Court Lets SABMiller Treat Biggest Shareholders as Separate Class in Takeover by AB InBev

August 23 2016 - 8:11AM

Dow Jones News

By Saabira Chaudhuri

LONDON--SABMiller PLC on Tuesday said a U.K. court had agreed to

its proposal that its two largest shareholders be treated as a

separate class from the rest of its investors with regard to its

pending acquisition by Anheuser-Busch InBev NV.

AB InBev last month raised its offer for SABMiller to £45 a

share from £44 a share to head off a possible shareholder revolt

following a slide in the British pound after the country's vote to

leave the European Union.

SABMiller's board after some deliberation approved that increase

but said it would ask that its two biggest shareholders, Altria

Group Inc. and the Santo Domingo family, be treated as a separate

voting class.

The plummeting pound against the dollar drove the value of AB

InBev's cash offer to SABMiller well below its alternative

cash-and-share offer because AB InBev shares are priced in euros.

Initially, the cash offer was designed to be a premium.

Some investors had complained about the discrepancy between the

two offers. The cash-and-stock offer was designed for Altria and

the Santo Domingos and is subject to a five-year lockup period

that most regular shareholders are unable to stomach due to

liquidity requirements.

Now AB InBev and SABMiller shareholders must vote on the deal,

expected to close this year. Treating Altria and the Santo Domingo

family as a separate class reduces the percentage of share holdings

needed to block the deal to 15% from 25%, according to analysis by

Stifel Nicolaus & Co.

The vote is scheduled for Sept. 28, and the deal is expected to

close Oct. 10.

Altria and the Santo Domingos have already committed to voting

in favor of the deal.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

August 23, 2016 07:56 ET (11:56 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

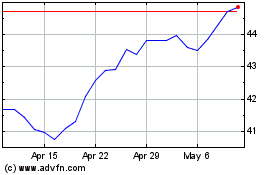

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

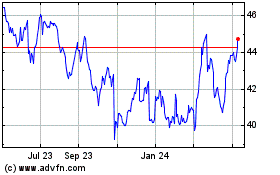

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024