TIDMCIC

RNS Number : 0667Z

Conygar Investment Company PLC(The)

24 May 2016

24 May 2016

The Conygar Investment Company PLC

Interim Results for the six months ended 31 March 2016

Highlights

-- Net asset value per share 201.0p at 31 March 2016 decreased

from 203.3p at 30 September 2015. EPRA NAV per share decreased 1.1%

to 201.0p from 203.2p.

-- The development pipeline is advancing. The Haverfordwest

infrastructure works have completed and we are making significant

progress on the approvals for the other projects.

-- Acquired a 9.96 acre site from Sainsbury's at Cross Hands,

west of Swansea, for GBP2.25 million plus an overage provision, and

the 203 acre freehold of the former gas storage facility site near

Rhosgoch, Anglesey, for GBP3 million.

-- In April 2016, completed the refinancing of the TAPP, TOPP

and Lamont portfolios with a new GBP48.1 million facility with

Lloyds Bank, Jersey, releasing GBP21 million after repayment of the

two existing RBS loans and transaction costs.

-- Total cash available for acquisitions and development funding

of GBP60 million after the refinancing in April 2016. Net debt of

GBP26.1 million as at March 2016, representing gearing of 16.8%

against net asset value and 20.6% on loan to value basis. Post

refinancing, net debt of GBP27.2 million representing gearing of

17.5% against net asset value and 21.4% on loan to value basis.

-- Investment property portfolio valuation of GBP126.7 million

at 31 March 2016. Due to a fall in the value of our asset in

Aberdeen, there is a reduction of GBP2.4 million on a like for like

basis.

-- Disposed of three investment properties in the period for a

total consideration of GBP5.4 million after costs, a deficit of

GBP0.1 million to the September 2015 valuation.

-- Bought back 5.3 million shares (6.4% of ordinary share

capital) at an average price of 167 pence per share, enhancing NAV

per share by 2.5p.

Summary Group Net Assets as at 31 March 2016

Per Share

GBP'm p

Investment Properties 126.7 164.1

Investment Properties Under Construction 9.0 11.6

Development Projects 46.2 59.8

Cash 41.6 53.9

Other Net Liabilities (1.0) (1.3)

------- ----------

222.5 288.1

ZDP Liability (33.4) (43.2)

Bank Loans (33.9) (43.9)

Net Assets 155.2 201.0

------- ----------

Robert Ware, Chief Executive, commented:

"We envisage that the markets we trade in will be volatile over

the summer months, and potentially the rest of this year, due to

the EU referendum, continuing economic problems in the Eurozone and

the US presidential election and we are cautious about the growth

prospects of the UK economy over the medium term.

Historically, we have performed strongly in difficult markets

and following the recent refinancing of a large portion of the

investment property portfolio, we hold cash of more than GBP60

million and are therefore well positioned to take advantage of

opportunities, should they arise."

Enquiries:

The Conygar Investment Company PLC

Robert Ware: 020 7258 8670

Ross McCaskill: 020 7258 8670

Liberum Capital (Nominated Adviser)

Richard Bootle: 020 3100 2222

Temple Bar Advisory (Public Relations)

Alex Child-Villiers: 07795 425 580

The Conygar Investment Company PLC

Interim Results

for the six months ended 31 March 2016

Chairman's and Chief Executive's Statement

Progress and Results Summary

We present the Group's results for the six months ended 31 March

2016. The net asset value per share decreased to 201.0p from 203.3p

at 30 September 2015 (199.2p at 31 March 2015). On an EPRA basis,

net asset value per share decreased to 201.0p from 203.2p at 30

September 2015 (198.8p at 31 March 2015).

The loss before taxation of GBP2.1 million compares with a

profit before taxation of GBP4.1 million in the six months ended 31

March 2015. The main reason for this was a fall in valuation of the

investment properties of GBP2.4 million on a like for like basis in

the six months ended 31 March 2016, compared with a GBP1.2 million

uplift for the six months ended 31 March 2015. The fall in

valuation is solely due to our asset in Aberdeen and this market

has been hit hard by the crisis in the oil industry and this is

reflected in the valuation.

The Group also disposed of three investment properties in the

current period and these sales, along with the disposals of nine

assets during the year ended 30 September 2015, have reduced net

property income to GBP3.6 million, before financing and overheads,

compared with GBP5.0 million for the same period last year.

The three disposals in the period were at Hinckley, Horsham and

Runcorn for a consideration of GBP5.4 million after costs, a

deficit of GBP0.1 million to the September 2015 valuation. These

disposals have resulted in a reduction in the contracted rent roll

to GBP9.2 million at 31 March 2016, compared with GBP9.8 million at

30 September 2015.

The development pipeline continues to make good progress and we

have acquired two sites during the period. The first is a 9.96 acre

site which was acquired in October 2015 from Sainsbury's for

GBP2.25 million plus an overage provision and is situated at Cross

Hands, west of Swansea. In April 2016, a planning application was

submitted to Carmarthenshire Council for a 106,000 square foot

retail development, which, along with a 562 space car park, will

include a family pub/restaurant, food stores, a drive-through

restaurant and other retail stores.

We acquired a second site in October 2015 for a consideration of

GBP3 million and this is the freehold of a former gas storage

facility site near Rhosgoch, Anglesey. This 203 acre brownfield

site is situated 6.5 miles from the existing and proposed Wylfa

Nuclear Power Station. Horizon Nuclear Power has identified this

site as a potential location to house approximately 4,000 temporary

workers and discussions are ongoing to make our land available for

this facility.

On the financing side, the Group has used GBP8.9 million surplus

cash to buy back 6.4% of its shares at a discount to net asset

value and this has enhanced net asset value per share by 2.5

pence.

In April 2016, we refinanced part of our investment property

portfolio with a new GBP48.1 million loan with Lloyds Bank, Jersey.

This has released GBP21 million to pursue other opportunities and

the funding rates have been reduced to 1.9% margin plus Bank of

England base rate, thus currently 2.4% per annum.

Although we continue to increase investment in the development

programme, the balance sheet remains strong and we have GBP60

million available after the refinancing for further investment and

development funding. Our total pre-refinancing debt was GBP67.7

million, resulting in net gearing of 16.8% and post refinancing is

GBP89.9 million, resulting in net gearing of 17.5%.

Property Portfolio

As at 31 March 2016, the Group's investment properties were

independently valued at GBP126.7 million compared to GBP133.2

million at 30 September 2015. The fall in valuation is a result of

disposals in the period and a decrease in value on a like for like

basis of GBP2.4 million. As referred to above, this fall on a like

for like basis is due to the difficult Aberdeen market which has

been adversely affected by the volatility in global oil prices. Our

exposure to Aberdeen was significantly greater not very long ago,

but we recognised the risks and disposed of our two other buildings

there in the year ended 30 September 2014 for a consideration of

GBP15.5 million, which was a significant surplus to our book cost

and GBP1.24 million over the previous valuation in September 2013.

Nevertheless, the building we still hold is exposed to the oil

industry and we will continue to mitigate the risks as best we

can.

The contracted annual rent roll is GBP9.2 million as at 31 March

2016, which is GBP0.6 million lower than at 30 September 2015,

mainly owing to the disposals already discussed. We continue to

work hard at letting vacant space, retaining tenants and pushing

down irrecoverable property costs and so the cash yield on the

portfolio remains strong. We continue to recycle assets and realise

value where opportunities arise and when assets are mature and we

cannot add further value through asset management initiatives. The

vacancy rate has increased to 17.0% as at 31 March 2016 from 14.1%

as at September 2015 but it should be noted that the vacancy rate

is skewed by the refurbishment projects which are taking place at

both Brennan House, Farnborough and the Links, Warrington. If these

projects are excluded and the new letting at Mochdre to Conwy

County Council, which is described below, is taken into account,

the vacancy rate reduces to 8.6%. The refurbishments of Farnborough

and Warrington are progressing well and will be completed during

the summer and the total expenditure on these projects is over GBP3

million.

Progress is being made with asset management initiatives across

the portfolio. In May 2016, we announced the letting of 60,000

square feet of industrial space and 3.2 acres of "open storage"

land at Mochdre Commerce Park in Colwyn Bay, North Wales. The new

tenant is Conwy County Council and they have taken a 35 year lease

with a first break clause in year 15, at an initial rent of

GBP240,000 per annum.

Also in May 2016, we announced that a planning application has

been submitted for the development site at Nottingham Road,

Ashby-de-la-Zouch for a Marks and Spencer's "Food Hall" measuring

approximately 11,000 square feet, with associated parking, services

and landscaping. The construction of the spine road and utility

services has been completed and this will enhance the marketability

of the remaining 2 acre plot at this site.

Development Projects

Continued progress has been made on our development projects

since we last reported.

At Haverfordwest, the substantial infrastructure works to

service the 729 residential units and 9.6 acre retail site were

completed on budget at a cost of GBP3.7 million and ahead of

schedule at the beginning of the calendar year. Marketing of the

housing land is being undertaken now that these infrastructure

works have been completed. A new planning application will be

submitted shortly for a 100,000 square foot retail development,

together with a multiplex cinema and hotel on the 9.6 acre retail

site.

In April 2016, we submitted a planning application for our 9.96

acre development site at Cross Hands, South West Wales, for a

106,000 square foot retail development and a 562 space car park. We

are in detailed negotiations with various potential tenants and are

planning to commence construction later this year.

At Fishguard Waterfront, the detailed planning and marine

consent licenses, to bring about the development platforms, marina

basin and new port facilities, were submitted in January 2016. We

hope to have a positive determination of these by the end of the

calendar year.

The Harbour Revision Order and marine license applications for

the Pembroke Dock development are still progressing. The proposed

60,000 square feet of leisure and retail development has attracted

significant interest from potential tenants and we expect to make

further announcements this year.

At Holyhead Waterfront, Ynys Mon council has decided to hold an

inquiry to consider the Village Green application. Whilst we do not

believe that there is any merit in the claim, we will be pushing

for a positive decision which will put the matter beyond any

further doubt. The application only covers a small part of our land

and does not prevent us starting construction on the vast majority

of the site. We are in discussions with parties involved in the

proposed Wylfa Newydd project in respect of providing substantial

residential accommodation and also the use of our marine facilities

at Soldiers Quay and adjoining land.

At Parc Cybi, the truckstop is attracting increased usage month

on month and our restaurant has been voted the second best eatery

in Holyhead. The truckstop is a joint venture with Fred Done, the

founder and owner of Betfred and the construction was completed

last year. At our 6.9 acre logistics centre, which is not part of

the joint venture but is located next to the lorry park, we are at

an advanced stage of negotiations with Horizon Nuclear to provide

facilities to handle all inward road-borne material for the

construction of Wylfa Newydd.

Our 205 acre site at Rhosgoch, which we purchased in October

2015, has been identified by Horizon Nuclear, through public

consultation, as a potential location to house approximately 4,000

temporary workers. We are in discussions with Horizon Nuclear to

make our land available for this facility.

At Llandudno Junction, Conwy Borough Council has approved our

90,000 square foot retail application and in partnership with them,

we are now moving forward to progress the development.

The planning and development progress is always difficult to

predict but we anticipate significant progress on the projects

throughout the year.

Financing and Cash Management

At 31 March 2016, the Group had cash of GBP41.6 million

available to pursue investment opportunities and bank debt of

GBP34.3 million, with total debt of GBP67.7 million, including the

zero dividend preference liability of GBP33.4 million. Net debt

amounted to GBP26.1 million, resulting in gearing of 16.8% against

net asset value and 20.6% on a loan to value basis. After the

recent refinancing in April 2016, total debt increased to GBP89.9

million and net debt to GBP27.2 million, resulting in gearing of

17.5% against net asset value and 21.4% on a loan to value

basis.

As at 31 March 2016, all of the Group debt was hedged or fixed

and the weighted average cost of all debt, including margin was

3.9% with an average debt maturity of 1.1 years. Post refinancing,

the weighted average cost of debt decreased to 2.4% and average

debt maturity increased to 4.3 years.

During the period, the Group acquired 5,299,819 ordinary shares,

representing 6.4% of its ordinary share capital, at an average

price of 167 pence per share. This cost approximately GBP8.9

million and, as a result of the buy backs, net asset value per

share has been enhanced by 2.5 pence per share.

Dividend Policy

As referred to in the Strategic Report within the Report and

Accounts for the year ended 30 September 2015, we have continued

our policy of selling down our investment property portfolio where

appropriate, and, as expected, the rental income we receive has

decreased. We anticipate that the portfolio will become smaller in

the medium term but remain sufficient to fund the operations of the

business.

The funds created by investment property sales will be, in the

main, redeployed within the development portfolio, where we believe

there is substantial inherent future value. This further investment

will be of significant benefit to our ultimate return.

As discussed within this statement, the rental income has

decreased in the six month period ended 31 March 2016. The Board

will review our dividend policy annually and our primary focus

continues to be growth in net asset value per share.

Summary Group Net Assets

The Group net assets as at 31 March 2016 may be summarised as

follows:

Per Share

GBP'm p

Investment Properties 126.7 164.1

Investment Properties Under Construction 9.0 11.6

Development Projects 46.2 59.8

Cash 41.6 53.9

Other Net Liabilities (1.0) (1.3)

------- ----------

222.5 288.1

ZDP Liability (33.4) (43.2)

Bank Loans (33.9) (43.9)

Net Assets 155.2 201.0

------- ----------

Outlook

We envisage that the markets we trade in will be volatile over

the summer months, and potentially the rest of this year, due to

the EU referendum, continuing economic problems in the Eurozone and

the US presidential election and we are cautious about the growth

prospects of the UK economy over the medium term.

Historically, we have performed strongly in difficult markets

and following the recent refinancing of a large portion of the

investment property portfolio, we hold cash of more than GBP60

million and are therefore well positioned to take advantage of

opportunities, should they arise.

N J Hamway R T E Ware

Chairman Chief Executive

23 May 2016

Financial review

Net Asset Value

The net asset value at 31 March 2016 was GBP155.2 million (31

March 2015: GBP165.0 million; 30 September 2015: GBP167.8 million).

The primary movements in the six month period were GBP8.9 million

used to buy back shares, GBP3.6 million net rental income, GBP2.4

million property revaluation deficit, GBP1.9 million spent on

finance costs and GBP1.4 million of dividends paid. Excluding the

amounts incurred paying dividends and buying back shares, net asset

value decreased in the period by 1.4%.

On an EPRA basis, the net asset value is:

31 Mar 30 31

2016 Sept Mar

2015 2015

GBP'm GBP'm GBP'm

Net asset value 155.2 167.8 165.0

Exercisable share

options 4.1 4.1 6.8

Diluted net asset

value 159.3 171.9 171.8

Fair value of hedging

instruments - - (0.1)

------- ------- -------

EPRA net asset

value 159.3 171.9 171.7

======= ======= =======

EPRA NAV per share 201.0p 203.2p 198.8p

======= ======= =======

Basic NAV per share 201.0p 203.3p 199.2p

======= ======= =======

Diluted NAV per

share 201.0p 203.3p 198.9p

======= ======= =======

The EPRA net asset value is calculated on a fully diluted basis

and excludes the impact of hedging instruments, as these are held

for long term benefit and not expected to crystallise at the

balance sheet date.

The NNNAV or "triple net asset value" is the net asset value

taking into account asset revaluations, the mark to market costs of

debt and hedging instruments and any associated tax effect. Our

investment properties are carried on our balance sheet at

independent valuation with any associated tax effect provided for

at the period end. Our development and trading assets are carried

at the lower of cost and net realisable value. We have not sought

to value these assets as, in our opinion, they are still at too

early a stage in their development to provide a meaningful figure,

so cost is equated to fair value for these purposes. On this basis,

there is no material difference between our stated net asset value

and NNNAV.

Revaluation

The Group's investment properties were independently valued by

Jones Lang LaSalle at 31 March 2016. In their opinion, the open

market value of the investment property portfolio was GBP126.7

million. The total portfolio decreased in value by GBP6.5 million

during the period as a result of three disposals and a decrease in

the underlying portfolio valuation on a like for like basis.

Cash Flow

The Group generated GBP0.4 million cash from operating

activities (31 March 2015: used GBP13.8 million; 30 September 2015:

used GBP12.9 million).

The primary cash outflows in the period were GBP7.3 million

incurred on investment properties under construction and

development and trading properties, GBP3.9 million to repay RBS

debt and GBP8.9 million to buy back shares. These were partly

offset by cash inflows of GBP5.4m from the sales of investment

properties, resulting in a net cash outflow during the period of

GBP15.8 million (31 March 2015: GBP25.7 million outflow; 30

September 2015: GBP13.4 million outflow).

Net Income From Property Activities

31 Mar 30 31

2016 Sept Mar

2015 2015

GBP'm GBP'm GBP'm

Rental income 4.8 11.4 6.1

Direct property costs (1.2) (2.9) (1.2)

------- ------- ------

Rental surplus 3.6 8.5 4.9

------- ------- ------

Proceeds from sale of

investment properties 5.5 31.3 5.8

Cost of investment properties

sold (5.6) (28.9) (5.6)

------- ------- ------

(Loss) / gain on sale

of investment properties (0.1) 2.4 0.2

------- ------- ------

Total net income arising

from property activities 3.5 10.9 5.1

======= ======= ======

Administrative Expenses

The administrative expenses for the six month period ended 31

March 2016 were GBP1.3 million. The major items were salary costs

of GBP0.6 million and various costs arising as a result of the

Group being quoted on AIM. The credit for the six months ended 31

March 2015 of GBP0.2 million included GBP1.75 million for the

reversal of 20% of the 2014 profit share, as previously reported in

the annual report for the year ended 30 September 2015. If this

credit is ignored, administrative expenses for the six months to 31

March 2015 amounted to GBP1.6 million.

Financing

At 31 March 2016, the Group had cash of GBP41.6 million (31

March 2015: GBP45.0 million; 30 September 2015: GBP57.4 million).

The decrease has resulted mainly from the cash used in buying back

shares, repaying bank debt, administrative costs and investing in

the investment properties and developments projects.

The bank debt at 31 March 2016 was GBP34.3 million. Taking into

account the ZDP liability, total debt was GBP67.7 million, with net

debt 20.6% by loan to value and 16.8% against net asset value.

The interest rate risk on the facilities continues to be managed

by way of interest rate swaps and caps, with 100% of debt protected

by hedging at 31 March 2016. The weighted average cost of all debt,

including margin, was 3.9%. The fair value of these derivative

financial instruments is provided for in full on the balance

sheet.

Post the refinancing in April 2016, the Group's cash increased

to GBP62.7 million and total debt, including the ZDP liability,

increased to GBP89.9 million, resulting in gearing of 21.4% by loan

to value and 17.5% against net asset value. Furthermore, the

weighted average cost of debt, including margin, reduced to

2.4%.

Property Information

Summary of Investment property portfolio

31 March 30 September 31 March

2016 2015 2015

Valuation GBP126.7 GBP133.2 GBP154.4

million million million

Number of properties 33 36 42

Contracted rent (pa) GBP9.2 GBP9.8 million GBP11.8

million million

Current ERV (pa) GBP11.5 GBP11.9 million GBP14.3

million million

Net initial yield 6.66% 7.16% 7.25%

Equivalent yield 8.16% 8.02% 8.16%

Reversionary yield 8.58% 8.35% 8.46%

Vacancy rate 17.0% 14.1% 14.3%

Average unexpired lease 4.7 years 4.8 years 4.3 years

lengths

Summary of Development Projects

31 March 30 September 31 March

2016 2015 2015

GBPm GBPm GBPm

Haverfordwest 23.11 23.91 24.17

Holyhead Waterfront 10.25 10.19 9.52

Pembroke Dock Waterfront 4.71 4.68 4.65

Parc Cybi, Holyhead 4.60 4.59 4.34

Fishguard Waterfront 1.46 1.36 1.26

Fishguard Lorry Stop 0.54 0.54 0.54

King's Lynn 0.87 0.85 0.85

Llandudno Junction 0.54 0.43 0.25

Other 0.08 0.07 0.18

--------- ------------- ---------

Total investment to date 46.16 46.62 45.76

========= ============= =========

The reduction in total investment to date arises due to the

reimbursement of retention funds from Pembrokeshire County Council

following completion of the infrastructure works at

Haverfordwest.

Summary of Investment Properties Under Construction

31 March 30 September 31 March

2016 2015 2015

GBPm GBPm GBPm

Haverfordwest Retail 3.18 3.16 -

Cross Hands 2.55 - -

Rhosgoch 3.23 - -

Total investment to date 8.96 3.16 -

========= ============= =========

The Conygar Investment Company PLC

Consolidated Statement of Comprehensive Income

For the six months ended 31 March 2016

Note Six months ended Year ended

31 March 31 March 30 Sept

2016 2015 2015

GBP'000 GBP'000 GBP'000

Rental income 4,555 5,908 10,957

Other property income 242 209 484

Sale of trading investments - 160 300

---------- --------- -----------

Revenue 4,797 6,277 11,741

---------- --------- -----------

Direct costs of:

Rental income 1,237 1,192 2,932

Sale of trading investments - 60 211

Direct Costs 1,237 1,252 3,143

---------- --------- -----------

Gross Profit 3,560 5,025 8,598

Share of results of

joint ventures (2) (2) (19)

(Loss) / gain on sale

of investment properties (126) 157 2,436

Movement on revaluation

of investment properties 6 (2,423) 1,217 2,742

Other gains and losses (10) (262) (309)

Administrative expenses (1,259) 153 (1,541)

---------- --------- -----------

Operating (Loss) / Profit (260) 6,288 11,907

Finance costs 3 (1,920) (2,332) (4,379)

Finance income 3 126 142 226

---------- --------- -----------

(Loss) / Profit Before

Taxation (2,054) 4,098 7,754

Taxation (229) (992) (1,316)

---------- --------- -----------

(Loss) / Profit and

Total Comprehensive

(Charge) / Income for

the Period (2,283) 3,106 6,438

========== ========= ===========

Attributable to:

- equity shareholders (2,283) 3,106 6,438

- minority interests - - -

---------- --------- -----------

(2,283) 3,106 6,438

========== ========= ===========

Basic (loss) / earnings

per share 5 (2.83)p 3.70p 7.72p

Diluted (loss) / earnings

per share 5 (2.83)p 3.69p 7.72p

All of the activities of the Group are classed as

continuing.

The Conygar Investment Company PLC

Consolidated Statement of Changes in Equity

For the six months ended 31 March 2016

Share Share Capital Treasury Retained Total Non-controlling Total

Capital Premium Redemption Shares Earnings Interests Equity

Reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 October

2014 4,932 124,128 1,568 (15,384) 54,185 169,429 20 169,449

Profit

for the

period - - - - 3,106 3,106 - 3,106

--------- --------- ------------ --------- ---------- -------- ---------------- --------

Total

recognised

income

and expense

for the

period - - - - 3,106 3,106 - 3,106

Dividend

paid - - - - (1,450) (1,450) - (1,450)

Purchase

of own

shares - - - (7,423) - (7,423) - (7,423)

Issue

of share

capital 53 1,243 - - - 1,296 - 1,296

At 31

March

2015 4,985 125,371 1,568 (22,807) 55,841 164,958 20 164,978

At 1 October

2014 4,932 124,128 1,568 (15,384) 54,185 169,429 20 169,449

Profit

for the

year - - - - 6,438 6,438 - 6,438

--------- --------- ------------ --------- ---------- -------- ---------------- --------

Total

comprehensive

income

for the

year - - - - 6,438 6,438 - 6,438

Dividend

paid - - - - (1,450) (1,450) - (1,450)

Purchase

of own

shares - - - (7,937) - (7,937) - (7,937)

Issue

of share

capital 53 1,243 - - - 1,296 - 1,296

At 30

September

2015 4,985 125,371 1,568 (23,321) 59,173 167,776 20 167,796

========= ========= ============ ========= ========== ======== ================ ========

Changes

in equity

for six

months

ended

31 March

2016

At 1 October

2015 4,985 125,371 1,568 (23,321) 59,173 167,776 20 167,796

Loss for

the period - - - - (2,283) (2,283) - (2,283)

--------- --------- ------------ --------- ---------- -------- ---------------- --------

Total

recognised

income

and expense

for the

period - - - - (2,283) (2,283) - (2,283)

Dividend

paid - - - - (1,415) (1,415) (1,415)

Purchase

of own

shares - - - (8,873) - (8,873) - (8,873)

At 31

March

2016 4,985 125,371 1,568 (32,194) 55,475 155,205 20 155,225

========= ========= ============ ========= ========== ======== ================ ========

The Conygar Investment Company PLC

Consolidated Balance Sheet

As at 31 March 2016

31 March 31 March 30 Sept

2016 2015 2015

Note GBP'000 GBP'000 GBP'000

Non-Current Assets

Property, plant and

equipment 15 43 28

Investment properties 6 126,710 154,430 133,190

Investment properties

under construction 7 8,957 - 3,156

Investment in joint

ventures 8 6,742 6,114 6,660

Loan to joint venture 3,410 3,110 3,410

Goodwill 3,173 3,173 3,173

149,007 166,870 149,617

--------- --------- ---------

Current Assets

Development and trading

properties 9 32,912 33,358 33,373

Trade and other receivables 3,922 4,198 4,969

Derivatives 8 96 37

Cash and cash equivalents 41,621 45,029 57,386

--------- --------- ---------

78,463 82,681 95,765

--------- --------- ---------

Total Assets 227,470 249,551 245,382

Current Liabilities

Trade and other payables 2,990 4,632 5,370

Bank loans 10 33,857 300 17,768

Tax liabilities 516 2,319 2,254

--------- --------- ---------

37,363 7,251 25,392

--------- --------- ---------

Non-Current Liabilities

Bank loans 10 - 45,811 19,723

Zero dividend preference

shares 11 33,427 31,511 32,471

Deferred tax 1,455 - -

34,882 77,322 52,194

--------- --------- ---------

Total Liabilities 72,245 84,573 77,586

--------- --------- ---------

Net Assets 12 155,225 164,978 167,796

========= ========= =========

Equity

Called up share capital 4,985 4,985 4,985

Share premium account 125,371 125,371 125,371

Capital redemption

reserve 1,568 1,568 1,568

Treasury Shares (32,194) (22,807) (23,321)

Retained earnings 55,475 55,841 59,173

--------- --------- ---------

Equity Attributable

to Equity Holders 155,205 164,958 167,776

Minority interests 20 20 20

Total Equity 155,225 164,978 167,796

========= ========= =========

Net Assets Per Share 201.0p 199.2p 203.3p

The Conygar Investment Company PLC

Consolidated Cash Flow Statement

For the six months ended 31 March 2016

Six months ended Year ended

31 March 31 March 30 Sept

2016 2015 2015

GBP'000 GBP'000 GBP'000

Cash Flows From Operating

Activities

Operating (loss) / profit (260) 6,288 11,907

Depreciation and amortisation 14 18 34

Amortisation of reverse

lease premium 51 87 180

Share of results of joint

ventures 2 2 19

Other gains and losses 17 280 340

Loss / (gain) on sale of

investment properties 126 (157) (2,436)

Movement on revaluation

of investment properties 2,423 (1,217) (2,742)

Cash Flows From Operations

Before Changes In Working

Capital 2,373 5,301 7,302

Change in trade and other

receivables 1,047 (420) (1,191)

Change in land, developments

and trading properties (325) (7,873) (7,102)

Change in trade and other

payables (1,595) (9,333) (9,248)

--------- ----------- -----------

Cash Generated From / (Used

In ) Operations 1,500 (12,325) (10,239)

Finance costs (713) (1,178) (2,020)

Finance income 81 142 207

Tax paid (512) (470) (859)

--------- ----------- -----------

Cash Flows Generated From

/ (Used In) Operating Activities 356 (13,831) (12,911)

--------- ----------- -----------

Cash Flows From Investing

Activities

Acquisition of and additions

to investment properties (7,290) (580) (3,979)

Disposal of trading investments - 160 -

Sale proceeds of investment

properties 5,424 5,760 30,971

Investment in joint ventures (81) (38) (573)

Loans to joint venture - (906) (1,206)

Purchase of plant and equipment (1) - -

Cash Flows (Used In) /

Generated From Investing

Activities (1,948) 4,396 25,213

--------- ----------- -----------

Cash Flows From Financing

Activities

Bank loans repaid (3,885) (8,712) (17,578)

Dividend paid (1,415) (1,450) (1,450)

Purchase of own shares (8,873) (7,423) (7,937)

Issue of shares - 1,296 1,296

Cash Flows Used In Financing

Activities (14,173) (16,289) (25,669)

--------- ----------- -----------

Net decrease in cash and

cash equivalents (15,765) (25,724) (13,367)

Cash and cash equivalents

at 1 October 57,386 70,753 70,753

--------- ----------- -----------

Cash and Cash Equivalents

at 31 March 41,621 45,029 57,386

--------- ----------- -----------

The Conygar Investment Company PLC

Notes to the Interim Results

For the six months ended 31 March 2016

1. Basis of Preparation

The accounting policies used in preparing the condensed

financial information are consistent with those of the annual

financial statements for the year ended 30 September 2015 other

than the mandatory adoption of new standards, revisions and

interpretations that are applicable to accounting periods

commencing on or after 1 October 2015, as detailed in the annual

financial statements.

The condensed financial information for the six month period

ended 31 March 2016 and the six month period ended 31 March 2015

has been reviewed but not audited and does not constitute full

financial statements within the meaning of section 435 of the

Companies Act 2006.

The financial information for the year ended 30 September 2015

does not constitute the Group's statutory accounts for that period

but it is derived from those accounts. Statutory accounts for the

year ended 30 September 2015 have been delivered to the Registrar

of Companies. The auditors have reported on these accounts; their

report was unqualified and did not contain statements under section

498(2) or (3) of the Companies Act 2006.

The board of directors approved the above results on 23 May

2016.

Copies of the interim report may be obtained from the Company

Secretary, The Conygar Investment Company PLC, Fourth Floor, 110

Wigmore Street, London, W1U 3RW.

2. Segmental Information

IFRS 8 requires the identification of the Group's operating

segments which are defined as being discrete components of the

Group's operations whose results are regularly reviewed by the

board of directors. The Group divides its business into the

following segments:

-- Investment properties, which are owned or leased by the Group

for long-term income and for capital appreciation, and trading

properties, which are owned or leased with the intention to sell;

and,

-- Development properties, which include sites, developments in

the course of construction and sites available for sale.

The only item of revenue or profit / loss relating to the

development properties is the part disposal in the period ended 31

March 2015 and therefore only the segmented balance sheet is

reported.

Balance Sheet

31 March 2016 31 March 2015

Investment Development Other Group Investment Development Other Group

Properties Properties Total Properties Properties Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Investment

properties 135,667 - - 135,667 154,430 - - 154,430

Investment

in joint

ventures - 10,152 - 10,152 - 9,224 - 9,224

Goodwill - 3,173 - 3,173 - 3,173 - 3,173

Development

& trading

properties - 32,912 - 32,912 - 33,358 - 33,358

------------ ------------ --------- ---------- ------------ ------------ --------- ----------

135,667 46,237 - 181,904 154,430 45,755 - 200,185

Other

assets 25,055 - 20,511 45,566 36,463 - 12,903 49,366

------------ ------------ --------- ---------- ------------ ------------ --------- ----------

Total

assets 160,722 46,237 20,511 227,470 190,893 45,755 12,903 249,551

Liabilities (38,618) - (33,627) (72,245) (52,509) - (32,064) (84,573)

------------ ------------ --------- ---------- ------------ ------------ --------- ----------

Net assets 122,104 46,237 (13,116) 155,225 138,384 45,755 (19,161) 164,978

============ ============ ========= ========== ============ ============ ========= ==========

3. Finance Income / Costs

Six months ended Year ended

31 March 31 March 30 Sept

2016 2015 2015

GBP'000 GBP'000 GBP'000

Finance income

Bank interest 126 142 226

========= ========= ================

Finance costs

Bank loans (713) (1,159) (2,021)

Loan repayment costs - (19) -

Amortisation of arrangement

fees (251) (264) (508)

ZDP interest (889) (823) (1,716)

Amortisation of ZDP costs (67) (67) (134)

(1,920) (2,332) (4,379)

========= ========= ================

4. 4. Dividend

The final dividend of 1.75 pence per ordinary share

in respect of the year ended 30 September 2015 (year

ended 30 September 2014: 1.75 pence) was approved

at the AGM and paid in February 2016. This final

dividend amounted to GBP1,415,000 (30 September 2014:

GBP1,450,000).

5. Earnings per Share

The calculation of earnings per ordinary share is based on the

loss after tax of GBP2,283,000 (31 March 2015: profit of

GBP3,106,000; 30 September 2015: profit of GBP6,438,000) and on the

number of shares in issue being the weighted average number of

shares in issue during the period of 80,618,599 (net of 22,482,688

shares purchased by the Company and held as treasury shares) (31

March 2015: 84,053,739; 30 September 2015: 83,429,315). The

weighted average number of shares on a fully diluted basis was

80,618,599 (31 March 2015: 84,157,452; 30 September 2015:

83,429,315) and loss after tax of GBP2,283,000 (31 March 2015:

profit of GBP3,106,000; 30 September 2015: profit of GBP6,438,000).

No adjustment has been made for anti-dilutive potential ordinary

shares. The total number of ordinary shares in issue (net of

22,482,688 shares purchased by the Company and held as treasury

shares) at the date of this report was 77,231,435.

6. Investment Properties

Freehold Long-Leasehold Reverse Total

Lease

Premiums

GBP'000 GBP'000 GBP'000 GBP'000

Valuation at 30 September

2015 112,552 20,146 492 133,190

Additions 267 1,270 7 1,544

Reverse lease premium amortisation - - (51) (51)

Disposals (5,550) - - (5,550)

Revaluation movement (2,386) (37) - (2,423)

--------- --------------- ---------- --------

Valuation at 31 March 2016 104,883 21,379 448 126,710

========= =============== ========== ========

The historical cost of properties held at 31 March 2016 is

GBP160,744,000 (31 March 2015: GBP183,496,000; 30 September 2015:

GBP164,890,000).

The properties were valued by Jones Lang LaSalle, independent

valuers not connected with the Group, at 31 March 2016 at market

value in accordance with the Practice Statements contained in the

RICS Appraisal and Valuation Standards published by the Royal

Institution of Chartered Surveyors which conform to international

valuation standards.

As at 31 March 2016 the Group had pledged GBP88,460,000 (31

March 2015: GBP101,170,000; 30 September 2015: GBP95,530,000) of

investment property to secure Royal Bank of Scotland debt

facilities and GBP32,920,000 (31 March 2015: GBP49,020,000; 30

September 2015: GBP32,870,000) to secure Barclays debt facilities.

Further details of these facilities are provided in note 10.

The property rental income earned from investment property, all

of which is leased out under operating leases, amounted to

GBP4,797,000 (March 2015: GBP6,117,000; September 2015:

GBP11,441,000).

7. Investment properties under construction

Investment properties under construction are freehold land and

buildings representing investment properties under development or

construction and they amount to GBP8,957,000 as at 31 March 2016

(31 March 2015: GBPnil; 30 September 2015: GBP3,156,000). These

properties comprise landholdings for current or future development

as investment properties. This methodology has been adopted because

the value of these properties is dependent on a detailed knowledge

of the planning status, the competitive position of the assets and

a range of complex development appraisals. The fair value of these

properties rests in the planned developments, and is difficult to

estimate pending confirmation of designs and planning permission,

and hence has been estimated by the directors at cost as an

approximation to fair value.

8. Investment in Joint Ventures

The group has a 50% interest in a joint venture, Conygar Stena

Line Limited, which is a property development company. It also has

a 50% interest in a joint venture, CM Sheffield Limited, which is a

property trading company, and another 50% interest in a joint

venture, Roadking Holyhead Limited, which is a property development

company and truck-stop operator.

The following amounts represent the group's 50% share of the

assets and liabilities, and results of the joint ventures. They are

included in the balance sheet and income statement:

31 March 2016 31 30 Sept

March 2015 2015

GBP'000 GBP'000 GBP'000

Assets

Current assets 10,222 9,237 10,158

Liabilities

Current liabilities (70) (13) (88)

Net assets 10,152 9,224 10,070

========= ========= ===========

Six months ended Year ended

31 March 31 March 30 Sept

2016 2015 2015

GBP'000 GBP'000 GBP'000

Operating loss (2) (2) (19)

Finance income - - -

--------- --------- -----------

Loss before tax (2) (2) (19)

Tax - - -

--------- --------- -----------

Loss after tax (2) (2) (19)

========= ========= ===========

9. Property Inventories

31 March 31 March 30 Sept

2016 2015 2015

GBP'000 GBP'000 GBP'000

Properties held for resale

or development 32,912 33,358 33,373

========= ========= ========

The above amounts relate to development properties, which

include sites, developments in the course of construction and sites

available for sale.

10. Bank Loans

31 March 2016 31 30 Sept

March 2015 2015

GBP'000 GBP'000 GBP'000

Bank loans 34,266 47,051 38,151

Debt issue costs (409) (940) (660)

--------- -------- --------

33,857 46,111 37,491

========= ======== ========

The interest rate profile of the Group bank borrowings at 31

March 2016 was as follows:

Interest Maturity 31 Mar 31 Mar 30 Sep

Rate 2016 2015 2015

GBP'000 GBP'000 GBP'000

Royal Bank of

Scotland (TAPP)

(1) LIBOR +3% Feb 2018 19,019 24,171 20,174

LIBOR +

Barclays (2) 3.5% Aug 2016 8,335 13,088 8,335

Royal Bank of

Scotland (TOPP) LIBOR +

(3) 3.5% Apr 2016 6,912 9,792 9,642

34,266 47,051 38,151

======== ======== ========

(1) As at 31 March 2016, TAPP Property Limited maintained a

facility with the Royal Bank of Scotland PLC of up to GBP22,191,000

(31 March 2015: GBP37,195,000; 30 September 2015: GBP23,346,000)

under which GBP19,019,000 (31 March 2015: GBP24,171,000; 30

September 2015: GBP20,174,000) had been drawn down. As at 31 March

2016 this facility was repayable on or before 5 February 2018 and

was secured by fixed and floating charges over the assets of the

TAPP Property Limited group and the Lamont companies. The facility

was subject to a maximum loan to value covenant of 60%, an interest

cover ratio covenant of 225% maximum and a debt to rent cover ratio

of 8:1. As set out in the Chairman's and Chief Executive's

statement the loan was repaid in full on 28 April 2016.

(2) As at 31 March 2016, Conygar Dundee Limited, Conygar Hanover

Street Limited, Conygar Stafford Limited and Conygar St Helens

Limited jointly maintained a facility with Barclays Bank PLC of up

to GBP8,335,000 (31 March 2015: GBP13,088,000; 30 September 2015:

GBP8,335,000) of which GBP8,335,000 (31 March 2015: GBP13,088,000;

30 September 2015: GBP8,335,000) had been drawn down. This facility

is repayable on or before 20 August 2016 and is secured by fixed

and floating charges over the assets of Conygar Dundee Limited,

Conygar Hanover Street Limited, Conygar Stafford Limited and

Conygar St Helens Limited. The facility is subject to a maximum

loan to value covenant of 52% and an interest cover ratio covenant

of 225%.

(3) As at 31 March 2016, TOPP Property Limited and TOPP

Bletchley Limited maintained a facility with the Royal Bank of

Scotland PLC of up to GBP6,912,000 (31 March 2015: GBP9,792,000; 30

September 2015: GBP9,642,000) of which GBP6,912,000 (31 March 2015:

GBP9,792,000; 30 September 2015: GBP9,642,000) had been drawn down.

As at 31 March 2016 this facility was repayable on or before 3

April 2016 and was secured by fixed and floating charges over the

assets of the TOPP Property Limited group. The facility was subject

to a maximum loan to value covenant of 55%, interest cover ratio

covenant of 225% and a debt to rent cover ratio covenant of 7:1. As

set out in the Chairman's and Chief Executive's statement the loan

was repaid in full on 28 April 2016.

At 31 March 2016, the group had the following derivative

financial instruments:

An interest rate cap was in place relating to the TAPP Property

Limited loan with the Royal Bank of Scotland. The cap has a

notional amount of GBP37,000,000 (31 March 2015 and 30 September

2015: GBP37,000,000), a strike rate of 2% and a termination date of

5 February 2018.

An interest rate cap was in place relating to the TOPP Property

Limited loan with the Royal Bank of Scotland The cap has a notional

amount of GBP10,175,000 (31 March 2015: GBP10,475,000; 30 September

2015: GBP10,325,000), a strike rate of 0.75% and a termination date

of 3 April 2016.

An interest rate swap and cap were in place relating to the

Barclays Bank PLC facility. The swap has a notional amount of

GBP4,334,606 (31 March 2015: GBP9,087,642; 30 September 2015:

GBP4,334,606) and a fixed rate of 1.055%. The cap has a notional

amount of GBP4,000,000 (31 March 2015 and 30 September 2015:

GBP4,000,000) and a strike rate of 1%. Both the swap and the cap

expire on 20 August 2016.

At 31 March 2016, the fair value of the hedging instruments was

GBP8,050 (31 March 2015: GBP96,000; 30 September 2015: GBP37,000).

The valuation of the hedging instruments was provided by JC

Rathbone Associates and represents the change in fair value since

execution.

11. Zero Dividend Preference Shares

The Group issued 30,000,000 zero dividend preference shares

('ZDP Shares') at 100 pence per share. The ZDP shares have an

entitlement to receive a fixed cash amount on 9 January 2019, being

the maturity date, but do not receive any dividends or income

distributions. Additional capital accrues to the ZDP shares on a

daily basis at a rate equivalent to 5.5% per annum, resulting in a

final capital entitlement of 130.7 pence per share. The ZDP shares

were listed on the London Stock Exchange on 10 January 2014.

During the period, the Group has accrued for GBP889,000 (31

March 2015: GBP823,000; 30 September 2015 GBP1,716,000) of

additional capital. The total amount repayable at maturity is

GBP39,210,000.

The movement on the zero dividend preference share liability

during the period was as follows:

Six months

ended

31 March

2016

GBP'000

Balance at start of period 32,471

Amortisation of share issue costs 67

Accrued capital 889

-----------

Balance at end of period 33,427

===========

12. Net Asset Value per share

Net asset value per share is calculated as the net assets of the

Group divided by the number of shares in issue.

The European Public Real Estate Association ("EPRA") guidelines

provide for a measure of net asset value excluding the effects of

fluctuations in derivative financial instruments, deferred tax and

taking into account the fair value of development properties. EPRA

net asset value per share is calculated as the EPRA net asset value

divided by the number of shares in issue on a fully diluted

basis.

31 March 31 March 30 Sept

2016 2015 2015

GBP'000 GBP'000 GBP'000

Diluted net asset value 159,275 171,759 171,846

Adjustments:

Fair value of hedging instruments (8) (96) (37)

EPRA net asset value 159,267 171,663 171,809

=========== =========== ===========

No. No. No.

Shares in issue 79,256,435 86,356,254 84,556,254

=========== =========== ===========

EPRA net asset value per

share 201.0p 198.9p 203.2p

=========== =========== ===========

The above calculations exclude the fair value of

the Group's development properties. We have not sought

to value these assets as, in our opinion, they are

at too early a stage in their development to provide

a meaningful figure.

13. Related Party Transactions

The Group has made advances to the following joint ventures in

order to provide both long term and additional working capital

funding. All amounts are repayable upon demand and will be repaid

from the trading activities of those subsidiaries. No provisions

have been made against the outstanding amounts.

31 March 31 March 30 Sept

2016 2015 2015

GBP'000 GBP'000 GBP'000

Joint Ventures

Conygar Stena Line Limited 7,554 6,788 7,406

CM Sheffield 2 2 2

Roadking Holyhead Limited 3,410 3,110 3,410

--------- --------- --------

10,966 9,900 10,818

========= ========= ========

The loans to Conygar Stena Line Limited may be analysed as

follows:

31 March 31 March 30 Sept

2016 2015 2015

GBP'000 GBP'000 GBP'000

Secured interest bearing

loan 4,534 3,768 4,386

Unsecured non-interest

bearing shareholder loan 3,020 3,020 3,020

--------- --------- --------

7,554 6,788 7,406

========= ========= ========

Key Management Compensation

Key management personnel have the authority and responsibility

for planning, directing and controlling the activities of the Group

and are considered to be the directors of the Company. Amounts paid

in respect of key management compensation were as follows:

Six months ended Year ended

31 March 31 March 30 Sept

2016 2015 2015

GBP'000 GBP'000 GBP'000

Short term employee benefits 417 (905) 140

417 (905) 140

========= ========= ===========

The credit for the six months ended 31 March 2015 of GBP0.9

million includes GBP1.75 million for the reversal of 20% of the

2014 profit share. If this credit is ignored, amounts paid in

respect of key management compensation for the six months to 31

March 2015 was GBP0.8 million.

Independent Review Report to The Conygar Investment Company

PLC

Introduction

We have been engaged by the company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 31 March 2016 which comprises the consolidated

statement of comprehensive income, the consolidated statement of

changes in equity, the consolidated balance sheet, the consolidated

cash flow statement and the related notes. We have read the other

information contained in the half-yearly financial report and

considered whether it contains any apparent misstatements or

material inconsistencies with the information in the condensed set

of financial statements.

This report is made solely to the company in accordance with the

terms of our engagement to assist the company in meeting the

requirements of the AIM Rules for Companies issued by the London

Stock Exchange. Our review has been undertaken so that we might

state to the Company those matters we are required to state to it

in this report and for no other purpose. To the fullest extent

permitted by law, we do not accept or assume responsibility to

anyone other than the Company for our review work, for this report,

or for the conclusions we have reached.

Directors' Responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

the AIM Rules for Companies issued by the London Stock

Exchange.

As disclosed in note 1, the annual financial statements of the

group are prepared in accordance with IFRS as adopted by the

European Union. The condensed set of financial statements included

in this half-yearly financial report has been prepared in

accordance with International Accounting Standard 34, "Interim

Financial Reporting," as adopted by the European Union.

Our Responsibility

Our responsibility is to express to the Company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

Scope of Review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity" issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK and Ireland) and consequently does not enable us to

obtain assurance that we would become aware of all significant

matters that might be identified in an audit. Accordingly, we do

not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 31

March 2016 is not prepared, in all material aspects, in accordance

with International Accounting Standard 34 as adopted by the

European Union and AIM Rules for Companies issued by the London

Stock Exchange.

Rees Pollock

Chartered Accountants and Registered Auditors

London

23 May 2016

Notes:

(a) The maintenance and integrity of The Conygar Investment

Company PLC website is the responsibility of the directors; the

work carried out by the auditors does not involve consideration of

these matters and, accordingly, the auditors accept no

responsibility for any changes that may have occurred to the

interim report since it was initially presented on the website.

(b) Legislation in the United Kingdom governing the presentation

and dissemination of financial information may differ from

legislation in other jurisdictions.

The directors of Conygar accept responsibility for the

information contained in this announcement. To the best knowledge

and belief of the directors of Conygar (who have taken all

reasonable care to ensure that such is the case), the information

contained in this announcement is in accordance with the facts and

does not omit anything likely to affect the import of such

information.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR KXLFLQEFEBBK

(END) Dow Jones Newswires

May 24, 2016 02:01 ET (06:01 GMT)

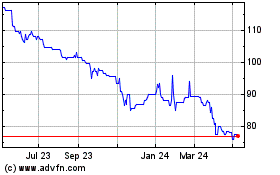

Conygar Investment (LSE:CIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

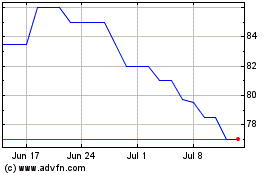

Conygar Investment (LSE:CIC)

Historical Stock Chart

From Apr 2023 to Apr 2024