Corcept Therapeutics Incorporated (NASDAQ: CORT), a pharmaceutical

company engaged in the discovery, development and commercialization

of drugs for the treatment of severe metabolic and psychiatric

disorders, today reported its financial results for the quarter

ended June 30, 2013.

Second Quarter Financial Results

- Recognized GAAP net revenue of $1.9 million. During the quarter

we transitioned to a new specialty pharmacy and our prior specialty

pharmacy reduced its inventory of Korlym® tablets by (i) purchasing

fewer tablets than it dispensed in the quarter, which resulted in

$100,000 less revenue than if inventory levels had not changed and

(ii) returning the tablets it did not dispense, which reduced

revenue by an additional $300,000. Without these reductions, our

net revenue would have been $2.3 million on a non-GAAP basis.

- Recorded a GAAP net loss of $11.9 million, or $0.12 per share.

After adjusting for significant non-cash expenses, net loss on a

non-GAAP basis was $0.10 per share. A reconciliation of non-GAAP

net loss to GAAP net loss is included in this press release.

- As of June 30, 2013, we held cash and cash equivalents of $72.2

million.

Recent Operational Highlights

- Continued to enroll patients in our phase 3 study of the use of

mifepristone, Korlym's active ingredient, in the treatment of

psychotic depression. We expect to perform an interim analysis of

data from this study and report results of that analysis in the

third quarter of 2014.

- Transitioned our specialty pharmacy and patient services

provider to Centric Health Services, Inc., a company that focuses

on the needs of orphan drug companies and the patients they serve.

Centric became our sole provider of such services beginning July 1,

2013.

- Made Korlym available to patients in countries outside of the

United States through a named-patient program with IDIS Limited. A

named-patient program provides access to unapproved drugs in a

particular country. IDIS's rights are restricted to named-patient

programs and will terminate with respect to a particular country

upon Korlym's regulatory approval and commercial availability

there.

"In the second quarter, we made substantial progress toward our

goal of providing Korlym to every Cushing's syndrome patient who

might benefit from it," said Joseph K. Belanoff, M.D., Corcept's

Chief Executive Officer. "We believe our new specialty pharmacy

will provide patients with careful attention and quality service.

We're looking forward to working with IDIS to make Korlym available

on a named-patient basis worldwide."

Financial Results

For the second quarter of 2013, we recognized net product

revenue of $1.9 million after deducting a product return reserve of

$300,000 incurred in connection with the company's transition to a

new specialty pharmacy, as well as government rebates, chargebacks

and other allowances. Cost of sales for the second quarter of 2013

was $23,000. Because we expensed product manufacturing costs

incurred prior to FDA approval in February 2012, our cost of sales

in the second quarter of 2013 consisted primarily of stability

testing and distribution costs.

We reported a net loss of $11.9 million, or $0.12 per share, for

the second quarter of 2013, compared to a net loss of $7.6 million,

or $0.09 per share, for the same period in 2012.

The net loss for the second quarter of 2013 and the

corresponding period in 2012 included significant non-cash

stock-based compensation expenses of $1.3 million and $0.9 million,

respectively. In addition, we recorded non-cash accreted interest

expense related to our capped royalty financing transaction of $1.1

million in the second quarter of 2013. After adjusting for these

non-cash expenses, the company's net loss on a non-GAAP basis was

$9.5 million, or $0.10 per share, for the second quarter of 2013,

compared to $6.7 million, or $0.08 per share, for the same period

in 2012. A reconciliation of GAAP net loss to non-GAAP net loss is

included below.

Operating expenses for the second quarter of 2013 were $12.7

million, compared to $8.5 million for the second quarter of

2012.

- Selling, general and administrative expenses in the second

quarter of 2013 were $8.2 million, compared to $5.8 million for the

comparable period in 2012. The increase was primarily due to

increased staffing, consultancy, contracted sales force and other

professional services costs related to the commercialization of

Korlym.

- Research and development expenses in the second quarter of 2013

were $4.5 million, compared to $2.7 million for the comparable

period in 2012. The increase was primarily due to increased

clinical trials costs, staffing and consultancy to support the

expansion of our phase 3 trial of mifepristone for the treatment of

psychotic depression and the development of our next-generation

selective GR-II antagonists.

Our cash balance as of June 30, 2013 was $72.2 million, as

compared to $93.0 million at December 31, 2012, and reflects

approximately $20.8 million spent on operations during the first

half of 2013.

Conference Call

Corcept will hold a conference call on August 8, 2013, at 5:00

p.m. Eastern Time (2:00 p.m. Pacific Time) to discuss this

announcement. To participate, dial 1-888-771-4371 in the United

States or +1-847-585-4405 internationally approximately ten minutes

before the start of the call. The pass code is 35403018.

A replay of the call will be available through August 22, 2013

at 1-888-843-7419 from the United States and +1-630-652-3042

internationally. The pass code is 35403018.

About Cushing's Syndrome

Endogenous Cushing's syndrome is caused by prolonged exposure of

the body's tissues to high levels of the hormone cortisol and is

generated by tumors that produce cortisol or ACTH. Cushing's

syndrome is an orphan indication that most commonly affects adults

aged 20 to 50. An estimated 10-15 of every one million people are

newly diagnosed with this syndrome each year, resulting in over

3,000 new patients annually in the United States. An estimated

20,000 patients in the United States have Cushing's syndrome,

approximately half of whom are cured by surgery. Symptoms vary, but

most people have one or more of the following manifestations: high

blood sugar, diabetes, high blood pressure, upper body obesity,

rounded face, increased fat around the neck, thinning arms and

legs, severe fatigue and weak muscles. Irritability, anxiety,

cognitive disturbances and depression are also common. Cushing's

syndrome can affect every organ system in the body and can be

lethal if not treated effectively.

About Korlym®

Korlym competitively blocks the glucocorticoid receptor type II

(GR-II), one of the two receptors to which cortisol normally binds,

thereby inhibiting the effects of excess cortisol in Cushing's

syndrome patients. In April 2012, Corcept made Korlym available as

a once-daily oral treatment of hyperglycemia secondary to

endogenous Cushing's syndrome in adult patients with glucose

intolerance or diabetes mellitus type 2 who have failed surgery or

are not candidates for surgery. Korlym was the first FDA-approved

treatment for that illness and the FDA has designated it as an

Orphan Drug for that indication. Orphan Drug designation is a

special status designed to encourage the development of medicines

for rare diseases and conditions. Because Korlym is an Orphan Drug,

Corcept will have marketing exclusivity for the approved indication

in the United States until February 2019.

About Psychotic Depression

Psychotic depression is a serious psychiatric disorder that

affects approximately three million people annually in the United

States. It is more prevalent than either schizophrenia or bipolar I

disorder. The disorder is characterized by severe depression

accompanied by delusions, hallucinations or both. People with

psychotic depression are approximately 70 times more likely to

commit suicide than the general population and often require

lengthy and expensive hospital stays. There is no FDA-approved

treatment for psychotic depression.

About Corcept Therapeutics

Incorporated

Corcept is a pharmaceutical company engaged in the discovery,

development and commercialization of drugs for the treatment of

severe metabolic and psychiatric disorders. Korlym, a first

generation competitive GR-II antagonist, is the company's first

FDA-approved medication. The company has a phase 3 trial underway

for mifepristone for treatment of the psychotic features of

psychotic depression and a portfolio of selective GR-II antagonists

that competitively block the effects of cortisol but not

progesterone. It owns extensive intellectual property covering the

use of GR-II antagonists, including mifepristone, in the treatment

of a wide variety of metabolic, psychiatric and other disorders. It

also holds composition of matter patents for its selective GR-II

antagonists.

Non-GAAP Measures

To supplement Corcept's financial results presented on a GAAP

basis, we use non-GAAP measures of net loss that exclude

significant non-cash expenses related to stock-based compensation

expense and the accretion of interest expense under our capped

royalty financing transaction. We also use a non-GAAP measure of

net revenue that adds back to GAAP net revenue expenses associated

with our specialty pharmacy's elimination of its entire Korlym

inventory through reduced purchases from us and the return of

product it had not yet sold. We believe that these non-GAAP

measures of net revenue and net loss help investors better evaluate

the company's past financial performance and potential future

results. Non-GAAP measures should not be considered in isolation or

as a substitute for comparable GAAP accounting and investors should

read them in conjunction with the company's financial statements

prepared in accordance with GAAP. The non-GAAP measures of net

revenue and net loss we use may be different from, and not directly

comparable to, similarly titled measures used by other

companies.

"Safe Harbor" Statement under the Private

Securities Litigation Reform Act of 1995

Statements made in this news release, other than statements of

historical fact, are forward-looking statements. Forward-looking

statements are subject to a number of known and unknown risks and

uncertainties that might cause actual results to differ materially

from those expressed or implied by such statements. Forward-looking

statements include those regarding the pace of Korlym's acceptance

by physicians and patients, the pace of enrollment in or the

outcome of the company's phase 3 trial of mifepristone for the

treatment of psychotic depression, the effects of rapid

technological change and competition, the protections afforded by

Korlym's Orphan Drug Designation, by Corcept's patent portfolio, or

by the company's other intellectual property rights, or the cost,

pace and success of Corcept's product development efforts,

including its ability to advance its next-generation selective

GR-II antagonists towards human use. These and other risks are set

forth in the company's SEC filings, all of which are available from

the company's website (http://www.corcept.com) or from the SEC's website

(http://www.sec.gov). Corcept disclaims any

intention or duty to update any forward-looking statement made in

this news release.

CORCEPT THERAPEUTICS INCORPORATED

CONDENSED BALANCE SHEETS

(in thousands)

June 30, December 31,

2013 2012

------------- -------------

(Unaudited) (Note)

ASSETS:

Cash and cash equivalents $ 72,220 $ 93,032

Trade receivables, net 855 557

Inventory 5,544 4,663

Other assets 1,068 914

------------- -------------

Total assets $ 79,687 $ 99,166

============= =============

LIABILITIES AND STOCKHOLDERS' EQUITY:

Accounts payable $ 3,033 $ 3,804

Deferred revenue 37 16

Long-term obligation 33,887 31,680

Other liabilities 2,359 1,889

Stockholders' equity 40,371 61,777

------------- -------------

Total liabilities and stockholders' equity $ 79,687 $ 99,166

============= =============

Note: Derived from audited financial statements at that

date.

CORCEPT THERAPEUTICS INCORPORATED

CONDENSED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts)

(Unaudited)

Three Months Ended Six Months Ended

June 30, June 30,

-------------------- --------------------

2013 2012 2013 2012

--------- --------- --------- ---------

Revenues:

Product sales, net $ 1,891 $ 875 $ 3,608 $ 875

Operating expenses:

Cost of sales 23 48 43 48

Research and development 4,491 2,668 8,748 6,210

Selling, general and

administrative 8,160 5,751 16,544 13,238

--------- --------- --------- ---------

Total operating expenses 12,674 8,467 25,335 19,496

--------- --------- --------- ---------

Loss from operations (10,783) (7,592) (21,727) (18,621)

Interest and other expense (1,114) (5) (2,254) (9)

--------- --------- --------- ---------

Net loss and comprehensive

loss $ (11,897) $ (7,597) $ (23,981) $ (18,630)

========= ========= ========= =========

Basic and diluted net loss per

share $ (0.12) $ (0.09) $ (0.24) $ (0.22)

========= ========= ========= =========

Shares used in computing basic

and diluted net loss per share 99,814 88,621 99,814 86,521

========= ========= ========= =========

CORCEPT THERAPEUTICS INCORPORATED

RECONCILIATION OF GAAP TO NON-GAAP NET LOSS

(in thousands, except per share amounts)

(Unaudited)

Three Months Ended Six Months Ended

June 30, June 30,

-------------------- --------------------

2013 2012 2013 2012

--------- --------- --------- ---------

GAAP net loss $ (11,897) $ (7,597) $ (23,981) $ (18,630)

Significant non-cash expenses:

Stock-based compensation

Research and development 157 138 305 256

Selling, general and

administrative 1,108 744 2,270 3,015

--------- --------- --------- ---------

Total stock-based

compensation 1,265 882 2,575 3,271

--------- --------- --------- ---------

Accretion of interest expense

related to long-term

obligation 1,092 -- 2,207 --

--------- --------- --------- ---------

Non-GAAP net loss $ (9,540) $ (6,715) $ (19,199) $ (15,359)

========= ========= ========= =========

GAAP basic and diluted net loss

per share $ (0.12) $ (0.09) $ (0.24) $ (0.22)

========= ========= ========= =========

Non-GAAP basic and diluted net

loss per share as adjusted for

significant non-cash expenses $ (0.10) $ (0.08) $ (0.19) $ (0.18)

========= ========= ========= =========

Shares used in computing basic

and diluted net loss per share 99,814 88,621 99,814 86,521

========= ========= ========= =========

CONTACT: Charles Robb Chief Financial Officer Corcept

Therapeutics 650-688-8783 Email Contact www.corcept.com

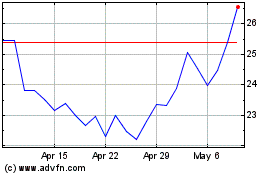

Corcept Therapeutics (NASDAQ:CORT)

Historical Stock Chart

From Mar 2024 to Apr 2024

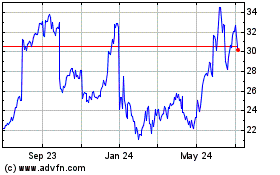

Corcept Therapeutics (NASDAQ:CORT)

Historical Stock Chart

From Apr 2023 to Apr 2024