Commodity Currencies As Oil Prices Add To Gains

February 03 2016 - 7:00PM

RTTF2

Commodity currencies such as the Australian, the New Zealand and

the Canadian dollars strengthened against their major counterparts

in the Asian session on Thursday amid rising risk appetite, as

gains in crude oil prices as well as other commodity prices on the

back of a weaker dollar lifted resource stocks.

Crude oil for March delivery are currently up $0.40 at $32.68 a

barrel. Oil prices rallied, taking back steep losses from the

previous two sessions as the dollar weakened.

Wednesday, the Australian, the New Zealand and the Canadian

dollars showed mixed trading against its major rivals.

The Australian and the Canadian dollars fell against the yen and

the euro. However, the NZ dollar rose against the euro and held

steady against the yen. Meanwhile, the Australian, the New Zealand

and the Canadian dollars rose against the U.S. dollar.

In the Asian trading, the Australian dollar rose to a 1-month

high of 0.7191 against the U.S. dollar and a 2-day high of 84.94

against the yen, from yesterday's closing quotes of 0.7168 and

84.48, respectively. If the aussie extends its uptrend, it is

likely to find resistance around 0.73 against the greenback and

88.00 against the yen.

Against the euro, the aussie edged up to 1.5422 from yesterday's

closing value of 1.5487. The aussie may test resistance near the

1.49 region.

The NZ dollar rose to 0.6684 against the U.S. dollar, 78.96

against the yen and 1.6588 against the euro, from yesterday's

closing quotes of 0.6661, 78.53 and 1.6645, respectively. If the

kiwi extends its uptrend, it is likely to find resistance around

0.68 against the greenback, 82.00 against the yen and 1.61 against

the euro.

Against the Australian dollar, the kiwi edged up to 1.0747 from

an early low of 1.0779. The kiwi is likely to find resistance

around the 1.05 area.

The Canadian dollar rose to nearly a 2-month high of 1.3719

against the U.S. dollar, from yesterday's closing value of 1.3778.

On the upside, 1.35 is seen as the next resistance level for the

loonie.

Against the yen, the euro and the Australian dollar, the loonie

edged up to 86.06, 1.5222 and 0.9849 from yesterday's closing

quotes of 85.52, 1.5299 and 0.9871, respectively. If the loonie

extends its uptrend, it is likely to find resistance around 89.00

against the yen, 1.49 against the euro and 0.97 against the

aussie.

Looking ahead, SECO Swiss consumer confidence index for January

is due to be released in the pre-European session at 1:45 am

ET.

Subsequently, Federal Reserve Bank of Boston President Eric

Rosengren will deliver a speech titled "Too Big to Fail" at the

Bank of International Settlements in Cape Town at 2:15 am ET.

At 3:00 am ET, European Central Bank President Mario Draghi is

scheduled to deliver the Marjolin Lecture at the SUERF conference

organised by the German Bundesbank in Frankfurt.

At 4:00 am ET, the European Central Bank is scheduled to release

the economic bulletin.

The Bank of England is due to announce its interest rate

decision, inflation report and the minutes of the meeting at 7:00

am ET. Economists expect the bank to retain interest rates

unchanged at 0.50 percent and asset purchase target at GBP 375

billion.

At 7:45 am ET, Bank of England Governor Mark Carney, along with

the other MPC members, will hold a press conference on the

Inflation Report in London.

In the New York session, U.S. weekly jobless claims for the week

ended January 30 and U.S. factory orders data for December are

slated for release.

Federal Reserve Bank of Dallas President Robert Kaplan is due to

participate in a discussion of Global Economic Conditions at an

event hosted by the Real Estate Council in Dallas at 8:30 am

ET.

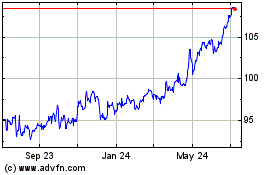

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Mar 2024 to Apr 2024

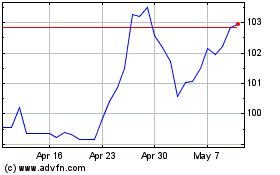

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Apr 2023 to Apr 2024