ConAgra Foods, Inc. (NYSE: CAG) (“ConAgra Foods”)

announced today the early tender results of its previously

announced tender offer (the “Tender Offer”) to purchase for cash up

to $500.0 million combined aggregate principal amount (the “Maximum

Tender Amount”) of its 3.20% Senior Notes due 2023 (the “2023

Notes”), its 4.65% Senior Notes due 2043 (the “2043 Notes”), its

7.00% Senior Notes due 2019 (the “2019 Notes”), its 5.819% Senior

Notes due 2017 (the “2017 Notes”) and its 2.10% Senior Notes due

2018 (the “2018 Notes” and, collectively with the 2023 Notes, the

2043 Notes, the 2019 Notes and the 2017 Notes, the “Notes”).

The principal amount of each series of Notes that were validly

tendered and not validly withdrawn as of 5:00 p.m., New York City

time, on August 1, 2014 (the “Early Tender Date”) and the principal

amount of each series of Notes that will be accepted for purchase

by the Company on the Early Settlement Date (as defined below) are

specified in the table below.

Title of

Security

CUSIP

Numbers

Principal Amount Outstanding

Tender Cap

Acceptance Priority

Level

Principal Amount Tendered Principal Amount to be

Accepted Early Tender Premium (per $1,000) Total

Consideration (per $1,000)(1) 3.20% Senior Notes

due 2023 205887 BR2 $1,225,000,000 $225,000,000 1 $814,449,000

$225,000,000 $30.00 $988.64 4.65% Senior Notes due 2043 205887 BS0

$937,000,000 $200,000,000 2 $588,774,000 $200,000,000 $30.00

$1,018.27 7.00% Senior Notes due 2019 205887 BF8 $500,000,000

$25,000,000 3 $114,798,000 $24,998,000 $30.00 $1,204.52 5.819%

Senior Notes due 2017

205887 BD3 /205887 BB7 /U20436 AA6

$499,999,000 $25,000,000 4 $64,352,000 $24,997,000 $30.00 $1,122.83

2.10% Senior Notes due 2018 205887 BG6 $250,000,000 $25,000,000 5

$120,468,000 $24,997,000 $30.00 $1,007.92

(1) Inclusive of the Early Tender Premium.

The amounts of each series of Notes that are purchased were

determined in accordance with the acceptance priority levels

specified in the table above and on the cover page of the Offer to

Purchase, dated July 21, 2014 (the “Offer to Purchase”), in the

column entitled “Acceptance Priority Level” (the “Acceptance

Priority Level”), with 1 being the highest Acceptance Priority

Level and 5 being the lowest Acceptance Priority Level. In

addition, no more than $225.0 million aggregate principal amount of

the 2023 Notes, no more than $200.0 million aggregate principal

amount of the 2043 Notes, no more than $25.0 million aggregate

principal amount of the 2019 Notes, no more than $25.0 million

aggregate principal amount of the 2017 Notes and no more than $25.0

million aggregate principal amount of the 2018 Notes will be

purchased (the “Tender Caps”).

Because the amount of Notes tendered in each series prior to the

Early Tender Date exceeded the applicable Tender Cap, no additional

Notes of any series tendered after the Early Tender Date will be

accepted for purchase and Notes not accepted, including Notes not

accepted because of proration, will be returned promptly.

The Tender Offer is being made upon and is subject to the terms

and conditions set forth in the Offer to Purchase and the related

Letter of Transmittal. The consideration to be paid in the Tender

Offer for each series of Notes validly tendered and accepted for

purchase was calculated in the manner described in the Offer to

Purchase by reference to a fixed spread over the yield to maturity

of the applicable U.S. Treasury Security specified in the Offer to

Purchase (the “Total Consideration”). Holders of the Notes that

validly tendered and did not withdraw their Notes on or prior to

the Early Tender Date and whose Notes are accepted for purchase

will receive the applicable Total Consideration, which includes an

early tender premium of $30.00 per $1,000 principal amount of the

Notes accepted for purchase (the “Early Tender Premium”). The Total

Consideration was determined at 2:00 p.m., New York City time, on

August 1, 2014, and is set forth in the table above.

Payments for Notes purchased will include accrued and unpaid

interest from and including the last interest payment date

applicable to the relevant series of Notes up to, but not

including, the applicable settlement date for such Notes accepted

for purchase. The settlement date for Notes that were validly

tendered on or prior to the Early Tender Date and accepted for

purchase is expected to be August 4, 2014 (the “Early Settlement

Date”).

ConAgra Foods’ obligation to accept for payment and to pay for

the Notes validly tendered in the Tender Offer is subject to the

satisfaction or waiver of a number of general conditions described

in the Offer to Purchase. ConAgra Foods reserves the right, subject

to applicable law, to: (i) waive any and all conditions to the

Tender Offer; (ii) extend or terminate the Tender Offer; (iii)

increase or decrease the Maximum Tender Amount and/or increase,

decrease or eliminate one or more of the Tender Caps; or (iv)

otherwise amend the Tender Offer in any respect.

Wells Fargo Securities, LLC is acting as the Lead Dealer Manager

for the Tender Offer. Mizuho Securities USA Inc., Scotia Capital

(USA) Inc. and U.S. Bancorp Investments, Inc. are acting as the

Co-Dealer Managers for the Tender Offer. The Information Agent and

Tender Agent is Global Bondholder Services Corporation. Copies of

the Offer to Purchase, Letter of Transmittal and related offering

materials are available by contacting the Information Agent at

(866) 470-4200 (U.S. toll-free) or (212) 430-3774 (banks and

brokers). Questions regarding the Tender Offer should be directed

to Wells Fargo Securities, LLC, Liability Management Group, at

(866) 309-6316 (toll-free) or (704) 410-4760 (collect).

This news release shall not constitute an offer to sell, a

solicitation to buy or an offer to purchase or sell any securities.

The Tender Offer is being made only pursuant to the Offer to

Purchase and only in such jurisdictions as is permitted under

applicable law.

About ConAgra Foods

ConAgra Foods, Inc. (NYSE: CAG) is one of North America’s

largest packaged food companies with branded and private branded

food found in 99 percent of America’s households, as well as a

strong commercial foods business serving restaurants and

foodservice operations globally. Consumers can find recognized

brands such as Banquet®, Chef Boyardee®, Egg Beaters®, Healthy

Choice®, Hebrew National®, Hunt’s®, Marie Callender’s®, Orville

Redenbacher’s®, PAM®, Peter Pan®, Reddi-wip®, Slim Jim®, Snack

Pack® and many other ConAgra Foods brands, along with food sold by

ConAgra Foods under private brand labels, in grocery, convenience,

mass merchandise, club and drug stores. Additionally, ConAgra Foods

supplies frozen potato and sweet potato products as well as other

vegetable, seasoning blends, flavors, and bakery products to

commercial and foodservice customers. ConAgra Foods operates

ReadySetEat.com, an interactive recipe website that provides

consumers with easy dinner recipes and more. For more information,

please visit us at www.conagrafoods.com.

Note on Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These forward-looking statements are based on management’s

current expectations and assumptions and are subject to certain

risks, uncertainties and changes in circumstances that could cause

actual results to differ materially from potential results

discussed in the forward-looking statements. These risks and

uncertainties include, among other things: ConAgra Foods’ ability

to realize the synergies and benefits contemplated by the

acquisition of Ralcorp Holdings, Inc. (“Ralcorp”) and its ability

to promptly and effectively integrate the business of Ralcorp;

ConAgra Foods’ ability to realize the synergies and benefits

contemplated by the recently formed joint venture combining the

flour milling businesses of ConAgra Foods, Cargill, Incorporated,

and CHS Inc.; risks and uncertainties associated with intangible

assets, including any future goodwill impairment charges; the

availability and prices of raw materials, including any negative

effects caused by inflation or adverse weather conditions; the

effectiveness of ConAgra Foods’ product pricing, including product

innovation, any pricing actions and changes in promotional

strategies; the ultimate outcome of litigation, including

litigation related to lead paint and pigment matters; future

economic circumstances; industry conditions; ConAgra Foods’ ability

to execute its operating and restructuring plans; the success of

ConAgra Foods’ cost-savings initiatives, and innovation and

marketing investments; the competitive environment; operating

efficiencies; the ultimate impact of any ConAgra Foods product

recalls; access to capital; actions of governments and regulatory

factors affecting ConAgra Foods’ businesses, including the Patient

Protection and Affordable Care Act; the amount and timing of

repurchases of ConAgra Foods’ common stock and debt, if any; and

other risks described in ConAgra Foods’ reports filed with the

Securities and Exchange Commission, including its most recent

annual report on Form 10-K and subsequent reports on Forms 10-Q and

8-K. Investors and security holders are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of the date they are made. ConAgra Foods disclaims any

obligation to update or revise statements contained in this press

release to reflect future events or circumstances or otherwise.

MEDIAConAgra Foods, Inc.Teresa Paulsen, 402-240-5210Vice

President,Communication & External

RelationsorANALYSTSConAgra Foods, Inc.Chris Klinefelter,

402-240-4154Vice President, Investor Relationswww.conagrafoods.com

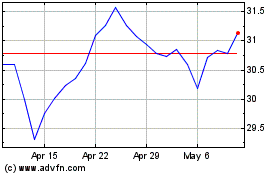

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Mar 2024 to Apr 2024

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Apr 2023 to Apr 2024