Copper Pulls Back From Recent Highs

February 16 2017 - 7:07AM

Dow Jones News

By Ed Ballard

LONDON--Copper prices slipped on Thursday but the prospect of

supply disruption kept the price near a 20-month high.

The London Metal Exchange's three-month copper contract was down

0.4% at $6,028.50 a metric ton. Other base metals were mixed.

The focus continued to be Chile's Escondida mine, majority owned

by BHP Billiton Ltd., where a strike over pay has reportedly been

postponed while union officials hold mediated talks with

management.

"The strike has now entered its seventh day and, while parties

are keen to talk to each other, it seems an agreement will take

some time to reach," wrote analysts at ING.

Copper has retreated since briefly cresting $6,200 a ton for the

first time since May 2015 on Monday, but remains up 9% for the

year. A production outage at Freeport-McMoRan Inc.'s Grasberg mine

in Indonesia because it hadn't received an export license has added

to concern about a potential supply crunch.

Brokerage firm Marex Spectron said that in recent sessions

buyers have stepped in whenever copper has fallen, but warned that

without another upward tilt, funds that bought during the recent

run-up will sell out of their positions, weighing on the price.

"Copper has looked vulnerable a few times this week on the way

down but dips have held and the uptrend is still broadly intact for

now," Marex wrote. However "The recent speculative longs need to

see it revisit $6,200 sooner rather than later."

Aluminium was down 1% at $1,895 a ton, zinc down 0.7% at

$2,850.50 a ton, lead down 0.7% at $2,304.50 a ton, nickel up 0.3%

at $10,940 a ton, tin up 0.6% at $19,950 a ton.

Write to Ed Ballard at ed.ballard@wsj.com

(END) Dow Jones Newswires

February 16, 2017 06:52 ET (11:52 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

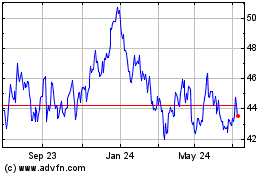

BHP (ASX:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

BHP (ASX:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024