Metal prices' rebound ends rough stretch marked by deep losses

and rush to cut debt

By Scott Patterson and Rhiannon Hoyle

The world's biggest miners are profit machines again, cashing in

on soaring commodity prices and rewarding investors who stuck with

them through a brutal downturn.

BHP Billiton Ltd., the world's largest miner by market value,

said Tuesday it had a profit of $3.2 billion for the second half of

2016 after posting a $5.7 billion loss in the year-earlier period.

Anglo American PLC, the fifth-largest mining company, reported a

profit of $1.6 billion for all of 2016, a dramatic rebound from

2015, when it lost $5.6 billion.

The solid performance builds on strong results from

British-Australian miner Rio Tinto PLC, which two weeks ago said it

earned $4.6 billion in 2016 following a loss of $866 million in the

prior year. Switzerland-based Glencore PLC is scheduled to release

2016 results on Thursday, with analysts widely predicting a return

to profit.

The swift return to profitability for the world's mining giants

has surprised analysts, investors and executives alike. Few had

predicted sustained rallies in everything from iron ore to coal to

copper last year.

Global mining companies are in better shape now than they were

two years ago, when a steep decline in commodity prices sent their

shares reeling, analysts say. To bolster their health, they sold

off underperforming mines, shrank workforces and paid down massive

piles of debt.

Glencore scrambled to sell $4.7 billion in assets in the past

year, including an Australian rail business and a 49.9% stake in

its agriculture business. The company raised $1.4 billion from

selling future deliveries of gold and silver from a pair of mines

in Peru.

The sales, along with eliminating its dividend and issuing new

stock, helped Glencore survive a scary dive in its share price as

investors rebelled over its debt levels. The company has said its

net debt would fall to $17.5 billion or less by the end of 2016,

from $29.7 billion as of June 30, 2015.

Anglo American last April agreed to sell its Brazilian niobium

and phosphates business to China Molybdenum Co. for $1.5 billion --

part of a downsizing plan the company described as "radical." The

miner had expected to unload more operations, but a rebound in coal

and iron-ore prices made it more attractive to keep those

assets.

Anglo American also benefited from solid sales of diamonds from

its De Beers Group business, which was boosted by U.S. demand. The

U.K.-based firm cut its net debt to $8.5 billion at the end of 2016

from $12.9 billion a year earlier.

BHP's net debt at year-end stood at $20.1 billion, down from

$26.1 billion at midyear. Rio Tinto last year slashed net debt by

30% from the previous year to less than $10 billion.

"They're as lean as can be," said Campbell Parry, an analyst

with Abax Investments, referring to the mining companies. The Cape

Town, South Africa, investment firm owns shares of Anglo American

and BHP.

Leaner balance sheets should give the companies "a lot more

agility than they had a few years ago," Mr. Parry said.

Rising copper prices have helped the miners. Glencore, Anglo

American, BHP and Rio are among the world's biggest producers of

the metal, whose price rose 27% in 2016. Copper has continued

rising in 2017; it is up nearly 10% as work stoppages in Chile and

permit disputes in Indonesia contribute to supply concerns.

Now that the miners have dug themselves out of a hole, the

question is whether they can keep from sliding back in, analysts

say. Mining executives, burned by the downturn, remain

cautious.

They have chosen to use the surge in profits largely to reward

investors, not launch big new projects. Rio increased its dividend

and announced a $500 million share buyback. BHP doubled its

dividend. Anglo says it plans to pay dividends on 2017 profits

after eliminating its dividend last year.

Although profits are back, they remain far below the dizzying

heights reached in years like 2011, when BHP recorded over $23

billion in profit amid a China-fueled boom in commodity prices.

Mining executives are particularly wary that coal and iron-ore

prices, which surged last year amid renewed demand in China and

reduced Chinese production, have risen too far too fast.

"I have to say, we don't think these prices will hold up in the

long term," Anglo American Chief Executive Mark Cutifani said on a

conference call with reporters Tuesday, referring to coal and iron

ore.

BHP CEO Andrew Mackenzie, in comments to reporters in London

Tuesday, said reduced stimulus in China and new supplies will

likely hurt prices for bulk commodities.

But Mr. Mackenzie said he remains confident that, overall,

demand from China will remain solid this year. "I think China is

steady as she goes, " he said.

Executives are also growing concerned that an increasingly

unpredictable political situation in the U.S. and elsewhere could

spark trade disputes, disrupting global growth and demand for

commodities.

BHP executives have singled out the policy platform of President

Donald Trump's administration, which they said could spark trade

wars that weigh on business confidence, hurt investment and lead to

higher inflation in the U.S. Mr. Cutifani has also cautioned Mr.

Trump against pushing the world toward protectionism.

"It's an uncertain world out there," Mr. Mackenzie said. "Trade

wars are not going to help anybody."

White House deputy press secretary Lindsay Walters said Mr.

Trump's "policies will ultimately prioritize the best interests of

the American people and American workers."

Other mining executives have expressed enthusiasm about Mr.

Trump's plans to ramp up infrastructure spending in the U.S.

Glencore CEO Ivan Glasenberg believes that a $1 trillion

infrastructure program floated by Mr. Trump is likely to boost

demand for the commodities his firm produces, especially

copper.

Mr. Mackenzie and BHP Chairman Jac Nasser met with Mr. Trump,

then president-elect, in January. At the meeting, they discussed

the impact the U.S. policy direction could have on resources

markets, Mr. Mackenzie said Tuesday.

Write to Scott Patterson at scott.patterson@wsj.com and Rhiannon

Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

February 22, 2017 02:47 ET (07:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

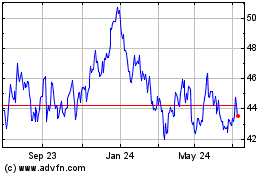

BHP (ASX:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

BHP (ASX:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024