Consolidated 2nd Quarter 2017 Highlights:

- Consolidated Revenue Increased 9.8%;

Net Income Attributable to Comcast Increased 23.9%; Adjusted EBITDA

Increased 10.0%

- Net Cash Provided by Operating

Activities was $5.2 Billion; Free Cash Flow was $2.2 Billion

- Earnings per Share Increased 26.8% to

$0.52

- Dividends Paid Totaled $747 Million and

Share Repurchases were $1.4 Billion

Cable Communications 2nd Quarter 2017 Highlights:

- Cable Communications Revenue Increased

5.5% and Adjusted EBITDA Increased 5.4%

- Customer Relationships Increased by

114,000; Total Revenue per Customer Relationship Increased

2.2%

- High-Speed Internet Residential Revenue

Increased 9.2%; Total Customers Increased by 175,000

- Video Residential Revenue Increased

3.9% and 55% of Residential Video Customers Now Have X1; Total

Customer Net Losses were 34,000

- Business Services Revenue Increased

12.6%, Over $6.0 Billion in Annualized Revenue

NBCUniversal 2nd Quarter 2017 Highlights:

- NBCUniversal Revenue Increased 17.3%

and Adjusted EBITDA Increased 22.6%

- Theme Parks Revenue Increased 15.6% and

Adjusted EBITDA Increased 17.3%

- Filmed Entertainment Revenue Increased

59.6% and Adjusted EBITDA Increased $229 Million to $285 Million,

Driven by Strong Box Office Performance and Home Entertainment

- Cable Networks and Broadcast Television

Adjusted EBITDA Increased 11.7% and 5.5%, Respectively, Driven by

Increases in Affiliate and Retransmission Revenue

- NBC Remains Ranked #1 Among Adults

18-49

Comcast Corporation (NASDAQ: CMCSA) today reported results for

the quarter ended June 30, 2017.

Brian L. Roberts, Chairman and Chief Executive Officer of

Comcast Corporation, said, “We delivered terrific results during

the second quarter, highlighted by 10.0% growth in Adjusted EBITDA,

which continued our strong progress in 2017. Thanks to broad-based

momentum across our businesses, our first half Adjusted EBITDA

growth is the fastest in six years. NBCUniversal continued to

deliver outstanding performance, with 17.3% revenue growth and

22.6% Adjusted EBITDA growth. Driving these tremendous results

were the box office success of Fate of the Furious, continued

increases in affiliate and retransmission revenues at our TV

businesses, and impressive growth at our Theme Parks. At Cable

Communications, we generated strong Adjusted EBITDA growth and

added 114,000 net new customer relationships, demonstrating our

disciplined approach to driving profitability and customer

metrics. We launched our fantastic new xFi experience for

in-home broadband during the quarter, the latest example of our

culture of innovation and continued focus on developing

differentiated products and services for our customers. Our teams

continue to execute incredibly well and I am excited about the

opportunities ahead for Comcast NBCUniversal.”

Consolidated Financial Results

2nd Quarter Year to Date ($ in millions) 2016

2017 Growth 2016 2017 Growth

Revenue $19,269 $21,165 9.8 % $38,059

$41,628 9.4 % Net Income Attributable to Comcast

$2,028 $2,513 23.9 % $4,162

$5,079 22.0 % Adjusted EBITDA1 $6,455 $7,099

10.0 % $12,822 $14,131 10.2 % Earnings

per Share2 $0.41 $0.52 26.8 % $0.85 $1.05

23.5 % Excluding Adjustments (see Table 5) — — — $0.83 $1.05

26.5 %

For additional detail on segment revenue and expenses, customer

metrics, capital expenditures, and free cash flow, please refer to

the trending schedules on Comcast’s Investor Relations website at

www.cmcsa.com.

Consolidated Revenue for the second quarter of 2017

increased 9.8% to $21.2 billion. Consolidated Net Income

Attributable to Comcast increased 23.9% to $2.5 billion.

Consolidated Adjusted EBITDA increased 10.0% to $7.1

billion.

For the six months ended June 30, 2017, consolidated

revenue increased 9.4% to $41.6 billion compared to 2016.

Consolidated net income attributable to Comcast increased 22.0% to

$5.1 billion. Consolidated Adjusted EBITDA increased 10.2% to $14.1

billion.

Earnings per Share (EPS) for the second quarter of 2017

was $0.52, a 26.8% increase compared to the second quarter of

2016.

For the six months ended June 30, 2017, EPS was $1.05, a

23.5% increase compared to the prior year. On an adjusted basis,

EPS increased 26.5% (see Table 5).

Capital Expenditures increased 2.5% to $2.3 billion in

the second quarter of 2017. Cable Communications’ capital

expenditures increased 4.0% to $2.0 billion in the second quarter

of 2017, reflecting a higher level of investment in scalable

infrastructure to increase network capacity and increased

investment in line extensions, partially offset by a decrease in

spending on customer premise equipment. Cable capital expenditures

represented 14.9% of Cable revenue in the second quarter of 2017

compared to 15.1% in last year’s second quarter. NBCUniversal’s

capital expenditures of $338 million decreased 6.1%, reflecting

continued investment at Theme Parks more than offset by the timing

of real estate and infrastructure spending.

For the six months ended June 30, 2017, capital

expenditures increased 6.0% to $4.4 billion compared to 2016. Cable

Communications' capital expenditures increased 8.1% to $3.7 billion

and represented 14.4% of Cable revenue compared to 14.0% in 2016.

NBCUniversal's capital expenditures of $623 million decreased 4.8%

for the first six months of 2017.

Net Cash Provided by Operating Activities was $5.2

billion in the second quarter of 2017. Free Cash

Flow3 was $2.2 billion (see Table 4).

For the six months ended June 30, 2017, net cash provided

by operating activities was $10.8 billion. Free cash flow was $5.3

billion (see Table 4).

Dividends and Share Repurchases. During the second

quarter of 2017, Comcast paid dividends totaling $747 million and

repurchased 35.2 million of its common shares for $1.4 billion. In

the first six months of 2017, Comcast has repurchased 55.6 million

of its common shares for $2.1 billion. As of June 30, 2017,

Comcast had $9.9 billion available under its share repurchase

authorization.

Cable Communications

2nd Quarter Year to Date ($ in millions) 2016

4 2017 Growth 2016 4 2017 Growth

Cable Communications Revenue

Video

$5,581 $5,797 3.9 % $11,119

$11,571 4.1 % High-Speed Internet 3,369 3,679

9.2 % 6,644 7,285 9.6 % Voice

893 856 (4.1 %) 1,789 1,719 (3.9

%) Business Services 1,360 1,531 12.6 %

2,671 3,021 13.1 % Advertising 586 574

(2.1 %) 1,132 1,086 (4.1 %) Other

655 685 5.0 % 1,293 1,352

4.7 %

Cable Communications Revenue $12,444

$13,122 5.5 % $24,648

$26,034 5.6 %

Cable Communications Adjusted EBITDA

$5,048 $5,320 5.4 %

$9,937 $10,518 5.8

% Adjusted EBITDA Margin 40.6% 40.5% 40.3% 40.4%

Cable Communications Capital

Expenditures $1,881 $1,956

4.0 % $3,457 $3,737

8.1 % Percent of Cable Communications Revenue

15.1% 14.9% 14.0% 14.4%

Revenue for Cable Communications increased 5.5% to $13.1

billion in the second quarter of 2017, driven primarily by

increases in high-speed Internet, video and business services

revenue. High-speed Internet revenue increased 9.2%, driven by an

increase in the number of residential high-speed Internet customers

and rate adjustments. Video revenue increased 3.9%, reflecting rate

adjustments and an increase in the number of customers subscribing

to additional services. Business services revenue increased 12.6%,

primarily due to increases in the number of customers receiving our

small and medium-sized business services offerings. Advertising

revenue decreased 2.1%, reflecting a decrease in political

advertising revenue and softness in core linear advertising across

several categories, partially offset by growth in interactive

advertising. Other revenue increased 5.0%, primarily due to an

increase in security and automation revenue and higher franchise

and regulatory fees.

For the six months ended June 30, 2017, Cable revenue

increased 5.6% to $26.0 billion compared to 2016, driven by growth

in high-speed Internet, video and business services.

Total Customer Relationships increased by 114,000 to 29.0

million in the second quarter of 2017. Residential customer

relationships increased by 77,000 and business customer

relationships increased by 37,000. At the end of the second

quarter, penetration of our double, triple and quad product

residential customers was 70.5%. Total video customer net losses

were 34,000, total high-speed Internet customer net additions were

175,000, total voice customer net losses were 22,000 and total

security and automation customer net additions were 71,000.

Customers Net Additions (in thousands)

2Q16 2Q17 2Q16 2Q17 Residential Video

Customers 21,401 21,475 (21 )

(45 ) Business Services Video Customers 994 1,040

17 11

Total Video

Customers 22,396 22,516

(4 ) (34 ) Residential

High-Speed Internet Customers 22,189 23,364

176 140 Business Services High-Speed

Internet Customers 1,797 1,942 43

35

Total High-Speed Internet Customers

23,987 25,306 220

175 Residential Voice Customers

10,551 10,470 35 (50 ) Business

Services Voice Customers 1,090 1,189 29

27

Total Voice Customers

11,641 11,659 64

(22 ) Total Security and Automation

Customers 737 1,028

70 71

Residential

Customer Relationships 26,138 26,874 73

77 Business Services Customer Relationships

1,964 2,115 43 37

Total Customer Relationships 28,101

28,989 116 114

Single Product Residential Customers 7,671

7,931 (10 ) 70 Double Product

Residential Customers 8,585 8,945 13

8 Triple and Quad Product Residential

Customers 9,882 9,998 70 —

Adjusted EBITDA for Cable Communications increased 5.4%

to $5.3 billion in the second quarter of 2017, reflecting higher

revenue, partially offset by a 5.5% increase in operating expenses.

The higher expenses were primarily due to a 12.0% increase in video

programming costs, reflecting the timing of contract renewals, as

well as higher retransmission consent fees and sports programming

costs. Non-programming expenses increased 1.4%, reflecting

increases in technical and product support expenses and

advertising, marketing and promotion costs, and a decrease in

customer service expenses. Technical and product support expenses

increased 1.8% related to the development, delivery and support of

our X1 platform, cloud DVR technology and wireless gateways, and

the continued growth in business services and security and

automation services. Advertising, marketing and promotion costs

increased 2.1%, primarily due to an increase in spending associated

with attracting new customers. Customer service expenses decreased

1.1%, reflecting reduced call volumes. This quarter’s Adjusted

EBITDA margin was 40.5% compared to 40.6% in the second quarter of

2016.

For the six months ended June 30, 2017, Cable Adjusted

EBITDA increased 5.8% to $10.5 billion compared to 2016, driven by

higher revenue, partially offset by a 5.5% increase in operating

expenses. The higher expenses were primarily due to an 11.8%

increase in video programming costs and a 1.4% increase in

non-programming expenses. Year-to-date Adjusted EBITDA margin was

40.4% compared to 40.3% in 2016.

NBCUniversal

2nd Quarter Year to Date ($ in millions)

2016 2017 Growth 2016 2017

Growth

NBCUniversal Revenue Cable Networks

$2,566 $2,696 5.1 % $5,019

$5,337 6.3 % Broadcast Television

2,128 2,241 5.3 % 4,212

4,449 5.6 % Filmed Entertainment

1,351 2,155 59.6 % 2,734

4,136 51.3 % Theme Parks 1,136

1,314 15.6 % 2,162 2,432

12.5 % Headquarters, other and eliminations

(78 ) (75 ) NM (163 ) (155 ) NM

NBCUniversal Revenue $7,103

$8,331 17.3 % $13,964

$16,199 16.0 %

NBCUniversal Adjusted EBITDA

Cable Networks $944 $1,055

11.7 % $1,900 $2,171 14.2

% Broadcast Television 394 416

5.5 % 678 738 8.8 % Filmed

Entertainment 56 285 407.4 %

223 653 192.7 % Theme Parks

469 551 17.3 % 844

948 12.3 % Headquarters, other and

eliminations (174 ) (236 ) NM (334 )

(422 ) NM

NBCUniversal Adjusted EBITDA

$1,689 $2,071 22.6 % $3,311

$4,088 23.5 % NM=comparison not meaningful.

Revenue for NBCUniversal increased 17.3% to $8.3 billion

in the second quarter of 2017. Adjusted EBITDA increased

22.6% to $2.1 billion, reflecting increases at Filmed

Entertainment, Theme Parks, Cable Networks and Broadcast

Television.

For the six months ended June 30, 2017, NBCUniversal

revenue increased 16.0% to $16.2 billion compared to 2016 and

Adjusted EBITDA increased 23.5% to $4.1 billion, reflecting

increases at Filmed Entertainment, Cable Networks, Theme Parks, and

Broadcast Television.

Cable Networks

Cable Networks revenue increased 5.1% to $2.7 billion in the

second quarter of 2017, reflecting higher distribution and content

licensing and other revenue, partially offset by lower advertising

revenue. Distribution revenue increased 8.1%, driven by contractual

rate increases and contract renewals, partially offset by a decline

in subscribers at our cable networks. Content licensing and other

revenue increased 10.5%, reflecting the timing of content provided

under licensing agreements. Advertising revenue decreased 0.9%, due

to audience ratings declines, mostly offset by higher rates.

Adjusted EBITDA increased 11.7% to $1.1 billion in the second

quarter of 2017, reflecting higher revenue, partially offset by a

modest increase in operating expenses.

For the six months ended June 30, 2017, revenue from the

Cable Networks segment increased 6.3% to $5.3 billion compared to

2016, reflecting higher distribution and content licensing and

other revenue, partially offset by a decline in advertising

revenue. Adjusted EBITDA increased 14.2% to $2.2 billion compared

to 2016, reflecting higher revenue, partially offset by a modest

increase in operating expenses.

Broadcast Television

Broadcast Television revenue increased 5.3% to $2.2 billion in

the second quarter of 2017, reflecting higher distribution and

other and content licensing revenue, partially offset by a decline

in advertising revenue. Distribution and other revenue increased

36.1%, due to higher retransmission consent fees. Content licensing

revenue increased 2.1%, reflecting the timing of content provided

under licensing agreements. Advertising revenue decreased 1.2%, due

to audience ratings declines, partially offset by higher rates.

Adjusted EBITDA increased 5.5% to $416 million in the second

quarter of 2017, reflecting higher revenue, partially offset by

increases in programming and production costs and advertising,

marketing and promotion expenses.

For the six months ended June 30, 2017, revenue from the

Broadcast Television segment increased 5.6% to $4.4 billion

compared to 2016, reflecting higher distribution and other and

content licensing revenue. Adjusted EBITDA increased 8.8% to $738

million compared to 2016, reflecting higher revenue, partially

offset by an increase in programming and production costs.

Filmed Entertainment

Filmed Entertainment revenue increased 59.6% to $2.2 billion in

the second quarter of 2017, primarily reflecting higher theatrical

revenue, as well as increased home entertainment, content licensing

and other revenue. Theatrical revenue increased by $540 million to

$837 million, reflecting the strong performance of The Fate of the

Furious in this year’s second quarter. Home Entertainment revenue

increased 42.6%, driven by strong sales of recent titles including

Fifty Shades Darker and Sing. Content licensing and other revenue

increased 14.1% and 37.1%, respectively, primarily due to the

inclusion of DreamWorks in the current year period. Adjusted EBITDA

increased by $229 million to $285 million in the second quarter of

2017, reflecting higher revenue, partially offset by higher

programming and production costs.

For the six months ended June 30, 2017, revenue from the

Filmed Entertainment segment increased 51.3% to $4.1 billion

compared to 2016, primarily reflecting higher theatrical revenue,

as well as increases in content licensing, other and home

entertainment revenue. Adjusted EBITDA increased $430 million to

$653 million compared to 2016, reflecting higher revenue, partially

offset by higher programming and production costs.

Theme Parks

Theme Parks revenue increased 15.6% to $1.3 billion in the

second quarter of 2017 reflecting higher attendance and per capita

spending. Revenue growth also benefitted from the timing of spring

break vacations, the continued success of The Wizarding World of

Harry PotterTM in Hollywood, and the openings of Minion ParkTM in

Japan and Volcano BayTM in Orlando. Adjusted EBITDA increased 17.3%

to $551 million in the second quarter of 2017, reflecting higher

revenue, partially offset by an increase in operating expenses,

including costs to support new attractions.

For the six months ended June 30, 2017, revenue from the

Theme Parks segment increased 12.5% to $2.4 billion compared to

2016, reflecting higher attendance and per capita spending.

Adjusted EBITDA increased 12.3% to $948 million compared to 2016,

reflecting higher revenue, partially offset by an increase in

operating expenses, including costs to support new attractions.

Headquarters, Other and Eliminations

NBCUniversal Headquarters, Other and Eliminations include

overhead and eliminations among the NBCUniversal businesses. For

the quarter ended June 30, 2017, NBCUniversal Headquarters,

Other and Eliminations Adjusted EBITDA loss was $236 million

compared to a loss of $174 million in the second quarter of

2016.

For the six months ended June 30, 2017, NBCUniversal

Headquarters, Other and Eliminations Adjusted EBITDA loss was $422

million compared to a loss of $334 million in 2016.

Corporate, Other and Eliminations

Corporate, Other and Eliminations primarily relate to corporate

operations, Comcast Spectacor and our new wireless initiative,

Xfinity Mobile, as well as eliminations among Comcast's businesses.

For the quarter ended June 30, 2017, Corporate, Other and

Eliminations revenue was ($288) million compared to ($278) million

in the second quarter of 2016. The Adjusted EBITDA loss was $292

million compared to a loss of $282 million in the second quarter of

2016.

For the six months ended June 30, 2017, Corporate, Other

and Eliminations revenue was ($605) million compared to ($553)

million in 2016. The Adjusted EBITDA loss was $475 million compared

to a loss of $426 million in 2016.

Notes:

1 We define Adjusted EBITDA (formerly Operating Cash Flow)

as net income attributable to Comcast Corporation before net

(income) loss attributable to noncontrolling interests and

redeemable subsidiary preferred stock, income tax expense, other

income (expense) items, net, and depreciation and amortization, and

excluding impairment charges related to fixed and intangible assets

and gains or losses on the sale of long-lived assets, if any. See

Table 4 for reconciliation of non-GAAP financial measures. 2

All earnings per share amounts are presented on a diluted basis and

reflect the two-for-one stock split on February 17, 2017. 3

We define Free Cash Flow as Net Cash Provided by Operating

Activities (as stated in our Consolidated Statement of Cash Flows)

reduced by capital expenditures, cash paid for intangible assets,

principal payments on capital leases and cash distributions to

noncontrolling interests; and adjusted for any payments and

receipts related to certain nonoperating items, net of estimated

tax effects. The definition of Free Cash Flow excludes any impact

from Economic Stimulus packages. These amounts have been excluded

from Free Cash Flow to provide an appropriate comparison. See Table

4 for reconciliation of non-GAAP financial measures. 4 To be

consistent with our current management reporting presentation,

certain 2016 operating results were reclassified within the Cable

Communications segment. All percentages are calculated on

whole numbers. Minor differences may exist due to rounding.

Conference Call and Other Information

Comcast Corporation will host a conference call with the

financial community today, July 27, 2017 at 7:30 a.m. Eastern Time

(ET). The conference call and related materials will be

broadcast live and posted on its Investor Relations website at

www.cmcsa.com. Those parties

interested in participating via telephone should dial (800)

263-8495 with the conference ID number 39307493. A replay of the

call will be available starting at 12:00 p.m. ET on July 27, 2017,

on the Investor Relations website or by telephone. To access the

telephone replay, which will be available until Thursday, August 3,

2017 at midnight ET, please dial (855) 859-2056 and enter the

conference ID number 39307493.

From time to time, we post information that may be of interest

to investors on our website at www.cmcsa.com and on our corporate

blog, www.corporate.comcast.com/comcast-voices. To automatically

receive Comcast financial news by email, please visit www.cmcsa.com

and subscribe to email alerts.

Caution Concerning Forward-Looking Statements

This press release contains forward-looking statements. Readers

are cautioned that such forward-looking statements involve risks

and uncertainties that could cause actual events or our actual

results to differ materially from those expressed in any such

forward-looking statements. Readers are directed to Comcast’s

periodic and other reports filed with the Securities and Exchange

Commission (SEC) for a description of such risks and uncertainties.

We undertake no obligation to update any forward-looking

statements.

Non-GAAP Financial Measures

In this discussion, we sometimes refer to financial measures

that are not presented according to generally accepted accounting

principles in the U.S. (GAAP). Certain of these measures are

considered “non-GAAP financial measures” under the SEC regulations;

those rules require the supplemental explanations and

reconciliations that are in Comcast’s Form 8-K (Quarterly Earnings

Release) furnished to the SEC.

About Comcast Corporation

Comcast Corporation (Nasdaq: CMCSA) is a global media and

technology company with two primary businesses, Comcast Cable and

NBCUniversal. Comcast Cable is one of the nation’s largest video,

high-speed internet, and phone providers to residential customers

under the XFINITY brand, and also provides these services to

businesses. It also provides wireless and security and automation

services to residential customers under the XFINITY brand.

NBCUniversal operates news, entertainment and sports cable

networks, the NBC and Telemundo broadcast networks, television

production operations, television station groups, Universal

Pictures and Universal Parks and Resorts.

Visit www.comcastcorporation.com for more

information.

TABLE 1 Condensed Consolidated Statement of Income

(Unaudited) Three Months

Ended Six Months Ended (in millions, except per share

data)

June 30, June 30, 2016

2017 2016

2017 Revenue $19,269

$21,165 $38,059

$41,628 Programming and production 5,492

6,341

10,923

12,415 Other operating and administrative 5,763

6,060 11,289

11,887 Advertising, marketing and

promotion 1,559

1,665 3,025

3,195 12,814

14,066 25,237

27,497 Adjusted EBITDA 6,455

7,099 12,822

14,131 Depreciation expense 1,868

1,970 3,653

3,885 Amortization expense 521

571 1,014

1,158 2,389

2,541 4,667

5,043 Operating

income 4,066

4,558 8,155

9,088 Other

income (expense) Interest expense (732 )

(758 )

(1,435 )

(1,513 ) Investment income (loss), net 58

64 88

123 Equity in net income (losses) of investees,

net (19 )

15 (30 )

51 Other income (expense), net (15

)

20 115

55 (708 )

(659

) (1,262 )

(1,284 ) Income before

income taxes 3,358

3,899 6,893

7,804 Income

tax expense (1,278 )

(1,364 ) (2,589 )

(2,622

) Net income 2,080

2,535 4,304

5,182 Net (income) loss attributable to

noncontrolling interests and redeemable subsidiary preferred stock

(52 )

(22 ) (142 )

(103 )

Net income attributable to Comcast Corporation

$2,028

$2,513 $4,162

$5,079

Diluted earnings per common share

attributable to Comcast Corporation shareholders $0.41

$0.52 $0.85

$1.05

Dividends declared per common share $0.1375

$0.1575 $0.275

$0.315

Diluted weighted-average number of common shares 4,891

4,809 4,908

4,820 TABLE 2

Condensed Consolidated Balance Sheet (Unaudited)

(in millions) December 31,

June 30, 2016

2017

ASSETS Current Assets Cash and cash equivalents

$3,301

$2,693 Receivables, net 7,955

7,849

Programming rights 1,250

1,633 Other current assets 3,855

2,657 Total current assets 16,361

14,832 Film

and television costs 7,252

6,595 Investments 5,247

6,521 Property and equipment, net 36,253

37,171 Franchise rights 59,364

59,364

Goodwill 35,980

36,742 Other intangible assets, net

17,274

18,907 Other noncurrent assets, net 2,769

2,899 $180,500

$183,031 LIABILITIES

AND EQUITY Current Liabilities Accounts payable and

accrued expenses related to trade creditors $6,915

$6,730

Accrued participations and residuals 1,726

1,882 Deferred

revenue 1,132

1,448 Accrued expenses and other current

liabilities 6,282

5,858 Current portion of long-term debt

5,480

6,358 Total current liabilities 21,535

22,276

Long-term debt, less current portion 55,566

57,210

Deferred income taxes 34,854

35,409 Other

noncurrent liabilities 10,925

10,837 Redeemable

noncontrolling interests and redeemable subsidiary preferred stock

1,446

1,451 Equity Comcast Corporation shareholders'

equity 53,943

55,005 Noncontrolling interests 2,231

843 Total equity 56,174

55,848 $180,500

$183,031 TABLE 3 Consolidated Statement of

Cash Flows (Unaudited) Six Months Ended

(in millions)

June 30, 2016

2017 OPERATING

ACTIVITIES Net income $4,304

$5,182 Adjustments to

reconcile net income to net cash provided by operating activities:

Depreciation and amortization 4,667

5,043 Share-based

compensation 331

391 Noncash interest expense (income), net

113

122 Equity in net (income) losses of investees, net 30

(51 ) Cash received from investees 42

49 Net

(gain) loss on investment activity and other (126 )

(110

) Deferred income taxes 618

470 Changes in operating

assets and liabilities, net of effects of acquisitions and

divestitures: Current and noncurrent receivables, net 172

18

Film and television costs, net (171 )

277 Accounts payable

and accrued expenses related to trade creditors (104 )

(144

) Other operating assets and liabilities (82 )

(433

) Net cash provided by operating activities 9,794

10,814 INVESTING ACTIVITIES

Capital expenditures (4,156 )

(4,405 ) Cash paid for

intangible assets (737 )

(836 ) Acquisitions and

construction of real estate properties (211 )

(250 )

Acquisitions, net of cash acquired (126 )

(398 )

Proceeds from sales of investments 138

57 Purchases of

investments (580 )

(1,825 ) Other (156 )

170

Net cash provided by (used in) investing activities

(5,828 )

(7,487 ) FINANCING ACTIVITIES

Proceeds from (repayments of) short-term borrowings, net 205

(1,695 ) Proceeds from borrowings 4,753

8,963

Repurchases and repayments of debt (2,551 )

(4,967 )

Repurchases of common stock under repurchase program and employee

plans (2,636 )

(2,476 ) Dividends paid (1,281 )

(1,404 ) Purchase of Universal Studios Japan

noncontrolling interests —

(2,299 ) Issuances of

common stock 19

— Distributions to noncontrolling interests

and dividends for redeemable subsidiary preferred stock (125 )

(137 ) Other 20

80 Net

cash provided by (used in) financing activities (1,596 )

(3,935 ) Increase (decrease) in cash and cash

equivalents 2,370

(608 ) Cash and cash

equivalents, beginning of period 2,295

3,301

Cash and cash equivalents, end of period $4,665

$2,693 TABLE 4

Reconciliation from Net Income Attributable to Comcast

Corporation to Adjusted EBITDA (Unaudited)

Three Months Ended Six Months Ended

June 30, June 30, (in millions) 2016

2017 2016

2017 Net income attributable to Comcast Corporation

$2,028

$2,513 $4,162

$5,079 Net income (loss)

attributable to noncontrolling interests and redeemable subsidiary

preferred stock 52

22 142

103 Income tax expense

1,278

1,364 2,589

2,622 Other (income) expense items,

net(1) 708

659 1,262

1,284 Depreciation and

amortization 2,389

2,541 4,667

5,043 Adjusted EBITDA $6,455

$7,099 $12,822

$14,131

Reconciliation from Net Cash Provided by Operating Activities to

Free Cash Flow (Unaudited) Three Months Ended

Six Months Ended June 30, June 30, (in

millions) 2016

2017 2016

2017 Net cash provided by

operating activities $4,395

$5,158 $9,794

$10,814

Capital expenditures (2,271 )

(2,327 ) (4,156 )

(4,405 ) Cash paid for capitalized software and other

intangible assets (359 )

(420 ) (737 )

(836

) Principal payments on capital leases (7 )

(6

) (17 )

(17 ) Distributions to noncontrolling

interests and dividends for redeemable subsidiary preferred stock

(48 )

(65 ) (125 )

(137 ) Nonoperating

items(2) (61 )

30 (16 )

30 Impact of share-based

compensation accounting change(4) (122 )

— (411 )

— Free cash flow (including Economic Stimulus

Packages) 1,527

2,370 4,332

5,449 Economic Stimulus

Packages(2) (107 )

(151 ) (107 )

(151 )

Total free cash flow $1,420

$2,219

$4,225

$5,298 Alternate Presentation

of Free Cash Flow (Unaudited) Three Months Ended

Six Months Ended June 30, June 30, (in

millions) 2016

2017 2016

2017 Adjusted EBITDA

$6,455

$7,099 $12,822

$14,131 Capital expenditures

(2,271 )

(2,327 ) (4,156 )

(4,405 )

Cash paid for capitalized software and other intangible assets (359

)

(420 ) (737 )

(836 ) Cash interest

expense (512 )

(477 ) (1,235 )

(1,372 )

Cash taxes on operating items (including Economic Stimulus

Packages)(3,4) (1,556 )

(2,047 ) (1,701 )

(2,179 ) Changes in operating assets and

liabilities(4) (300 )

337 (558 )

(243 )

Noncash share-based compensation 178

218 331

391

Distributions to noncontrolling interests and dividends for

redeemable subsidiary preferred stock (48 )

(65 )

(125 )

(137 ) Other 62

52 102

99 Impact

of share-based compensation accounting change(4) (122 )

—

(411 )

— Free cash flow (including Economic

Stimulus Packages) 1,527

2,370 4,332

5,449 Economic

Stimulus Packages(3) (107 )

(151 ) (107 )

(151

) Total free cash flow $1,420

$2,219

$4,225

$5,298 (1) Other (income)

expense items, net include interest expense, investment income

(loss), equity in net income (losses) of investees, and other

income (expense), net (as stated in our Statement of Income).

(2) Nonoperating items include adjustments for any payments

and receipts related to certain nonoperating items, net of

estimated tax effects (such as income taxes on investment sales and

payments related to income tax and litigation contingencies of

acquired companies). Our definition of free cash flow specifically

excludes any impact from the Economic Stimulus Packages and these

amounts are presented separately. (3) Cash taxes on

operating items (including Economic Stimulus Packages) has been

adjusted to exclude the impact of nonoperating items, such as for

cash taxes paid related to certain investing and financing

transactions. Our definition of free cash flow specifically

excludes any impact from the Economic Stimulus Packages and these

amounts are presented separately.

Three Months Ended Six Months Ended June 30, June 30,

2016 2017 2016 2017 Payments of income taxes ($1,495

) ($2,077 ) ($1,685 ) ($2,209 ) Nonoperating items (61 ) 30

(16 ) 30 Cash taxes on operating items (including Economic

Stimulus Packages) ($1,556 ) ($2,047 ) ($1,701 ) ($2,179 )

(4) In 1Q17, we adopted new accounting guidance related to

share-based compensation. The guidance requires excess tax benefits

under share-based compensation arrangements to be classified as an

operating activity rather than a financing activity as they were

under prior guidance. In addition, the new guidance requires when

an employer withholds shares upon exercise of options or the

vesting of restricted stock for the purpose of meeting withholding

tax requirements, that the cash paid for withholding taxes be

classified as a financing activity, which we present in Repurchases

of Common Stock Under Repurchase Program and Employee Plans. We

previously recorded cash paid for withholding taxes as an operating

activity in changes in operating assets and liabilities. These

changes will prospectively affect our calculation of Free Cash

Flow. While we have retrospectively adopted these changes in our

Statement of Cash Flows and the components of Free Cash Flow, we

have not adjusted Total Free Cash Flow for periods prior to January

1, 2017. The table below summarizes the impact to the components of

Free Cash Flow for the share-based compensation accounting change.

Three Months Ended Six Months Ended June 30,

June 30, 2016 2016 Cash taxes on operating items (including

Economic Stimulus Packages) $49 $160 Changes in operating assets

and liabilities 73 251 Impact of share-based compensation

accounting change $122 $411

Note: Minor

differences may exist due to rounding.

TABLE 5 Reconciliation of EPS Excluding

Adjustments (Unaudited) Three Months

EndedJune 30, Six Months EndedJune 30,

2016

2017 2016

2017 (in millions,

except per share data) $ EPS

$ EPS $ EPS

$ EPS

Net income attributable to Comcast Corporation $2,028 $0.41

$2,513 $0.52 $4,162 $0.85

$5,079 $1.05

Growth % 23.9% 26.8% 22.0% 23.5% Gain on sale of

investment(1) — —

— — (67)

(0.02)

— — Net income attributable to Comcast

Corporation (excluding adjustments) $2,028 $0.41

$2,513 $0.52 $4,095 $0.83

$5,079

$1.05 Growth % 23.9% 26.8% 24.0% 26.5% (1)

2016 year to date net income attributable to Comcast Corporation

includes $108 million of other income, $67 million net of tax,

resulting from a gain on the sale of our investment in The Weather

Channel's product and technology business.

Note: Minor

differences may exist due to rounding.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170727005600/en/

Comcast CorporationInvestor Contacts:Jason Armstrong,

215-286-7972Jane Kearns, 215-286-4794orPress Contacts:D’Arcy

Rudnay, 215-286-8582John Demming, 215-286-8011

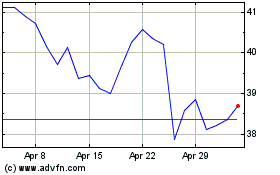

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

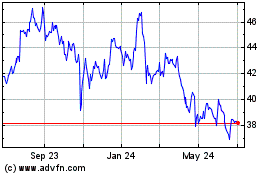

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024