Commodity Currencies Extend Slide

March 30 2015 - 1:28AM

RTTF2

Commodity currencies such as the Australian, the New Zealand and

the Canadian dollars continued to be weaker against their major

currencies in the Asian session on Monday, hurt by talks between

Iran and six world powers on lifting of sanctions that could add

more oil to the market. Crude oil for May delivery is currently

down $0.21 to $48.635 a barrel.

Foreign ministers of the six world powers - the U.S., China,

Russia, Germany, France and Britain - and Iran meet for the second

day today in Switzerland to reach a deal over sanctions and the

country's nuclear activities.

The Organisation of Petroleum Exporting Countries resisted calls

to cut output in order to maintain market share, which also weighed

on oil prices.

Speculation that concerns over the Yemen military operations may

be overdone also dampened sentiment.

Meanwhile, the decline in prices of copper and iron ore also

weighed on the commodity currencies.

In a speech at a San Francisco Fed conference on Friday, Federal

Reserve chief Janet Yellen said an interest rate hike may well be

warranted later this year but stressed that any increase in

interest rates would be gradual.

Amid uncertainties concerning the U.S. monetary policy and

economic outlook, the AUD, NZD and CAD has been trading lower in

recent sessions.

Friday, the commodity currencies fell against their major

rivals. The Australian dollar fell 1.04 percent against the U.S.

dollar, 1.11 percent against the yen and 0.22 percent against the

euro. The NZ dollar fell 0.39 percent against the U.S. dollar. The

Canadian dollar fell 1.06 percent against the U.S. dollar, 1.12

percent against the yen and 0.20 percent against the euro.

In the Asian trading today, the Australian dollar fell to near a

3-week low of 91.93 against the yen and near a 2-week low of 0.7711

against the U.S. dollar, from Friday's closing quotes of 92.25 and

0.7745, respectively. If the aussie extends its downtrend, it is

likely to find support around 91.10 against the yen and 0.75

against the greenback.

Against the euro, the aussie edged down to 1.4094 from last

week's closing quote of 1.4042. On the downside, 1.43 is seen as

the next support level for the aussie.

The NZ dollar also fell to near 2-week lows of 0.7524 against

the U.S. dollar and 89.72 against the yen in the Asian trading

today, from last week's closing quotes of 0.7561 and 90.06,

respectively. If the kiwi extends its downtrend, it is likely to

find support around 0.72 against the greenback and 86.90 against

the yen.

Against the euro, the kiwi edged down to 1.4443 from Friday's

closing value of 1.4384. The kiwi is likely to find support around

the 1.47 area.

The Canadian dollar also dropped to near a 2-week low of 1.2629

against the U.S. dollar, from Friday's closing value of 1.2612. If

the loonie extends its downtrend, it is likely to find support

around the 1.28 area.

Pulling away from early highs of 94.66 against the yen and

1.3706 against the euro, the loonie edged down to 94.40 and 1.3733,

respectively. The loonie may test support near 92.80 against the

yen and 1.40 against the euro.

Looking ahead, Swiss KOF leading indicator index for March, U.K.

mortgage approvals and M4 money supply data - both for February and

Eurozone business climate index for March are due to be

released.

In the New York session, preliminary German consumer price index

for March, Canada industrial product price and raw materials price

index - both for February and U.S. personal income and spending

data and pending home sales data for February are slated for

release.

At 9:00 am ET, European Union's financial affairs chief Pierre

Moscovici is expected to speak to the EU parliament committee in

Brussels.

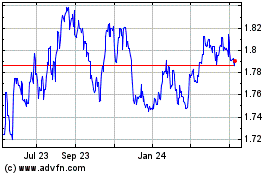

Euro vs NZD (FX:EURNZD)

Forex Chart

From Mar 2024 to Apr 2024

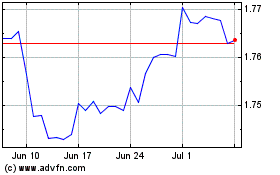

Euro vs NZD (FX:EURNZD)

Forex Chart

From Apr 2023 to Apr 2024