Commodity Currencies Fall As Chinese Yuan Devalued

August 11 2015 - 1:09AM

RTTF2

The commodity currencies such as the Australian, the New Zealand

and Canadian dollars fell against their major currencies in the

Asian session on Tuesday following China devaluing its currency

against the greenback by a record amount.

The People's Bank of China surprised the market by reducing the

value of yuan at 6.2298 a dollar, 1.9 percent lower than Monday's

official fixing rate.

The PBOC said the move is an effort to keep the yuan stable at a

reasonable level and to boosts export earnings. In other economic

news, the latest survey from the National Australia Bank showed

that the business confidence in Australia was down sharply in

Australia in July, with an index score of +4. That's down from +10

in June. The index for business conditions also tumbled in July,

falling to +6 from +11.

Monday, the Australian dollar rose 0.02 percent against the U.S.

dollar, 0.21 percent against the yen and 0.71 percent against the

euro. The New Zealand and the Canadian dollars showed mixed trading

against its major rivals. As the kiwi held steady against the U.S.

dollar and the euro, it rose against the yen.

The loonie, rose against the U.S. dollar, fell against the euro

and held steady against the euro.

In the Asian trading today, the Australian dollar fell to 1-week

lows of 0.7304 against the U.S. dollar and 91.16 against the yen,

from an early 3-week high of 0.7439 and nearly a 6-week high of

92.69, respectively. At yesterday's close, the aussie was trading

at 0.7407 against the greenback and 92.28 against the yen. If the

aussie extends its downtrend, it is likely to find support around

0.72 against the greenback and 89.00 against the yen.

Against the euro and the Canadian dollar, the aussie dropped to

1-week lows of 1.5013 and 0.9565 from yesterday's closing quotes of

1.4868 and 0.9636, respectively. The aussie may test support near

1.52 against the euro and 0.94 against the loonie.

Meanwhile, the aussie slipped to a 4-day low of 1.1166 against

the NZ dollar, from yesterday's closing value of 1.1206. On the

downside, 1.10 is seen as the next support level for the

aussie.

The NZ dollar fell to 4-day lows of 0.6534 against the U.S.

dollar and 81.55 against the yen, from an early 4-day high of

0.6633 and nearly a 2-week high of 82.65, respectively. At

yesterday's close, the kiwi was trading at 0.6610 against the

greenback and 82.30 against the yen. If the kiwi extends its

downtrend, it is likely to find support around 0.64 against the

greenback and 80.00 against the yen.

Against the euro, the kiwi dropped to a 6-day low of 1.6781 from

yesterday's closing value of 1.6664. On the downside, 1.68 is seen

as the next support level for the kiwi.

The Canadian dollar fell to 95.18 against the yen, from an early

near 2-week high of 95.88. At yesterday's close, the loonie was

trading at 94.53 against the yen. If the loonie extends its

downtrend, it is likely to find support around 93.00 against the

yen and 1.33 against the greenback.

Against the U.S. dollar and the euro, the loonie dropped to

1.3102 and 1.4379 from yesterday's closing quotes of 1.3008 and

1.4329, respectively. The loonie may test support near the 1.45

region.

Meanwhile, the euro also fell against their major

currencies.

The euro fell to a 4-day low of 0.7045 against the pound, from

yesterday's closing value of 0.7067. On the downside, 0.69 is seen

as the next support level for the euro.

Pulling away from an early near 1-month high of 137.47 against

the yen, the euro dropped to 136.80. At yesterday's close, the euro

was trading at 137.23 against the yen. The euro may test support

near the 134.00 region.

Against the U.S. dollar and the Swiss franc, the euro edged down

to 1.0967 and 1.0800 from yesterday's closing quotes of 1.1016 and

1.0836, respectively. If the euro extends its downtrend, it is

likely to find support around 1.08 against the greenback and 1.06

against the franc.

However, the data increased the demand for the safe-haven asset

or the U.S. dollar.

The U.S. dollar rose to a 4-day high of 124.89 against the yen,

from yesterday's closing value of 124.58. The greenback may test

resistance near the 125.50 region.

Against the euro, the pound and the Swiss franc, the greenback

edged up to 1.0967, 1.5555 and 0.9858 from yesterday's closing

quotes of 1.1016, 1.5587 and 0.9835, respectively. If the greenback

extends its uptrend, it is likely to find resistance around 1.08

against the euro, 1.54 against the pound and 0.99 against the

franc.

Looking ahead, the German wholesale price index for July is due

to be released at 2:00 am ET. Subsequently, the German ZEW economic

sentiment for August is also slated for release.

In the New York session, U.S. wholesale inventories data for

June, U.S. preliminary second quarter productivity and costs data

and Canada housing starts for July are set to be published.

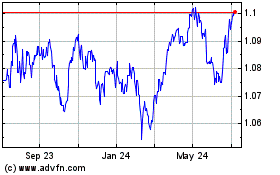

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Apr 2023 to Apr 2024