By Carolyn Cui and Daniel Huang

One of China's biggest lenders is planting its flag in the

middle of Manhattan, a symbolic move for a bank with ambitions to

challenge Wall Street on its home turf.

Bank of China is preparing to move its U.S. headquarters this

fall to a new 450-foot-tall glass tower overlooking Bryant Park,

leaving the low-slung brick building on New York City's East Side

that has been its home for 35 years. The bank will occupy more than

half of the 28-story building, which it acquired for nearly $600

million in 2014.

The move reflects the bank's burgeoning business in the U.S.,

where assets soared to $78 billion last year from $12 billion in

2010, according to the Federal Reserve.

As the world's fourth-largest bank by assets, state-owned Bank

of China has quietly funded some of its country's most ambitious

cross-border deals. That included a loan to Anbang Insurance Group

Co. for its purchase of a stake in a Fifth Avenue office

building.

"We've grown so much these years," said Xu Chen, general manager

of Bank of China's U.S. branch, in an interview. "The small

building is not enough to hold all of us now."

Mr. Xu said he was attracted to both the building and its

location, which he noted was at the other end of the park from the

Bank of America tower on 42nd Street. The two buildings are "a

symbol of the economic interconnection between China and the U.S.,"

he said.

Bank of China has about 500 employees in the U.S., including 400

in New York. More than 90% of the New York staff are local hires,

though most of them are ethnically Chinese, according to the bank.

Positions in the new building will include loan officers, trade

service and clearing.

The U.S. subsidiary's general manager is from Beijing, though

other top executives like the chief risk officer and chief

compliance officer are from the U.S.

Bank of China is starting to move beyond its core business of

lending to Chinese companies. Its roster of blue-chip U.S.

borrowers includes Visa Inc., Diamond Offshore Drilling Inc. and

CME Group Inc., the owner of the derivatives exchange, according to

Dealogic.

The bank also aims to compete in some of the lucrative areas

that Wall Street firms historically have dominated, such as

corporate finance, commodity hedging and commercial-real-estate

lending, Chinese bank officials have said.

Other Chinese banks have been growing overseas, too: Chinese

bank assets in the U.S. stood at around $130 billion last year, up

from $15 billion in 2010.

Bank of China by far has been the most aggressive. According to

the bank's annual report, overseas subsidiaries accounted for 23.6%

of the group's pre-tax profit in 2015. At Industrial &

Commercial Bank of China Ltd., the country's largest lender, the

figure was 6.8%, according to the company's annual report.

Chinese bank expansion is a response to the country's slowing

economic growth. Last year, China's biggest banks posted their

lowest annual profit growth in a decade, squeezed by shrinking

interest margins and growing non-performing loans at home. Bank of

China's net profit grew by only 1.3% in 2015, down from 8.2% in

2014. The bank recently reported that first-quarter net profit rose

1.7%.

The bank's Shanghai-listed shares fell 27% over the past year,

while the Shanghai stock market index was down 16%.

One way to stabilize the bank's profit is to "do a little more

overseas, and maybe a little less at home," Chen Siqing, the bank's

president, told Chinese media in March. Mr. Xu said its U.S.

operation is one of the bank's most profitable.

Efforts to ramp up U.S. operations haven't always been easy.

Chinese banks have struggled to compete for top employee talent in

the U.S. because they are less well known and have a smaller

network of corporate contacts in the U.S. than Wall Street firms

do, the banks said.

The bank also has to adhere to stricter U.S. regulations after

it surpassed $50 billion in assets. That includes liquidity-focused

"stress testing," which could require the bank to hold more

capital.

Mr. Xu said he wasn't concerned. "Compliance is our top

priority," he said.

As its U.S. business grows, Bank of China is planning to add 100

people this year to its U.S. operations, primarily on the West

Coast, Mr. Xu said. The lender is also considering a new branch in

Houston, where many Chinese oil companies operate. An application

to open the new location has been pending with the Office of the

Comptroller of the Currency since 2014.

Bank of China's new 470,000-square-foot U.S. headquarters was

developed by the Houston-based real-estate firm Hines, which

selected Pei Cobb Freed & Partners Architects to design the

project.

The architecture firm has a long history with the bank. It was

co-founded by I.M. Pei, whose father, Tsuyee Pei, had been an

executive at Bank of China, where he pioneered its foreign-exchange

business. When the bank looked for someone to design its new

headquarter buildings in Hong Kong and Beijing, I.M. Pei got the

job.

The signature attribute of the New York tower, known as 7 Bryant

Park, is a concave, hourglass-shaped incision that runs the length

of the structure on its northeast corner, instead of a traditional

right angle.

That feature would help distinguish the property from a forest

of midtown skyscrapers, while the curved glass on the lower floors

has the effect of magnifying the park's green lawn.

The building's canteen will feature American and Chinese

cuisine. Whether that means Cantonese or Szechuan isn't yet clear,

one bank official said, "but it will be very diverse."

Although the building's 10th floor terrace offers views of the

Empire State Building to the east and the World Trade Center to the

south, the bank also wanted a respite from Manhattan's urban

jungle. Two large video screens at street level will show calming

landscapes, meant as an extension of Bryant Park's greenery. At

other times, the screens will flash scenes of busy Chinese assembly

lines, happy Chinese children and bamboo-chomping pandas.

--Keiko Morris contributed to this article.

Write to Carolyn Cui at carolyn.cui@wsj.com and Daniel Huang at

dan.huang@wsj.com

(END) Dow Jones Newswires

April 30, 2016 05:44 ET (09:44 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

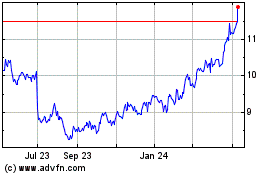

Bank of China (PK) (USOTC:BACHY)

Historical Stock Chart

From Mar 2024 to Apr 2024

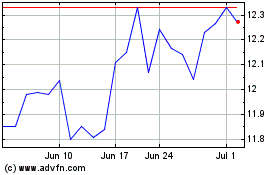

Bank of China (PK) (USOTC:BACHY)

Historical Stock Chart

From Apr 2023 to Apr 2024