UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 6, 2014

AAON, INC.

(Exact name of Registrant as Specified in Charter)

|

| | |

Nevada | 0-18953 | 87-0448736 |

(State or Other Jurisdiction | (Commission File Number: ) | (IRS Employer Identification No.) |

of Incorporation) | | |

| | |

2425 South Yukon, Tulsa, Oklahoma | | 74107 |

(Address of Principal Executive Offices) | | (Zip Code) |

(Registrant's telephone number, including area code): (918) 583-2266

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Conditions.

On November 6, 2014, AAON, Inc. (the "Company") announced its financial and operating results for the third quarter ending September 30, 2014. A copy of the Company's press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference. The Company plans to host a teleconference at 4:15 P.M (Eastern Time) on November 6, 2014 to discuss these results. To access the call, please dial 1-888-241-0551 (code 25661198). A replay of the call will be available through November 13, 2014 at 1-855-859-2056 (code 25661198).

In accordance with General Instruction B.2 of Form 8-K, the information in this Item shall not be deemed "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing.

Item 7.01 Regulation FD Disclosure.

On November 6, 2014, the Company issued the press release described above in Item 2.02 of this Current Report on Form 8-K. A copy of the press release is attached hereto as Exhibit 99.1.

On November 6, 2014, the Company issued the press release described below in Item 8.01 of this Current Report on Form 8-K. A copy of the press release is attached hereto as Exhibit 99.2.

All statements in the teleconference, other than historical financial information, may be deemed to be forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

In accordance with General Instruction B.2 of Form 8-K, the information in this Item shall not be deemed "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing.

Item 8.01 Other Events.

The Company today announced at a meeting of the Board of Directors on November 4, 2014, the Board declared a regular semi-annual cash dividend of $0.09 per share. The next dividend will be paid to stockholders of record as of the close of business on December 2, 2014, with a payment date of December 23, 2014. A copy of the Company's press release is furnished as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

| | | | |

Exhibit Number | | Description |

| | | | |

99.1 | | Press release dated November 6, 2014 announcing financial and operating results. |

99.2 | | Press release dated November 6, 2014 announcing regular semi-annual cash dividend. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| | AAON, INC. |

| | | |

Date: | November 6, 2014 | By: | /s/ John B. Johnson, Jr. |

| | | John B. Johnson, Jr., Secretary |

Exhibit 99.1

|

| | | | |

NEWS BULLETIN | | AAON, Inc. |

| 2425 South Yukon Ave. Ÿ Tulsa, OK 74107-2728 |

| Ÿ Ph: (918) 583-2266 Ÿ Fax: (918) 583-6094 Ÿ |

| Ÿhttp://www.aaon.comŸ |

| | | For Further Information: |

FOR IMMEDIATE RELEASE November 6, 2014 | | Jerry R. Levine Ÿ Phone: (914) 244-0292 Ÿ Fax: (914) 244-0295

|

| Email: jrladvisor@yahoo.com |

AAON REPORTS RECORD SALES AND EARNINGS

TULSA, OK, November 6, 2014 - AAON, Inc. (NASDAQ-AAON), today announced its operating results for the third quarter and nine months ended September 30, 2014.

Sales and earnings for the third quarter and nine months ended September 30, 2014, were all time records and sales in the third quarter exceeded $100.0 million for the first time in any quarter in the Company's history.

Net sales in the third quarter were $102.9 million, up 14.7% from $89.7 million in 2013. Net income was $12.4 million, up 18.2% from $10.5 million for the same period a year ago. Net sales and net income for the nine months ended September 30, 2014, were $271.6 million, up 9.6% from $247.8 million in 2013, with net income of $33.6 million, up 12.9% compared to $29.8 million in 2013.

Earnings per diluted share in the third quarter of 2014 were $0.22, up 15.8% from $0.19 for the same period the previous year, based upon 55.5 million shares outstanding at both September 30, 2014 and 2013. Earnings per diluted share were $0.61, up 13.0% from $0.54, for the nine months ended September 30, 2014 and 2013, based upon 55.4 million and 55.6 million diluted shares outstanding, respectively. All per share earnings and shares reflect the three-for-two stock split effective July 16, 2014.

Norman H. Asbjornson, President and CEO, stated, “The third quarter increase in sales primarily reflects shifts in product mix with more expensive units being sold during the period. Gross profit as a percent of sales increased to 32.4% compared to 29.7% a year ago. SG&A expense as a percent of sales increased 2.6% (from 10.8% to 13.4%), primarily due to a commitment of $3.0 million to A Gathering Place for Tulsa.”

Mr. Asbjornson added that, "While our commitment to the Gathering Place is expected to be paid over five years, U.S. GAAP rules require AAON to book it all in the third quarter when the commitment was made. Absent this very special, non-recurring item, our earnings for the past quarter would have been $0.03 per share higher. The Gathering Place will transform nearly 100 acres of Tulsa's waterfront along the Arkansas River into a $350.0 million park being financed by the George Kaiser Family Foundation ($200.0 million) and numerous local corporate and community philanthropists. AAON will have its name placed on focal points known as the Swing Hill Valley and Bridge at the park. We feel it is important for AAON to be a part of this transformational project in our headquarters' community. Over 1,300 of our total 1,700 employees live in the Tulsa area and we want them and their families to enjoy and personally identify with the park and its many offerings."

Mr. Asbjornson continued, “The Company's balance sheet at September 30, 2014, was very strong, showing a current ratio of 2.7:1 (including cash and short-term investments totaling $42.1 million), plus long-term marketable investments of $12.6 million, and we remained debt-free. In this regard, it should be noted that the Company purchased a total of 530 thousand shares of AAON stock under its resumed buyback program for approximately $9.8 million during the third quarter of this year, for an average of $18.55 per share. Additionally, our backlog increased from $49.9 million at September 30, 2013, to $54.8 million at September 30, 2014."

Mr. Asbjornson then said, "While we are confident of having record sales and profits for 2014, we believe we will experience our normal seasonal softening in the fourth quarter but expect to compare favorably with 2013."

The Company will host a conference call today at 4:15 P.M. Eastern Time to discuss the third quarter results. To participate, call 1-888-241-0551 (code 25661198); or, for rebroadcast, call 1-855-859-2056 (code 25661198).

AAON, Inc. is a manufacturer of air conditioning and heating equipment consisting of rooftop units, chillers, outdoor mechanical rooms, air handling units, makeup air units, energy recovery units, condensing units, commercial self-contained units and coils. Its products serve the new construction and replacement markets. The Company has successfully gained market share through its “semi-custom” product lines, which offer the customer value, quality, function, serviceability and efficiency.

Certain statements in this news release may be “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended. Statements regarding future prospects and developments are based upon current expectations and involve certain risks and uncertainties that could cause actual results and developments to differ materially from the forward-looking statements.

|

| | | | | | | | | | | | | | | |

AAON, Inc. and Subsidiaries |

Consolidated Statements of Income |

(Unaudited) |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2014 | | 2013 | | 2014 | | 2013 |

| (in thousands, except share and per share data) | | | | |

Net sales | $ | 102,917 |

| | $ | 89,690 |

| | $ | 271,594 |

| | $ | 247,764 |

|

Cost of sales | 69,567 |

| | 63,074 |

| | 188,522 |

| | 178,160 |

|

Gross profit | 33,350 |

| | 26,616 |

| | 83,072 |

| | 69,604 |

|

Selling, general and administrative expenses | 13,830 |

| | 9,687 |

| | 32,043 |

| | 25,743 |

|

Gain on disposal of assets | — |

| | — |

| | (24 | ) | | (52 | ) |

Income from operations | 19,520 |

| | 16,929 |

| | 51,053 |

| | 43,913 |

|

Interest income | 55 |

| | 60 |

| | 195 |

| | 151 |

|

Other income (expense), net | (43 | ) | | 15 |

| | (30 | ) | | 252 |

|

Income before taxes | 19,532 |

| | 17,004 |

| | 51,218 |

| | 44,316 |

|

Income tax provision | 7,092 |

| | 6,482 |

| | 17,593 |

| | 14,535 |

|

Net income | $ | 12,440 |

| | $ | 10,522 |

| | $ | 33,625 |

| | $ | 29,781 |

|

Earnings per share: | |

| | |

| | | | |

Basic* | $ | 0.23 |

| | $ | 0.19 |

| | $ | 0.61 |

| | $ | 0.54 |

|

Diluted* | $ | 0.22 |

| | $ | 0.19 |

| | $ | 0.61 |

| | $ | 0.54 |

|

Cash dividends declared per common share*: | $ | — |

| | $ | — |

| | $ | 0.09 |

| | $ | 0.07 |

|

Weighted average shares outstanding: | |

| | |

| | | | |

Basic* | 54,905,288 |

| | 55,113,393 |

| | 54,851,911 |

| | 55,128,986 |

|

Diluted* | 55,484,043 |

| | 55,526,342 |

| | 55,423,294 |

| | 55,562,663 |

|

*Reflects three-for-two stock split effective July 16, 2014

|

| | | | | | | |

AAON, Inc. and Subsidiaries |

Consolidated Balance Sheets |

(Unaudited) |

| September 30, 2014 | | December 31, 2013 |

Assets | (in thousands, except share and per share data) |

Current assets: | | | |

Cash and cash equivalents | $ | 18,819 |

| | $ | 12,085 |

|

Certificates of deposit | 7,223 |

| | 8,110 |

|

Investments held to maturity at amortized cost | 16,079 |

| | 16,040 |

|

Accounts receivable, net | 54,785 |

| | 39,063 |

|

Income tax receivable | — |

| | 1,073 |

|

Note receivable | 30 |

| | 29 |

|

Inventories, net | 37,240 |

| | 32,140 |

|

Prepaid expenses and other | 790 |

| | 304 |

|

Deferred tax assets | 7,093 |

| | 4,779 |

|

Total current assets | 142,059 |

| | 113,623 |

|

Property, plant and equipment: | |

| | |

|

Land | 2,233 |

| | 1,417 |

|

Buildings | 64,098 |

| | 61,821 |

|

Machinery and equipment | 128,459 |

| | 119,439 |

|

Furniture and fixtures | 10,230 |

| | 9,748 |

|

Total property, plant and equipment | 205,020 |

| | 192,425 |

|

Less: Accumulated depreciation | 112,995 |

| | 105,142 |

|

Property, plant and equipment, net | 92,025 |

| | 87,283 |

|

Certificates of deposit | 6,720 |

| | 2,638 |

|

Investments held to maturity at amortized cost | 5,845 |

| | 10,981 |

|

Note receivable | 860 |

| | 919 |

|

Total assets | $ | 247,509 |

| | $ | 215,444 |

|

| | | |

Liabilities and Stockholders' Equity | |

| | |

|

Current liabilities: | |

| | |

|

Revolving credit facility | $ | — |

| | $ | — |

|

Accounts payable | 13,602 |

| | 7,779 |

|

Accrued liabilities | 39,922 |

| | 28,550 |

|

Total current liabilities | 53,524 |

| | 36,329 |

|

Deferred revenue | 920 |

| | 585 |

|

Deferred tax liabilities | 12,377 |

| | 14,424 |

|

Donations | 1,645 |

| | — |

|

Commitments and contingencies |

|

| |

|

|

Stockholders' equity: | |

| | |

|

Preferred stock, $.001 par value, 5,000,000 shares authorized, no shares issued | — |

| | — |

|

Common stock, $.004 par value, 100,000,000 shares authorized, 54,460,266 and 55,067,031 | 218 |

| | 221 |

|

issued and outstanding at September 30, 2014 and December 31, 2013, respectively* | |

| | |

|

Additional paid-in capital | — |

| | — |

|

Retained earnings* | 178,825 |

| | 163,885 |

|

Total stockholders' equity | 179,043 |

| | 164,106 |

|

Total liabilities and stockholders' equity | $ | 247,509 |

| | $ | 215,444 |

|

*Reflects three-for-two stock split effective July 16, 2014

|

| | | | | | | |

AAON, Inc. and Subsidiaries |

Consolidated Statements of Cash Flows |

(Unaudited) |

| Nine Months Ended

September 30, |

| 2014 | | 2013 |

Operating Activities | (in thousands) |

Net income | $ | 33,625 |

| | $ | 29,781 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | |

| | |

|

Depreciation | 8,660 |

| | 9,349 |

|

Amortization of bond premiums | 561 |

| | 545 |

|

Provision for losses on accounts receivable, net of adjustments | (59 | ) | | 121 |

|

Provision for excess and obsolete inventories, net | 223 |

| | 468 |

|

Share-based compensation | 1,578 |

| | 1,054 |

|

Excess tax benefits from stock options exercised and restricted stock awards vested | (908 | ) | | (502 | ) |

Gain on disposition of assets | (24 | ) | | (52 | ) |

Foreign currency transaction loss | 36 |

| | 35 |

|

Interest income on note receivable | (30 | ) | | (31 | ) |

Deferred income taxes | (4,361 | ) | | (1,794 | ) |

Write-off of note receivable | — |

| | 75 |

|

Changes in assets and liabilities: | |

| | |

|

Accounts receivable | (15,663 | ) | | (2,384 | ) |

Income tax receivable | 1,981 |

| | 1,753 |

|

Inventories | (5,323 | ) | | (1,237 | ) |

Prepaid expenses and other | (486 | ) | | 121 |

|

Accounts payable | 5,982 |

| | (227 | ) |

Deferred revenue | 591 |

| | 358 |

|

Accrued liabilities | 12,761 |

| | 1,410 |

|

Net cash provided by operating activities | 39,144 |

| | 38,843 |

|

Investing Activities | |

| | |

|

Capital expenditures | (13,567 | ) | | (6,407 | ) |

Proceeds from sale of property, plant and equipment | 30 |

| | 72 |

|

Investment in certificates of deposits | (9,940 | ) | | (8,869 | ) |

Maturities of certificates of deposits | 6,745 |

| | 1,440 |

|

Purchases of investments held to maturity | (6,880 | ) | | (22,275 | ) |

Maturities of investments | 8,891 |

| | 3,315 |

|

Proceeds from called investments | 2,525 |

| | — |

|

Principal payments from note receivable | 52 |

| | 52 |

|

Net cash used in investing activities | (12,144 | ) | | (32,672 | ) |

Financing Activities | |

| | |

|

Borrowings under revolving credit facility | — |

| | 8,325 |

|

Payments under revolving credit facility | — |

| | (8,325 | ) |

Stock options exercised | 908 |

| | 986 |

|

Excess tax benefits from stock options exercised and restricted stock awards vested | 908 |

| | 502 |

|

Repurchase of stock | (17,309 | ) | | (4,817 | ) |

Cash dividends paid to stockholders | (4,773 | ) |

| (3,712 | ) |

Net cash used in financing activities | (20,266 | ) | | (7,041 | ) |

Net increase (decrease) in cash and cash equivalents | 6,734 |

| | (870 | ) |

Cash and cash equivalents, beginning of period | 12,085 |

| | 3,159 |

|

Cash and cash equivalents, end of period | $ | 18,819 |

| | $ | 2,289 |

|

Exhibit 99.2

|

| | | | |

NEWS BULLETIN | | AAON, Inc. |

| 2425 South Yukon Ave. Ÿ Tulsa, OK 74107-2728 |

| Ÿ Ph: (918) 583-2266 Ÿ Fax: (918) 583-6094 Ÿ |

| Ÿhttp://www.aaon.comŸ |

| | | For Further Information: |

FOR IMMEDIATE RELEASE November 6, 2014 | | Jerry R. Levine Ÿ Phone: (914) 244-0292 Ÿ Fax: (914) 244-0295

|

| Email: jrladvisor@yahoo.com |

AAON REPORTS REGULAR SEMI-ANNUAL CASH DIVIDEND

TULSA, OK, November 6, 2014 - AAON, Inc. (NASDAQ-AAON), today announced at a meeting of the Board of Directors on November 4, 2014, the Board declared a regular semi-annual cash dividend of $0.09 per share. The next dividend will be paid to stockholders of record as of the close of business on December 2, 2014, with a payment date of December 23, 2014.

AAON, Inc. is a manufacturer of air conditioning and heating equipment consisting of rooftop units, chillers, outdoor mechanical rooms, air handling units, makeup air units, energy recovery units, condensing units, commercial self-contained units and coils. Its products serve the new construction and replacement markets. The Company has successfully gained market share through its “semi-custom” product lines, which offer the customer value, quality, function, serviceability and efficiency.

Certain statements in this news release may be “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended. Statements regarding future prospects and developments are based upon current expectations and involve certain risks and uncertainties that could cause actual results and developments to differ materially from the forward-looking statements.

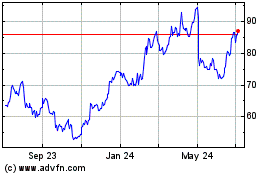

AAON (NASDAQ:AAON)

Historical Stock Chart

From Mar 2024 to Apr 2024

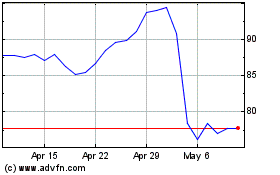

AAON (NASDAQ:AAON)

Historical Stock Chart

From Apr 2023 to Apr 2024