Commodity currencies such as the Australian, the New Zealand and

the Canadian dollars continued to be weak against their major

counterparts in the Asian session on Monday, as investors are

treading cautiously after the sell-off in the Chinese markets last

Friday. Lower commodity prices also weighed on the currencies.

Chinese shares posted their biggest one-day selloff in three

months Friday on news of investigations into three major Chinese

brokerages over suspected securities violations.

Traders bet that the U.S. jobs data due this week is likely to

support a Fed rate hike from near zero, The Federal Reserves

Monetary Policy Committee is set to meet on December 15-16.

Federal Reserve Chair Janet Yellen is also scheduled to deliver

two speeches this week, joining several other Fed officials who are

due to give remarks.

Additionally, the European Central Bank is scheduled to hold a

monetary policy meeting on Thursday, with many expecting the bank

to provide further stimulus.

Also, the Reserve Bank of Australia's interest rate decision due

on Tuesday is also in the spotlight. Economists expect the central

bank to hold the cash rate at 2 percent.

In economic news, data from the Reserve Bank of Australia showed

that total credit to the private sector in Australia was up 0.7

percent on month in October. That topped expectations for an

increase of 0.6 percent but was unchanged from the previous month

following a downward revision from 0.8 percent.

The Australian Bureau of Statistics said that company operating

profits in Australia were up a seasonally adjusted 1.3 percent on

quarter in the third quarter of 2015. That beat expectations for an

increase of 1.1 percent following the 1.9 percent contraction in

the second quarter.

Data from TD Securities showed that consumer prices in Australia

are expected to pick up just 1.8 percent on year in November. That

was in line with expectations and unchanged from the previous

month's forecast.

On a monthly basis, inflation is expected to add 0.1 percent

following the flat reading in October.

Data from NBNZ showed that business confidence in New Zealand

rebounded in November, with an index score of 14.6. That was

slightly below forecasts for 15.0 but still up from 10.5 in

October. The activity outlook came in with a score of 32.0, up from

23.7 in the previous month.

Data from Statistics New Zealand showed that the total number of

building permits issued in New Zealand was up a seasonally adjusted

5.1 percent on month in October, standing at 2,349. That follows

the 5.7 percent decline in September.

Last Friday, the Australian, New Zealand and Canadian dollars

fell against their major rivals. The Australian dollar fell 0.51

percent against the U.S. dollar, 0.27 percent against the yen and

0.27 percent against the euro. The NZ dollar fell 0.65 percent

against the U.S. dollar, 0.39 percent against the yen and 0.35

percent against the euro. The Canadian dollar fell 0.38 percent

against the U.S. dollar, 0.39 percent against the yen and 0.27

percent against the euro.

In the Asian trading, the Australian dollar fell to a 1-week low

of 0.7170 against the U.S. dollar and a 6-day low of 88.05 against

the yen, from last week's closing quotes of 0.7188 and 88.31,

respectively. If the aussie extends its downtrend, it is likely to

find support around 0.70 against the greenback and 87.00 against

the yen.

Against the euro and the Canadian dollar, the aussie dropped to

1.4756 and 0.9591 from Friday's closing quotes of 1.4718 and

0.9610, respectively. The aussie is likely to find support around

1.51 against the euro and 0.94 against the loonie.

The NZ dollar fell to a 6-day low of 0.6514 against the U.S.

dollar and a 5-day low of 1.6243 against the euro, from last week's

closing quotes of 0.6525 and 1.6203, respectively. If the kiwi

extends its downtrend, it is likely to find support around 0.64

against the greenback and 1.65 against the euro.

Against the yen and the Australian dollar, the kiwi dropped to

79.98 and 1.1021 from Friday's closing quotes of 80.18 and 1.0999,

respectively. The kiwi may test support near 79.00 against the yen

and 1.11 against the aussie.

The Canadian dollar fell to a 1-week low of 1.3386 against the

yen and a 6-day low of 91.69 against the U.S. dollar, from last

week's closing quotes of 1.3367 and 91.81, respectively. If the

loonie extends its downtrend, it is likely to find support around

1.34 against the yen and 90.00 against the greenback.

Against the euro, the loonie dropped to 1.4167 from Friday's

closing value of 1.4158. The loonie is likely to find support

around the 1.44 area.

Meanwhile, safe-haven currencies such as the U.S. dollar and the

yen rose against their major rivals.

The U.S. dollar rose to more than a 7-month high of 1.5015

against the pound, from Friday's closing value of 1.5029. The

greenback may test resistance near the 1.49 region.

Against the euro and the Swiss franc, the greenback edged up to

1.0570 and 1.0313 from last week's closing quotes of 1.0589 and

1.0289, respectively. If the greenback extends its uptrend, it is

likely to find resistance around 1.04 against the euro and 1.04

against the Swiss franc.

The yen rose to 129.82 against the euro and 184.35 against the

pound, from Friday's closing quotes of 130.09 and 184.55,

respectively. If the yen extends its uptrend, it is likely to find

resistance around 128.00 against the euro and 181.00 against the

pound.

Against the U.S. dollar and the Swiss franc, the yen advanced to

122.72 and 119.02 from early lows of 122.85 and 119.26,

respectively. The yen is likely to find resistance around 121.00

against the greenback and 118.00 against the franc.

Looking ahead, Japanese housing starts and construction orders

for October is due to be released at 12:00 am ET. Subsequently,

German retail sales data for October is slated for release in the

pre-European session at 2:00 am ET.

In the European session, Swiss KOF leading indicator for

November, U.K. mortgage approvals data and M4 money supply data,

both for October, are set to be announced.

In the New York session, preliminary German CPI data for

November, Canada current account data for the third quarter, U.S.

pending home sales data for October and U.S. Chicago PMI for

November are set to be published.

At 1:25 pm ET, European Central Bank member and Bank of Spain

Governor Luis Maria Linde will deliver the speech "Situation and

Outlook for the Spanish Economy" at Palma De Mallorca, in

Spain.

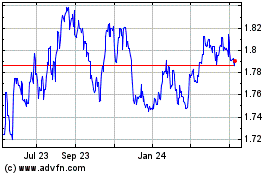

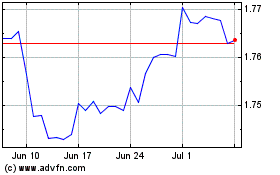

Euro vs NZD (FX:EURNZD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs NZD (FX:EURNZD)

Forex Chart

From Apr 2023 to Apr 2024