for Vascepa

| |

• |

|

Vascepa is contraindicated in patients with known hypersensitivity (e.g., anaphylactic reaction) to Vascepa or any of its components and should be used with caution in patients with known hypersensitivity to fish and/or

shellfish. |

| |

• |

|

The most common reported adverse reaction (incidence >2% and greater than placebo) was arthralgia (2.3% for Vascepa, 1.0% for placebo). |

FULL VASCEPA PRESCRIBING INFORMATION CAN BE FOUND AT WWW.VASCEPA.COM.

Vascepa has been approved for use by the FDA as an adjunct to diet to reduce triglyceride levels in adult patients with severe (>500 mg/dL)

hypertriglyceridemia. Vascepa is under various stages of development for potential use in other indications that have not been approved by the FDA. Nothing in this press release should be construed as marketing the use of Vascepa in any indication

that has not been approved by the FDA.

Forward-looking statements

This press release contains forward-looking statements, including statements about the future commercialization of Vascepa, including the continued expansion

of promotional efforts resulting from the co-promotion agreement with Kowa Pharmaceuticals America, the anticipated increase in prescriptions, expectations for revenue growth, product awareness, receptivity of clinicians to and patient experience

with Vascepa; expectations regarding managed care coverage and continued growth in Tier 2 coverage; the pricing terms of commercial supply for Vascepa; expectations regarding cash burn, gross margins and cost of goods sold; Amarin plans related to

its SPA appeal; the efficacy, safety and therapeutic benefits of Vascepa; the ability of Amarin to continue the REDUCE-IT study in light of company resources and other factors; and continued enrollment and following of patients in Amarin’s

REDUCE-IT cardiovascular outcomes study. These forward-looking statements are not promises or guarantees and involve substantial risks and uncertainties. In particular, as disclosed in its previous filings with the U.S. Securities and Exchange

Commission, Amarin’s ability to effectively commercialize Vascepa will depend in part on its ability to continue to effectively finance its business, efforts of third parties, its ability to create market demand for Vascepa through education,

marketing and sales activities, to achieve market acceptance of Vascepa, to receive adequate levels of reimbursement from third-party payers, to develop and maintain a consistent source of commercial supply at a competitive price, and to maintain

patent protection for Vascepa. Among the factors that could cause actual results to differ materially from those described or projected herein include the following: uncertainties associated generally with research and development, clinical trials

and related regulatory approvals; the risk associated with the FDA’s October 2013 rescission of the ANCHOR SPA agreement; the risk that FDA will follow the negative recommendation of the advisory committee in its review of the ANCHOR

supplemental new drug application; the risk that the reductions in the company’s operating expenses will not be sufficient or will hurt sales; the risk that historical REDUCE-IT clinical trial enrollment and randomization rates may not be

predictive of future results and related cost may increase beyond expectations; the risk that regulatory reviews may impact the current design of the REDUCE-IT study or

6

cause a change in strategic direction with respect to continuation of the study, the risk that changes in studied lipid biomarkers in REDUCE-IT may not have clinically meaningful effect or

support regulatory approvals; and the risk that patents may not be upheld in patent litigation and applications may not result in issued patents. A further list and description of these risks, uncertainties and other risks associated with an

investment in Amarin can be found in Amarin’s filings with the U.S. Securities and Exchange Commission, including its most recent Quarterly Report on Form 10-Q. Existing and prospective investors are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date hereof. Amarin undertakes no obligation to update or revise the information contained in this press release, whether as a result of new information, future events or circumstances or

otherwise.

Important information regarding prescriptions data and product revenue

The historical prescription data provided in this press release is based on data published by third parties. Although Amarin believes these data are

prepared on a period to period basis in a manner that is generally consistent and that such results are indicative of current prescription trends, these data are based on estimates and should not be relied upon as definitive. These data may

overstate or understate actual prescriptions. Based on other data available to Amarin and the history of such third-party prescription estimates in the early stages of launch of other new pharmaceutical products, Amarin believes that the trends

provided by this information can be useful to gauge current prescription levels. There is a limited amount of information available to determine the actual number of total prescriptions for prescription products like Vascepa. Amarin believes that

investors should view these data with caution, as data for this single and limited period may not be representative of a trend consistent with the results presented or otherwise predictive of future results, especially in light of the October 2013

negative advisory committee vote, the October 2013 reduction in our sales force by approximately 50% and the March 2014 co-promotion Agreement with Kowa Pharmaceuticals America. Seasonal fluctuations in pharmaceutical sales, for example, may also

affect future prescription trends of Vascepa as could changes in prescriber sentiment and other factors. Amarin believes investors should consider its results during this quarter together with its results over several future quarters, or longer,

before making an assessment about potential future performance. The commercial launch and co-promotion of a new pharmaceutical product are complex undertakings, and Amarin’s ability to effectively and profitably commercialize Vascepa will

depend in part on its ability to continue to generate market demand for Vascepa through education, marketing and sales activities, its ability to achieve market acceptance of Vascepa, its ability to generate product revenue and its ability to

receive adequate levels of reimbursement from third-party payers and its ability to benefit from continued contributions of its Vascepa co-promotion partner, Kowa Pharmaceuticals America. See “Risk Factors—Risks Related to the

Commercialization and Development of Vascepa” included in Part II, Item 1A. Risk Factors in Amarin’s most recent Quarterly Report on Form 10-Q.

Availability of other information about Amarin

Investors

and others should note that we communicate with our investors and the public using our company website (www.amarincorp.com), our investor relations website (http://www.amarincorp.com/investor-splash.html), including but not limited to investor

presentations and investor FAQs, Securities and Exchange Commission filings, press releases, public conference calls and webcasts. The information that we post on these channels and websites could be deemed to be

7

material information. As a result, we encourage investors, the media, and others interested in Amarin to review the information that we post on these channels, including our investor relations

website, on a regular basis. This list of channels may be updated from time to time on our investor relations website and may include social media channels. The contents of our website or these channels, or any other website that may be accessed

from our website or these channels, shall not be deemed incorporated by reference in any filing under the Securities Act of 1933.

Amarin contact

information:

Michael Farrell

Investor Relations and

Corporate Communications

Amarin Corporation plc

In U.S.: +1

(908) 719-1315

investor.relations@amarincorp.com

Graham Morrell

Trout Group

In U.S.: +1 (646) 378-2954

gmorrell@troutgroup.com

8

CONSOLIDATED BALANCE SHEET DATA

(U.S. GAAP)

Unaudited

|

|

|

|

|

|

|

|

|

| |

|

September 30, 2014 |

|

|

December 31, 2013 |

|

| |

|

(in thousands) |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current Assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

135,435 |

|

|

$ |

191,514 |

|

| Restricted cash |

|

|

600 |

|

|

|

1,000 |

|

| Accounts receivable |

|

|

6,667 |

|

|

|

3,645 |

|

| Inventory, current |

|

|

11,886 |

|

|

|

21,209 |

|

| Deferred tax assets |

|

|

471 |

|

|

|

471 |

|

| Other current assets |

|

|

2,980 |

|

|

|

1,563 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

$ |

158,039 |

|

|

$ |

219,402 |

|

|

|

|

|

|

|

|

|

|

| Property, plant and equipment, net |

|

|

424 |

|

|

|

579 |

|

| Inventory, long-term |

|

|

— |

|

|

|

5,482 |

|

| Deferred tax assets |

|

|

11,862 |

|

|

|

11,944 |

|

| Other non-current assets |

|

|

4,823 |

|

|

|

4,360 |

|

| Intangible asset, net |

|

|

10,225 |

|

|

|

10,709 |

|

|

|

|

|

|

|

|

|

|

| TOTAL ASSETS |

|

$ |

185,373 |

|

|

$ |

252,476 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ DEFICIT |

|

|

|

|

|

|

|

|

| Current Liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

6,059 |

|

|

$ |

6,375 |

|

| Current portion of long-term debt |

|

|

13,790 |

|

|

|

12,974 |

|

| Warrant derivative liability |

|

|

121 |

|

|

|

6,894 |

|

| Deferred revenue |

|

|

— |

|

|

|

1,703 |

|

| Accrued expenses and other current liabilities |

|

|

15,365 |

|

|

|

9,594 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

$ |

35,335 |

|

|

$ |

37,540 |

|

|

|

|

|

|

|

|

|

|

| Long-Term Liabilities: |

|

|

|

|

|

|

|

|

| Exchangeable senior notes |

|

|

120,487 |

|

|

|

149,317 |

|

| Long-term debt |

|

|

89,152 |

|

|

|

87,717 |

|

| Long-term debt derivative liabilities |

|

|

9,000 |

|

|

|

11,100 |

|

| Other long-term liabilities |

|

|

640 |

|

|

|

658 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

$ |

254,614 |

|

|

$ |

286,332 |

|

|

|

|

|

|

|

|

|

|

| Stockholders’ Deficit: |

|

|

|

|

|

|

|

|

| Common stock |

|

|

143,113 |

|

|

|

141,477 |

|

| Additional paid-in capital |

|

|

738,440 |

|

|

|

738,754 |

|

| Treasury stock |

|

|

(217 |

) |

|

|

(217 |

) |

| Accumulated deficit |

|

|

(950,577 |

) |

|

|

(913,870 |

) |

|

|

|

|

|

|

|

|

|

| Total stockholders’ deficit |

|

$ |

(69,241 |

) |

|

$ |

(33,856 |

) |

|

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIT |

|

$ |

185,373 |

|

|

$ |

252,476 |

|

|

|

|

|

|

|

|

|

|

9

CONSOLIDATED STATEMENTS OF OPERATIONS DATA

(U.S. GAAP)

Unaudited

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended September 30,

(in thousands, except per share amounts) |

|

|

Nine months ended September 30,

(in thousands, except per share amounts) |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

| Product revenues |

|

$ |

14,149 |

|

|

$ |

8,403 |

|

|

$ |

37,722 |

|

|

$ |

16,245 |

|

| Less: Cost of goods sold |

|

|

5,366 |

|

|

|

3,682 |

|

|

|

14,637 |

|

|

|

7,813 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross margin |

|

|

8,783 |

|

|

|

4,721 |

|

|

|

23,085 |

|

|

|

8,432 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and administrative (1) |

|

|

19,270 |

|

|

|

28,274 |

|

|

|

60,949 |

|

|

|

101,502 |

|

| Research and development (1) |

|

|

14,457 |

|

|

|

16,821 |

|

|

|

37,891 |

|

|

|

56,148 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

33,727 |

|

|

|

45,095 |

|

|

|

98,840 |

|

|

|

157,650 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating loss |

|

|

(24,944 |

) |

|

|

(40,374 |

) |

|

|

(75,755 |

) |

|

|

(149,218 |

) |

| Gain (loss) on change in fair value of derivative liabilities (2) |

|

|

4,466 |

|

|

|

(1,402 |

) |

|

|

11,870 |

|

|

|

21,059 |

|

| Gain on extinguishment of debt |

|

|

— |

|

|

|

— |

|

|

|

38,034 |

|

|

|

— |

|

| Interest expense, net |

|

|

(4,876 |

) |

|

|

(8,441 |

) |

|

|

(13,565 |

) |

|

|

(26,646 |

) |

| Other (expense) income, net |

|

|

(247 |

) |

|

|

(302 |

) |

|

|

3,994 |

|

|

|

(838 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations before taxes |

|

|

(25,601 |

) |

|

|

(50,519 |

) |

|

|

(35,422 |

) |

|

|

(155,643 |

) |

| (Provision for) benefit from income taxes |

|

|

(449 |

) |

|

|

1,635 |

|

|

|

(1,285 |

) |

|

|

4,827 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(26,050 |

) |

|

$ |

(48,884 |

) |

|

$ |

(36,707 |

) |

|

$ |

(150,816 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

(0.15 |

) |

|

$ |

(0.29 |

) |

|

$ |

(0.21 |

) |

|

$ |

(0.96 |

) |

| Diluted |

|

$ |

(0.17 |

) |

|

$ |

(0.29 |

) |

|

$ |

(0.25 |

) |

|

$ |

(1.02 |

) |

| Weighted average shares: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

174,502 |

|

|

|

170,187 |

|

|

|

173,426 |

|

|

|

157,105 |

|

| Diluted |

|

|

175,141 |

|

|

|

170,187 |

|

|

|

174,305 |

|

|

|

163,487 |

|

| (1) |

Excluding non-cash stock and warrant based compensation, research and development expenses were $13,847 and $16,231 for the three months ended September 30, 2014 and 2013, respectively, and selling, general and

administrative expenses were $18,284 and $24,333, respectively, for the same periods. |

| (2) |

Non-cash gains and losses result from changes in the fair value of a warrant derivative liability, long-term debt derivative liabilities, and forward exchange contracts. |

10

RECONCILIATION OF NON-GAAP LIABILITIES

Unaudited

|

|

|

|

|

|

|

|

|

| |

|

September 30, 2014 |

|

|

December 31, 2013 |

|

| |

|

(in thousands) |

|

| Current Liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

6,059 |

|

|

$ |

6,375 |

|

| Current portion of long-term debt |

|

|

13,790 |

|

|

|

12,974 |

|

| Warrant derivative liability |

|

|

121 |

|

|

|

6,894 |

|

| Deferred revenue |

|

|

— |

|

|

|

1,703 |

|

| Accrued expenses and other current liabilities |

|

|

15,365 |

|

|

|

9,594 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

$ |

35,335 |

|

|

$ |

37,540 |

|

|

|

|

|

|

|

|

|

|

| Long-Term Liabilities: |

|

|

|

|

|

|

|

|

| Exchangeable senior notes |

|

|

120,487 |

|

|

|

149,317 |

|

| Long-term debt |

|

|

89,152 |

|

|

|

87,717 |

|

| Long-term debt derivative liabilities |

|

|

9,000 |

|

|

|

11,100 |

|

| Other long-term liabilities |

|

|

640 |

|

|

|

658 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities - GAAP |

|

$ |

254,614 |

|

|

$ |

286,332 |

|

|

|

|

|

|

|

|

|

|

| Warrant derivative liability |

|

|

(121 |

) |

|

|

(6,894 |

) |

|

|

|

|

|

|

|

|

|

| Total liabilities - non GAAP |

|

$ |

254,493 |

|

|

$ |

279,438 |

|

|

|

|

|

|

|

|

|

|

RECONCILIATION OF NON-GAAP NET LOSS

Unaudited

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended September 30,

(in thousands, except per share amounts) |

|

|

Nine months ended September 30,

(in thousands, except per share amounts) |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

| Net loss for EPS1 - GAAP |

|

$ |

(26,050 |

) |

|

$ |

(48,884 |

) |

|

$ |

(36,707 |

) |

|

$ |

(150,816 |

) |

| Share based compensation expense |

|

|

1,922 |

|

|

|

4,255 |

|

|

|

6,273 |

|

|

|

14,218 |

|

| Warrant compensation (income) expense |

|

|

(326 |

) |

|

|

276 |

|

|

|

(503 |

) |

|

|

(1,179 |

) |

| (Gain) loss on change in fair value of derivatives |

|

|

(4,466 |

) |

|

|

1,402 |

|

|

|

(11,870 |

) |

|

|

(21,059 |

) |

| Gain on extinguishment of debt |

|

|

— |

|

|

|

— |

|

|

|

(38,034 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net loss for EPS1 - non GAAP |

|

$ |

(28,920 |

) |

|

$ |

(42,951 |

) |

|

$ |

(80,841 |

) |

|

$ |

(158,836 |

) |

| 1 basic and diluted |

|

|

|

|

|

|

|

|

|

|

|

|

| Loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted - non GAAP |

|

$ |

(0.17 |

) |

|

$ |

(0.25 |

) |

|

$ |

(0.47 |

) |

|

$ |

(1.01 |

) |

| Weighted average shares: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted |

|

|

174,502 |

|

|

|

170,187 |

|

|

|

173,426 |

|

|

|

157,105 |

|

11

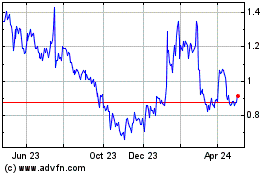

Amarin (NASDAQ:AMRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

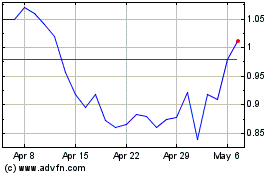

Amarin (NASDAQ:AMRN)

Historical Stock Chart

From Apr 2023 to Apr 2024