TIDMCPG

RNS Number : 0772X

Compass Group PLC

21 November 2017

Legal Entity Identifier (LEI) No. 2138008M6MH9OZ6U2T68

Full year results announcement for the year ended 30 September

2017

Underlying(1) results Statutory results

2017 2016 Change 2017 2016 Change

GBP22.9 GBP22.0 GBP22.6 GBP19.6

Revenue billion billion(2) 4.0%(3) billion billion 15.1%

Operating GBP1,705 GBP1,614 GBP1,665 GBP1,409

profit million million(2) 5.6%(2) million million 18.2%

Operating +20 +20

margin 7.4% 7.2% bps 7.4% 7.2% bps

Earnings

per share 72.3 pence 68.4 pence(2) 5.7%(2) 71.3 pence 60.4 pence 18.0%

Free cash GBP974 GBP908

flow million million 7.3%

Annual dividend

per share 33.5 pence 31.7 pence 5.7% 33.5 pence 31.7 pence 5.7%

================= =========== ============== ======== =========== =========== =======

(1) Reconciliation of statutory to underlying results can be

found on pages 34 - 35.

(2) Measured on a constant currency basis.

(3) Organic revenue growth.

Compass reports another strong set of results. Organic revenue

grew by 4%, operating margin improved by 20 basis points and we

returned GBP1.6bn to shareholders.

Organic revenue growth of 4.0%

-- Growth accelerated in the second half as expected

-- Another excellent year in North America with organic revenue up 7.1%

-- Organic revenue grew by 1.6% in Europe

-- Rest of World declined by 2.5%, but excluding Offshore & Remote it grew by 3.0%

Margin up 20bps

-- The Management and Performance (MAP) programme continues to drive operating efficiencies

-- Margin improvement benefitted from the end of restructuring plan in Offshore & Remote

Growth, performance and returns to shareholders: a proven and

sustainable model

-- Free cash flow of GBP974 million, up 7.3% on 2016

-- Proposed annual dividend up 5.7%, in line with constant currency EPS

-- Total returns to shareholders of GBP1.6bn, including GBP1bn special dividend

Statutory results

-- On a statutory basis, revenue, operating profit and earnings

per share benefitted by around 11% from the translational effect of

weaker sterling

Chief Executive's Statement

Richard Cousins, Group Chief Executive, said:

"Compass had another strong year. North America continues to

deliver excellent growth, we are continuing to make progress in

Europe and in Rest of World, with trends in our commodity related

business improving.

We continue to drive operating efficiencies around the business

which, combined with the end of the restructuring in our Offshore

and Remote business, resulted in margin improvement of 20bps in the

period.

Given our excellent cash generation and the strength of the

business, this year we returned GBP1.6 billion to shareholders via

ordinary and special dividends and share buybacks. This reflects

our commitment to return surplus cash to shareholders whilst

maintaining an efficient balance sheet.

Our expectations for FY2018 are positive, with growth and margin

improvement weighted to the second half. The pipeline of new

contracts is encouraging and our focus on organic growth,

efficiencies and cash gives us confidence in achieving another year

of progress.

In the longer term, we remain excited about the significant

structural growth opportunities globally and the potential for

further revenue growth, margin improvement, as well as continued

returns to shareholders."

Results presentation today

The results presentation for investors and analysts is being

held today, Tuesday 21 November 2017, at 9.00 a.m. at Bank of

America Merrill Lynch, 2 King Edward Street, London EC1A 1HQ. A

live webcast of the results presentation will be broadcast today at

9.00 a.m., accessible via the Company's website,

www.compass-group.com. At the end of the presentation you will be

able to participate in a question and answer session by

dialling:

UK Toll Number: +44 (0) 3333 000 804

UK Toll-Free Number: +44 (0) 800 358 9473

US Toll Number: +1 631 913 1422

US Toll-Free Number: +1 855 857 0686

Participant PIN Code: 03721269#

Financial calendar

Ex-dividend date for 2017 final dividend 18 January 2018

Record date for 2017 final dividend 19 January 2018

2017 final dividend date for payment 26 February 2018

Q1 Trading Update / Annual General Meeting 8 February 2018

Half year results 9 May 2018

Enquiries

Investors Sandra Moura +44 1932 573 000

Press Gordon Simpson, Finsbury +44 207 251 3801

Website www.compass-group.com

Chief Executive's Statement (continued)

Basis of preparation

Throughout this preliminary announcement, and consistent with

prior years, underlying and other alternative performance measures

are used to describe the Group's performance. These are not

recognised under International Financial Reporting Standards (IFRS)

or other generally accepted accounting principles (GAAP).

The Executive Board of the Group manages and assesses the

performance of the business on these measures and believes they are

more representative of ongoing trading, facilitate meaningful year

on year comparisons, and hence provide more useful information to

shareholders. All underlying measures are defined in the glossary

of terms on pages 37 to 38.

A summary of the adjustments from statutory results to

underlying results is shown in note 8 on page 34 and further

detailed in the consolidated income statement (page 21),

reconciliation of free cash flow (page 27), note 2 segmental

reporting (pages 28 to 29) and note 9 organic revenue and organic

profit (page 35).

Group overview

Revenue for the Group grew by 4.0% on an organic basis. New

business wins were 8.7% driven by strong MAP 1 (client sales and

marketing) performance in all regions, our retention rate was 94.3%

as a result of our ongoing focus and investment, and like for like

revenue grew by 1.0% reflecting sensible price increases partially

offset by weak volumes in our commodity related business. On a

statutory basis, revenue grew by 15.1%, of which 11.3% was the

benefit of currency translation.

Underlying operating profit increased by 5.6% on a constant

currency basis. Operating profit margin increased by 20 basis

points as we continue to drive efficiencies across the business

using our Management and Performance (MAP) framework and foreign

exchange. We also benefitted from the end of the restructuring plan

in the Emerging Markets and Offshore & Remote last year and the

absence of these costs this year. We have maintained our focus on

MAP 3 (cost of food) with initiatives such as menu planning and

supplier rationalisation, as well as continually optimising MAP 4

(labour and in unit costs) and MAP 5 (above unit overheads). These

efficiencies combined with modest pricing increases enabled us to

offset inflation pressures and reinvest to support the exciting

growth opportunities we see around the world. On a statutory basis,

operating profit grew by 18.2%, of which 11.3% was the benefit of

currency translation.

Returns to shareholders continue to be an integral part of our

business model. As a result of continued strong cash flow

generation, and limited M&A this year, we paid a special

dividend of GBP1 billion (61.0 pence per share) in July and

declared an annual dividend of 33.5 pence per share (up 5.7%). We

have also bought back GBP19 million of shares. Our leverage policy

remains unchanged: to maintain strong investment grade credit

ratings, returning any surplus cash to shareholders to target net

debt to EBITDA of around 1.5x.

Chief Executive's Statement (continued)

Regional performances

North America - 58.3% Group revenue (2016: 56.3%)

Underlying Change

Regional financial summary 2017 2016 Reported rates Constant currency Organic

============================ =========== =========== =============== ================== ========

Revenue GBP13,322m GBP11,198m 19.0% 6.7% 7.1%

Regional operating profit GBP1,082m GBP908m 19.2% 6.9% 7.4%

Regional operating margin 8.1% 8.1% -

============================ =========== =========== =============== ================== ========

We have had another strong performance from our North American

business with organic revenue growth of 7.1%. This was driven by

good new business wins and an excellent retention rate at 96%. Like

for like revenues were positive across the business reflecting

modest pricing and flat volumes - with the exception of the

Offshore & Remote sector which remains challenging.

Solid organic growth in our Business & Industry sector was

driven by strong new business and excellent retention. New contract

wins include Costco as well as additional business with Qualcomm

Inc.

In the Healthcare & Seniors sector, organic revenue growth

was driven by double digit new business and some like for like

growth. New contract wins include Mayo Foundation, University of

Cincinnati Health System, Cleveland Clinic and Arkansas Children's

Hospital.

Excellent retention in our Education sector has contributed to

the delivery of solid organic revenue growth along with contract

wins including the University of Houston and Vassar College.

Our Sports & Leisure business had excellent retention of

nearly 100%. Increased participation at some sporting events, with

the benefit of additional playoffs, contributed to strong organic

revenue growth. Contract wins include the George R. Brown

Convention Center, Vivint Smart Home Arena, home of the Utah Jazz,

and Smith's Ballpark, home of the Salt Lake Bees.

Offshore & Remote is small at circa 2% of revenues. It

continued to decline in the year, with the second half of the year

worsening due to client site closures, the impact of which will

continue in 2018. Volume and pricing pressures also remain.

However, some new contracts continue to be won including additional

projects for Noble Drilling and Forbes Bros. Ltd.

Underlying operating profit of GBP1,082 million increased by

6.9% (GBP70 million) on a constant currency basis. The benefits

generated by ongoing efficiency initiatives across MAPs 3 and 4,

along with sensible price increases and leverage of the overhead

base, were largely offset by the continued weakness in our Offshore

& Remote business and above average labour inflation. As a

result, the underlying operating margin for the year was

unchanged.

Chief Executive's Statement (continued)

Europe - 25.9% Group revenue (2016: 27.5%)

Underlying Change

Regional financial summary 2017 2016 Reported rates Constant currency Organic

============================ ========== ========== =============== ================== ========

Revenue GBP5,911m GBP5,458m 8.3% 1.5% 1.6%

Regional operating profit GBP428m GBP394m 8.6% 1.2% 1.2%

Regional operating margin 7.2% 7.2% -

============================ ========== ========== =============== ================== ========

Organic revenue growth for the region was 1.6% with growth

improving as the year progressed. The performance was driven by

good levels of new business in the UK and Turkey, partly offset by

dull trading on the Continent, principally in France and Germany.

Like for like revenues benefitted from some pricing but continued

to be impacted by poor trading conditions in our North Sea oil

& gas business.

Our improving new business performance reflects good levels of

wins in the UK, Turkey and Iberia. New contracts include Colegios

Mayores UCM in Spain and Oxford University in the UK. Contract

extensions include Peugeot in France and Slovakia, Rabobank in the

Netherlands, Premier Inn and Wimbledon both in the UK and Mercedes

in Turkey.

Underlying operating profit grew by 1.2% (GBP5 million) on a

constant currency basis. The ongoing focus on driving operational

efficiencies and sensible pricing allowed us to support the higher

levels of growth, and associated mobilisation costs. This was

offset by lower volumes in the oil & gas business, and

inflationary pressures, particularly unrecovered labour cost

inflation in our UK support services business. As a result of our

actions, we have maintained the underlying operating margin at

7.2%.

Chief Executive's Statement (continued)

Rest of World - 15.8% Group revenue (2016: 16.2%)

Underlying Change

Regional financial summary 2017 2016 Reported rates Constant currency Organic

============================ ========== ========== =============== ================== ========

Revenue GBP3,619m GBP3,215m 12.6% (2.5)% (2.5)%

Regional operating profit GBP248m GBP218m 13.8% (2.0)% (2.0)%

Regional operating margin 6.9% 6.8% 10bps

============================ ========== ========== =============== ================== ========

Organic revenue in our Rest of World region declined by 2.5%.

Excluding the Offshore & Remote business, organic revenue grew

by 3.0%. Offshore & Remote contracted by 14%, reflecting the

continuing impact of the transition of construction contracts to

production in Australia and continued weakness in our commodity

related business around the region. However, the rate of decline

has slowed in recent months and we expect this trend to continue

into 2018.

As expected, our Australian Offshore & Remote business saw a

slowdown in the rate of organic revenue decline to 14% in the

second half of the year. Contracts continue to move from their

construction to production phase and the ongoing pressures from

lower volumes remain, however the number of site closures have

reduced. Similar challenges continue to be seen in our

non-Australian Offshore & Remote business, although trends are

starting to improve. We continue to win and retain contracts at the

RAPID site in Malaysia and Centinela in Chile.

The non-Offshore & Remote business continues to perform

reasonably well across the region with several countries enjoying

double digit growth, including India, China and some of our Spanish

speaking Latin American businesses. Although the rate of decline

has marginally slowed, Brazil remains challenging. New business

wins include the Calvary Bruce Public Hospital in Australia, Fiat

in Brazil, Apple Shenzhen in China, J-Village in Japan and Mercedes

Benz in India. We continue to retain contracts, including the

Kagoshima University Hospital in Japan, New York University Abu

Dhabi, Roche in China and Prodeco Food in Colombia.

Overall, underlying operating profit declined by 2.0% (GBP5

million) on a constant currency basis. The underlying margin

benefitted more than expected from last year's restructuring

allowing for 10 basis points of margin improvement to 6.9%.

Chief Executive's Statement (continued)

Strategy

Focus on food

Food is our focus and our core competence. The food service

market is estimated to be more than GBP200 billion; with only

around 50% of the market currently outsourced, it represents a

significant structural growth opportunity. We believe the benefits

of outsourcing become further apparent as economic conditions and

regulatory changes put further pressure on organisations' budgets.

As one of the largest providers in all of our sectors, we are well

placed to benefit from these trends.

Our approach to support services is low risk and incremental,

with strategies developed on a country by country basis. Our

largest sector in this market is Defence, Offshore & Remote,

where the model is almost universally multi service. In addition,

we have an excellent support services business in North America and

some operations in other parts of the world. This is a complex

segment and there are significant differences in client buying

behaviour across countries, sectors and sub-sectors.

Geographic spread

We have a truly international business, with operations in

around 50 countries.

North America (58% of Group revenue) is likely to remain the

principal growth engine for the Group. We have a market leading

business, which delivers high levels of growth by combining the

cost advantage of our scale with a segmented client facing sector

approach. The outsourcing culture is vibrant and the addressable

market is significant.

The fundamentals of our businesses in Europe (26% of Group

revenue) are good. Our investment in MAP 1 sales and retention has

returned the region to growth and with the creation of sub-regional

business units, we continue to see opportunities to deliver

efficiencies and make our operations more competitive.

Rest of World (16% of Group revenue) offers excellent long term

growth potential. Our largest markets are Australia, Japan and

Brazil, whilst India and China have strong long term growth

potential. Lower commodity prices and a weak macroeconomic backdrop

have impacted our Offshore & Remote business and some of our

emerging markets, but trends are beginning to improve. We have

concluded a restructuring of our business to adapt to the changing

market environment and remain excited about the attractive long

term growth prospects of the region.

Sectorised approach

The global food services market is very large and disparate and

we find that segmenting the market into various sectors and

sub-sectors using our portfolio of B2B brands allows us to operate

more effectively. It allows us to be closer to our clients and

consumers and better understand their different needs. In this way,

we can create innovative, bespoke offers that meet their

requirements, and in so doing truly differentiate ourselves.

Scale

As we continue to grow, our scale enables us to achieve our goal

of being the lowest cost, most efficient provider of food and

support services. Scale is a benefit in terms of food procurement,

labour management and back office costs. It underpins our

competitiveness and enables us to deliver sustainable growth over

time.

MAP culture

We use the Management and Performance (MAP) framework across the

business. All our employees use this simple framework to drive

performance across the Group. It helps us focus on a common set of

business drivers, whether it is winning new business in the right

sector on the right terms (MAP 1), increasing our consumer

participation and spend (MAP 2), reducing our food costs (MAP 3),

our labour costs (MAP 4) or our overhead (MAP 5).

Chief Executive's Statement (continued)

Uses of cash and balance sheet priorities

The Group's cash flow generation remains excellent and it will

continue to be a key part of the business model. Our priorities for

how we use our cash remain unchanged. We will continue to: (i)

invest in the business to support organic growth where we see

opportunities with good returns; (ii) pursue M&A opportunities;

our preference is for small to medium sized infill acquisitions,

where we look for returns greater than our cost of capital by the

end of year two; (iii) grow the dividend in line with underlying

constant currency earnings per share; and (iv) maintain strong

investment grade credit ratings returning any surplus cash to

shareholders to target net debt to EBITDA of around 1.5x.

Summary and outlook

"Compass had another strong year. North America continues to

deliver excellent growth, we are continuing to make progress in

Europe and in Rest of World, with trends in our commodity related

business improving.

We continue to drive operating efficiencies around the business

which, combined with the end of the restructuring in our Offshore

and Remote business, resulted in margin improvement of 20bps in the

period.

Given our excellent cash generation and the strength of the

business, this year we returned GBP1.6 billion to shareholders via

ordinary and special dividends and share buybacks. This reflects

our commitment to return surplus cash to shareholders whilst

maintaining an efficient balance sheet.

Our expectations for FY2018 are positive, with growth and margin

improvement weighted to the second half. The pipeline of new

contracts is encouraging and our focus on organic growth,

efficiencies and cash gives us confidence in achieving another year

of progress.

In the longer term, we remain excited about the significant

structural growth opportunities globally and the potential for

further revenue growth, margin improvement, as well as continued

returns to shareholders."

Richard Cousins

Group Chief Executive

21 November 2017

Business Review

2017 has been another strong year with good organic revenue

growth of 4.0%, underlying margin delivery of 7.4% and an increase

in free cash flow of 7.3%.

Financial summary 2017 2016

GBPm GBPm Increase

Revenue

Underlying at constant currency 22,852 22,017 3.8%

Underlying at reported rates 22,852 19,871 15.0%

Statutory 22,568 19,605 15.1%

Organic growth 4.0% 5.0%

================================== ======= ======= =========

Total operating profit

Underlying at constant currency 1,705 1,614 5.6%

Underlying at reported rates 1,705 1,445 18.0%

Statutory 1,665 1,409 18.2%

================================== ======= ======= =========

Operating margin

Underlying at reported rates 7.4% 7.2% 20 bps

Statutory 7.4% 7.2% 20 bps

================================== ======= ======= =========

Profit before tax

Underlying at constant currency 1,591 1,504 5.8%

Underlying at reported rates 1,591 1,344 18.4%

Statutory 1,560 1,321 18.1%

================================== ======= ======= =========

Basic earnings per share

Underlying at constant currency 72.3p 68.4p 5.7%

Underlying at reported rates 72.3p 61.1p 18.3%

Statutory 71.3p 60.4p 18.0%

================================== ======= ======= =========

Free cash flow

Underlying at reported rates 974 908 7.3%

Full year dividend per ordinary

share 33.5p 31.7p 5.7%

================================== ======= ======= =========

Definitions of underlying measures of performance can be found

in the glossary on pages 37 to 38.

Business Review (continued)

Segmental performance

Underlying Growth

revenue(1)

------------------------ ----------------------------- ----------------------- --------

2017 2016 Reported Constant

GBPm GBPm Rates Currency Organic

------------ --------------- ----------- ---------- --------

North America 13,322 11,198 19.0% 6.7% 7.1%

Europe 5,911 5,458 8.3% 1.5% 1.6%

Rest of World 3,619 3,215 12.6% (2.5%) (2.5%)

Total 22,852 19,871 15.0% 3.8% 4.0%

------------------------- ------------ --------------- ----------- ---------- --------

Underlying Underlying operating

operating profit(1) margin(1)

----------------------------- -----------------------

2017 2016 2017 2016

GBPm GBPm % %

------------ --------------- ----------- ----------

North America 1,082 908 8.1% 8.1%

Europe 428 394 7.2% 7.2%

Rest of World 248 218 6.9% 6.8%

Unallocated overheads (70) (65)

Total before

EM & OR restructuring 1,688 1,455 7.4% 7.3%

------------------------- ------------ --------------- ----------- ----------

EM & OR restructuring - (25)

Total before

associates 1,688 1,430 7.4% 7.2%

Associates 17 15

------------------------- ------------ ---------------

Total 1,705 1,445

------------------------- ------------ ---------------

(1) Definitions of underlying measures of performance can be

found in the glossary on page 37 to 38.

Business Review (continued)

Statutory and underlying results

2017 2016

Statutory Adjustments Underlying Statutory Adjustments Underlying

GBPm GBPm GBPm GBPm GBPm GBPm

Revenue 22,568 284 22,852 19,605 266 19,871

Operating profit 1,665 40 1,705 1,409 36 1,445

Other gains/ (losses) - - - 1 (1) -

Net finance costs (105) (9) (114) (89) (12) (101)

Profit before tax 1,560 31 1,591 1,321 23 1,344

Tax (389) (15) (404) (319) (11) (330)

======================= ========== ============ =========== ========== ============ ===========

Profit after tax 1,171 16 1,187 1,002 12 1,014

Non-controlling

interest (10) - (10) (10) - (10)

Attributable profit 1,161 16 1,177 992 12 1,004

Average number

of shares (millions) 1,628 - 1,628 1,643 - 1,643

Basic earnings

per share (pence) 71.3p 1.0p 72.3p 60.4p 0.7p 61.1p

======================= ========== ============ =========== ========== ============ ===========

EBITDA 2,188 1,840

Gross capex 717 580

Free cash flow 974 908

======================= ========== ============ =========== ========== ============ ===========

Further details of the adjustments can be found in the

consolidated income statement, note 2 segmental reporting and note

8 statutory and underlying results.

Statutory results

On a statutory basis, revenue was GBP22,568 million (2016:

GBP19,605 million), growth of 15.1%, which included 11.3% of

foreign currency translation benefit.

Operating profit was GBP1,665 million (2016: GBP1,409 million),

an increase of 18.2% over the prior year, which included 11.3% of

foreign currency translation benefit.

Operating margin was 7.4% (2016: 7.2%).

Net finance costs were GBP105 million (2016: GBP89 million).

Profit before tax was GBP1,560 million (2016: GBP1,321 million)

giving rise to an income tax expense of GBP389 million (2016:

GBP319 million), equivalent to an effective tax rate of 24.9%

(2016: 24.1%).

Basic earnings per share were 71.3 pence (2016: 60.4 pence), an

increase of 18.0%, of which 11.3% relates to foreign currency

translation.

Business Review (continued)

Underlying results

A summary of adjustments from statutory results to underlying

results is shown on page 34 and further detailed in the

consolidated income statement (page 21), reconciliation of free

cash flow from operations (page 27), the segmental reporting note

(pages 28 to 29) and the organic revenue and organic profit note

(page 35).

Underlying revenue

On an organic basis, revenue increased by 4.0%. New business

wins were 8.7% driven by a strong performance in most countries.

Our retention rate was 94.3% as a result of our ongoing focus and

investment. Like for like revenue growth was 1.0%, reflecting

sensible price increases partly offset by weak volumes in our

commodity related business.

Underlying operating profit

Underlying operating profit was GBP1,705 million (2016: GBP1,445

million), an increase of 18.0%. If we restate 2016's profit at the

2017 average exchange rates, it would have increased by GBP169

million to GBP1,614 million. On a constant currency basis,

underlying operating profit has therefore increased by GBP91

million, or 5.6%.

Underlying operating margin

The underlying operating margin increased by 20 basis points as

we continue to drive efficiencies across the business, benefitted

from the end of the Emerging Markets and Offshore & Remote

restructuring and foreign exchange. These efficiencies, combined

with modest pricing increases, enabled us to offset inflation

pressures and reinvest to support the exciting growth opportunities

we see around the world.

Underlying finance costs

The underlying net finance cost increased to GBP114 million

(2016: GBP101 million) as a result of sterling weakness and the

additional interest on debt to fund the GBP1 billion special

dividend. This equates to an effective interest rate of just under

3.0% on gross debt. For 2018, we expect an underlying net finance

cost of around GBP120 million.

Underlying tax charge

On an underlying basis, the tax charge was GBP404 million (2016:

GBP330 million), equivalent to an effective tax rate of 25.4%

(2016: 24.5%). This increase is a consequence of both the changing

regulatory environment affecting all multinational groups,

specifically the enactment into law in the UK of the OECD BEPS

legislation, and the impact of exchange rate movements. Our current

expectations for the 2018 tax rate are to be around 1.0% higher

than 2017. As previously noted, we are likely to see a continuing

period of significant uncertainty in the international corporate

tax environment.

Underlying basic earnings per share

On a constant currency basis, the underlying basic earnings per

share were 72.3 pence (2016: 68.4 pence), an increase of 5.7%.

Dividends

Our dividend policy is to grow the dividend in line with growth

in underlying constant currency earnings per share.

In determining the level of dividend in any year in accordance

with the policy, the Board also considers a number of other factors

that influence the proposed dividend, which include but are not

limited to:

-- the level of available distributable reserves in the Parent Company;

-- future cash commitments and investment needs to sustain the

long-term growth prospects of the business;

-- potential strategic opportunities; and

-- the level of dividend cover.

Further surpluses, after considering the matters set out above,

are distributed to shareholders over time by way of special

dividend payments, share repurchases or a combination of both.

Compass Group PLC, the Parent Company of the Group, is a

non-trading investment holding company which derives its

distributable reserves from dividends paid by subsidiary companies.

The level of distributable reserves in the Parent Company is

reviewed annually and the Group aims to maintain distributable

reserves that provide adequate cover for dividend payments. The

distributable reserves of the Parent Company include the balance on

the profit and loss account reserve, which at 30 September 2017

amounted to GBP1,127 million.

The Group is currently in a strong position to continue to fund

its dividend which continues to be well covered by cash generated

by the business. Details on the Group's going concern assessment

can be found on page 16.

The ability of the Board to maintain its future dividend policy

will be influenced by a number of the principal risks identified on

pages 17 to 20 that could adversely impact the performance of the

Group although we believe we have the ability to mitigate those

risks as outlined on pages 17 to 20.

It is proposed that a final dividend of 22.3 pence per share be

paid on 26 February 2018 to shareholders on the register on 19

January 2018. This will result in a total dividend for the year of

33.5 pence per share (2016: 31.7 pence per share), a year on year

increase of 5.7%. The dividend is covered 2.2 times on an

underlying earnings basis and 1.8 times on a cash basis.

The final dividend of 22.3 pence will be paid gross and a

Dividend Reinvestment Plan (DRIP) will be available. The last date

for receipt of elections for the DRIP will be 5 February 2018.

Special dividend

On 7 June 2017, shareholder approval was given at a General

Meeting for a return of 61.0 pence per share to shareholders, which

was equivalent to GBP1 billion in aggregate and was accompanied by

a Share Capital Consolidation. The special dividend was paid on 17

July 2017 to shareholders on the register on 26 June 2017.

Purchase of own shares

During the year, the Group purchased shares for a consideration

of GBP19 million (2016: GBP100 million).

Shareholder return

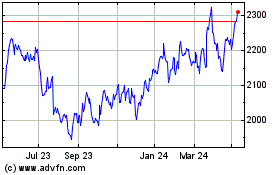

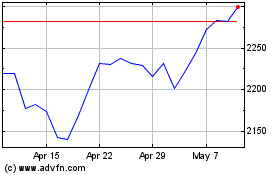

The market price of the Group's ordinary shares at the close of

the financial year was 1,583.00 pence per share (2016: 1,495.00

pence per share).

Business Review (continued)

Free cash flow

Free cash flow totalled GBP974 million (2016: GBP899 million).

In 2016, we made cash payments of GBP9 million related to the

European exceptional programme. Adjusting for this, free cash flow

on an underlying basis would have grown by GBP66 million or 7.3%.

Free cash flow conversion was 57% (2016: 63%).

Gross capital expenditure of GBP717 million (2016: GBP580

million), including assets purchased under finance leases of GBP2

million (2016: GBP2 million), is equivalent to 3.1% of underlying

revenues (2016: 2.9% of underlying revenues). We continue to

deliver strong returns on our capital expenditure across all

regions. In 2018 we expect capital expenditure to be just over 3%

of revenue, which includes an investment in a long term partnership

with the LA Dodgers in the US.

The working capital outflow, excluding provisions and pensions,

was GBP62 million (2016: GBP12 million inflow). In 2018 we expect a

small underlying outflow which will be offset by a positive inflow

of around GBP70 million due to the timing of our payroll run in

September. This payroll inflow is a reversal of the outflow which

occurred in 2016.

The GBP14 million outflow (2016: GBP39 million) in respect of

post employment benefit obligations reflects the reduction in

regular payments agreed with trustees of the UK defined benefit

pension scheme as a result of the funding surplus following the

triennial valuation in April 2016. We now continue to expect a

total outflow for the Group of around GBP20 million per annum.

The net interest outflow was GBP97 million (2016: GBP94

million).

The underlying cash tax rate was in line with expectations at

21% (2016: 18%).

Acquisition payments

The total cash spent on acquisitions in the year, net of cash

acquired, was GBP96 million (2016: GBP180 million), comprising

GBP72 million of infill acquisitions, GBP1 million of acquisition

transaction costs net of cash acquired and GBP23 million of

contingent consideration relating to prior years' acquisitions.

Disposals

The Group received GBP19 million (2016: GBP2 million) in respect

of the disposal of some non core businesses.

Post employment benefit obligations

The Group has continued to review and monitor its pension

obligations throughout the period working closely with the trustees

and members of all schemes around the Group to ensure proper and

prudent assumptions are used and adequate provision and

contributions are made.

The Group's net pension surplus, calculated in accordance with

IAS 19, for all Group defined benefit schemes was GBP28 million

(2016: GBP21 million deficit).

The total pensions charge for defined benefit contribution

schemes in the year was GBP123 million (2016: GBP100 million) and

GBP20 million (2016: GBP17 million) for defined benefit

schemes.

Return on capital employed

Return on capital employed was 20.3% (2016: 19.4%) based on net

operating profit after tax at the underlying effective tax rate of

25.4% (2016: 24.5%). The average capital employed was GBP6,218

million (2016: GBP5,565 million).

On a constant currency basis, the increase in return on capital

employed was 10 basis points.

Related party transactions

Details of transactions with related parties are set out in note

29 of the consolidated financial statements. These transactions

have not had, and are not expected to have, a material effect on

the financial performance or position of the Group.

Business Review (continued)

Financial position

The ratio of net debt to market capitalisation of GBP25,035

million as at 30 September 2017 was 13.8% (2016: 12%).

Net debt increased to GBP3,446 million (2016: GBP2,874 million).

The ratio of net debt to underlying EBITDA was 1.6x, slightly above

the target ratio due to the funding of the GBP1 billion special

dividend. Our leverage policy is to maintain strong investment

grade credit ratings, returning any surplus cash to shareholders to

target net debt to underlying EBITDA of around 1.5x.

The Group generated GBP974 million of free cash flow (2016:

GBP899 million), including investing GBP683 million in net capital

expenditure, and spent GBP77 million on acquisitions net of

disposal proceeds. GBP347 million was paid in respect of the final

dividend for the financial year 2016, GBP184 million was paid for

the interim 2017 dividend, GBP1,003 million in relation to the

special dividend and GBP19 million returned to shareholders through

share buybacks.

The remaining GBP84 million movement in net debt related

predominantly to foreign currency translation.

Liquidity risk

The Group finances its borrowings from a number of sources

including the bank, the public and the private placement markets.

The Group has developed long term relationships with a number of

financial counterparties with the balance sheet strength and credit

quality to provide credit facilities as required. The Group seeks

to avoid a concentration of debt maturities in any one period to

spread its refinancing risk.

The maturity profile of the Group's principal borrowings at 30

September 2017 shows that the average period to maturity is 5.6

years (2016: 5.0 years).

The Group's undrawn committed bank facilities at 30 September

2017 were GBP1,387 million (2016: GBP1,000 million).

Financial management

The Group continues to manage its interest rate and foreign

currency exposure in accordance with the policies set out

below.

The Group's financial instruments comprise cash, borrowings,

receivables and payables that are used to finance the Group's

operations. The Group also uses derivatives, principally interest

rate swaps, forward currency contracts and cross currency swaps, to

manage interest rate and currency risks arising from the Group's

operations. The Group does not trade in financial instruments. The

Group's treasury policies are designed to mitigate the impact of

fluctuations in interest rates and exchange rates and to manage the

Group's financial risks. The Board approves any changes to the

policies. These policies have not changed in the year.

Foreign currency risk

The Group's policy is to match as far as possible its principal

projected cash flows by currency to actual or effective borrowings

in the same currency. As currency cash flows are generated, they

are used to service and repay debt in the same currency. Where

necessary, to implement this policy, forward currency contracts and

cross currency swaps are taken out which, when applied to the

actual currency borrowings, convert these to the required

currency.

The borrowings in each currency can give rise to foreign

exchange differences on translation into sterling. Where the

borrowings either are less than, or equate to, the net investment

in overseas operations, these exchange rate movements are treated

as movements on reserves and recorded in the consolidated statement

of comprehensive income rather than in the income statement.

Non-sterling earnings streams are translated at the average rate

of exchange for the year. Fluctuations in exchange rates have

given, and will continue to give, rise to translation differences.

The Group is only partially protected from the impact of such

differences through the matching of cash flows to currency

borrowings.

Business Review (continued)

Interest rate risk

As set out above, the Group has effective borrowings in a number

of currencies and its policy is to ensure that, in the short term,

it is not materially exposed to fluctuations in interest rates in

its principal currencies. The Group implements this policy either

by borrowing fixed rate debt or by using interest rate swaps so

that the interest rates on at least 80% of the Group's projected

debt are fixed for one year, reducing to 60% fixed for the second

year and 40% fixed for the third year.

Group tax policy

As a Group, we are committed to creating long term shareholder

value through the responsible, sustainable and efficient delivery

of our key business objectives. This will enable us to grow the

business and make significant investments into the Group and its

operations.

We therefore adopt an approach to tax that supports this

strategy and also balances the various interests of our

stakeholders including shareholders, governments, employees and the

communities in which we operate. Our aim is to pursue a principled

and sustainable tax strategy that has strong commercial merit and

is aligned with our business strategy. We believe this will enhance

shareholder value whilst protecting Compass' reputation.

In doing so, we act in compliance with the relevant local and

international laws and disclosure requirements, and we conduct an

open and transparent relationship with the relevant tax authorities

that fully complies with the Group's Code of Business Conduct and

Code of Ethics.

In an increasingly complex international environment, a degree

of tax risk and uncertainty is, however, inevitable. We manage and

control these risks in a proactive manner and in doing so, exercise

our judgement and seek appropriate advice from relevant

professional firms. Tax risks are assessed as part of the Group's

formal governance process and are reviewed by the Board and the

Audit Committee on a regular basis.

Risks and uncertainties

The Board takes a proactive approach to risk management with the

aim of protecting its employees and customers and safeguarding the

interests of the Group, its shareholders, employees, clients,

consumers and all other stakeholders.

The principal risks and uncertainties that face the business and

the activities the Group undertakes to mitigate these are set out

on pages 17 to 20.

Going concern

The Group's business activities, together with the factors

likely to affect its future development, performance and position

are set out in the Business Review, as is the financial position of

the Group, its cash flows, liquidity position, and borrowing

facilities.

The Group has considerable financial resources together with

longer term contracts with a number of clients and suppliers across

different geographic areas and industries. As a consequence, the

directors believe that the Group is well placed to manage its

business risks successfully.

After making enquiries, the directors have a reasonable

expectation that the Group has adequate resources to continue in

operational existence for the 12 months from the date of approval

of the Annual Report. For this reason, they continue to adopt the

going concern basis in preparing the financial statements.

Johnny Thomson

Group Finance Director

21 November 2017

Focus on Risk

Identifying and managing risk

The Board continues to take a proactive approach to recognising,

assessing and mitigating risk with the aim of protecting its

employees and consumers and safeguarding the interests of the

Company and its shareholders in the constantly changing environment

in which it operates.

As set out in the Corporate Governance section within the Annual

Report, the Group has policies and procedures in place to ensure

that risks are properly identified, evaluated and managed at the

appropriate level within the business.

The identification of risks and opportunities, the development

of action plans to manage the risks and maximise the opportunities,

and the continual monitoring of progress against agreed key

performance indicators (KPIs) are integral parts of the business

process and core activities throughout the Group.

The table on pages 18 to 20 sets out the principal risks and

uncertainties facing the business at the date of this announcement.

These have been subject to robust assessment and review. They do

not comprise all of the risks that the Group may face and are not

listed in any order of priority. Additional risks and uncertainties

not presently known to management, or deemed to be less material at

the date of this announcement, may also have an adverse effect on

the Group. These include risks resulting from the UK's decision to

leave the EU and the potential for US tax reform which could

adversely affect the risks noted under the 'economic and political

environment' section of the table on the following pages as well as

affecting financial risks such as liquidity and credit. The Board

views the potential impact of Brexit as an integral part of its

principal risks rather than a stand-alone risk. However, there is

still significant uncertainty about the withdrawal process, its

timeframe, and the outcome of negotiations about future

arrangements between the UK and the EU, and the period for which

existing EU laws for member states will continue to apply to the

UK. Therefore, although the risks related to Brexit have been

discussed by the Board, it remains too early to properly understand

the impact on the business whilst negotiations continue to take

place. The Board will continue to assess the risk to the business

as the Brexit process evolves.

The Group has significant operations and a substantial employee

base in the USA where the new administration has signalled broad

policy changes. Some of these potential changes in policy are in

respect of trade and tax, none of which are clear at this stage. We

are closely monitoring developments from the new administration and

will continue to assess the impact of any changes and the extent to

which they will be enacted.

In accordance with the provisions of the UK Corporate Governance

Code, the Board has taken into consideration the principal risks in

the context of determining whether to adopt the going concern basis

of accounting and when assessing the prospects of the Company for

the purpose of preparing the Viability Statement. The Going Concern

and Viability Statement can be found in the Strategic Report in the

Annual Report.

The Group faces a number of operational risks on an ongoing

basis such as litigation and financial (including liquidity and

credit) risk and some wider risks, for example, environmental and

reputational. Additionally, there are risks (such as those relating

to the eurozone economy, pensions, and acquisitions and

investments) which vary in importance depending on changing

conditions. All risks disclosed in previous years can be found in

the annual reports available on our website at

www.compass-group.com. We recognise that these risks remain

important to the business and they are kept under review. However,

we have focused the disclosures on pages below on those risks that

are currently considered to be more significant to the Group.

Focus on Risk (continued)

Principal risks

-- Increased risk Consistent risk

RISKS DESCRIPTION EXAMPLES OF MITIGATION

HEALTH AND SAFETY

Health and Health and safety All management meetings

safety is our number one throughout the Group

operational priority. feature a health and

We are focused on safety update as their

protecting people's first substantive

wellbeing, as well agenda item.

as avoiding serious

business interruption

and potential damage

to our reputation.

Compass feeds millions

of consumers and employs

thousands of people

around the world every

day. Therefore, setting

the highest standards

for food hygiene and

safety is paramount.

2017 Health and safety

improvement KPIs are

included in the annual

bonus plans for each

of the business' management

teams.

2016 The Group has policies,

procedures and standards

in place to ensure

compliance with legal

obligations and industry

standards.

The safety and quality

of our global supply

chain are assured

through compliance

against a robust set

of standards which

are regularly reviewed,

audited and upgraded

as necessary to improve

supply chain visibility

and product integrity.

CLIENTS AND CONSUMERS

Client and Our business relies We have strategies

consumer sales on securing and retaining which strengthen our

retention a diverse range of long term relationships

clients. with our clients and

consumers based on

quality, value and

innovation.

2017 Our business model

is structured so that

we are not reliant

on one particular

sector, geography

or group of clients.

2016

---------------- ------------------------------- ---------------------------------

Bidding Each year, the Group A rigorous tender

could bid for a large review process is

number of opportunities. in place, which includes

a critical assessment

of contracts to identify

potential risks (including

social and ethical

risks) and rewards,

prior to approval

at an appropriate

level in the organisation.

2017

2016

---------------- ------------------------------- ---------------------------------

Service delivery The Group's operating Processes are in place

and contractual companies contract to ensure that the

compliance with a large number services delivered

2017 of clients. Failure to clients are of

2016 to comply with the an appropriate standard

terms of these contracts, and comply with the

including proper delivery required contract

of services, could terms and conditions.

lead to loss of business.

---------------- ------------------------------- ---------------------------------

Competition We operate in a highly We aim to minimise

competitive marketplace. this by continuing

The levels of concentration to promote our differentiated

and outsource penetration propositions and by

vary by country and focusing on our points

by sector. Some markets of strength, such

are relatively concentrated as flexibility in

with two or three our cost base, quality

key players. Others and value of service

are highly fragmented and innovation.

and offer significant

opportunities for

consolidation and

penetration of the

self-operated market.

Aggressive pricing

from our competitors

could cause a reduction

in our revenues and

margins.

2017

2016

Focus on Risk (continued)

RISKS DESCRIPTION EXAMPLES OF MITIGATION

PEOPLE

Recruitment Failure to attract The Group aims to

and recruit people mitigate this risk

with the right skills by efficient, time

at all levels could critical resource

limit the success management, mobilisation

of the Group. The of existing, experienced

Group faces resourcing employees within the

challenges in some organisation, improved

of its businesses use of technology

due to a lack of industry and through offering

experience amongst training and development

candidates and appropriately programmes.

qualified people,

and the seasonal nature

of some of our business.

2017

2016

--------------- -------------------------------- ----------------------------

Retention Retaining and motivating The Group has established

and motivation the best people with training, development,

the right skills, performance management

at all levels of the and reward programmes

organisation, is key to retain, develop

to the long term success and motivate our best

of the Group. people.

2017 The Group has a well

established employee

engagement initiative,

Your Voice, which

helps us to monitor,

understand and respond

to our employees'

needs.

2016

ECONOMIC AND POLITICAL ENVIRONMENT

Economy Some sectors of our With the variable

business could be and flexible nature

susceptible to adverse of our cost base,

changes in economic it is generally possible

conditions and employment to contain the impact

levels. of these adverse conditions.

2017

2016

-------------- --------------------------------- ----------------------------------

Cost inflation Our objective is always As part of our MAP

to deliver the right framework, we seek

level of service in to manage inflation

the most efficient by continuing to drive

way. An increase in greater efficiencies

the cost of labour, through menu management,

for example, minimum supplier rationalisation,

wages in the USA and labour scheduling

UK, or food, especially and productivity.

in countries such Cost indexation in

as Brazil, could constitute our contracts also

a risk to our ability gives us the contractual

to do this. right to review pricing

with our clients.

2017

2016

-------------- --------------------------------- ----------------------------------

Political We are a global business The Group remains

stability operating in countries vigilant to future

and regions with diverse changes presented

economic and political by emerging markets

conditions. Our operations or fledgling administrations

and earnings may be and we try to anticipate

adversely affected and contribute to

by political or economic important changes

instability caused, in public policy.

for example, by the

UK's decision to leave

the EU.

2017

2016

COMPLIANCE AND FRAUD

Compliance Ineffective compliance The Group's zero tolerance

and fraud management with increasingly based Codes of Business

complex laws and regulations, Conduct and Ethics

or evidence of fraud, continue to govern

could have an adverse all aspects of our

effect on the Group's relationships with

reputation and could our stakeholders.

result in an adverse All alleged breaches

impact on the Group's of the Codes, including

performance if significant any allegations of

financial penalties fraud, are investigated.

are levied or a criminal

action is brought

against the Company

or its directors.

2017 The Group's procedures

include regular operating

reviews, underpinned

by a continual focus

on ensuring the effectiveness

of internal controls.

2016 Regulation and compliance

risk is also considered

as part of our annual

business planning

process.

-------------- --------------------------------- ----------------------------------

Focus on Risk (continued)

RISKS DESCRIPTION EXAMPLES OF MITIGATION

COMPLIANCE AND FRAUD

Tax compliance As a Group, we seek We manage and control

to plan and manage these risks in a proactive

our tax affairs efficiently manner and in doing

in the jurisdictions so exercise our judgement

in which we operate. and seek appropriate

In doing so, we act advice from reputable

in compliance with professional firms.

the relevant laws Tax risks are assessed

and disclosure requirements. as part of the Group's

formal governance

process and are reviewed

by the Board and the

Audit Committee on

a regular basis.

2017 However, in an increasingly

complex international

corporate tax environment,

a degree of uncertainty

is inevitable and

we note in particular

the policy efforts

being led by the EU

and the OECD which

may have a material

impact on the taxation

of all international

businesses.

2016

INFORMATION SYSTEMS AND TECHNOLOGY

Information The digital world We seek to assess

systems and creates many risks and manage the maturity

technology for a global business of our enterprise

including technology risk and security

failures, loss of infrastructure and

confidential data our ability to effectively

and damage to brand defend against current

reputation, through, and future cyber risks

for example, the use by using analysis

of social media. tools and experienced

professionals to evaluate

and mitigate potential

impacts.

2017 The Group relies on

a variety of IT systems

in order to manage

and deliver services

and communicate with

our clients, consumers,

suppliers and employees.

2016 We are focused on

the need to maximise

the effectiveness

of our information

systems and technology

as a business enabler

and to reduce both

cost and exposure

as a result.

============== ================================ ==============================

Compass Group PLC

Consolidated Financial Statements

CONSOLIDATED INCOME STATEMENT

FOR THE YEARED 30 SEPTEMBER 2017

Total Total

2017 2016

Notes GBPm GBPm

Combined sales of Group and share

of equity accounted joint ventures 2 22,852 19,871

Less: share of sales of equity

accounted joint ventures (284) (266)

======================================================================== ========== ========= =========

Revenue 22,568 19,605

Operating costs (20,945) (18,235)

======================================================================== ========== ========= =========

Operating costs, excluding Emerging

Markets and Offshore & Remote

restructuring (20,945) (18,210)

Emerging Markets and Offshore

& Remote restructuring - (25)

======================================================================== ========== ========= =========

Operating profit before joint

ventures and associates 1,623 1,370

Share of profit after tax of joint

ventures and associates 42 39

======================================================================== ========== ========= =========

Operating profit 1,665 1,409

======================================================================== ========== ========= =========

Underlying operating profit(1) 2 1,705 1,445

Amortisation of intangibles arising

on acquisition (39) (31)

Acquisition transaction costs (2) (2)

Adjustment to contingent consideration

on acquisition 3 -

Share-based payments expense -

non-controlling interest call

option - (1)

Tax on share of profit of joint

ventures (2) (2)

======================================================================== ========== ========= =========

Profit on disposal of businesses - 1

Finance income 6 4

Finance costs (120) (105)

Other financing items 9 12

Profit before tax 1,560 1,321

Income tax expense 3 (389) (319)

======================================================================== ========== ========= =========

Profit for the year 1,171 1,002

======================================================================== ========== ========= =========

ATTRIBUTABLE TO

Equity shareholders of the Company 1,161 992

Non-controlling interests 10 10

======================================================================== ========== ========= =========

Profit for the year 1,171 1,002

======================================================================== ========== ========= =========

BASIC EARNINGS PER SHARE (PENCE) 4 71.3p 60.4p

======================================================================== ========== ========= =========

DILUTED EARNINGS PER SHARE (PENCE) 4 71.3p 60.3p

======================================================================== ========== ========= =========

5

(1) Underlying operating profit excludes amortisation

of intangibles arising on acquisition, acquisition

transaction costs, adjustment to contingent consideration

on acquisition and share-based payments expense

relating to non-controlling interest call options,

but includes share of profit after tax of associates

and operating profit of joint ventures.

Compass Group PLC

Consolidated Financial Statements (continued)

CONSOLIDATED STATEMENT OF COMPREHENSIVE

INCOME

FOR THE YEARED 30 SEPTEMBER 2017

2017 2016

============================================== ===

GBPm GBPm

================================================= === ====== ======

Profit for the year 1,171 1,002

================================================= === ====== ======

Other comprehensive income

Items that are not reclassified subsequently

to profit or loss

Remeasurement of post employment benefit

obligations - gain / (loss) 125 (500)

Return on plan assets, excluding interest

income - gain / (loss) (96) 480

Tax on items relating to the components of

other comprehensive income (8) 6

================================================= === ====== ======

21 (14)

================================================= === ====== ======

Items that may be reclassified subsequently

to profit or loss

Currency translation differences (47) 158

================================================= === ====== ======

(47) 158

================================================= === ====== ======

Total other comprehensive (loss)/income for

the year (26) 144

================================================= === ====== ======

Total comprehensive income for the year 1,145 1,146

================================================= === ====== ======

ATTRIBUTABLE TO

Equity shareholders of the Company 1,135 1,136

Non-controlling interests 10 10

================================================= === ====== ======

Total comprehensive income for the year 1,145 1,146

================================================= === ====== ======

Compass Group PLC

Consolidated Financial Statements (continued)

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED

30 SEPTEMBER 2017

Attributable to equity

shareholders of the Company

=========================================================

Share Capital

Share premium redemption Other Retained Non-controlling

capital account reserve reserves earnings interests Total

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

================== ======== ======== =========== ============= ========= ================ ===========

At 1 October 2016 176 182 295 4,359 (2,507) 15 2,520

Profit for the

year - - - - 1,161 10 1,171

================== ======== ======== =========== ============= ========= ================ ===========

Other

comprehensive

income

Currency

translation

differences - - - (47) - - (47)

Remeasurement of

post

employment

benefit

obligations -

gain - - - - 125 - 125

Return on plan

assets,

excluding

interest

income - loss - - - - (96) - (96)

Tax on items

relating

to the

components

of other

comprehensive

income - - - (1) (7) - (8)

================== ======== ======== =========== ============= ========= ================ ===========

Total other

comprehensive

(loss)/income - - - (48) 22 - (26)

================== ======== ======== =========== ============= ========= ================ ===========

Total

comprehensive

(loss)/income

for

the year - - - (48) 1,183 10 1,145

Fair value of

share-based

payments - - - 21 - - 21

Use of treasury

shares

to satisfy

employee

share scheme

awards - - - (3) - - (3)

Tax on items

taken

directly to

equity - - - - 3 - 3

Share buyback(1) - - - - (19) - (19)

Other changes - - - (9) (1) 10 -

================== ======== ======== =========== ============= ========= ================ ===========

176 182 295 4,320 (1,341) 35 3,667

Dividends paid to

Compass

shareholders

(note 5) - - - - (1,534) - (1,534)

Dividends paid to

non-controlling

interests - - - - - (13) (13)

================== ======== ======== =========== ============= ========= ================ ===========

At 30 September

2017 176 182 295 4,320 (2,875) 22 2,120

================== ======== ======== =========== ============= ========= ================ =========== ====

(1) Including stamp duty and brokers' commission.

Adjustment

for non-controlling

Share-based interest Total

payment Merger Revaluation Translation put options other

reserve reserve reserve reserve reserve Reserves

OTHER RESERVES GBPm GBPm GBPm GBPm GBPm GBPm

=========================== ============= ======== ============ ============ ===================== =========

At 1 October 2016 193 4,170 7 (5) (6) 4,359

=========================== ============= ======== ============ ============ ===================== =========

Other comprehensive

income

Currency translation

differences - - - (47) - (47)

Tax on items relating

to the components of

other comprehensive

income - - - (1) - (1)

=========================== ============= ======== ============ ============ ===================== =========

Total other comprehensive

loss - - - (48) - (48)

=========================== ============= ======== ============ ============ ===================== =========

Fair value of share-based

payments 21 - - - - 21

Use of treasury shares

to satisfy employee

share scheme awards (3) - - - - (3)

Other changes - - - - (9) (9)

=========================== ============= ======== ============ ============ ===================== =========

At 30 September 2017 211 4,170 7 (53) (15) 4,320

=========================== ============= ======== ============ ============ ===================== =========

Compass Group PLC

Consolidated Financial Statements (continued)

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 30 SEPTEMBER 2017

Attributable to equity

shareholders of the Company

===============================================================================

Share Capital

Share premium redemption Own Other Retained Non-controlling

capital account reserve shares reserves earnings interests Total

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

================== ========= ========= =========== ============ ============ ================ ================ ======

At 1 October 2015 176 182 295 (1) 4,189 (2,904) 13 1,950

Profit for the

year - - - - - 992 10 1,002

================== ========= ========= =========== ============ ============ ================ ================ ======

Other

comprehensive

income

Currency

translation

differences - - - - 158 - - 158

Remeasurement of

post

employment

benefit

obligations -

loss - - - - - (500) - (500)

Return on plan

assets,

excluding

interest

income - gain - - - - - 480 - 480

Tax on items

relating

to the

components

of other

comprehensive

income - - - - (2) 8 - 6

================== ========= ========= =========== ============ ============ ================ ================ ======

Total other

comprehensive

income/(loss) - - - - 156 (12) - 144

================== ========= ========= =========== ============ ============ ================ ================ ======

Total

comprehensive

income for the

year - - - - 156 980 10 1,146

Fair value of

share-based

payments - - - 1 16 1 - 18

Release of LTIP

award

settled by issue

of

shares - - - - (2) - - (2)

Tax on items

taken

directly to

equity - - - - - 9 - 9

Share buyback(1) - - - - - (100) - (100)

Issue of treasury

shares

to satisfy

employee

share scheme

awards

exercised - - - - - 3 - 3

Other changes - - - - - - 1 1

================== ========= ========= =========== ============ ============ ================ ================ ======

176 182 295 - 4,359 (2,011) 24 3,025

Dividends paid to

Compass

shareholders

(note 5) - - - - - (496) - (496)

Dividends paid to

non-controlling

interests - - - - - - (9) (9)

================== ========= ========= =========== ============ ============ ================ ================ ======

At 30 September

2016 176 182 295 - 4,359 (2,507) 15 2,520

================== ========= ========= =========== ============ ============ ================ ================ ======

1 Including stamp duty and brokers' commission.

Adjustment

for

non-controlling

Share-based interest Total

payment Merger Revaluation Translation put options other

reserve reserve reserve reserve reserve reserves

OTHER RESERVES GBPm GBPm GBPm GBPm GBPm GBPm

=================== ==================== =========== ============ ============ ================ ========================

At 1 October 2015 179 4,170 7 (161) (6) 4,189

=================== ==================== =========== ============ ============ ================ ========================

Other

comprehensive

income

Currency

translation

differences - - - 158 - 158

Tax on items

relating

to the components

of

other

comprehensive

income - - - (2) - (2)

=================== ==================== =========== ============ ============ ================ ========================

Total other

comprehensive

income - - - 156 - 156

=================== ==================== =========== ============ ============ ================ ========================

Fair value of

share-based

payments 16 - - - - 16

Release of LTIP

award

settled by issue

of

shares (2) - - - - (2)

=================== ==================== =========== ============ ============ ================ ========================

At 30 September

2016 193 4,170 7 (5) (6) 4,359

=================== ==================== =========== ============ ============ ================ ========================

Compass Group PLC

Consolidated Financial Statements (continued)

CONSOLIDATED BALANCE SHEET

AS AT 30 SEPTEMBER 2017

2017 2016

Notes GBPm GBPm

==================================================== ======= ======== ========

NON-CURRENT ASSETS

Goodwill 3,994 4,050

Other intangible assets 1,537 1,469

Property, plant and equipment 1,000 953

Interests in joint ventures and associates 220 222

Other investments 63 50

Post employment benefit assets(1) 259 244

Trade and other receivables 104 97

Deferred tax assets* 132 149

Derivative financial instruments** 7 139 184

==================================================== ======= ======== ========

Non-current assets 7,448 7,418

==================================================== ======= ======== ========

CURRENT ASSETS

Inventories 353 347

Trade and other receivables 2,701 2,596

Tax recoverable* 86 77

Cash and cash equivalents** 7 387 346

Derivative financial instruments** 7 4 2

==================================================== ======= ======== ========

Current assets 3,531 3,368

==================================================== ======= ======== ========

Total assets 10,979 10,786

==================================================== ======= ======== ========

CURRENT LIABILITIES

Short term borrowings** 7 (20) (321)

Derivative financial instruments** 7 (6) (9)

Provisions (132) (143)

Current tax liabilities* (227) (195)

Trade and other payables (3,892) (3,851)

==================================================== ======= ======== ========

Current liabilities (4,277) (4,519)

==================================================== ======= ======== ========

NON-CURRENT LIABILITIES

Long term borrowings** 7 (3,939) (3,075)

Derivative financial instruments** 7 (11) (1)

Post employment benefit obligations (231) (265)

Provisions (266) (280)

Deferred tax liabilities* (48) (40)

Trade and other payables (87) (86)

==================================================== ======= ======== ========

Non-current liabilities (4,582) (3,747)

==================================================== ======= ======== ========

Total liabilities (8,859) (8,266)

==================================================== ======= ======== ========

Net assets 2,120 2,520

==================================================== ======= ======== ========

EQUITY

Share capital 176 176

Share premium account 182 182

Capital redemption reserve 295 295

Other reserves 4,320 4,359

Retained earnings (2,875) (2,507)

Total equity shareholders' funds 2,098 2,505

Non-controlling interests 22 15

==================================================== ======= ======== ========

Total equity 2,120 2,520

==================================================== ======= ======== ========

* Component of current and deferred taxes.

** Component of net debt.

(1) Represented to reclassify GBP244 million of post

employment defined benefit pension schemes in a net surplus

position included within post employment benefit obligations

for the year ended 30 September 2016. As a result, non-current

assets and non-current liabilities have increased by

the same amount.

Approved by the Board of Directors on 21 November 2017

and signed on their behalf by

RICHARD COUSINS, Director

JOHNNY THOMSON, Director

Compass Group PLC

Consolidated Financial Statements (continued)

CONSOLIDATED CASH FLOW STATEMENT

FOR THE YEARED 30 SEPTEMBER 2017

2017 2016

Notes GBPm GBPm

===================================================== ====== ======== ======

CASH FLOW FROM OPERATING ACTIVITIES

Cash generated from operations 6 2,068 1,768

Interest paid (103) (98)

Tax received 25 17

Tax paid (357) (263)

===================================================== ====== ======== ======

Net cash from operating activities 1,633 1,424

===================================================== ====== ======== ======

CASH FLOW FROM INVESTING ACTIVITIES

Purchase of subsidiary companies and investments

in associated undertakings(1) (96) (180)

Purchase of additional interest joint operations (5) -

Proceeds from sale of subsidiary companies

and associated undertakings(1) 19 2

Purchase of intangible assets (339) (267)

Purchase of property, plant and equipment(2) (376) (311)

Proceeds from sale of property, plant and

equipment/intangible assets 32 29

Purchase of other investments (8) (6)

Proceeds from sale of other investments - 2

Dividends received from joint ventures and

associates 39 33

Interest received 6 4

===================================================== ====== ======== ======

Net cash used in investing activities (728) (694)