Fiscal 2014 Third-quarter Highlights (% cited vs. year-ago

period amounts, where applicable):

- Diluted EPS from continuing

operations of $0.58 as reported vs. $0.28 a year ago. Comparable

EPS of $0.62 increased 13%.

- Consumer Foods sales declined in

line with expectations, and comparable operating profit was flat.

Challenges for a few key brands are weighing on overall segment

sales results. Strong productivity, lower marketing expense, and

other cost reductions benefited segment profits.

- Commercial Foods posted a slight

decline in sales and a decrease in operating profit, as expected.

The decrease in profit was due to previously discussed customer

transition and crop quality issues in the Lamb Weston potato

products business.

- Private Brands sales and comparable

operating profit increased substantially, although below original

expectations, as prior year results included only 27 days of

contribution from Ralcorp given the date of that

acquisition.

- The company continues to expect

full-year diluted EPS to be in the range of $2.22 - $2.25, adjusted

for items impacting comparability.

- Debt reduction and other capital

allocation goals are unchanged.

- The Ardent Mills transaction remains

on track for completion in the second quarter of calendar

2014.

ConAgra Foods, Inc., (NYSE: CAG) one of North America’s leading

food companies, today reported results for the fiscal 2014 third

quarter ended Feb. 23, 2014. Diluted EPS from continuing operations

was $0.58 as reported for the fiscal third quarter vs. $0.28 in the

year-ago period. After adjusting for items impacting comparability,

current-quarter diluted EPS of $0.62 was 13% above the comparable

$0.55 earned in the year-ago period. Items impacting comparability

are summarized toward the end of this release and reconciled for

Regulation G purposes on page 11.

Gary Rodkin, ConAgra Foods’ chief executive officer, said, “We

are on track with our EPS projections for the second half of this

fiscal year. As we have previously discussed, there are operating

challenges that have impacted segment performance and overall EPS

growth, but we are encouraged by some pockets of strength. This

quarter we posted good sales and market share performances for some

of our consumer brands, good international growth for our potato

operations, and continued improvement in the operations and

organization for our private brands. The synergies expected from

the former Ralcorp businesses are coming in slightly ahead of

plans, and we continue to make good progress on SG&A efficiency

initiatives. We reaffirm our full year fiscal 2014 EPS guidance,

and remain confident in our long-term strategy and outlook.”

Consumer Foods SegmentBranded food items

sold worldwide in retail channels.

The Consumer Foods segment posted sales of approximately $1.9

billion and operating profit of $266 million, as reported. Sales

declined, as expected, reflecting a 3% volume decrease and flat

price/mix. The impact of foreign exchange negatively impacted

segment sales by 1%.

- As previously discussed, some of the

volume decline in the fiscal third quarter reflects business that

occurred earlier than planned in the fiscal second quarter as part

of holiday promotions and changes in customer inventory levels,

thus a shift in timing.

- Brands posting sales growth for the

quarter include Bertolli, Hebrew National, Reddi-wip, Ro*Tel, Slim

Jim, Swiss Miss, Wolf and others. More brand details are in the

Q&A document accompanying this release.

- As previously discussed, Healthy

Choice, Orville Redenbacher’s and Chef Boyardee (which collectively

have annual sales in excess of $1 billion) continue to face

challenges and are posting substantial volume declines. The company

has important product changes, in-store initiatives, and

refinements to consumer communication under way, which are expected

to gradually improve the volume and profit performance of these

brands throughout fiscal 2015.

Operating profit of $266 million was 1% above year-ago amounts

as reported. After adjusting for $4 million of net expense in the

current quarter and $5 million of net expense in the year-ago

period from items impacting comparability, current quarter

operating profit of $270 million was in line with comparable

year-ago amounts. While top-line challenges weighed on

profitability, several factors favorably contributed to the

quarter’s profit performance, including manageable inflation,

supply chain productivity initiatives, lower incentive

compensation, and a strong focus on other selling, general, and

administrative (SG&A) related efficiencies. Advertising and

consumer promotion costs declined $15 million year-over-year,

reflecting a focus on efficiency.

Commercial Foods SegmentSpecialty

potato, seasonings, blends, flavors, milled grain, as well as

consumer branded and private branded packaged food items and bakery

products, sold to foodservice and commercial channels

worldwide.

Sales for the Commercial Foods segment were $1.5 billion, down

slightly compared with $1.5 billion a year-ago (rounded) as

reported. Current-quarter sales include some benefit from

acquisitions, specifically legacy Ralcorp foodservice results,

which had only 27 days of contribution in year-ago amounts because

of the date of the acquisition. Segment operating profit was $163

million, 12% below year-ago amounts as reported. After adjusting

for $17 million of net expense in the current quarter and $10

million of net expense in year-ago amounts from items impacting

comparability, comparable current-quarter operating profit of $180

million declined 8% versus $196 million a year ago.

Lamb Weston potato products’ profits were below year-ago

amounts, as expected, given that a major foodservice customer did

not renew a sizeable amount of potato business toward the end of

last fiscal year. Lamb Weston continues to expand business with

other customers; margins are lower-than-planned because of the

customer mix shift as well as weaker-than-planned potato crop

quality. Lamb Weston is achieving good growth internationally

despite the fact that some customers are facing short-term

challenges in certain Asian markets. Flour milling sales decreased,

reflecting the pass-through of lower wheat costs as well as lower

volumes, while milling profits increased over year-ago amounts due

to favorable mix and efficiencies. Overall segment profits also

reflect lower incentive compensation expense.

Private BrandsPrivate brand food items

sold in domestic markets.

Sales for the Private Brands segment were $1.1 billion in the

quarter, up more than $600 million over year-ago amounts. This

increase reflects the acquisition of the Ralcorp businesses; sales

from most of the former Ralcorp businesses are reported within this

segment. Year-ago amounts include only 27 days of contribution from

Ralcorp because of the date of the acquisition. Operating profit

for this segment was $45 million as reported and $66 million

adjusted for items impacting comparability; the increase over

prior-year amounts reflects the acquisition.

As previously discussed, profitability for the Private Brands

segment is below plan this fiscal year in part due to sales force

and supply chain transition issues, as well as pricing actions

implemented in response to competitive pressure. As part of

improving connections with customers as the company works through

those issues, and to remain competitive in the marketplace, the

company has made deliberate pricing concessions to protect volumes;

these concessions have negatively impacted margins. The margin

pressures are expected to continue throughout the remainder of the

fiscal year and have been reflected in the current EPS guidance.

The company has made organizational, pricing, and customer service

improvements that are expected to gradually improve performance

over time.

Hedging Activities – This language primarily relates to

operations other than the company’s milling operations or

significant financing activities.

Hedge gains and losses are aggregated, and net amounts are

reclassified from unallocated Corporate expense to the operating

segments when the underlying commodity or foreign currency being

hedged is expensed in segment cost of goods sold. The net of these

activities resulted in $52 million of favorable impact in the

current quarter and $27 million of unfavorable impact in the

year-ago period. The company identifies these amounts as items

impacting comparability.

Other Items

- Unallocated Corporate amounts were $50

million of expense in the current quarter and $199 million of

expense in the year-ago period, as reported.

- Current-quarter amounts include:

- $52 million of favorable hedge-related

impact.

- $55 million of unfavorable impact

related to settling interest rate derivatives and recognizing the

loss in the current quarter. This is connected to the company’s

decision to forego refinancing debt that matures in the fiscal

fourth quarter.

- $13 million of integration and

restructuring costs.

- Prior-year period amounts include:

- $27 million of unfavorable

hedge-related impact, and

- $85 million of other expenses from

items impacting comparability.

- Excluding these amounts, unallocated

Corporate expense was $34 million for the current quarter and $87

million in the year-ago period. The comparable decline largely

reflects lower incentive and pension costs.

- Equity method investment earnings were

$11 million for the current quarter and $12 million in the year-ago

period.

- Net interest expense was $95 million in

the current quarter and $71 million in the year-ago period; the

increase reflects the incremental interest related to the debt

incurred to fund acquisitions, principally Ralcorp.

Capital Items

- Dividends for the current quarter

totaled $105 million versus $101 million in the year-ago period,

reflecting an increase in shares outstanding.

- The company did not repurchase any

shares of common stock during the quarter.

- For the current quarter, capital

expenditures for property, plant and equipment were $139 million,

compared with $107 million in the year-ago period. Depreciation and

amortization expense was approximately $156 million for the fiscal

third quarter; this compares with a total of $113 million in the

year-ago period.

- The company is currently preparing for

the formation of Ardent Mills, a joint venture into which the

company expects to contribute its milling operations. As discussed

in the company’s 8-K filed on Feb. 10, 2014, that transaction is

expected to close in the second quarter of calendar 2014, subject

to reaching agreement with the U.S. Department of Justice,

financing and other customary closing conditions. The company will

offer more details on the specifics of the venture in connection

with the close of the transaction.

- The company is preparing to divest a

small operation within the Private Brands segment; historical

amounts have been adjusted slightly to reflect the reclassification

of this business as discontinued operations.

Outlook

The company continues to expect fiscal 2014 diluted EPS,

adjusted for items impacting comparability, to be in the range of

$2.22-$2.25. The company continues to expect operating cash flow of

approximately $1.4 billion in fiscal 2014, and to repay

approximately $550 million of debt before the end of the fiscal

year. After repaying approximately $550 million of debt in fiscal

2014, this will amount to slightly more than $950 million of

cumulative net debt repayment since the acquisition of Ralcorp.

Consistent with past practice, the company will communicate

details on expectations for fiscal 2015 EPS performance with the

fiscal 2014 year-end release; as previously disclosed, the company

expects comparable EPS growth in fiscal 2015 at a rate lower than

the original double-digit target.

The company’s long-term EPS growth rates, and multi-year synergy

goals related to the Ralcorp acquisition, are unchanged from prior

estimates. The company expects at least 10% annual comparable EPS

growth in the fiscal 2016-2017 period, largely due to the benefit

of Ralcorp-related synergies; the company continues to expect the

Ralcorp transaction to generate $300 million of annual pretax

cost-related synergies by the end of fiscal 2017.

Major Items Impacting Third-quarter Fiscal 2014 EPS

Comparability

Included in the $0.58 diluted EPS from continuing operations for

the third quarter of fiscal 2014 (EPS amounts rounded and after

tax):

- Approximately $0.08 per diluted share

of net benefit, or $52 million pretax, related to the

mark-to-market impact of derivatives used to hedge input costs,

temporarily classified in unallocated Corporate expense. Hedge

gains and losses are aggregated, and net amounts are reclassified

from unallocated Corporate expense to the operating segments when

the underlying commodity or foreign currency being hedged is

expensed in segment cost of goods sold.

- Approximately $0.08 per diluted share

of net expense, or $55 million pretax, related to the settlement of

interest rate derivative hedges that were initiated in prior years

in anticipation of refinancing debt that matures in the fourth

quarter of fiscal 2014. Based on an assessment of the company’s

debt repayment alternatives, the company has decided to forego

refinancing that debt, and has therefore recognized the derivative

loss in earnings immediately.

- Approximately $0.06 per diluted share

of net expense, or $38 million pretax, resulting from restructuring

and integration (including acquisition-related restructuring). $21

million of this is classified within the results of the Private

Brands segment (mostly SG&A), $13 million is classified as

unallocated Corporate expense (SG&A), and $4 million is

classified within the Consumer Foods segment (mostly

SG&A).

- Approximately $0.04 per diluted share

of net benefit due to resolving U.S. and foreign tax matters

related to transactions occurring in prior years.

- Approximately $0.02 per diluted share

of net expense, or $17 million pretax, resulting from impairment of

assets in the Commercial Foods segment (SG&A).

Included in the $0.28 diluted EPS from continuing operations for

the third quarter of fiscal 2013 (EPS amounts rounded and after

tax):

- Approximately $0.16 per diluted share

of net expense, or $103 million pretax, resulting from acquisition,

acquisition-related restructuring, integration, and transaction

costs. $81 million is within unallocated Corporate expense (all of

which is in SG&A), $17 million is within the Private Brands

results (all cost of goods sold, “COGS”) and $5 million is within

Consumer Foods ($2 million in COGS, $3 million in SG&A).

- Approximately $0.04 per diluted share

of net expense, or $27 million pretax, related to the

mark-to-market impact of derivatives used to hedge input costs,

temporarily classified in unallocated Corporate expense. Hedge

gains and losses are aggregated, and net amounts are reclassified

from unallocated Corporate expense to the operating segments when

the underlying commodity or foreign currency being hedged is

expensed in segment cost of goods sold.

- Approximately $0.03 per diluted share

of net expense related to unusual tax matters resulting from

acquisition costs.

- Approximately $0.02 per diluted share

of net expense, or $10 million pretax, related to impairment

charges for assets within the Commercial Foods segment.

- Approximately $0.01 per diluted share

of net expense, or $5 million pretax, related to historical legal

and environmental matters, classified within unallocated Corporate

expense.

- Note: There is an impact of

approximately $0.01 per diluted share impact from rounding, as well

as results from businesses that have been subsequently reclassified

as discontinued operations. Due to the anticipated sale of a small

business within the Private Brands segment, and the divestiture of

another small operation completed earlier in fiscal 2014, small

amounts historically included in diluted EPS from continuing

operations, adjusted for items impacting comparability, and thus

part of the original basis for comparison, have been reclassified

as discontinued operations.

Discussion of Results

ConAgra Foods will host a conference call at 9:30 a.m. EDT today

to discuss the results. Following the company’s remarks, the call

will include a question-and-answer session with the investment

community. Domestic and international participants may access the

conference call toll-free by dialing 1-800-500-3170 and

1-719-457-2602, respectively. No confirmation or pass code is

needed. This conference call also can be accessed live on the

Internet at http://investor.conagrafoods.com.

A rebroadcast of the conference call will be available after 1

p.m. EDT today. To access the digital replay, a pass code number

will be required. Domestic participants should dial 1-888-203-1112,

and international participants should dial 1-719-457-0820 and enter

pass code 9669257. A rebroadcast also will be available on the

company’s website.

In addition, the company has posted a question-and-answer

supplement relating to this release at

http://investor.conagrafoods.com. To view recent company news,

please visit http://media.conagrafoods.com.

ConAgra Foods, Inc., (NYSE: CAG) is one of North America's

largest packaged food companies with branded and private branded

food found in 99 percent of America’s households, as well as a

strong commercial foods business serving restaurants and

foodservice operations globally. Consumers can find recognized

brands such as Banquet®, Chef Boyardee®, Egg Beaters®, Healthy

Choice®, Hebrew National®, Hunt's®, Marie Callender's®, Orville

Redenbacher's®, PAM®, Peter Pan®, Reddi-wip®, Slim Jim®, Snack

Pack® and many other ConAgra Foods brands, along with food sold by

ConAgra Foods under private brand labels, in grocery, convenience,

mass merchandise, club and drug stores. Additionally, ConAgra Foods

supplies frozen potato and sweet potato products as well as other

vegetable, spice, bakery and grain products to commercial and

foodservice customers. ConAgra Foods operates ReadySetEat.com, an

interactive recipe website that provides consumers with easy dinner

recipes and more. For more information, please visit us at

www.conagrafoods.com.

Note on Forward-looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These forward-looking statements are based on management’s

current expectations and assumptions and are subject to certain

risks, uncertainties and changes in circumstances that could cause

actual results to differ materially from potential results

discussed in the forward-looking statements. These risks and

uncertainties include, among other things: ConAgra Foods’ ability

to realize the synergies and benefits contemplated by the

acquisition of Ralcorp Holdings, Inc. (“Ralcorp”) and its ability

to promptly and effectively integrate the business of Ralcorp; the

timing to consummate the potential joint venture combining the

flour milling businesses of ConAgra Foods, Cargill, Incorporated,

and CHS Inc.; ConAgra Foods’ ability to realize the synergies and

benefits contemplated by the potential joint venture; the

availability and prices of raw materials, including any negative

effects caused by inflation or adverse weather conditions; the

effectiveness of ConAgra Foods’ product pricing, including product

innovation, any pricing actions and changes in promotional

strategies; the ultimate outcome of litigation, including the lead

paint matter; future economic circumstances; industry conditions;

ConAgra Foods’ ability to execute its operating and restructuring

plans; the success of ConAgra Foods’ cost-savings initiatives, and

innovation and marketing investments; the competitive environment;

operating efficiencies; the ultimate impact of any ConAgra Foods

product recalls; access to capital; actions of governments and

regulatory factors affecting ConAgra Foods’ businesses, including

the Patient Protection and Affordable Care Act; the amount and

timing of repurchases of ConAgra Foods’ common stock and debt, if

any; and other risks described in ConAgra Foods’ reports filed with

the Securities and Exchange Commission, including its most recent

annual report on Form 10-K and subsequent reports on Forms 10-Q and

8-K. Investors and security holders are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of the date they are made. ConAgra Foods disclaims any

obligation to update or revise statements contained in this press

release to reflect future events or circumstances or otherwise.

Regulation G Disclosure Below is

a reconciliation of Q3 FY14 and Q3 FY13 diluted earnings per share

from continuing operations, Consumer Foods segment operating

profit, Commercial Foods segment operating profit, and Private

Brands segment operating profit. Amounts may be impacted by

rounding.

Q3 FY14 & Q3 FY13 Diluted EPS from

Continuing Operations Q3 FY14 Q3 FY13 %

change Diluted EPS from continuing operations $

0.58 $ 0.28 107% Items impacting

comparability: Net expense related to settlement of interest rate

derivatives 0.08 - Restructuring and integration costs (including

acquisition-related restructuring) 0.06 0.02 Transaction costs -

0.15 Net expense related to impairment costs in the Commercial

Foods segment 0.02 0.02 Net expense (benefit) related to

unallocated mark-to-market impact of derivatives (0.08 ) 0.04 Net

expense (benefit) related to the resolution of certain tax matters

(0.04 ) 0.03 Net expense related to historical legal, insurance,

and environmental matters - 0.01 Note: Amounts impacted by

rounding. Minor amounts in FY13 EPS from continuing operations have

been subsequently reclassed to discontinued operations due to

divestitures. - -

Diluted EPS

adjusted for items impacting comparability $ 0.62

$ 0.55 13% Consumer

Foods Segment Operating Profit Reconciliation (Dollars

in millions)

Q3 FY14 Q3 FY13 % change

Consumer Foods Segment Operating Profit $ 266

$ 265 1% Restructuring, integration, and

transactions costs (including acquisition-related restructuring)

4 5

Consumer Foods Segment

Adjusted Operating Profit $ 270 $

270 0% Commercial Foods Segment

Operating Profit Reconciliation (Dollars in millions)

Q3 FY14 Q3 FY13 % change Commercial Foods

Segment Operating Profit $ 163 $

186 -12% Net expense related to impairment costs

17 10

Commercial Foods

Segment Adjusted Operating Profit $ 180

$ 196 -8% Private Brands

Segment Operating Profit Reconciliation (Dollars in

millions)

Q3 FY14 Private Brands Segment Operating

Profit $ 45 Restructuring, integration, and

transactions costs (including acquisition-related restructuring)

21

Private Brands Segment Adjusted Operating

Profit $ 66 ConAgra Foods,

Inc. Segment Operating Results (in millions) (unaudited)

THIRD QUARTER 13 Weeks Ended 13 Weeks Ended

February 23, 2014

February 24, 2013 Percent Change

SALES

Consumer Foods $ 1,870.4 $ 1,939.0 (3.5)% Commercial Foods 1,456.0

1,466.9 (0.7)% Private Brands 1,063.3 427.9

148.5% Total 4,389.7 3,833.8

14.5%

OPERATING

PROFIT

Consumer Foods $ 266.3 $ 264.6 0.6% Commercial Foods 163.5 186.2

(12.2)% Private Brands 44.7 7.0 538.6%

Total operating profit for segments 474.5 457.8 3.6%

Reconciliation of total operating profit to income from

continuing operations before income taxes and equity method

investment earnings Items excluded from segment operating

profit: General corporate expense (49.5 ) (198.6 ) (75.1)% Interest

expense, net (95.0 ) (70.6 ) 34.6% Income from

continuing operations before income taxes and equity method

investment earnings $ 330.0 $ 188.6 75.0%

Segment operating profit excludes general

corporate expense, equity method investment earnings, and net

interest expense. Management believes such amounts are not directly

associated with segment performance results for the period.

Management believes the presentation of total operating profit for

segments facilitates period-to-period comparison of results of

segment operations.

ConAgra Foods, Inc. Segment Operating Results (in

millions) (unaudited) THIRD QUARTER 39 Weeks

Ended 39 Weeks Ended

February 23, 2014

February 24, 2013 Percent Change

SALES

Consumer Foods $ 5,535.9 $ 5,629.3 (1.7)% Commercial Foods 4,563.9

4,455.8 2.4% Private Brands 3,167.3 778.2

307.0% Total 13,267.1 10,863.3

22.1%

OPERATING

PROFIT

Consumer Foods $ 722.3 $ 730.0 (1.1)% Commercial Foods 493.8 541.9

(8.9)% Private Brands 198.1 20.9 847.8%

Total operating profit for segments 1,414.2 1,292.8 9.4%

Reconciliation of total operating profit to income from

continuing operations before income taxes and equity method

investment earnings Items excluded from segment operating

profit: General corporate expense (278.6 ) (247.7 ) 12.5% Interest

expense, net (286.0 ) (173.3 ) 65.0% Income from

continuing operations before income taxes and equity method

investment earnings $ 849.6 $ 871.8 (2.5)%

Segment operating profit excludes general

corporate expense, equity method investment earnings, and net

interest expense. Management believes such amounts are not directly

associated with segment performance results for the period.

Management believes the presentation of total operating profit for

segments facilitates period-to-period comparison of results of

segment operations.

ConAgra Foods, Inc. Consolidated Statements of

Earnings (in millions, except per share amounts)

(unaudited)

THIRD QUARTER 13 Weeks Ended 13 Weeks Ended

February 23, 2014

February 24, 2013

Percent Change

Net sales $ 4,389.7

$

3,833.8

14.5% Costs and expenses: Cost of goods sold 3,414.5 2,962.9 15.2%

Selling, general and administrative expenses 550.2 611.7 (10.1)%

Interest expense, net 95.0 70.6 34.6%

Income from continuing operations before

income taxes and equity method investment earnings

330.0 188.6 75.0% Income tax expense 90.3 77.7 16.2% Equity

method investment earnings 11.2 12.0

(6.7)% Income from continuing operations 250.9 122.9 104.1%

Income (loss) from discontinued operations, net of tax (14.0

) 0.5 N/A Net income $ 236.9

$

123.4

92.0% Less: Net income attributable to noncontrolling

interests 2.6 3.4 (23.5)% Net income

attributable to ConAgra Foods, Inc. $ 234.3

$

120.0

95.2% Earnings per share – basic Income from

continuing operations $ 0.59

$

0.29

103.4% Loss from discontinued operations (0.03 ) -

100.0% Net income attributable to ConAgra Foods, Inc. $ 0.56

$

0.29

93.1% Weighted average shares outstanding

421.2 410.7 2.6% Earnings per share –

diluted Income from continuing operations $ 0.58

$

0.28

107.1% Income (loss) from discontinued operations (0.03 )

0.01 N/A Net income attributable to ConAgra Foods,

Inc. $ 0.55

$

0.29

89.7% Weighted average share and share equivalents

outstanding

427.3 417.8 2.3%

ConAgra Foods, Inc. Consolidated Statements of Earnings (in

millions, except per share amounts)

(unaudited)

THIRD QUARTER 39 Weeks Ended 39 Weeks Ended

February 23, 2014

February 24, 2013

Percent Change

Net sales $ 13,267.1

$

10,863.3

22.1% Costs and expenses: Cost of goods sold 10,450.1 8,262.2 26.5%

Selling, general and administrative expenses 1,681.4 1,556.0 8.1%

Interest expense, net 286.0 173.3 65.0%

Income from continuing operations before

income taxes and equity method investment earnings

849.6 871.8 (2.5)% Income tax expense 240.9 311.2 (22.6)%

Equity method investment earnings 20.6 32.4

(36.4)% Income from continuing operations 629.3

593.0

6.1%

Income (loss) from discontinued

operations, net of tax

7.2

(0.9

)

N/A Net income $ 636.5

$

592.1

7.5% Less: Net income attributable to noncontrolling

interests 9.2 10.4 (11.5)%

Net income attributable to ConAgra Foods,

Inc.

$ 627.3

$

581.7

7.8% Earnings per share – basic Income from

continuing operations $ 1.47

$

1.42

3.5% Income from discontinued operations 0.02

- 100.0% Net income attributable to ConAgra Foods, Inc. $

1.49

$

1.42

4.9% Weighted average shares outstanding 421.1

408.4 3.1% Earnings per share – diluted

Income from continuing operations $ 1.45

$

1.40

3.6% Income from discontinued operations 0.01

- 100.0% Net income attributable to ConAgra Foods, Inc. $

1.46

$

1.40

4.3% Weighted average share and share equivalents

outstanding

427.4 414.5 3.1%

ConAgra Foods, Inc. Consolidated Balance Sheets (in millions)

(unaudited)

February 23, 2014

May 26, 2013

ASSETS Current assets Cash and cash equivalents $ 239.2 $

183.9

Receivables, less allowance for doubtful

accounts of $7.4 and $7.6

1,275.6 1,279.4 Inventories 2,498.7 2,340.9 Prepaid expenses and

other current assets 451.1 510.8 Current assets held for sale

56.0 64.8 Total current assets

4,520.6

4,379.8

Property, plant and equipment, net 3,819.7 3,757.6 Goodwill

8,427.2 8,426.7 Brands, trademarks and other intangibles, net

3,308.2 3,403.6 Other assets 270.7 293.5 Noncurrent assets held for

sale 86.9 144.1 $ 20,433.3 $

20,405.3

LIABILITIES AND STOCKHOLDERS' EQUITY Current

liabilities Notes payable $ 145.6 $ 185.0 Current installments of

long-term debt 585.1 517.9 Accounts payable 1,486.0 1,498.1 Accrued

payroll 167.4 287.0 Other accrued liabilities 850.1 908.5 Current

liabilities held for sale 6.3 4.8 Total

current liabilities 3,240.5 3,401.3 Senior long-term debt,

excluding current installments 8,564.8 8,691.0 Subordinated debt

195.9 195.9 Other noncurrent liabilities 2,714.1 2,754.0 Noncurrent

liabilities held for sale 0.2 0.1 Total stockholders' equity

5,717.8 5,363.0 $ 20,433.3 $ 20,405.3

ConAgra Foods, Inc. and Subsidiaries

Condensed Consolidated Statement of Cash Flows (in millions)

(unaudited)

Thirty-nine weeks ended

February 23, 2014

February 24, 2013

Cash flows from operating activities: Net income $ 636.5 $ 592.1

Income (loss) from discontinued operations 7.2

(0.9 ) Income from continuing operations 629.3 593.0 Adjustments to

reconcile income from continuing operations to net cash flows from

operating activities: Depreciation and amortization 447.4 298.1

Asset impairment charges 34.5 19.8 Earnings of affiliates in excess

of distributions (2.9 ) (11.8 ) Share-based payments expense 45.9

52.8 Contributions to pension plans (13.7 ) (14.7 ) Pension expense

(6.7 ) 16.5 Terminated forward starting swap payable 54.9 — Other

items 1.4 (37.7 ) Change in operating assets and liabilities

excluding effects of business acquisitions and dispositions:

Accounts receivable 14.2 (12.8 ) Inventory (157.8 ) (234.8 )

Deferred income taxes and income taxes payable, net 47.1 68.1

Prepaid expenses and other current assets (22.4 ) (32.7 ) Accounts

payable (10.3 ) 43.8 Accrued payroll (119.5 ) 88.0 Other accrued

liabilities (4.0 ) (54.8 ) Net cash flows from

operating activities — continuing operations 937.4 780.8 Net cash

flows from operating activities — discontinued operations

4.9 0.9 Net cash flows from operating

activities 942.3 781.7 Cash flows from

investing activities: Additions to property, plant and equipment

(471.0 ) (286.0 ) Sale of property, plant and equipment 15.0 7.6

Purchase of businesses, net of cash acquired (40.9 ) (5,017.7 )

Investment in equity method investee — (1.8 )

Net cash flows from investing activities — continuing operations

(496.9 ) (5,297.9 ) Net cash flows from investing activities —

discontinued operations 53.1 (3.1 ) Net cash

flows from investing activities (443.8 ) (5,301.0 )

Cash flows from financing activities: Net short-term borrowings

(39.3 ) (38.9 ) Issuance of long-term debt — 6,217.7 Debt issuance

costs — (56.6 ) Repayment of long-term debt (71.2 ) (911.8 )

Issuance of ConAgra Foods, Inc. common shares — 269.3 Repurchase of

ConAgra Foods, Inc. common shares (100.0 ) (245.0 ) Cash dividends

paid (315.5 ) (296.6 ) Exercise of stock options and issuance of

other stock awards 87.4 197.2 Other items —

2.2 Net cash flows from financing activities (438.6 )

5,137.5 Effect of exchange rate changes on cash and

cash equivalents (4.6 ) 2.6 Net change in cash and cash equivalents

55.3 620.8 Cash and cash equivalents at beginning of period

183.9 103.0 Cash and cash equivalents at end

of period $ 239.2 $ 723.8

ConAgra Foods, Inc.MediaTeresa Paulsen,

402-240-5210Vice President, Communication & External

RelationsorAnalystsChris Klinefelter, 402-240-4154Vice

President, Investor Relationswww.conagrafoods.com

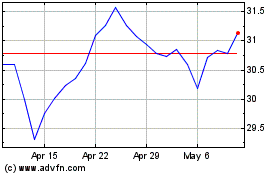

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Mar 2024 to Apr 2024

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Apr 2023 to Apr 2024