Commodity Currencies Gain Amid Risk Appetite

January 24 2016 - 8:40PM

RTTF2

Commodity currencies such as the Australian, the New Zealand and

the Canadian dollars strengthened against their major counterparts

in the Asian session on Monday, as Asian stocks extended its rally

and crude oil prices surged up. Expectations of more stimulus from

central banks also lifted investor sentiment.

Crude oil for March delivery is currently up $0.17 to $32.36 a

barrel. Harsh winter weather on the U.S. East coast triggered the

demand of U.S. crude oil.

Friday, the Australian, the New Zealand and the Canadian dollars

traded higher, as the rebound in crude oil prices and expectations

of more stimulus from the European Central Bank boosted investor

sentiment.

The Australian dollar rose 0.41 percent against the U.S. dollar,

1.06 percent against the yen and 0.77 percent against the euro. The

NZ dollar rose 0.16 percent against the yen and 0.05 percent

against the euro. The Canadian dollar rose 1.04 percent against the

U.S. dollar, 1.69 percent against the yen and 1.70 percent against

the euro. Meanwhile, the NZ dollar held steady against the U.S.

dollar.

In the Asian trading, the Australian dollar rose to 0.7009

against the U.S. dollar, from an early 4-day low of 0.6981. The

aussie may tests resistance near the 0.71 region.

Against the yen, the euro and the Canadian dollar, the aussie

edged up to 83.31, 1.5411 and 0.9914 from early lows of 82.75,

1.5487 and 0.9884, respectively. If the aussie extends its uptrend,

it is likely to find resistance around 85.00 against the yen, 1.51

against the euro and 1.01 against the loonie.

The NZ dollar rose to 0.6503 against the U.S. dollar, from an

early 4-day low of 0.6462. The kiwi is likely to find resistance

around the 0.66 area.

The kiwi advanced to nearly a 2-week high of 77.57 against the

yen, from an early low of 76.64. The next possible upside target of

the kiwi-yen pair is seen around the 79.00 area.

Against the euro, the kiwi advanced to 1.6605 from an early low

of 1.6705. If the kiwi extends its uptrend, it is likely to find

resistance around the 1.64 region.

The kiwi edged up to 1.0764 against the Australian dollar, from

an early low of 1.0816. On the upside, 1.06 is seen as the next

resistance level for the kiwi.

The Canadian dollar rose to 1.5264 against the euro, from an

early low of 1.5315. The loonie is likely to find resistance around

the 1.50 area.

Against the U.S. dollar and the yen, the loonie edged up to

1.4130 and 84.06 from early lows of 1.4169 and 83.65, respectively.

If the loonie extends its uptrend, it is likely to find resistance

around 1.40 against the greenback and 87.00 against the yen.

Meanwhile, the safe-haven yen weakened against its major rivals

amid risk appetite.

Data from the Ministry of Finance showed that Japan posted a

merchandise trade surplus of 140.28 billion yen in December. That

beat forecasts for a surplus of 117.0 billion yen following the

381.3 billion yen deficit in November.

Exports were down 8.0 percent on year to 6.337 trillion yen,

missing forecasts for a decline of 7.0 percent following the 3.3

percent contraction in the previous month. Imports tumbled an

annual 18.0 percent to 6.197 trillion yen versus expectations for a

fall of 16.4 percent following the 10.2 percent drop a month

earlier.

The yen fell to a 6-day low of 128.49 against the euro, from

Friday's closing value of 128.19. On the downside, 130.00 is seen

as the next support level for the yen.

Against the pound, the U.S. dollar and the Swiss franc, the yen

edged down to 170.00, 118.85 and 117.14 from last week's closing

quotes of 169.40, 118.74 and 116.85, respectively. If the yen

extends its downtrend, it is likely to find support around 173.00

against the pound, 119.00 against the greenback and 119.00 against

the franc.

Looking ahead, the German Ifo business climate index for January

is due to be released at 4:00 am ET.

At 1:00 pm ET, European Central Bank President Mario Draghi is

scheduled to speak at the Deutsche Borse New Year's reception, in

Frankfurt.

The New Zealand markets are closed in observance of Wellington

Anniversary day holiday.

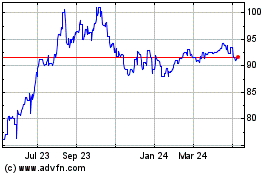

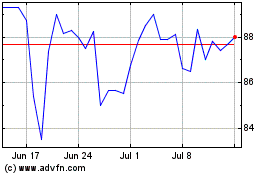

US Dollar vs RUB (FX:USDRUB)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs RUB (FX:USDRUB)

Forex Chart

From Apr 2023 to Apr 2024