Credit Markets: Beijing Policy Shift Boosts Yields -- WSJ

January 26 2017 - 3:02AM

Dow Jones News

By Rachel Rosenthal

Chinese government bond yields are approaching their highest

level since September 2015, after authorities overnight tightened a

key rate on loans to financial institutions.

The yield on China's benchmark 10-year government bond climbed

to 3.336% on Wednesday compared with 3.296% late Tuesday,

approaching a recent peak in mid-December when yields hit

3.387%.

Late Tuesday, China raised rates on an important tool that the

central bank uses to manage liquidity, called the medium-term

lending facility. Some analysts are interpreting the move as an

effective interest-rate increase, which would be the first such

step since 2011.

The decision is the latest evidence of Beijing fiddling with the

dials of monetary policy to tamp down rampant credit growth, while

simultaneously keeping enough liquidity in the financial system for

banks to meet funding needs and prevent market panic.

"Undoubtedly this is a tightening signal," said Pin Ru Tan,

director of Asia-Pacific rates strategy at HSBC Holdings PLC in

Singapore. "One of China's top priorities this year is to reduce

financial leverage, prevent asset bubbles and avoid a systemic

crisis."

Last week, the People's Bank of China pumped 1.13 trillion yuan

(roughly $165 billion) -- a weekly record -- into domestic money

markets ahead of the Lunar New Year holiday, when Chinese

traditionally give gifts of cash in red envelopes. The rush of cash

withdrawals tends to tighten liquidity this time of year,

particularly because markets will be closed from Jan. 27 through

Feb. 2.

Chinese officials have put deleveraging at the top of their

agenda for 2017, after a flood of cheap, post-financial-crisis

money pushed up prices of financial assets from real estate and

corporate bonds to iron ore and soybean-meal futures. China's money

supply has more than quadrupled since 2007, sending more cash after

a shrinking pool of appealing investment options, just as capital

controls keep money coursing through Chinese assets rather than

those abroad.

The build-up of credit in the bond market began in 2015, when

the central bank started holding short-term borrowing rates at very

low, stable levels to boost growth. By the summer of 2016, roughly

90% of interbank borrowing was in the overnight market, the

shortest and cheapest form of funding.

Many investors used the cheap cash to buy bonds and other

financial products, and then used those securities as collateral to

invest even more. Much of this borrowing was done through

off-balance sheet products, adding layers of leverage and financial

risk beyond regulators' view.

Officials started to crack down on this pattern in August, by

pushing borrowers to longer-term maturities, which elevates

short-term funding costs. The impact of this gradual tightening

campaign combined with a more hawkish U.S. Federal Reserve and

default scares triggered a deep selloff in the onshore bond market

in mid-December.

At that point, China halted trading in some bond futures

contracts for the first time, after 10-year and five-year futures

fell 2% and 1.2%, respectively. Currently, 10-year bond futures are

down 0.90% and five-year bond futures are down 0.50%.

Officials' deleveraging efforts have shown some signs of

success: The daily volume of overnight transactions has fallen to

1.96 trillion yuan from a peak of nearly 4 trillion yuan over the

summer, according to BNP Paribas. Now, roughly 70% of interbank

borrowing is in the overnight market.

China's decision to raise rates on medium-term lending

facilities by 0.1 percentage point -- to 2.95% for the six-month

and 3.10% for the one-year tenor -- isn't terribly dramatic. More

important, for market watchers, is the affirmation that officials'

tighter stance is here to stay.

"While the size of the rate increase is modest, the signal seems

clear that the PBOC has stepped up the tightening bias," wrote

economists at Goldman Sachs in a note.

Despite temporary bouts of volatility, there are some signs that

the long-term view on China's bond market is nevertheless

optimistic.

On Wednesday, Bloomberg announced that it would create two new

indexes, set to launch March 1, that will include China's onshore

government and policy bank bonds.

The move could accelerate inclusion into other closely tracked

international bond indexes, such as J.P. Morgan's emerging-market

government bond index, and accelerate foreign participation in

China's onshore bond market, said Becky Liu, a China macro

strategist at Standard Chartered. Foreigners currently own less

than 2% of China's onshore bond market.

Index providers have been charting China's progress in opening

up its financial markets as a condition for inclusion. Deutsche

Bank estimates that China's addition to some indexes could help

boost foreign investment inflows into China to $700 billion-$800

billion over the next five years.

Write to Rachel Rosenthal at Rachel.Rosenthal@wsj.com

Corrections & Amplifications The yield on China's benchmark

10-year government bond reached a peak in mid-December of 3.387%.

An earlier version of this article misstated the yield figure.

(Jan. 25)

(END) Dow Jones Newswires

January 26, 2017 02:47 ET (07:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

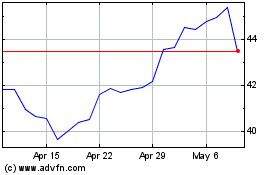

HSBC (NYSE:HSBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

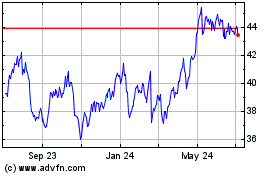

HSBC (NYSE:HSBC)

Historical Stock Chart

From Apr 2023 to Apr 2024