CommSec Tips Better Year for Australia Stocks -- Market Talk

January 01 2015 - 7:00PM

Dow Jones News

[Dow Jones] As U.S. stocks charged higher in 2014, Australia's

stock market had its worst year in three years. But CommSec thinks

the year ahead will be a better one for Australian equities. "After

under-performing in 2014, we tip the ASX 200 to end 2015 between

5,900-6,200 with total returns around 15%," says Craig James, chief

economist at CommSec. "As a result 10-year and 15-year average

returns on shares will be around 10%." He says the share market

will be supported by "favourable" valuations, strong corporate

balance sheets, solid U.S. economic growth, a switch of investor

appetite to shares from property and the continued maturing of the

Chinese economy. The main risks: the health of oil-producing

economies following the slide in oil prices; deflation risks in

developed economies; the state of the euro zone; and the U.S.

correctly timing the start of any rate increases. S&P/ASX 200

trades down 0.2% at 5402.9. (rhiannon.hoyle@wsj.com; Twitter:

@RhiannonHoyle)

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

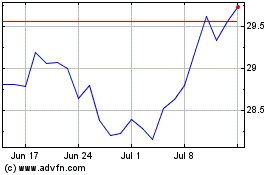

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Apr 2023 to Apr 2024