By Shalini Ramachandran

Comcast Corp. reported higher revenue and earnings in its third

quarter, as cable operations added more video subscribers and the

summer Olympics Games powered strong gains at its NBCUniversal

broadcast unit.

NBCUniversal's latest performance is likely to be tracked

closely given AT&T Inc.'s recent agreement to buy Time Warner

for $85.4 billion -- a deal modeled largely on Comcast's purchase

of NBCUniversal, which married content and distribution.

Comcast Chief Executive Brian Roberts declined to comment on the

AT&T deal on a call with analysts on Wednesday, but said that

he believes "we have a fabulous company" and NBCUniversal has been

a great investment.

Its NBCUniversal unit's revenue jumped 28% over a year earlier

to $9.2 billion on business tied to the Rio de Janeiro Olympics

broadcasts. Excluding the boost from the event, NBCU's revenue

increased 5.7% compared with a year earlier.

Comcast added 32,000 video customers to its cable business,

compared with a loss of 48,000 subscribers in the prior-year

quarter, lengthening a strong streak for the cable industry in a

weak overall pay-TV market.

The Philadelphia-based company's improved results highlight

cable's comeback after years of losing video subscribers to

satellite and phone companies. Cable-TV companies are benefiting

from pouring more investment into their services and bundling those

alongside fast broadband internet, and cheaper, slimmed-down

bundles of programming for more cost-conscious consumers.

Total quarterly profit rose to $2.2 billion, or 92 cents a

share, up from $2 billion, or 80 cents a share, a year ago. Revenue

grew 14% to $21.3 billion, though up 5.5% when excluding the

contribution from the 2016 summer Olympics.

Revenue and profit slightly exceeded estimates from analysts,

who were projecting earnings of 91 cents a share on $21.2 billion

in revenue, according to Thomson Reuters.

Comcast may soon have a new media-and-broadband rival. On

Tuesday, AT&T said its new DirecTV Now nationwide streaming

service will be priced at $35 a month and stream more than 100

channels -- an offer that undercuts similar packages from

traditional operators like Comcast and new entrants like Sony

Corp.'s PlayStation Vue.

NBCUniversal Chief Executive Steve Burke said he doesn't think

such online television services are going to be "material" to

television growth "in the next year or two." He expects new

entrants to sign up a fraction of the 20 million homes that don't

subscribe to pay-TV today.

"I think we all have a healthy degree of skepticism that these

new [over-the-top] entrants are going to create millions and

millions and millions of subscribers any time soon," Mr. Burke

said. "Most people find tremendous value...in their cable and

satellite subscriptions and are not looking to change."

Comcast, so far, has said it is focused on its own cable

footprint and isn't interested in creating a nationwide streaming

service. That strategy has paid off for the company, as it has

managed to grow video customers despite cord-cutting affecting the

broader industry. The cable company has, in part, credited its

next-generation X1 internet-connected set-top box and guide, which

it says increases customers' stickiness with Comcast. The company

said nearly 45% of its customers now have X1 boxes.

The cable giant's broadband and business services divisions

posted strong sales growth in the third quarter, lifting overall

revenue at the cable business, which accounts for the bulk of

Comcast's top line, by 6.9% to $12.6 billion.

It added 330,000 broadband customers in the quarter, compared

with 320,000 a year earlier. Voice customer additions slowed to

2,000 from 17,000 a year earlier, as the company focused on adding

"double-play" cable TV and internet customers in the quarter.

Revenue grew 22% to $2.9 billion at NBCUniversal's cable

networks, though excluding the Olympics it would have grown 4.1%.

Revenue at the broadcast-TV segment, which includes the flagship

NBC network, grew 56.6% to $3 billion. Excluding the impact of the

Olympics, it would have declined 3.6%, largely because of a

content-licensing deal in the year-ago quarter.

It cable networks' advertising revenue shot up almost 16% in the

third quarter. But, excluding the Olympics, advertising growth was

flat because higher ad rates were offset by viewership

declines.

Comcast shares fell 3% to $62.55 in Wednesday trading in New

York.

A major point of debate in the media industry of late has been

falling ratings for National Football League games. On the call,

Mr. Burke said between 1% and 2% of people are watching NFL and

Olympics programming online, which doesn't explain the viewership

falloffs.

"It's very difficult to tell precisely what is happening on any

sporting property...but if you step back, the Olympics and the NFL

are the two highest-rated programs of the year in all of

television," Mr. Burke said. He added that both continue to be

"very profitable relationships" for Comcast.

Write to Shalini Ramachandran at

shalini.ramachandran@wsj.com

(END) Dow Jones Newswires

October 27, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

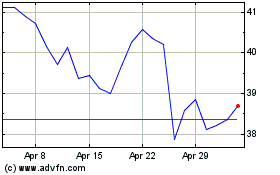

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

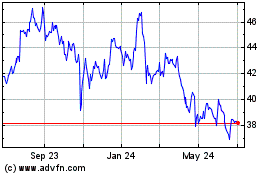

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024