Chipotle, Ackman Near Settlement

November 18 2016 - 7:40AM

Dow Jones News

Chipotle Mexican Grill Inc. and William Ackman are nearing a

settlement that would give the activist investor a say in the

boardroom at the beleaguered burrito chain.

The Denver company and Mr. Ackman's Pershing Square Capital

Management LP, which disclosed a 9.9% stake two months ago, have

been discussing changing the board and could reach an agreement

soon, according to people familiar with the matter. A deal isn't

assured and could be delayed or fall apart, they said. Both the

company and Mr. Ackman say they've had a cordial relationship.

A settlement could head off a potentially expensive and

distracting public fight over the board, which shareholders,

analysts and governance experts say hasn't properly performed its

role of overseeing and guiding management, especially during a

food-safety crisis that has hobbled the company's sales and

performance for over a year.

Chipotle has said it was already on a path to changing its

nine-member board. Chris Arnold, a spokesman for Chipotle, said on

Thursday the company is "actively looking" for new board directors

and has an "open dialogue" with all the shareholders. He declined

to comment further.

Even before Mr. Ackman's arrival, some investors have questioned

the independence of a board whose members have largely been with

the 23-year-old company from the start and have close ties to the

company's founder, Chairman and Co-Chief Executive Steve Ells. For

instance, some point to a lack of marketing savvy and food-safety

experience contributing to the company's slow response and say the

board is more like a startup than a nearly $12-billion company.

The company's strategy of giving away free food hasn't been

enough to lure back customers scared off by a string of outbreaks,

including salmonella and E. coli outbreaks that sickened customers

in several states a year ago. Chipotle last month said its

same-store sales fell a worse-than-expected 21.9% in the third

quarter. Profit fell 95% and shares of Chipotle are down 31% in the

past year.

"The food-safety crisis really exposed shortcomings in

Chipotle's management and governance," said Jeff Gramm, a small

activist who owns about $8 million in shares.

Four of Chipotle's seven outside directors were appointed to the

board when Chipotle was still privately held. Two worked at former

owner McDonald's Corp. but have been retired for at least 15 years.

Only one other independent member has other restaurant experience.

Shareholders say that the board members' industry experience is too

little and not recent enough.

Two other board members used to work at the same pharmaceutical

company as Mr. Ells's father, who was an early investor in

Chipotle. Five of the directors are at least 60.

Barclays Research said Chipotle's board members have the

second-longest tenure, behind Buffalo Wild Wings Inc., of all the

restaurants it covers. Chipotle's board has an average tenure of 14

years, compared with the industry average of eight and the S&P

500 average of nine. Proxy advisory firm Institutional Shareholder

Services in April criticized the makeup as not in line with

Chipotle's size.

Some investors said a dual-CEO structure slows responses and is

too expensive.

Other governance experts are focused on getting a new chairman.

CtW Investment Group, which represents union pension funds that own

approximately $22 million in Chipotle stock, and Amalgamated Bank,

another investor, are seeking a nonbinding shareholder vote to

separate the chairman and CEO role. They often push such votes.

"If they just add one or two people to this standing group

that's chummy, it will be no panacea to their problems," said

Derrick Wortes, lead equity analyst at CtW.

Joe Dennison of Zevenbergen Capital Investments LLC, which holds

about $40 million in shares, said criticism of the board discounts

strong growth before the outbreaks.

For Mr. Ackman, a settlement would mark an important victory

after two rough years of losses in investments, particularly

Valeant Pharmaceuticals International Inc. Some activist watchers

have questioned if he'd be able to win support amid his

performance.

Some Chipotle investors say he has been more positive in

meetings about Chipotle management than they expected.

He told Pershing Square's investors last week that his

relationship with Chipotle was productive, and that he and Mr. Ells

had mutual friends.

His partners defended Chipotle's response to the crisis on the

conference call, saying "the company has done a very good job of

significantly reducing the risk of another incident while still

maintaining the freshness and taste of its food." They also said

Chipotle could expand mobile ordering and catering and more than

double its store count to grow sales, even if the chain didn't win

back all of its customers.

Write to David Benoit at david.benoit@wsj.com and Julie Jargon

at julie.jargon@wsj.com

(END) Dow Jones Newswires

November 18, 2016 07:25 ET (12:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

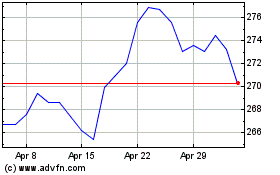

McDonalds (NYSE:MCD)

Historical Stock Chart

From Mar 2024 to Apr 2024

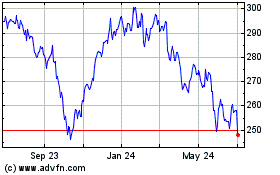

McDonalds (NYSE:MCD)

Historical Stock Chart

From Apr 2023 to Apr 2024