Commodity Currencies Rise Amid Rising Risk Appetite

August 13 2015 - 1:51AM

RTTF2

The commodity currencies such as the Australian, New Zealand and

the Canadian dollars strengthened against their major currencies in

the Asian session on Thursday despite China lowering the yuan's

reference rate further on Thursday.

Investors are cautiously optimistic following China's currency

devaluation. The People's Bank of China lowered its daily reference

rate 1.1 percent to 6.4010 yuan per dollar on Thursday, following

reductions of 1.6 percent on Wednesday and 1.9 percent on

Tuesday.

Meanwhile, crude oil prices rebounded amid the dollar weakness

and the release of official data from the Energy Information

Administration showed crude stockpiles in the U.S. to have declined

last week, albeit less than expected.

In other economic news, data from the Statistics New Zealand

showed that food prices in New Zealand gained 0.6 percent on month

in July, following the 0.5 percent gain in June and the 0.4 percent

increase in May. On a yearly basis, food prices jumped 1.2 percent

after easing 0.1 percent in the previous month and 0.8 percent in

May.

Data from Melbourne Institute showed that Australia inflation

expectations increased further at a faster pace in August from the

previous month. The expected inflation rate rose to 3.7 percent in

August from 3.4 percent in July.

Wednesday, commodity currencies fell against their major rivals

following Chinese central bank devaluing its currency. The

Australian dollar fell 1.05 percent against the U.S. dollar, 0.31

percent against the yen and 0.78 percent against the euro. The NZ

dollar fell 1.19 percent against the U.S. dollar, 0.44 percent

against the yen and 0.79 percent against the euro. The Canadian

dollar fell 1.05 percent against the U.S. dollar, 0.31 percent

against the yen and 0.27 percent against the euro.

In the Asian trading, the Australian dollar recovered to 2-day

highs of 92.06 against the yen and 1.5046 against the euro, from

recent lows of 91.18 and 1.5208, respectively. At yesterday's

close, the aussie was trading at 91.68 against the yen and 1.5110

against the euro. If the aussie extends its uptrend, it is likely

to find resistance around 94.50 against the yen and 1.47 against

the euro.

Against the U.S. and the Canadian dollars, the aussie advanced

to 2-day highs of 0.7409 and 0.9603 from recent lows of 0.7331 and

0.9542, respectively. At yesterday's close, the aussie was trading

at 0.7382 against the greenback and 0.9579 against the loonie. The

aussie may test resistance around 0.74 against the greenback and

0.97 against the loonie.

The NZ dollar rose to 2-day highs of 82.51 against the yen and

1.6756 against the euro, from yesterday's closing quotes of 82.17

and 1.6854, respectively. If the kiwi extends its uptrend, it is

likely to find resistance around 83.50 against the yen and 1.65

against the euro.

Against the U.S. dollar, the kiwi edged up to 0.6641 from

yesterday's closing value of 0.6617. On the upside, 0.67 is seen as

the next resistance level for the kiwi.

The Canadian dollar rose to 2-day highs of 95.94 against the yen

and 1.4434 against the euro, from yesterday's closing quotes of

95.69 and 1.4476, respectively. If the loonie extends its uptrend,

it is likely to find resistance around 97.50 against the yen and

1.41 against the euro.

Against the U.S. dollar, the loonie edged up to 1.2955 from

yesterday's closing value of 1.2975. The loonie may test resistance

around the 1.28 area.

Meanwhile, the Australian dollar fell to 1.1118 against the NZ

dollar earlier and held steady thereafter.

Looking ahead, final German CPI estimate for July is due to be

released at 2:00 am ET.

Swiss producer and import prices for July are also set to be

announced later on in the day.

At 7:30 am ET, the European Central Bank is set to publish the

minutes of its July policy meeting.

In the New York session, U.S. advance retail sales data for

July, U.S. weekly jobless claims for the week ended August 8 and

Canada new housing price index for June are slated for release.

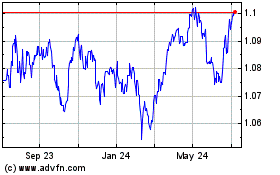

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Apr 2023 to Apr 2024