Current Report Filing (8-k)

November 03 2014 - 10:31AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) November 3, 2014

AMPCO-PITTSBURGH CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Pennsylvania |

|

1-898 |

|

25-1117717 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

file number) |

|

(I.R.S. Employer

Identification Number) |

|

|

|

| 600 Grant Street, Pittsburgh, PA |

|

15219 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (412) 456-4400

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.21 below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02. |

Disclosure of Results of Operations and Financial Condition. |

On October 31,

2014, Ampco-Pittsburgh Corporation issued a press release announcing its results for the three and nine months ended September 30, 2014. A copy of the press release is attached hereto and is being furnished to the SEC.

| Item 9.01. |

Financial Statements and Exhibits |

Exhibit 99.1 – Press release dated October 31, 2014.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AMPCO-PITTSBURGH CORPORATION |

|

|

|

|

|

| Date: |

|

November 3, 2014 |

|

|

|

By: |

|

/s/ Marliss D. Johnson |

|

|

|

|

|

|

Marliss D. Johnson |

|

|

|

|

|

|

Chief Financial Officer and Treasurer |

Exhibit 99.1

CONTACT:

Dee Ann Johnson

Chief Financial Officer and Treasurer

(412) 456-4410

dajohnson@ampcopgh.com

FOR IMMEDIATE RELEASE

PITTSBURGH, PA

October 31, 2014

Ampco-Pittsburgh Announces Third Quarter Earnings

Ampco-Pittsburgh Corporation (NYSE: AP) announces sales for the three and nine months ended September 30, 2014 of $65,409,000 and

$198,270,000, respectively, against $64,433,000 and $203,995,000 for the comparable prior year periods. Income from operations equaled $42,000 and $2,837,000 for the three and nine months ended September 30, 2014, respectively. Income from

operations approximated $20,777,000 and $24,879,000 for the three and nine months ended September 30, 2013, respectively, and includes a pre-tax credit of $16,340,000 for estimated additional insurance recoveries for asbestos liabilities

through 2022 as a result of insurance coverage settlement agreements entered into during the third quarter of 2013. The Corporation incurred a net loss for the three months ended September 30, 2014 of $343,000 or $0.03 per share but remains

profitable for the nine months ended September 30, 2014 earning $856,000 or $0.08 per share. Net income for the three and nine months ended September 30, 2013 was $12,705,000 or $1.23 per share and $13,937,000 or $1.35 per share,

respectively, including an after-tax credit of approximately $10,620,000 or $1.03 per share for the above-mentioned insurance settlements.

For the Forged and Cast Rolls segment, sales for the third quarter were slightly better when compared to the same period of the prior year

while sales on a year-to-date basis fell short of the prior year. With both the steel and aluminum industries operating below capacity, depressed pricing and weak demand, particularly for forged roll product, have resulted in lower current year

operating results when compared to the same periods of the prior year. Additionally, operating income of the prior year benefited from receipt of approximately $1,500,000 of insurance proceeds for lost margin on rolls damaged in 2012.

For the Air and Liquid Processing group, sales for the third quarter were also slightly better when compared to the same period of the prior

year but somewhat less on a year-to-date basis. Operating income for the three and nine months ended September 30, 2014 was less than the same periods of the prior year due to the pre-tax credit of $16,340,000 for the above-mentioned insurance

settlements.

The matters discussed herein may contain forward-looking statements that are subject to risks and uncertainties that could cause actual

results to differ materially from expectations. Some of these risks are set forth in the Corporation’s Annual Report on Form 10-K as well as the Corporation’s other reports filed with the Securities and Exchange Commission.

AMPCO-PITTSBURGH CORPORATION

FINANCIAL SUMMARY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

|

|

|

|

|

| Sales |

|

$ |

65,409,000 |

|

|

$ |

64,433,000 |

|

|

$ |

198,270,000 |

|

|

$ |

203,995,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from operations |

|

|

42,000 |

|

|

|

20,777,000 |

(1) |

|

|

2,837,000 |

|

|

|

24,879,000 |

(1) |

| Other expense – net |

|

|

(418,000 |

) |

|

|

(565,000 |

) |

|

|

(388,000 |

) |

|

|

(1,669,000 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) income before income taxes |

|

|

(376,000 |

) |

|

|

20,212,000 |

|

|

|

2,449,000 |

|

|

|

23,210,000 |

|

| Income tax benefit (expense) |

|

|

178,000 |

|

|

|

(7,057,000 |

) |

|

|

(773,000 |

) |

|

|

(7,958,000 |

) |

| Equity loss in Chinese joint venture |

|

|

(145,000 |

) |

|

|

(450,000 |

) |

|

|

(820,000 |

) |

|

|

(1,315,000 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income |

|

$ |

(343,000 |

) |

|

$ |

12,705,000 |

(2) |

|

$ |

856,000 |

|

|

$ |

13,937,000 |

(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

(0.03 |

) |

|

$ |

1.23 |

(2) |

|

$ |

0.08 |

|

|

$ |

1.35 |

(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

(0.03 |

) |

|

$ |

1.22 |

(2) |

|

$ |

0.08 |

|

|

$ |

1.34 |

(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average number of common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

10,424,287 |

|

|

|

10,362,746 |

|

|

|

10,397,695 |

|

|

|

10,355,272 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

|

10,477,346 |

|

|

|

10,407,664 |

|

|

|

10,447,739 |

|

|

|

10,404,158 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Income from operations for the three and nine months ended September 30, 2013 includes a pre-tax credit of $16,340,000 for estimated additional insurance recoveries for asbestos liabilities through 2022 as a result

of insurance coverage settlement agreements entered into during the quarter. |

| (2) |

Net income for the three and nine months ended September 30, 2013 includes an after-tax credit of approximately $10,620,000 or $1.03 per share for estimated additional insurance recoveries for asbestos liabilities

through 2022 as a result of insurance coverage settlement agreements entered into during the quarter. |

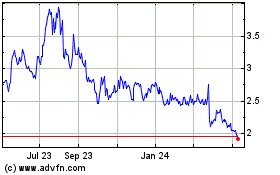

Ampco Pittsburgh (NYSE:AP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ampco Pittsburgh (NYSE:AP)

Historical Stock Chart

From Apr 2023 to Apr 2024