Corcept's Loss Narrows in 4Q - Analyst Blog

March 14 2013 - 9:48AM

Zacks

Corcept Therapeutics Inc. (CORT) posted a loss

per share of 11 cents in the fourth quarter of 2012 which was

narrower than the loss of 12 cents posted in the year-ago

quarter

Adjusted loss per share was 10 cents (including stock-based

compensation but excluding accretion of interest expense related to

long-term obligation) compared to an adjusted loss of 12 cents per

share in the year-ago quarter. The Zacks Consensus Estimate was a

loss of 9 cents per share.

Corcept generated revenues of $1.4 million in the fourth quarter of

2012, in line with the preliminary results provided on Feb 12, 2013

but missed the Zacks Consensus Estimate of $2.0 million.

In Apr 2012, Corcept began offering its first product, Korlym

(mifepristone) 300 mg tablets after getting approval from the US

Food and Drug Administration (FDA) in Feb 2012. Korlym, a potent

glucocorticoid receptor II (GR-II) antagonist, is approved in

the US as a once-daily oral medication for the treatment of

hyperglycemia secondary to hypercortisolism in adults suffering

from endogenous Cushing’s syndrome who have type II diabetes or

glucose intolerance.

We note that Corcept enjoys orphan drug designations for Korlym

from the FDA for the approved indication. Korlym was also approved

by the European Commission for the treatment of endogenous

Cushing’s syndrome in Oct 2011.

Selling, general and administrative expenses were $6.5 million in

the final quarter of 2012, up 97.4% from the year-ago quarter. The

phenomenal increase was due to higher staffing, consultancy and

other professional services costs related to the commercialization

of Korlym.

Research and development expenses in the fourth quarter were $4.9

million, down from 25.7% from the year-ago quarter. The decrease

was mainly due to a reduction in manufacturing expenses as a result

of capitalization of inventory following the FDA approval.

For 2012, Corcept reported revenues of $3.3 million beating the

Zacks Consensus Estimate of $3 million. Loss per share was 41 cents

per share, wider than the loss of 29 cents reported in 2011.

Adjusted loss per share was 39 cents, flat with 2011. The Zacks

Consensus Estimate for 2012 is a loss of 38 cents per share.

Corcept currently has an ongoing phase III study of mifepristone,

the active ingredient in Korlym, for the treatment of psychotic

depression. Corcept also discovered three series of novel selective

GR-II antagonists in 2012 and plans to develop it further in 2013

for human use.

Corcept currently carries a Zacks Rank #3 (Hold). Pharma stocks,

which are currently well placed, include Shire

(SHPG), Furiex Pharmaceuticals (FURX) and

Avanir Pharmaceuticals Inc (AVNR) with a Zacks

Rank #2 (Buy).

AVANIR PHARM (AVNR): Free Stock Analysis Report

CORCEPT THERAPT (CORT): Free Stock Analysis Report

FURIEX PHARMACT (FURX): Free Stock Analysis Report

SHIRE PLC-ADR (SHPG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

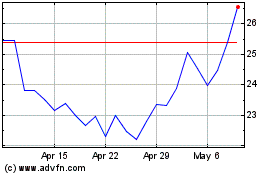

Corcept Therapeutics (NASDAQ:CORT)

Historical Stock Chart

From Mar 2024 to Apr 2024

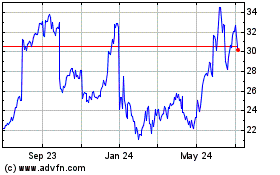

Corcept Therapeutics (NASDAQ:CORT)

Historical Stock Chart

From Apr 2023 to Apr 2024