Commodity Currencies Slide Amid Rising Risk Aversion

February 10 2016 - 8:07PM

RTTF2

Commodity currencies such as the Australian, the New Zealand and

the Canadian dollars weakened against their major counterparts in

the Asian session on Thursday amid rising risk aversion as U.S.

Federal Reserve Chair Janet Yellen's dovish comments failed to

bolster investor sentiment and amid volatility in crude oil

prices.

In her semi-annual monetary policy report prepared for delivery

to the House Financial Services, Yellen admitted that "downside

risks" from exposure to the slowing Chinese economy could hurt the

U.S.

Although Fed projections call for three or four rate hikes this

year, Yellen said that monetary policy is not on a preset course

and reiterated the oft-repeated statement that the path of the

federal funds rate will depend on incoming data.

Crude oil prices fell due to over supply and a slowdown in

Chinese economy. Crude oil for March delivery are currently down

$0.47 at $26.98 a barrel.

In other economic news, data from the Business New Zealand

showed that the Business NZ Performance of Manufacturing Index, or

PMI, rose to 57.9 in January from 57.0 in December. This was the

highest level of growth since October 2014. Moreover, the sector

has now been in continued expansion since October 2012. Wednesday,

the Australian and the New Zealand dollars showed mixed performance

against their major rivals. While the aussie and the kiwi rose

against the U.S. dollar and the euro, they held steady against the

yen.

Meanwhile, the Canadian dollar fell against its major rivals, as

worries about global economic growth and fall in commodity prices

weighed on investor sentiment. The Canadian dollar fell 0.27

percent against the U.S. dollar, 1.97 against the yen and 0.53

against the euro.

In the Asian trading, the Australian dollar fell to more than a

3-week low of 79.80 against the yen, from yesterday's closing value

of 80.38. The aussie is likely to find support around the 78.00

area.

The aussie edged down to 1.5941 against the euro, from

yesterday's closing value of 1.5899. On the downside, 1.62 is seen

as the next support level for the aussie.

Against the U.S. and the Canadian dollars, the aussie dropped to

0.7084 and 0.9873 from an early 6-day high of 0.7153 and a 9-day

high of 0.9930, respectively. If the aussie extends its downtrend,

it is likely to find support around 0.69 against the greenback and

0.97 against the loonie.

The NZ dollar fell to a 3-week low of 75.08 against the yen,

from yesterday's closing value of 75.73. The kiwi may test support

near the 73.00 region.

The kiwi dropped to 1.6936 against the euro, from yesterday's

closing value of 1.6876. On the downside, 1.72 is seen as the next

support level for the kiwi.

Against the U.S. and the Australian dollars, the kiwi edged down

to 0.6664 and 1.0646 from an early 6-day high of 0.6734 and a 2-day

high of 1.0599, respectively. If the kiwi extends its downtrend, it

is likely to find support around 0.65 against the greenback and

1.07 against the aussie.

The Canadian dollar fell to 3-week lows of 1.5752 against the

euro and 80.72 against the yen, from yesterday's closing quotes of

1.5718 and 81.35, respectively. If the loonie extends its

downtrend, it is likely to find support around 1.61 against the

euro, 78.00 against the yen

Against the U.S. dollar, the loonie dropped to 1.3948 from

yesterday's closing value of 1.3922. The loonie is likely to find

support around the 1.43 area.

Meanwhile, the safe-haven yen rose against its major rivals amid

rising risk aversion.

The yen rose to more than a 2-year high of 163.59 against the

pound and a 16-month high of 112.53 against the U.S. dollar, from

yesterday's closing quotes of 164.56 and 113.32, respectively. If

the yen extends its uptrend, it is likely to find resistance around

162.00 against the pound and 111.00 against the greenback.

Against the euro and the Swiss franc, the yen advanced to 3-week

highs of 127.13 and 115.82 from yesterday's closing quotes of

127.96 and 116.39, respectively. The yen is likely to find

resistance around 126.00 against the euro and 114.00 against the

franc.

Looking ahead, Swiss CPI data for January is due to be released

at 3:15 am ET.

At 6:30 am ET, Bank of England deputy governors Jon Cunliffe and

Andrew Bailey will appear at the Lords committee on euro zone

financial system in London.

In the New York session, U.S. weekly jobless claims for the week

ended February 6 and Canada new housing price index for December

are due to be released.

At 10:00 am ET, Federal Reserve Chair Janet Yellen will testify

on the Semiannual Monetary Policy Report before the Senate Banking

Committee in Washington DC.

Eurozone finance ministers will meet in Brussels later in the

day.

The Chinese market continues to remain closed in observance of

the week-long Golden Week holidays and the Japanese banks are

closed in observance of the National Foundation Day holiday.

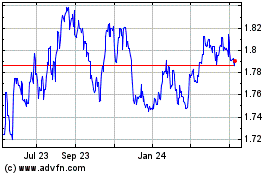

Euro vs NZD (FX:EURNZD)

Forex Chart

From Mar 2024 to Apr 2024

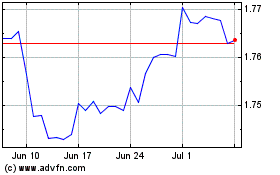

Euro vs NZD (FX:EURNZD)

Forex Chart

From Apr 2023 to Apr 2024