Chobani Rejects PepsiCo Offer to Buy Stake -- Update

February 05 2016 - 9:37PM

Dow Jones News

By Annie Gasparro and Mike Esterl

Chobani Inc. said it rejected an offer from PepsiCo Inc. to buy

a majority stake in the company.

The U.S. yogurt maker hired Goldman Sachs last summer to seek a

partnership with a major food company.

Chobani said Friday that the soda and snacks giant expressed

interest but was looking for a majority stake. Chobani said it was

only interested in selling a minority stake.

PepsiCo declined to comment Friday.

Chobani Founder and Chief Executive Hamdi Ulukaya presented his

strategy to multiple companies, hoping a partnership would help

propel Chobani into other product categories like dips and expand

to other countries.

The company now plans to pursue those opportunities on its own,

a Chobani executive told The Wall Street Journal on Friday.

"We took our time with this process, conducted thorough due

diligence and in the end, given our strong performance, we decided

to fund our new growth initiatives ourselves while keeping our

independence, which is important to us," Chobani spokesman Michael

Gonda said.

PepsiCo had already been in the yogurt business through a U.S.

joint venture with Germany's Theo Müller Group. It ended that

venture in December because of weak sales.

PepsiCo declined at the time to comment on any plans to re-enter

the U.S. yogurt market but said it remained committed to growing

its nutrition business, including the dairy category.

Chobani has built a roughly $1.5 billion yogurt brand in just

eight years, giving it nearly 20% of all U.S. yogurt sales,

according to market research firm Nielsen.

The company, still majority owned by Mr. Ulukaya, ran into some

growing pains in 2013 as it rapidly expanded across the country and

opened a new yogurt plant.

Chobani's business rebounded last year, benefiting from the help

of private-equity investors who cut costs and from a successful new

yogurt with granola and other mix-ins called Chobani Flip.

Müller Quaker Dairy LLC began selling products in the U.S. in

2012 and opened a $200 million plant in 2013 to take aim at the

fast-growing U.S. yogurt market. The move also fit with PepsiCo's

strategy of expanding into more "good for you" products.

But PepsiCo and Müller struggled to take market share from

established yogurt brands including Chobani, General Mills Inc.'s

Yoplait and Dannon, owned by France's Danone SA.

Write to Annie Gasparro at annie.gasparro@wsj.com and Mike

Esterl at mike.esterl@wsj.com

(END) Dow Jones Newswires

February 05, 2016 21:22 ET (02:22 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

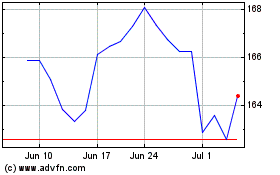

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From Mar 2024 to Apr 2024

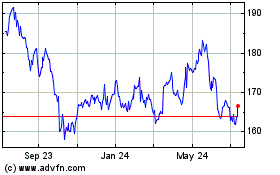

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From Apr 2023 to Apr 2024