Commodity Currencies Rise Amid Rising Risk Appetite

May 30 2016 - 11:14PM

RTTF2

Commodity currencies such as the Australian, the New Zealand and

the Canadian dollars strengthened against the other major

currencies in the Asian session on Tuesday amid rising risk

appetite, as investors were keeping an eye on economic data from

the region in the absence of cues from Wall Street, which was

closed overnight for a public holiday. Meanwhile, rising oil prices

also lifted the sentiment.

Crude oil for July delivery are currently up $0.33 to $49.66 a

barrel. Crude oil prices rose as oversupply concerns ease ahead of

this week's OPEC meeting.

The aussie started rising after the release of Australia's

upbeat building approvals data in April.

Data from the Australian Bureau of Statistics showed that the

seasonally adjusted estimate for total dwellings approved rose 3.0

percent monthly in April, following a 2.9 percent spike in March.

It was the second successive monthly increase. Meanwhile,

economists had expected a 3.0 percent fall for the month.

On an annual basis, building consents went up 0.7 percent in

April, reversing a 5.4 percent decline a month earlier.

Also, Australia's seasonally adjusted current account deficit

narrowed to A$20.8 billion in the first quarter from A$22.6 billion

in the fourth quarter. In seasonally adjusted chain volume terms,

the surplus on goods and services increased to A$12.6 billion from

A$7.8 billion.

The kiwi started rising after the release of New Zealand's

upbeat business confidence data in May.

Data from ANZ Bank showed that the business confidence index

climbed to 11.3 in May from 6.2 in the previous month. The survey

showed a net 11 percent of businesses were optimistic about

prospects over the coming year. The index measuring profit

expectations rose to 20.0 in April from 16.0 a month earlier. It

was the fourth consecutive increase.

The upbeat economic data from the Australia and the New Zealand

is likely to reduce the chances of interest rate cuts by its

central banks in June. The Reserve Bank of Australia is expected to

holds its monthly policy review on June 7, while the Reserve Bank

of New Zealand releases its full monetary policy statement on June

9.

Monday, the Australian, the New Zealand and the Canadian dollars

showed mixed trading against their major counterparts. While the

aussie, the kiwi and the loonie fell against the U.S. dollar, they

rose against the yen.

Meanwhile, the aussie and the kiwi fell against the euro, but

the loonie held steady against the euro.

In the Asian trading, the Australian dollar rose to 2-week highs

of 1.5395 against the euro and 80.47 against the yen, from

yesterday's closing quotes of 1.5502 and 79.79, respectively. The

aussie may test resistance near 1.50 against the euro and 82.00

against the yen.

Against the U.S., the Canadian and the New Zealand dollars, the

aussie advanced to a 5-day high of 0.7242, 6-day high of 0.9433 and

nearly a 2-week high of 1.0766 from yesterday's closing quotes of

0.7182, 0.9369 and 1.0726, respectively. If the aussie extends its

uptrend, it is likely to find resistance around 0.74 against the

greenback, 0.95 against the loonie and 1.10 against the kiwi.

The NZ dollar rose to more than a 1-month high of 74.93 against

the yen, from yesterday's closing value of 74.37. On the upside,

76.00 is seen as the next resistance level for the kiwi.

Against the euro and the U.S. dollar, the kiwi advanced to 4-day

highs of 1.6560 and 0.6732 from yesterday's closing quotes of

1.6628 and 0.6693, respectively. If the kiwi extends its uptrend,

it is likely to find resistance around 1.63 against the euro and

0.68 against the greenback.

The Canadian dollar rose to more than a 1-month high of 85.51

against the yen and a 4-day high of 1.3017 against the U.S. dollar,

from yesterday's closing quotes of 85.13 and 1.3046, respectively.

If the loonie extends its uptrend, it is likely to find resistance

around 88.00 against the yen and 1.28 against the greenback.

Against the euro, the loonie edged up to 1.4502 from yesterday's

closing value of 1.4529. The loonie is likely to find resistance

around the 1.42 area.

Looking ahead, German unemployment rate for May, Eurozone

consumer prices for May and jobless rate for April are due to be

released later in the day.

At 4:30 am ET, the Bank of Italy releases its annual report,

with governor Ignazio Visco set to give a speech in Rome.

In the New York session, Canada GDP for March, U.S. personal

income and spending data for April, U.S. S&P/Case-Shiller home

price index for March, U.S. Chicago PMI for May and U.S. consumer

confidence index for May are slated for release.

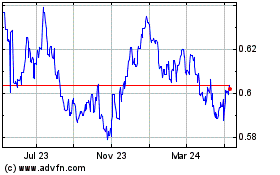

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Mar 2024 to Apr 2024

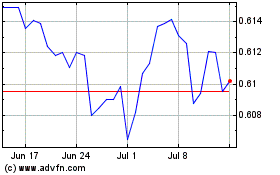

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Apr 2023 to Apr 2024