Currency Trading: Weak Dollar Gives Boost to U.S. Earnings -- WSJ

April 27 2016 - 3:02AM

Dow Jones News

By Chelsey Dulaney

U.S. corporations have been getting an unexpected boost from the

weak dollar this year. Now all eyes are on the Federal Reserve to

see if that lift can last.

Analysts came into the current earnings season warning that

first-quarter results would fall at their steepest pace in several

years. Instead, 75% of the companies in the S&P 500 that have

reported results for the period beat analysts' earnings forecasts,

according to FactSet, above the past five years' average of

67%.

Dubravko Lakos-Bujas, head of U.S. equity strategy at J.P.

Morgan Chase & Co., said that is due in part to low

expectations heading into the quarter. However, "part of that is

some relief related to the dollar," he said.

The dollar suffered its worst quarterly performance since 2010,

falling 4.2% in the quarter as the Fed signaled it could take a

slower approach to raising short-term interest rates because of

concerns about the global economy.

When the Fed concludes its latest policy meeting Wednesday, any

sign the central bank thinks the economy is firm enough to weather

a rate rise could strengthen the dollar. That could crimp results

at U.S. multinationals, because it diminishes the value of their

overseas sales when translated back into U.S. currency, and makes

their exports less competitive.

The dollar's strength in recent quarters has hurt Delta Air

Lines Inc. by depressing the value of its overseas tickets and

weighing on demand in regions like Latin America and Eastern

Europe. Now a weaker dollar is providing Delta some relief.

"One positive is that we will get a big help from currency as it

turns from a headwind into a tailwind beginning in the next

quarter," Delta Chief Revenue Officer Glen Hauenstein said on a

conference call April 14.

Also seeing relief is International Business Machines Corp. Its

4.6% decline in first-quarter revenue could have been worse, except

that the damage from currency translation was about $90 million

less than it had forecast, IBM said earlier this month.

Chief Financial Officer Martin Schroeter said on a conference

call that IBM's profit would get a boost from currency conversion

if the dollar remains at current levels for the rest of the

year.

If the dollar remains weak, he said, "we'd do a little bit

better at this point in profit."

Procter & Gamble Co. and Microsoft Corp. also were among the

more than a dozen companies that said they are benefiting or expect

to benefit from a weaker greenback.

The risk now is the benefits could easily be reversed by

changing market perceptions of what central banks are likely to

do.

Many company executives are hesitant to factor a weakening

dollar into their outlooks.

PepsiCo Inc., for example, didn't change its profit forecast for

the year after its better-than-expected first quarter and still

thinks its revenue and profit will take a 4% haircut due to

currency moves.

A Pepsi spokesman declined to comment, but executives noted on a

conference call last week that Pepsi uses analyst projections for

currency rather than current spot rates.

Other companies, however, have proved more willing to reflect a

weaker dollar in their forecasts. Cigarette maker Philip Morris

International Inc. and pharmaceutical giant Johnson & Johnson

boosted their guidance, citing easing currency headwinds.

Toy maker Hasbro Inc. and Netflix Inc. also indicated that they

could benefit from favorable currency movements starting as soon as

the current quarter.

"Last year we had a lot of headwinds, especially on the

international revenue line," said Netflix CFO David Wells on an

earnings call last week. "This year we're seeing the reverse of

that with the weakening of the dollar at least in the first part of

the year here where our international contribution margin is

benefiting from that."

The dollar started its climb in mid-2014, as the Federal Reserve

began to unwind its stimulus program and markets became more

optimistic that the central bank would raise short-term interest

rates for the first time since 2006.

But the strength and speed of the dollar's appreciation caught

many companies by surprise. Though some of them hedged currency

risks with derivative contracts that allow them to lock in an

exchange rate in advance, programs weren't aggressive enough to

fully protect U.S. multinationals from the dollar's rise.

The final months of 2015 were especially painful: A record 45%

of U.S. companies reported a negative currency impact in the fourth

quarter, according to FiREapps, a foreign-exchange software

company.

U.S. companies had been bracing for a particularly tough first

quarter. Analysts estimate an 8.8% decline in first-quarter

earnings for S&P 500 companies, according to FactSet, which

would mark the biggest year-over-year decline since 2009. Still, it

would represent an improvement from the 9.4% decline analysts had

forecast when earnings season began in early April.

Though the dollar was stronger in the first quarter than it was

a year ago, which hurt year-over-year growth numbers, many analysts

and companies had expected a bigger hit than materialized.

(END) Dow Jones Newswires

April 27, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

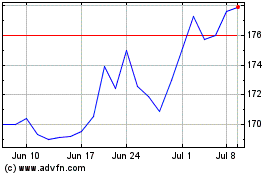

International Business M... (NYSE:IBM)

Historical Stock Chart

From Mar 2024 to Apr 2024

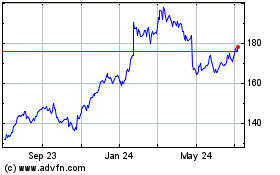

International Business M... (NYSE:IBM)

Historical Stock Chart

From Apr 2023 to Apr 2024