Commodity Currencies Rebound Amid Rising Risk Appetite

May 25 2016 - 10:36PM

RTTF2

Commodity currencies such as the Australian, the New Zealand and

the Canadian dollars rebounded from early lows against their major

counterparts in the Asian session on Thursday amid rising risk

appetite, as the crude oil prices rose near the $50 a barrel

mark.

Crude oil for July delivery are currently up $0.32 to $49.88 a

barrel. The crude oil price rose as official data confirmed a

significant draw down in U.S. oil inventories.

The U.S. Energy Information Administration reported that U.S.

crude supplies fell 4.2 million barrels for the week ended May 20.

Meanwhile, a two-day Group of Seven leaders' summit in Japan that

starts later on Thursday and a speech by U.S. Federal Reserve Chair

Janet Yellen on Friday, limited gains in the equity market.

The aussie fell earlier after the release of nation's capex data

but rebounded in a shortwhile.

Data from the Australian Bureau of Statistics showed that the

private capital expenditure in Australia was down a seasonally

adjusted 5.2 percent on quarter in the first three months of 2016,

standing at A$30.613 billion. That missed forecasts for a decline

of 3.5 percent following the 0.8 percent increase in the three

months prior.

Wednesday, the Australian, the New Zealand and the Canadian

dollars rose against their major counterparts. The Australian

dollar rose 0.51 percent against the yen and 0.06 percent against

the euro. Meanwhile, the aussie held steady against the U.S.

dollar.

The NZ dollar rose 0.07 percent against the U.S. dollar, 0.60

percent against the yen and 0.10 percent against the euro. The

Canadian dollar rose 0.78 percent against the U.S. dollar, 0.77

percent against the yen and 0.65 percent against the euro.

In the Asian trading, the Australian dollar rose to an 8-day

high of 1.0735 against the NZ dollar, from an early low of 1.0656.

The aussie may test resistance near the 1.10 region.

Against the U.S. dollar, the yen and the euro, the aussie edged

up to 0.7215, 79.12 and 1.5491 from early 2-day lows of 0.7163,

78.44 and 1.5594, respectively. If the aussie extends its uptrend,

it is likely to find resistance around 0.74 against the greenback,

82.00 against the yen and 1.50 against the euro.

The aussie advanced to 0.9361 against the Canadian dollar, from

an early more than 6-month low of 0.9325. The aussie is likely to

find resistance around the 0.98 area.

The NZ dollar rose to 1.6612 against the euro and 73.79 against

the yen, from early 2-day lows of 1.6678 and 73.45, respectively.

If the kiwi extends its uptrend, it is likely to find resistance

around 1.62 against the euro and 77.00 against the yen.

Against the U.S. dollar, the kiwi advanced to 0.6727 from an

early near 2-month low of 0.6696. On the upside, 0.68 is seen as

the next resistance level for the kiwi. The Canadian dollar rose to

more than a 3-week high of 1.4505 against the euro and an 8-day

high of 1.2973 against the U.S. dollar, from early lows of 1.4554

and 1.3037, respectively. If the loonie extends its uptrend, it is

likely to find resistance around 1.41 against the euro and 1.26

against the greenback

Against the yen, the loonie edged up to 84.58 from an early low

of 84.02. The loonie may test resistance near the 88.00 region.

Looking ahead, Swiss industrial production for the first

quarter, the second estimate of U.K. GDP data for the first quarter

and U.K. BBA mortgage approvals for April are due to be released

later in the day.

At 6:10 am ET, Federal Reserve Bank of St. Louis President James

Bullard will give Singapore City Lecture on the U.S. economy and

monetary policy before the Official Monetary and Financial

Institution Forum in Singapore.

In the New York session, U.S. durable good orders for April,

pending home sales data for April and U.S. weekly jobless claims

for the week ended May 21 are slated for release later in the

day.

At 9:00 am ET, Reserve Bank of Australia Assistant Governor Guy

Debelle will deliver opening remarks at the launch of the Global

Code of Conduct for the Foreign Exchange Market in New York.

At 12:00 pm ET, Federal Reserve Governor Jerome Powell will

deliver a speech titled "Recent Economic Developments, the

Productive Potential of the Economy, and Monetary Policy: Learning

from the Recovery" at the Peterson Institute for International

Economics in Washington DC.

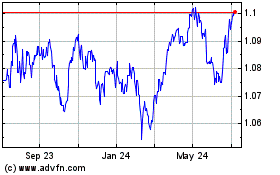

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Apr 2023 to Apr 2024