TIDMCIC

RNS Number : 7120N

Conygar Investment Company PLC(The)

20 May 2015

20 May 2015

The Conygar Investment Company PLC

Interim Results for the six months ended 31 March 2015

Highlights

-- Net asset value per share increased to 199.2p from 197.5p at

30 September 2014. EPRA NAV per share increased 1.5% to 198.8p from

195.9p.

-- Development pipeline is making good progress and we have

commenced the infrastructure and related works at several sites

which is an important step in attracting interest and realising

value.

-- Completed the construction and opening of a 9 acre, 200 space

truck stop facility at Parc Cybi, Anglesey as part of our Road King

Holyhead joint venture with Mr Fred Done, the co-founder of

Betfred.

-- Reacquired land at Haverfordwest, West Wales for GBP3 million

plus an overage provision. This land was previously sold to

Sainsbury's in 2014.

-- Disposed of three investment properties in the period for a

total consideration of GBP5.8 million, a surplus of GBP0.2 million

over book value. Subsequently, we have disposed of Norfolk House,

Birmingham for a total of GBP12.3 million, a surplus of GBP1.0

million, or 8.8%, over the September 2014 valuation. Vacancy rate

reduced to 11.8% from 18.2% at 30 September 2014.

-- Total cash available for acquisitions in excess of GBP45

million. Net debt of GBP33.6 million representing gearing of 20%

against net asset value and 22% on loan to value basis.

-- Bought back 4.1 million shares (4.7% of ordinary share

capital) at an average price of 182 pence per share, enhancing NAV

per share by 0.8p.

Summary Group Net Assets as at 31 March 2015

Per Share

GBP'm p

Investment Properties 154.4 186.4

Development Projects 45.8 55.3

Cash 45.0 54.3

Other net (liabilities) (2.6) (3.1)

------- ----------

242.6 292.9

Zero dividend preference shares (31.5) (38.0)

Bank loans (net of fees) (46.1) (55.7)

Net assets 165.0 199.2

------- ----------

Robert Ware, Chief Executive, commented:

"We continue to grow net asset value per share and our carefully

managed development projects have the potential to deliver further

significant growth over the next few years. However, we maintain

our disciplined approach to risk management and our balance sheet

remains strong. We anticipate increasing our investment and focus

onto the development projects whilst, at the same time, continuing

to realise value from the investment property portfolio. The

outlook is positive and increasingly so, as the economy continues

to improve."

Enquiries:

The Conygar Investment Company PLC

Robert Ware: 020 7258 8670

Peter Batchelor: 020 7258 8670

Liberum Capital (Nominated Adviser)

Richard Bootle: 020 3100 2222

Temple Bar Advisory (Public Relations)

Alex Child-Villiers: 07795 425 580

The Conygar Investment Company PLC

Interim Results

for the six months ended 31 March 2015

Chairman's and Chief Executive's Statement

Progress and Results Summary

We are pleased to present the Group's results for the six months

ended 31 March 2015. The net asset value per share increased to

199.2p from 197.5p at 30 September 2014 (180.8p at 31 March 2014).

On an EPRA basis, net asset value per share increased to 198.8p

from 195.9p at 30 September 2014 (179.2p at 31 March 2014).

The profit before taxation of GBP4.1 million compares with a

profit before taxation of GBP7.5 million in the six months ended 31

March 2014. The valuation of the investment properties increased by

GBP1.2 million on a like for like basis in the six months ended 31

March 2015, compared with a GBP4.8 million uplift for the six

months ended 31 March 2014, and this is the main reason for the

decrease in profit over the period. Net property income for the

period was GBP5.0 million, before financing and overheads, compared

with GBP5.7 million for the same period last year, reflecting asset

sales.

The development pipeline is making good progress and we are

pleased to have commenced the infrastructure and related works at

several sites which is an important step in attracting interest and

realising value.

The Group disposed of three investment properties in the period,

one at Maidenhead and two units at Mochdre Commerce Park, Colwyn

Bay, Wales, for a total consideration of GBP5.8 million, a surplus

of GBP0.2 million over book value. Subsequent to the balance sheet

date, we have disposed of Norfolk House, Birmingham for a total of

GBP12.3 million, a surplus of GBP1.0 million, or 8.8%, over the

September 2014 valuation. This disposal, along with that of

Geoffrey House, Maidenhead, has resulted in the overall portfolio

vacancy rate falling to 11.8% from 18.2% at 30 September 2014.

On the financing side, the Group has used GBP7.4 million surplus

cash to buy back 4.7% of its shares at a discount to net asset

value. Although we continue to increase investment in the

development programme, the balance sheet remains strong and we have

GBP45 million cash available for further investment and development

funding. Our total debt is GBP78.6 million resulting in net gearing

of 20.3%.

On a sadder note, we announce the departure of our Property

Director, Steven Vaughan who is leaving us to pursue other

projects. As one of our founding directors and shareholders, Steven

has been instrumental in getting the Company to where it is today

and we express our gratitude for his immense contribution and wish

him all the very best for the future. We have an established

property team which will continue the good work.

Property Portfolio

As at 31 March 2015, the Group's investment properties were

independently valued at GBP154.4 million compared to GBP158.3

million at 30 September 2014. The fall in the valuation is due to

the disposals in the period and the portfolio held at 31 March 2015

has increased in value by a net GBP1.2 million on a like for like

basis.

The contracted annual rent roll is GBP11.8 million as at 31

March 2015, which is GBP0.4 million lower than at 30 September

2014, mainly owing to the disposals already discussed. We continue

to work hard at letting vacant space, retaining tenants and pushing

down irrecoverable property costs and so the cash yield on the

portfolio remains strong. As mentioned previously, the portfolio

vacancy rate is 11.8% following the disposal of Norfolk House,

Birmingham. We will continue to recycle assets and realise value

where opportunities arise.

We are also making progress with various refurbishment and

redevelopment opportunities at several of our investment

properties. At the Ashby Gateway site at Ashby Park, Ashby de la

Zouch, terms are agreed with a food store operator for a pre-let of

a new store and with a leisure operator for the sale of a site for

a new pub/diner. Planning applications for both are to be submitted

shortly. A planning application for the site infrastructure is with

the Council awaiting determination. At Network House,

Wolverhampton, outline planning permission has been obtained for a

redevelopment of the existing building to provide a three-storey

retail and leisure development. At Mochdre Industrial Park in North

Wales, we have completed the refurbishment of the buildings,

satisfactorily addressed all the outstanding planning issues and

are in detailed discussions for a letting of a substantial part of

the available space. We have also realised GBP1 million from the

sale of two of the smaller units. Finally, we have decided to

undertake a major refurbishment of the 30,000 square foot Brennan

House, Farnborough which will cost approximately GBP2.5

million.

Development Projects

We continue to make good progress on our development projects

since we last reported.

Following Sainsbury's decision not to develop their 60,000

square foot store at Haverfordwest, West Wales, which we had sold

to them for GBP13.75 million in 2014, we have acquired their

interest for GBP3 million plus an overage provision. We will now

develop the 9.6 acre site for a retail/leisure commercial

development. Work is now well underway with the infrastructure and

highways works to service the 729 residential units and the 9.6

acre retail site and this should be completed by December 2015.

Good progress is being made with our partners, Stena Line, at

Fishguard Waterfront on the detailed planning and the marine

consent licences to bring about the development platform, marina

basin, and new port facilities. The various planning applications

should be submitted before the end of the calendar year.

In February 2015, we obtained detailed planning permission for

the construction of a 6 acre, 24 hour lorry stop on part of the

land we own in Fishguard, West Wales. Discussions continue with

both hauliers and the port operator and we will now proceed to

install the infrastructure to bring it forward for development.

In April 2015, we completed the construction of a 9 acre, 200

space truck stop facility at Parc Cybi, Anglesey as part of our

GBP6 million joint venture with Road King, a company controlled by

Mr Fred Done, the co-founder of Betfred. The facility opened for

business on 7 May 2015 and should now act as a catalyst for further

development at this site, aside from being a profitable venture in

its own right.

Infrastructure work will soon begin at Holyhead Waterfront to

bring the site forward for development on the land unaffected by

the Village Green application. We continue to await the outcome of

the Village Green application which was submitted fourteen months

ago and relates to part of our site. We are also awaiting further

news regarding the potential replacement Nuclear Power Station at

Wylfa, a project which would greatly benefit the development of our

site and the island.

At Pembroke Dock Waterfront, having re-engineered the original

design to reduce costs and facilitate a faster construction

process, we are now applying for the necessary statutory marine

licences for the marina construction. We are also finalising the

design to reflect positive retailer interest and we hope to enter

into agreements to lease as soon as possible.

As Conwy County Council's preferred developer at Llandudno

Junction, we have now submitted a planning application for up to

90,000 square feet of A1 retail use on the Council owned site and

are hopeful of a decision before the end of the year.

Our total expenditure to date on development projects amounts to

GBP45.8 million, having spent a further GBP8.8 million since 30

September 2014. We continue to carry the development projects in

our books at cost and they will be revalued, once the projects are

at a sufficiently advanced stage to produce a meaningful valuation.

We continue to seek suitable pre-lets or forward sales prior to

commencing any significant development though we will undertake

infrastructure and other preparatory works where they add to the

value and/or marketability of the respective site.

Financing and Cash Management

At 31 March 2015, the Group had cash of GBP45 million available

to pursue investment opportunities. The Group has bank debt of

GBP47.1 million with total debt of GBP78.6 million, including the

zero dividend preference liability of GBP31.5 million. Total

gearing is 20.3% against net asset value and 21.7% on a loan to

value basis. This is a comfortable level of gearing and combined

with our cash, the Group is able to pursue additional investment

opportunities and to fund our development commitments.

All of the Group debt is hedged or fixed and the weighted

average cost of all debt, including margin is 4.6% with an average

debt maturity of 2.7 years.

During the period, the Group acquired 4,072,350 ordinary shares,

representing 4.7% of its ordinary share capital, at an average

price of 182 pence per share. This cost approximately GBP7.4

million and, as a result of the buy backs, net asset value per

share has been enhanced by 0.8 pence per share.

Summary Group Net Assets

The Group net assets as at 31 March 2015 may be summarised as

follows:

Per Share

GBP'm P

Investment Properties 154.4 186.4

Development Projects 45.8 55.3

Cash 45.0 54.3

Other net (liabilities) (2.6) (3.1)

------- ----------

242.6 292.9

Zero dividend preference shares (31.5) (38.0)

Bank loans (net of fees) (46.1) (55.7)

Net assets 165.0 199.2

------- ----------

Outlook

We continue to grow net asset value per share and our carefully

managed development projects have the potential to deliver further

significant growth over the next few years. However, we maintain

our disciplined approach to risk management and our balance sheet

remains strong. We anticipate increasing our investment and focus

onto the development projects whilst, at the same time, continuing

to realise value from the investment property portfolio.

The outlook is positive and increasingly so, as the economy

continues to improve.

N J Hamway R T E Ware

Chairman Chief Executive

19 May 2015

Financial review

Net Asset Value

The net asset value at the period end was GBP165.0 million (31

March 2014: GBP160.8 million; 30 September 2014: GBP169.4 million).

The primary movements in the period were GBP7.4 million used to buy

back shares, GBP5.0 million net rental income, GBP1.2 million

property revaluation surplus, GBP2.3 million spent on finance costs

and GBP1.5 million of dividends paid. Excluding the amounts

incurred paying dividends and buying back shares, net asset value

increased by 2.6% in the period.

On an EPRA basis, the net asset value is:

31 Mar 30 31

2015 Sept Mar

2014 2014

GBP'm GBP'm GBP'm

Net asset value 165.0 169.4 160.8

Exercisable share

options 6.8 8.1 1.7

Diluted net asset

value 171.8 177.5 162.5

Fair value of hedging

instruments (0.1) (0.4) (0.6)

------- ------- -------

EPRA net asset

value 171.7 177.1 161.9

======= ======= =======

EPRA NAV per share 198.8p 195.9p 179.2p

======= ======= =======

Basic NAV per share 199.2p 197.5p 180.8p

======= ======= =======

Diluted NAV per

share 198.9p 196.3p 179.8p

======= ======= =======

The EPRA net asset value is calculated on a fully diluted basis

and excludes the impact of hedging instruments, as these are held

for long term benefit and not expected to crystallise at the

balance sheet date.

The NNNAV or "triple net asset value" is the net asset value

taking into account asset revaluations, the mark to market costs of

debt and hedging instruments and any associated tax effect. Our

investment properties are carried on our balance sheet at

independent valuation and there is no associated tax liability. Our

development and trading assets are carried at the lower of cost and

net realisable value. We have not sought to value these assets as,

in our opinion, they are still at too early a stage in their

development to provide a meaningful figure, so cost is equated to

fair value for these purposes. On this basis, there is no material

difference between our stated net asset value and NNNAV.

Revaluation

The Group's investment properties were independently valued by

Jones Lang LaSalle at 31 March 2015. In their opinion, the open

market value of the investment property portfolio was GBP154.4

million. The total portfolio decreased in value by GBP3.9 million

during the period due to three disposals, but the underlying

portfolio increased in value on a like for like basis by GBP1.2

million.

Cash Flow

The Group used GBP13.8 million cash from operating activities

(31 March 2014: generated GBP0.6 million; 30 September 2014:

generated GBP12.0 million), of which GBP7.9 million was incurred as

expenditure on development and trading properties.

The Group used GBP8.7 million repaying RBS and Barclays debt and

GBP7.4 million on buying back shares. The Group generated cash

inflows of GBP5.7m from the sales of investment properties and

GBP1.3 million from issue of shares. These movements result in an

overall cash outflow of GBP25.7 million (31 March 2014: GBP32.3

million inflow; 30 September 2014: GBP39.1 million inflow).

Net Income From Property Activities

31 Mar 30 31

2015 Sept Mar

2014 2014

GBP'm GBP'm GBP'm

Rental income 6.1 13.1 7.4

Direct property costs (1.2) (2.9) (1.6)

------- ------- ------

Rental surplus 4.9 10.2 5.8

------- ------- ------

Sale of investment properties 5.8 25.7 9.5

Cost of investment properties

sold (5.6) (24.1) (8.9)

------- ------- ------

Gain on sale of investment

properties 0.2 1.6 0.6

------- ------- ------

Total net income arising

from property activities 5.1 11.8 6.4

======= ======= ======

Administrative Expenses

The administrative expenses for the six month period ended 31

March 2015 were GBP(0.2) million. In the year ended 30 September

2014, 20% of the 2014 profit share had been deferred at the

discretion of the remuneration committee. After due consideration,

the remuneration committee decided that the deferred amount will

not be paid and therefore administrative expenses have been

credited by GBP1.75 million. If this credit is ignored,

administrative expenses amount to GBP1.6 million and the major

items were salary costs (GBP0.9 million) and various costs arising

as a result of the Group being quoted on AIM.

Financing

At 31 March 2015, the Group had cash of GBP45.0 million (31

March 2014: GBP63.9 million; 30 September 2014: GBP70.8 million).

The decrease has resulted mainly from the cash used in buying back

shares, repaying bank debt, administrative costs and investing in

the developments projects.

The bank debt at 31 March 2015 was GBP47.1 million. Taking into

account the ZDP liability, total debt increases to GBP78.6 million.

The net debt is currently 22% by loan to value and 20% against net

asset value.

The interest rate risk on the facility continues to be managed

by way of interest rate swaps and caps, with 100% of debt protected

by hedging. The weighted average cost of all debt, including

margin, is 4.6%. The fair value of these derivative financial

instruments is provided for in full on the balance sheet.

Property Information

Summary of Investment property portfolio

31 March 30 September 31 March

2015 2014 2014

Valuation GBP154,430,000 GBP158,340,000 GBP161,170,000

Number of properties 42 43 43

Contracted rent (pa) GBP11,842,000 GBP12,182,000 GBP13,319,000

Current ERV (pa) GBP14,278,000 GBP14,914,000 GBP15,578,000

Net initial yield 7.25% 6.51% 7.11%

Equivalent yield 8.16% 8.33% 8.66%

Reversionary yield 8.46% 8.74% 9.07%

Vacancy rate 14.3% 18.2% 17.8%

Average unexpired lease 4.3 years 4.4 years 4.1 years

lengths

Summary of Development Projects

31 March 30 September 31 March

2015 2014 2014

GBPm GBPm GBPm

Haverfordwest 24.17 17.21 15.42

Holyhead Waterfront 9.52 9.47 9.65

Pembroke Dock Waterfront 4.65 4.51 4.44

Fishguard Waterfront 1.26 1.02 0.94

King's Lynn 0.85 0.83 0.83

Fishguard Lorry Stop 0.54 0.52 0.52

Parc Cybi, Holyhead 4.34 3.00 0.79

Other 0.43 0.39 0.34

--------- ------------- ---------

Total investment to date 45.76 36.95 32.93

========= ============= =========

The Conygar Investment Company PLC

Consolidated Statement of Comprehensive Income

For the six months ended 31 March 2015

Note Six months ended Year ended

31 March 31 March 30 Sept

2015 2014 2014

GBP'000 GBP'000 GBP'000

Rental income 5,908 7,275 12,838

Other property income 209 20 214

Sale of trading investments 160 56 14,374

--------- --------- -----------

Revenue 6,277 7,351 27,426

--------- --------- -----------

Direct costs of:

Rental income 1,192 1,618 2,921

Sale of trading investments 60 - 2,812

Direct Costs 1,252 1,618 5,733

--------- --------- -----------

Gross Profit 5,025 5,733 21,693

Share of results of

joint ventures (2) (6) 45

Gain on sale of investment

properties 157 568 1,624

Movement on revaluation

of investment properties 6 1,217 4,783 14,044

Other gains and losses (262) 151 (32)

Administrative expenses 153 (1,341) (12,328)

--------- --------- -----------

Operating Profit 6,288 9,888 25,046

Finance costs 3 (2,332) (2,521) (4,793)

Finance income 3 142 88 257

--------- --------- -----------

Profit Before Taxation 4,098 7,455 20,510

Taxation (992) (571) 239

--------- --------- -----------

Profit and Total Comprehensive

Income for the Period 3,106 6,884 20,749

========= ========= ===========

Attributable to:

- equity shareholders 3,106 6,884 20,749

- minority interests - - -

--------- --------- -----------

3,106 6,884 20,749

========= ========= ===========

Basic earnings per share 5 3.70p 7.75p 23.53p

Diluted earnings per

share 5 3.69p 7.72p 23.43p

All of the activities of the Group are classed as

continuing.

The Conygar Investment Company PLC

Consolidated Statement of Changes in Equity

For the six months ended 31 March 2015

Share Share Capital Treasury Retained Total Non-controlling Total

Capital Premium Redemption Shares Earnings Interests Equity

Reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 October

2013 4,925 124,017 1,568 (10,173) 34,768 155,105 20 155,125

Profit

for the

period - - - - 6,884 6,884 - 6,884

--------- --------- ------------ --------- ---------- -------- ---------------- --------

Total

recognised

income

and expense

for the

period - - - - 6,884 6,884 - 6,884

Dividend

paid - - - - (1,332) (1,332) - (1,332)

Issue

of share

capital 7 111 - - - 118 - 118

At 31

March

2014 4,932 124,128 1,568 (10,173) 40,320 160,775 20 160,795

At 1 October

2013 4,925 124,017 1,568 (10,173) 34,768 155,105 20 155,125

Profit

for the

year - - - - 20,749 20,749 - 20,749

--------- --------- ------------ --------- ---------- -------- ---------------- --------

Total

comprehensive

income

for the

year - - - - 20,749 20,749 - 20,749

Dividend

paid - - - - (1,332) (1,332) - (1,332)

Purchase

of own

shares - - - (5,211) - (5,211) - (5,211)

Issue

of share

capital 7 111 - - - 118 - 118

At 30

September

2014 4,932 124,128 1,568 (15,384) 54,185 169,429 20 169,449

========= ========= ============ ========= ========== ======== ================ ========

Changes

in equity

for six

months

ended

31 March

2015

At 1 October

2014 4,932 124,128 1,568 (15,384) 54,185 169,429 20 169,449

Profit

for the

period - - - - 3,106 3,106 - 3,106

--------- --------- ------------ --------- ---------- -------- ---------------- --------

Total

recognised

income

and expense

for the

period - - - - 3,106 3,106 - 3,106

Dividend

paid - - - - (1,450) (1,450) (1,450)

Purchase

of own

shares - - - (7,423) - (7,423) - (7,423)

Issue

of share

capital 53 1,243 - - - 1,296 - 1,296

At 31

March

2015 4,985 125,371 1,568 (22,807) 55,841 164,958 20 164,978

========= ========= ============ ========= ========== ======== ================ ========

The Conygar Investment Company PLC

Consolidated Balance Sheet

As at 31 March 2015

31 March 31 March 30 Sept

2015 2014 2014

Note GBP'000 GBP'000 GBP'000

Non-Current Assets

Property, plant and

equipment 43 73 62

Investment properties 6 154,430 161,170 158,340

Investment in joint

ventures 7 6,114 5,957 6,087

Loan to joint venture 3,110 355 2,204

Goodwill 3,173 3,173 3,173

166,870 170,728 169,866

--------- --------- ---------

Current Assets

Development and trading

properties 8 33,358 23,449 25,485

Trade and other receivables 4,198 4,223 3,778

Derivatives 96 559 377

Cash and cash equivalents 45,029 63,896 70,753

--------- --------- ---------

82,681 92,127 100,393

--------- --------- ---------

Total Assets 249,551 262,855 270,259

Current Liabilities

Trade and other payables 4,632 4,884 13,832

Bank loans 9 300 742 1,035

Tax liabilities 2,319 2,779 1,797

--------- --------- ---------

7,251 8,405 16,664

--------- --------- ---------

Non-Current Liabilities

Bank loans 9 45,811 63,928 53,525

Zero dividend preference

shares 10 31,511 29,727 30,621

77,322 93,655 84,146

--------- --------- ---------

Total Liabilities 84,573 102,060 100,810

--------- --------- ---------

Net Assets 11 164,978 160,795 169,449

========= ========= =========

Equity

Called up share capital 4,985 4,932 4,932

Share premium account 125,371 124,128 124,128

Capital redemption

reserve 1,568 1,568 1,568

Treasury Shares (22,807) (10,173) (15,384)

Retained earnings 55,841 40,320 54,185

--------- --------- ---------

Equity Attributable

to Equity Holders 164,958 160,775 169,429

Minority interests 20 20 20

Total Equity 164,978 160,795 169,449

========= ========= =========

Net Assets Per Share 199.2p 180.8p 197.5p

The Conygar Investment Company PLC

Consolidated Cash Flow Statement

For the six months ended 31 March 2015

Six months ended Year ended

31 March 31 March 30 Sept

2015 2014 2014

GBP'000 GBP'000 GBP'000

Cash Flows From Operating

Activities

Operating profit 6,288 9,888 25,046

Depreciation and amortisation 18 24 47

Amortisation of reverse

lease premium 87 - 188

Share of results of joint

ventures 2 6 (45)

Other gains and losses 280 (14) 45

(Gain) / loss on sale of

investment properties (157) (568) (1,624)

Movement on revaluation

of investment properties (1,217) (4,783) (14,044)

Cash Flows From Operations

Before Changes In Working

Capital 5,301 4,553 9,613

Change in trade and other

receivables (420) (124) 554

Change in land, developments

and trading properties (7,873) (607) (2,405)

Change in trade and other

payables (9,333) (553) 8,242

----------- --------- -----------

Cash (Used In ) / Generated

From Operations (12,325) 3,269 16,004

Finance costs (1,178) (2,169) (3,445)

Finance income 142 88 186

Tax paid (470) (633) (774)

----------- --------- -----------

Cash Flows (Used In) /

Generated From Operating

Activities (13,831) 555 11,971

----------- --------- -----------

Cash Flows From Investing

Activities

Acquisition of and additions

to investment properties (580) (491) (3,524)

Disposal of trading investments 160 - -

Sale proceeds of investment

properties 5,760 9,343 25,429

Investment in joint ventures (38) (92) (1)

Loans to joint venture (906) - (2,204)

Purchase of plant and equipment - (1) (12)

Cash Flows Generated From

Investing Activities 4,396 8,759 19,688

----------- --------- -----------

Cash Flows From Financing

Activities

Bank loan drawdown - 37,195 37,195

Bank loans repaid (8,712) (41,590) (51,944)

Dividend paid (1,450) (1,332) (1,332)

ZDP share issue - 29,332 29,332

Purchase of own shares (7,423) - (5,211)

Issue of shares 1,296 - 118

Re-couponing of interest

rate swaps - - (41)

Purchase of interest rate

cap - (652) (652)

----------- --------- -----------

Cash Flows (Used In) /

Generated From Financing

Activities (16,289) 22,953 7,465

----------- --------- -----------

Net (decrease) / increase

in cash and cash equivalents (25,724) 32,267 39,124

Cash and cash equivalents

at 1 October 70,753 31,629 31,629

----------- --------- -----------

Cash and Cash Equivalents

at 31 March 45,029 63,896 70,753

----------- --------- -----------

The Conygar Investment Company PLC

Notes to the Interim Results

For the six months ended 31 March 2015

1. Basis of Preparation

The accounting policies used in preparing the condensed

financial information are consistent with those of the annual

financial statements for the year ended 30 September 2014 other

than the mandatory adoption of new standards, revisions and

interpretations that are applicable to accounting periods

commencing on or after 1 October 2014, as detailed in the annual

financial statements.

The condensed financial information for the six month period

ended 31 March 2015 and the six month period ended 31 March 2014

has been reviewed but not audited and does not constitute full

financial statements within the meaning of section 435 of the

Companies Act 2006.

The financial information for the year ended 30 September 2014

does not constitute the Group's statutory accounts for that period

but it is derived from those accounts. Statutory accounts for the

year ended 30 September 2014 have been delivered to the Registrar

of Companies. The auditors have reported on these accounts; their

report was unqualified and did not contain statements under section

498(2) or (3) of the Companies Act 2006.

The board of directors approved the above results on 19 May

2015.

Copies of the interim report may be obtained from the Company

Secretary, The Conygar Investment Company PLC, Fourth Floor, 110

Wigmore Street, London, W1U 3RW.

2. Segmental Information

IFRS 8 requires the identification of the Group's operating

segments which are defined as being discrete components of the

Group's operations whose results are regularly reviewed by the

board of directors. The Group divides its business into the

following segments:

-- Investment properties, which are owned or leased by the Group

for long-term income and for capital appreciation, and trading

properties, which are owned or leased with the intention to sell;

and,

-- Development properties, which include sites, developments in

the course of construction and sites available for sale.

The only item of revenue or profit / loss relating to the

development properties is the part disposal in the period and

therefore only the segmented balance sheet is reported.

Balance Sheet

31 March 2015 31 March 2014

Investment Development Other Group Investment Development Other Group

Properties Properties Total Properties Properties Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Investment

properties 154,430 - - 154,430 161,170 - - 161,170

Investment

in joint

ventures - 9,224 - 9,224 - 6,312 - 6,312

Goodwill - 3,173 - 3,173 - 3,173 - 3,173

Development

& trading

properties - 33,358 - 33,358 - 23,449 - 23,449

------------ ------------ --------- ---------- ------------ ------------ --------- ----------

154,430 45,755 - 200,185 161,170 32,934 - 194,104

Other

assets 36,463 - 12,903 49,366 32,527 - 36,224 68,751

------------ ------------ --------- ---------- ------------ ------------ --------- ----------

Total

assets 190,893 45,755 12,903 249,551 193,697 32,934 36,224 262,855

Liabilities (52,509) - (32,064) (84,573) (68,687) - (33,373) (102,060)

------------ ------------ --------- ---------- ------------ ------------ --------- ----------

Net assets 138,384 45,755 (19,161) 164,978 125,010 32,934 2,851 160,795

============ ============ ========= ========== ============ ============ ========= ==========

3. Finance Income / Costs

Six months ended Year ended

31 March 31 March 30 Sept

2015 2014 2014

GBP'000 GBP'000 GBP'000

Finance income

Bank interest 142 88 257

========= ========= ================

Finance costs

Bank loans (1,159) (1,609) (2,687)

Loan repayment costs (19) (12) (54)

Amortisation of arrangement

fees (264) (504) (762)

ZDP interest (823) (366) (1,193)

Amortisation of ZDP costs (67) (30) (97)

(2,332) (2,521) (4,793)

========= ========= ================

4. 4. Dividend

The final dividend of 1.75 pence per ordinary share

in respect of the year ended 30 September 2014 (2013

- 1.5 pence) was approved at the AGM and paid in

February 2015. This final dividend amounted to GBP1,450,000

(2013: GBP1,332,000).

5. Earnings per Share

The calculation of earnings per ordinary share is based on the

profit after tax of GBP3,106,000 (March 2014: GBP6,884,000;

September 2014: GBP20,749,000) and on the number of shares in issue

being the weighted average number of shares in issue during the

period of 84,053,739 (net of 16,882,869 shares purchased by the

Company and held as treasury shares) (March 2014: 88,844,875;

September 2014: 88,174,984). The weighted average number of shares

on a fully diluted basis was 84,157,452 (March 2014: 89,187,326;

September 2014: 88,563,656) and profit after tax of GBP3,106,000

(March 2014: GBP6,884,000; September 2014 profit: GBP20,749,000).

No adjustment has been made for anti-dilutive potential ordinary

shares. The total number of ordinary shares in issue (net of

16,882,869 shares purchased by the Company and held as treasury

shares) at the date of this report was 82,831,254.

6. Investment Properties

Freehold Long-Leasehold Reverse Total

Lease

Premiums

GBP'000 GBP'000 GBP'000 GBP'000

Valuation at 30 September

2014 136,672 20,996 672 158,340

Additions 573 - 7 580

Reverse lease premium amortisation - - (87) (87)

Disposals (5,620) - - (5,620)

Revaluation movement 1,312 (95) - 1,217

--------- --------------- ---------- --------

Valuation at 31 March 2015 132,937 20,901 592 154,430

========= =============== ========== ========

The historical cost of properties held at 31 March 2015 is

GBP183,496,000 (March 2014: GBP208,593,000; September 2014:

GBP192,162,000).

The properties were valued by Jones Lang LaSalle, independent

valuers not connected with the Group, at 31 March 2015 at market

value in accordance with the Practice Statements contained in the

RICS Appraisal and Valuation Standards published by the Royal

Institution of Chartered Surveyors which conform to international

valuation standards.

The Group has pledged GBP101,170,000 (March 2014:

GBP117,665,000; September 2014: GBP106,500,000) of investment

property to secure Royal Bank of Scotland debt facilities and

GBP49,020,000 (March 2014: GBP43,505,000; September 2014:

GBP47,090,000) to secure Barclays debt facilities. Further details

of these facilities are provided in note 9.

The property rental income earned from investment property, all

of which is leased out under operating leases, amounted to

GBP6,117,000 (March 2014: GBP7,295,000; September 2014:

GBP13,052,000).

7. Investment in Joint Ventures

The group has a 50% interest in a joint venture, Conygar Stena

Line Limited, which is a property development company. It also has

a 50% interest in a joint venture, CM Sheffield Limited, which is a

property trading company, and another 50% interest in a joint

venture, Roadking Holyhead Limited, which is a property development

company and truck-stop operator.

The following amounts represent the group's 50% share of the

assets and liabilities, and results of the joint ventures. They are

included in the balance sheet and income statement:

31 March 2015 31 30 Sept

March 2014 2014

GBP'000 GBP'000 GBP'000

Assets

Current assets 9,237 6,327 8,322

--------- --------- -----------

9,237 6,327 8,322

--------- --------- -----------

Liabilities

Current liabilities (13) (15) (31)

--------- --------- -----------

(13) (15) (31)

--------- --------- -----------

Net assets 9,224 6,312 8,291

========= ========= ===========

Six months ended Year ended

31 March 31 March 30 Sept

2015 2014 2014

GBP'000 GBP'000 GBP'000

Operating (loss) / profit (2) (6) 45

Finance income - - -

--------- --------- -----------

(Loss) / profit before

tax (2) (6) 45

Tax - - -

--------- --------- -----------

(Loss) / profit after tax (2) (6) 45

========= ========= ===========

8. Property Inventories

31 March 31 March 30 Sept

2015 2014 2014

GBP'000 GBP'000 GBP'000

Properties held for resale

or development 33,358 23,449 25,485

========= ========= ========

The above amounts relate to development properties, which

include sites, developments in the course of construction and sites

available for sale.

9. Bank Loans

31 March 2015 31 30 Sept

March 2014 2014

GBP'000 GBP'000 GBP'000

Bank loans 47,051 66,117 55,764

Debt issue costs (940) (1,447) (1,204)

--------- -------- --------

46,111 64,670 54,560

========= ======== ========

The interest rate profile of the Group bank borrowings at 31

March 2015 was as follows:

Interest Maturity 31 Mar 31 Mar 30 Sep

Rate 2015 2014 2014

GBP'000 GBP'000 GBP'000

Royal Bank of

Scotland (TAPP) LIBOR 2 - 5

(1) +3% years 24,171 37,195 27,367

LIBOR

Barclays (2) + 3.5% 1-4 years 13,088 18,830 18,455

Royal Bank of

Scotland (TOPP) LIBOR

(3) + 3.5% 1-4 years 9,792 10,092 9,942

47,051 66,117 55,764

======== ======== ========

(1) As at 31 March 2015, TAPP Property Limited maintained a

facility with the Royal Bank of Scotland PLC of up to GBP37,195,000

(March and September 2014: GBP37,195,000) under which GBP24,171,000

(March 2014: GBP37,195,000 September 2014: GBP27,367,000) had been

drawn down. This facility is repayable on or before 5 February 2018

and is secured by fixed and floating charges over the assets of the

TAPP Property Limited group and the Lamont companies. The facility

is subject to a maximum loan to value covenant of 60%, an interest

cover ratio covenant of 225% maximum and a debt to rent cover ratio

of 8:1.

(2) As at 31 March 2015, Conygar Dundee Limited, Conygar Hanover

Street Limited, Conygar Stafford Limited and Conygar St Helens

Limited jointly maintained a facility with Barclays Bank PLC of up

to GBP13,088,000 (March 2014: GBP18,830,000; September 2014:

GBP18,455,000) of which GBP13,088,000 (March 2014: GBP18,830,000;

September 2014: GBP18,455,000) had been drawn down. This facility

is repayable on or before 20 August 2016 and is secured by fixed

and floating charges over the assets of Conygar Dundee

Limited, Conygar Hanover Street Limited, Conygar Stafford

Limited and Conygar St Helens Limited. The facility is subject to a

maximum loan to value covenant of 55% and an interest cover ratio

covenant of 225%.

(3) As at 31 March 2015, TOPP Property Limited and TOPP

Bletchley Limited maintained a facility with the Royal Bank of

Scotland PLC of up to GBP9,792,000 (March 2014: GBP10,092,000;

September 2014: GBP9,942,000) of which GBP9,792,000 (March 2014:

GBP10,092,000; September 2014: GBP9,942,000) had been drawn down.

This facility is repayable on or before 3 April 2016 and is secured

by fixed and floating charges over the assets of the TOPP Property

Limited group. The facility is subject to a maximum loan to value

covenant of 55%, interest cover ratio covenant of 225% and a debt

to rent cover ratio covenant of 7:1. The facility is subject to

quarterly repayments of GBP75,000.

Three swaps relating to the TAPP Property Limited facility with

the Royal Bank of Scotland PLC with notional amounts of

GBP12,693,000 (March and September 2014: GBP12,693,000),

GBP9,009,622 (March and September 2014: GBP9,009,622) and

GBP15,297,344 (March 2014: GBP15,297,000; September 2014:

GBP14,500,000), the former two both with fixed rates of 1.329%

(March and September 2014: 1.329%) and the latter swap 0.9925%

(March and September 2013: 0.9925%) expired on 17 February 2015. An

interest rate cap was purchased in February 2014 to hedge the loan

from the date of the expiry of the three swaps referred to above

and has a notional amount of GBP37,000,000 (March 2014: GBPnil

September 2014: GBP37,000,000), a strike rate of 2% and a

termination date of 5 February 2018.

An amortising cap was in place relating to the TOPP Property

Limited and TOPP Bletchley Limited facility with the Royal Bank of

Scotland PLC. As at 31 March 2014, the cap had a notional amount of

GBP10,475,000 (31 March 2014: GBP10,775,000; 30 September 2014:

GBP10,600,000) with a strike rate of 0.75% (31 March 2014: 0.75%;

30 September 2014: 0.75%) which expires on 3 April 2016.

A swap and cap were in place relating to the Barclays Bank PLC

facility. The swap has a notional amount of GBP9,087,642 (March

2014: GBP18,430,000; September 2014: GBP14,455,000) with a fixed

rate of 1.055% (March and September 2014: 1.055%). The cap has a

notional amount of GBP4,000,000 (March and September 2014:

GBP4,000,000) with a strike rate of 1%. Both the swap and the cap

expire on 20 August 2016.

At 31 March 2015, the fair value of the hedging instruments was

valued at GBP96,000 (March 2014: GBP559,000; September 2014:

GBP377,000). The valuation of the swaps was provided by JC Rathbone

Associates and represents the change in fair value since

execution.

10. Zero Dividend Preference Shares

The Group issued 30,000,000 zero dividend preference shares

('ZDP Shares') at 100 pence per share and they were listed on the

London Stock Exchange on 10 January 2014. The ZDP shares have an

entitlement to receive a fixed cash amount on 9 January 2019, being

the maturity date, but do not receive any dividends or income

distributions. Additional capital accrues to the ZDP shares on a

daily basis at a rate equivalent to 5.5% per annum, resulting in a

final capital entitlement of 130.7 pence per share.

During the period, the Group has accrued for GBP823,000 (March

2014: GBP366,000; September 2014 GBP1,193,000) of additional

capital. The total amount repayable at maturity is

GBP39,210,000.

The movement on the zero dividend preference share liability

during the period was as follows:

31 March

2015

GBP'000

Balance at 1 October 2014 30,621

Amortisation of share issue costs 67

Accrued capital 823

---------

Balance at 31 March 2015 31,511

=========

11. Net Asset Value per share

Net asset value per share is calculated as the net assets of the

Group divided by the number of shares in issue.

The European Public Real Estate Association ("EPRA") guidelines

provide for a measure of net asset value excluding the effects of

fluctuations in derivative financial instruments, deferred tax and

taking into account the fair value of development properties. EPRA

net asset value per share is calculated as the EPRA net asset value

divided by the number of shares in issue on a fully diluted

basis.

31 March 31 March 30 Sept

2015 2014 2014

GBP'000 GBP'000 GBP'000

Diluted net asset value 171,759 162,454 177,500

Adjustments:

Fair value of hedging instruments (96) (559) (377)

EPRA net asset value 171,663 161,895 177,123

=========== =========== ===========

No. No. No.

Shares in issue 86,356,254 90,351,304 90,428,604

=========== =========== ===========

EPRA net asset value per

share 198.9p 179.2p 195.9p

=========== =========== ===========

The above calculations exclude the fair value of

the Group's development properties. We have not sought

to value these assets as, in our opinion, they are

at too early a stage in their development to provide

a meaningful figure.

12. Related Party Transactions

The Group has made advances to the following joint ventures in

order to provide both long term and additional working capital

funding. All amounts are repayable upon demand and will be repaid

from the trading activities of those subsidiaries. No provisions

have been made against the outstanding amounts.

31 March 31 March 30 Sept

2015 2014 2014

GBP'000 GBP'000 GBP'000

Joint Ventures

Conygar Stena Line Limited 6,788 6,532 6,709

CM Sheffield 2 2 2

Roadking Holyhead Limited 3,110 355 2,204

--------- --------- --------

9,900 6,889 8,915

========= ========= ========

The loans to Conygar Stena Line Limited may be analysed as

follows:

31 March 31 March 30 Sept

2015 2014 2014

GBP'000 GBP'000 GBP'000

Secured interest bearing

loan 3,768 3,512 3,689

Unsecured non-interest

bearing shareholder loan 3,020 3,020 3,020

--------- --------- --------

6,788 6,532 6,709

========= ========= ========

Key Management Compensation

Key management personnel have the authority and responsibility

for planning, directing and controlling the activities of the Group

and are considered to be the directors of the Company. Amounts paid

in respect of key management compensation were as follows:

Six months ended Year ended

31 March 31 March 30 Sept

2015 2014 2014

GBP'000 GBP'000 GBP'000

Short term employee benefits (905) 525 8,792

(905) 525 8,792

========= ========= ===========

Independent Review Report to The Conygar Investment Company

PLC

Introduction

We have been engaged by the company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 31 March 2015 which comprises the consolidated

statement of comprehensive income, the consolidated statement of

changes in equity, the consolidated balance sheet, the consolidated

cash flow statement and the related notes. We have read the other

information contained in the half-yearly financial report and

considered whether it contains any apparent misstatements or

material inconsistencies with the information in the condensed set

of financial statements.

This report is made solely to the company in accordance with the

terms of our engagement to assist the company in meeting the

requirements of the AIM Rules for Companies issued by the London

Stock Exchange. Our review has been undertaken so that we might

state to the Company those matters we are required to state to it

in this report and for no other purpose. To the fullest extent

permitted by law, we do not accept or assume responsibility to

anyone other than the Company for our review work, for this report,

or for the conclusions we have reached.

Directors' Responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

the AIM Rules for Companies issued by the London Stock

Exchange.

As disclosed in note 1, the annual financial statements of the

group are prepared in accordance with IFRS as adopted by the

European Union. The condensed set of financial statements included

in this half-yearly financial report has been prepared in

accordance with International Accounting Standard 34, "Interim

Financial Reporting," as adopted by the European Union.

Our Responsibility

Our responsibility is to express to the Company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

Scope of Review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity" issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK and Ireland) and consequently does not enable us to

obtain assurance that we would become aware of all significant

matters that might be identified in an audit. Accordingly, we do

not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 31

March 2015 is not prepared, in all material aspects, in accordance

with International Accounting Standard 34 as adopted by the

European Union and AIM Rules for Companies issued by the London

Stock Exchange.

Rees Pollock

Chartered Accountants and Registered Auditors

London

19 May 2015

Notes:

(a) The maintenance and integrity of The Conygar Investment

Company PLC website is the responsibility of the directors; the

work carried out by the auditors does not involve consideration of

these matters and, accordingly, the auditors accept no

responsibility for any changes that may have occurred to the

interim report since it was initially presented on the website.

(b) Legislation in the United Kingdom governing the presentation

and dissemination of financial information may differ from

legislation in other jurisdictions.

The directors of Conygar accept responsibility for the

information contained in this announcement. To the best knowledge

and belief of the directors of Conygar (who have taken all

reasonable care to ensure that such is the case) the information

contained in this announcement is in accordance with the facts and

does not omit anything likely to affect the import of such

information.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR KKLFFEEFBBBK

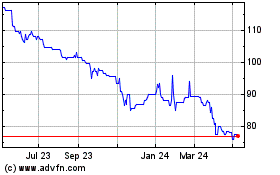

Conygar Investment (LSE:CIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

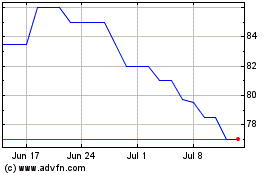

Conygar Investment (LSE:CIC)

Historical Stock Chart

From Apr 2023 to Apr 2024