By Selina Williams and Summer Said

Saudi Arabian Oil Co. has captured the oil industry's attention

with plans for an initial public offering that could raise more

than $100 billion, but some investors are wary, pointing to the

track records of other government-controlled energy companies.

The plan to float as much as 5% of Aramco, the world's largest

oil company, has kicked off a scramble among banks for a role in a

deal that could generate $1 billion in fees -- the biggest

investment-banking deal ever. The kingdom estimates the company has

a value of between $2 trillion and $3 trillion.

But several publicly listed, state-run oil firms have stumbled,

demonstrating the hazards in investing in government-controlled

companies.

Of that group, which includes Brazil's Petroleo Brasileiro SA,

Russia's OAO Rosneft and most recently Kazakhstan's KMG EP, only

Norway's Statoil ASA has avoided a steep share-price drop. Many

have been roiled by governments that put political concerns ahead

of investor returns.

That highlights the dilemma that would-be Aramco investors could

face: Would Aramco be accountable to shareholders or to the kingdom

that still would own a stake of at least 95%?

"Investing into a government-run entity, which acts as kind of a

government agency with huge influence and priorities other than

value creation, it raises tension," said Pascal Menges, who manages

a resources fund at Switzerland-based Lombard Odier Investment

Management. The fund used to have small stakes in state-controlled

oil companies but currently has none.

The Aramco IPO, which could happen as soon as 2018, is part of a

plan to raise funds to diversify the Saudi economy after a two-year

slump in oil prices. Saudi officials said New York, London and Hong

Kong are potential locations for a listing.

The Saudi oil ministry declined to comment. Saudi Oil Minister

Khalid al-Falih said in June that Aramco has "best-in-class

governance standards."

"Part of the IPO will be to disclose, and I think the company

will do that and everybody will see firsthand how great a company

it is, and that will contribute to its valuation," he said.

In recent years, New York-listed shares in Brazil's state-run

oil firm have withered under a continuing corruption probe

following its 2010 offering. The government's desire to build up

local companies that could supply the oil industry and other

sectors raised costs and delayed some oil developments while

infrastructure such as shipyards was constructed.

In Russia, Rosneft offered shares on the London Stock Exchange

in 2006, raising $10.7 billion from investors eager to take

advantage of the company's growth prospects. But in 2014, Rosneft's

ability to take on long-term debt to spend on new oil fields was

crimped after Russia annexed Crimea and the U.S. sanctioned the

company's leader for ties to President Vladimir Putin.

In China, the share prices of the listed units of China's big

three state-controlled oil companies have fared better, but profits

at producers such as PetroChina Co. continue to be dragged down by

a huge cost base. That includes hundreds of thousands of employees

on its books and aging, high-cost domestic oil fields.

The world's biggest independent energy companies such as Exxon

Mobil Corp. and Royal Dutch Shell PLC are also prone to ups and

downs, tending to trade up and down with the price of crude oil.

Some companies have had catastrophic events that have wiped out

billions in shareholder value, such as the blowout in the Gulf of

Mexico, in which BP PLC has so far incurred legal and cleanup costs

of $61.6 billion.

But their stocks generally have been steadier performers than

state-run oil companies.

Since October 2010, Chevron Corp. and Exxon shares have risen

about 30% and 52% respectively, while London listed shares of

Rosneft and KMG EP have lost 22% and 55%. New York-listed shares of

Petrobras have lost 78% over the same period.

Government-run oil companies have the potential to be profit

machines. They control about 75% of the world's proven reserves and

more than half of daily oil output. In addition, many have onshore

deposits that are cheaper to tap than budget-busting deepwater,

oil-sand and shale reserves that Western energy giants rely on.

But split priorities make some state-run companies less

profitable. "The government's objectives may not always be fully

aligned with the shareholders," said Wood Mackenzie oil-company

analyst Stewart Williams.

Investors say they see a fresh reason to worry about IPOs

involving state-run assets in Kazakhstan.

The government-controlled gas company, NC KazMunaiGas, spun off

publicly listed KMG EP 10 years ago for about $2.3 billion,

retaining about 58% of the new firm. Since the 2006 London IPO, KMG

EP shares have halved.

Now KazMunaiGas is trying to take control of KMG EP's oil and

gas resources and get better access to the public company's $3

billion in cash. KazMunaiGas is gearing up for its own IPO sometime

from 2018.

The oil-price decline, which has hit the state-controlled parent

company's finances hard, has partly prompted the latest moves.

Matthias Westman, founding partner of Russia-focused hedge fund

Prosperity Capital Management and a KMG EP investor, said it also

showed how government goals can clash with shareholders focused on

profits.

"When times get tough, then some people resort to worse

behavior," he said.

KazMunaiGas said it is seeking control to tackle KMG EP's

"bureaucracy and duplication in decision making, optimizing cost

and maximizing cooperation."

Write to Selina Williams at selina.williams@wsj.com and Summer

Said at summer.said@wsj.com

(END) Dow Jones Newswires

August 02, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

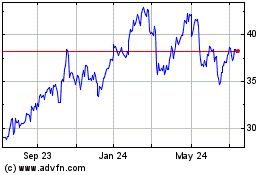

PETROBRAS PN (BOV:PETR4)

Historical Stock Chart

From Mar 2024 to Apr 2024

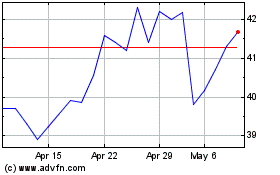

PETROBRAS PN (BOV:PETR4)

Historical Stock Chart

From Apr 2023 to Apr 2024