Companies Move to Reprice Employees' Stock Options

September 12 2016 - 7:30PM

Dow Jones News

By Alix Stuart

Stock-option exchanges are making a bit of a comeback, despite a

strong stock market and worries about the shareholder pushback they

can generate.

Such exchanges, which let employees trade nearly worthless

options for new options or restricted stock, have been proposed or

implemented by at least 10 publicly traded companies so far this

year, according to proxy-advisory firm Institutional Shareholder

Services -- up from seven last year, and three in 2014.

Options repricing surged in popularity after the dot-com bust in

the early 2000s, then again following the financial crisis in 2009,

when many employee stock options became underwater: The company's

stock had fallen way below the price at which they had the right to

buy shares.

Eighty companies including Apple Inc., Starbucks Corp. and

Google -- now Alphabet Inc. -- allowed employees to trade in

underwater options in 2009. Back then, about 25% of companies

swapped the options without consulting shareholders, according to

ISS data.

For the most part, the trend these days is confined to younger

firms that have recently gone public, said Brett Harsen, partner

for Radford, a part of Aon Hewitt, a consulting company.

"Companies that have lower values are competing for employees

with companies with stronger equity," said Robert Finkel, a partner

with the Boston-based law firm of Morse, Barnes-Brown &

Pendleton PC. "And equity is still a very important part of

compensation, particularly for technology companies."

Shares of Jive Software Inc., a maker of business software, slid

below $4 in March from a high of $27.16 in 2012. That left more

than 25% of the options held by the company's employees out of the

money, with their strike prices far above Jive's then current

trading price.

The Palo Alto, Calif., company pitched the idea of an option

exchange to shareholders and a majority approved. Nearly 80% of

eligible options were exchanged over the past two months for

restricted stock units that vest over two years.

"We were looking for ways wherever we could to help the people

who were staying with Jive be as incented and motivated as

possible," said Bryan LeBlanc, Jive's finance chief.

In the exchange process, Jive and other companies are offering

employees restricted stock units that automatically convert to

shares in place of the options to eliminate future uncertainty.

Companies typically take great pains to ensure that exchange

terms are acceptable to shareholders as well as employees. That

means executives and directors don't participate and employees

receive a value equivalent to their initial grant. While

shareholders approve most exchanges, companies only float them when

they know such approval is forthcoming, said Mr. Harsen.

Since 2012, Jive has used restricted stock exclusively for

nonexecutive employee equity awards, said Mr. LeBlanc.

Restricted stock has become much more popular partly because it

is easier to account for. It also lowers the risk to employees.

Such options exchanges can benefit companies by reducing

compensation expenses, since companies are required to expense the

value of outstanding stock options even when they are

underwater.

And for employees who receive new options, there is no guarantee

their prospects will improve. Electronics retailer hhgregg Inc.

repriced options with a three-year vesting schedule for 58

employees on May 1, 2013 to the then-current trading price of

$13.56, according to a filing. Since 2014, the stock hasn't

returned to that level, and is currently trading around $2 per

share.

A hhgregg representative declined to comment.

The process of structuring and executing an exchange can take up

to 12 months and cost as much as $300,000, estimates Sorrell

Johnson, senior equity compensation consultant with Stock &

Options Solutions. Terms often change along the way, as an

improving or declining stock price can affect the number of

eligible options and the new strike price.

How effectively such exchanges are in retaining employees is

hard to calculate, since most companies don't disclose turnover,

which is subject to other factors in any case.

(END) Dow Jones Newswires

September 12, 2016 19:15 ET (23:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

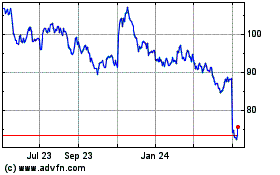

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Mar 2024 to Apr 2024

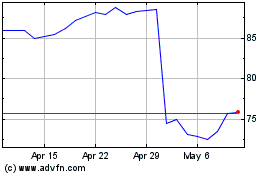

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Apr 2023 to Apr 2024