CitiMortgage today announced the launch of its proprietary 2012

Citi Military Road to Recovery Tour featuring five

homeowner-support events near military bases around the country for

current and former members of the Armed Forces. At these events,

Citi’s Homeowner Support Travel Team of mortgage experts and HUD

(Department of Housing and Urban Development) approved housing

counselors will have one-on-one discussions with current and former

members of the military in need of assistance with their mortgages.

Borrowers do not have to be CitiMortgage customers to attend. The

first event will take place in San Diego, California on June

29.

Sanjiv Das, CEO, CitiMortgage (Photo:

Business Wire)

The company is also introducing the Citi Military PCS (Permanent

Change of Station) Transfer Assistance Program, a new, reduced

payment program for qualifying servicemembers who have PCS orders.

Servicemembers required to relocate who have CitiMortgage-owned

first mortgages may have their monthly payments reduced to $250.00,

or to their escrow payment only, for a six-month period.

Sanjiv Das, CEO of CitiMortgage, said, “Military families face

many unique obstacles when it comes to purchasing and maintaining a

home. With the Fourth of July holiday approaching, we’re glad to

offer further support for our troops who sacrifice so much for all

of us.” Mr. Das added, “We would like to thank the military and

veterans organizations and other individuals who have so generously

offered their time and expertise to help us in our efforts.”

Citi Military Road to Recovery Tour

Bob Filner, the U.S. Congressman representing California's 51st

District said, "As Ranking Member of the House Committee on

Veterans' Affairs, I am deeply committed to finding ways to give

back to those who served our country so selflessly. I'm very

pleased that CitiMortgage is introducing its Military Road to

Recovery Tour in San Diego, and that Citi continues to look for new

and unique ways to help support members of our Armed Forces."

Citi Military Road to Recovery events are open to all members of

the military, including veterans, and participants do not have to

be CitiMortgage customers to attend. Any present or former military

personnel may attend to gain understanding of potential solutions

based on their individual circumstances. In these one-on-one

sessions, borrowers facing financial challenges can get clear

answers to questions about their mortgages in a private setting.

Any military mortgage borrowers who have missed payments or believe

they may miss payments in the future are encouraged to attend.

"We provide financial education and counseling to thousands of

service members and their families each year,” said John Pickens,

Executive Director of VeteransPlus, a national Veteran Service

Organization. “When Citi asked us to support their outreach efforts

to the military community, we were happy to help. Together, we are

helping ensure that Veterans and Servicemembers get all the

assistance they need and the financial peace of mind they

deserve."

Military Road to Recovery events are hosted by CitiMortgage

along with local non-profit housing counselor groups in each

market. Housing Opportunity Collaborative (HOC), a Southern

California non-profit organization that seeks to promote equal

access to housing for all persons in the region, will co-host the

first tour event in San Diego on Friday, June 29. CitiMortgage

representatives will be available to meet with CitiMortgage

customers and HOC HUD-approved housing counselors will meet with

non-Citi homeowners.

Subsequent 2012 events include:

- Northern VA

- Norfolk, VA

- San Antonio, TX

- Columbia, SC

Citi Military PCS Transfer Assistance Program

In conjunction with the Military Road to Recovery, CitiMortgage

is launching the Citi Military Permanent Change of Station (PCS)

Transfer Assistance Program. Approximately 60,000 military

homeowners are impacted by PCS orders each year, and this new,

proprietary program can offer immediate financial relief as they

deal with what can be a challenging transition.

The program is available for Armed Services borrowers with

CitiMortgage-owned first mortgages who have to relocate due to PCS

orders. The program will reduce eligible military borrowers’ first

mortgage payments for six months. Monthly payments on non-escrowed

loans will be reduced to $250.00. For escrowed loans, the monthly

payment will be reduced to the escrow payment only.

Michele Pearce, is Senior Vice president of Development for

CredAbility, Citi's partner on Reconnect, the financial education

partnership serving veterans and military families. Ms. Pierce

said, "Our housing counselors speak daily with military service men

and women, their spouses and veterans. Because our goal is to help

them find solutions for stable housing, as part of the counseling

process, we refer any CitiMortgage customer who has a military

background directly to Citi's assistance programs. These programs

give our nation's heroes some important options to achieve stable

housing."

Homeowners eligible for the program will be required to verify

their PCS orders prior to enrollment. Borrowers do not have to

provide evidence of financial hardship to be enrolled, and the

loans can be current or delinquent. FHA, VA, Rural Development and

Private Investor loans are not eligible, and other restrictions may

apply.

During the six-month period, CitiMortgage’s military homeowner

assistance team will work with borrowers on an ongoing basis. If a

customer needs longer term assistance, Citi will offer personalized

advice and review borrowers’ specific needs for potential long-term

solutions. For borrowers who are moving and no longer wish to own

their homes, CitiMortgage may offer them release from their

mortgage obligations through either a short sale or a Deed in

Lieu.

CitiMortgage has developed and implemented a variety of

additional programs to assist active duty military and veterans,

including the Citi Disabled Veterans Mortgage Relief Program, which

allows veterans disabled in the line of duty to make reduced

monthly payments on CitiMortgage-owned mortgages; CredAbility

Reconnect, a special collection of financial wellness resources

available to servicemembers; and Veterans on Wall Street

(VOWS), which is a program that

employs veterans at Citi. Further information is available at

www.citisalutes.com. As a result of these programs and other

efforts, Citi has been named a finalist for the 2012 Secretary of

Defense Employer Support Freedom Award, which is given to

organizations that provide exceptional support for Guard and

Reserve employees.

For CitiMortgage customers who would like more information on

the Road to Recovery Tour events, or for those who are unable to

attend an event but would like assistance, please call

1-866-915-9417 (select Option 4). Information for Citi’s Road To

Recovery events, including San Diego, can be found at

www.citiroadtorecovery.com. Non-Citi customers inquiring about the

event may call HOC on 619-283-2200.

About Citi:

Citi, the leading global bank, has approximately 200 million

customer accounts and does business in more than 160 countries and

jurisdictions. Citi provides consumers, corporations, governments

and institutions with a broad range of financial products and

services, including consumer banking and credit, corporate and

investment banking, securities brokerage, transaction services, and

wealth management.

Additional information may be found at www.citigroup.com |

Twitter: @Citi | YouTube: www.youtube.com/citi | Blog:

http://new.citi.com | Facebook: www.facebook.com/citi | LinkedIn:

www.linkedin.com/company/citi

Photos/Multimedia Gallery Available:

http://www.businesswire.com/cgi-bin/mmg.cgi?eid=50326176&lang=en

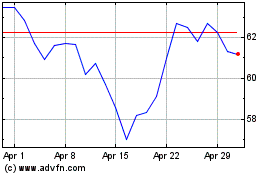

Citigroup (NYSE:C)

Historical Stock Chart

From Mar 2024 to Apr 2024

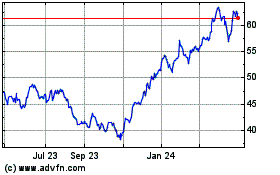

Citigroup (NYSE:C)

Historical Stock Chart

From Apr 2023 to Apr 2024