IBM to reveal new line of microprocessors as AMD touts its Zen

processor technology

By Don Clark

Few companies enjoy the kind of dominance Intel Corp. does in

chips for the computers found in data centers. But competitors keep

trying to pry open its server stronghold, with International

Business Machines Corp. the latest to brandish a new tool.

IBM, at a Silicon Valley technical conference on Tuesday, plans

to reveal new details of Power9, the next addition to the line of

microprocessors the technology giant uses in its own servers and --

in a recent strategy shift -- offers to other hardware

companies.

Advanced Micro Devices Inc., meanwhile, is using the same event

to discuss the inner workings of processor technology called Zen

that it plans to use in chips targeting servers and other hardware.

AMD, which uses the same x86 design as Intel, last week at a

company event demonstrated a chip using Zen processor cores

outpacing its larger rival's chips in one speed test.

"We had let our performance slip versus the competition," said

Mark Papermaster, AMD's senior vice president and chief technology

officer. "This really is quite a statement to the industry that AMD

is back in high-performance processors."

ARM Holdings PLC, which licenses chip technology used in most

mobile phones, is also discussing plans at the Hot Chips conference

to add features for use in supercomputers and other scientific

applications. The British company estimates that 13 companies

already are using its technology in chips for servers and other

data-center hardware, which are expected to compete with Intel

products.

Of 9.81 million servers shipped last year, x86 chips were used

in 9.6 million of them -- a 98% share, International Data Corp.

estimates. Intel in the second quarter accounted for 99.7% of x86

server-chip shipments to just 0.3% for AMD, according to Mercury

Research.

Server chips command much higher prices and profit margins than

Intel's other products. The company's data center group in 2015

posted $7.8 billion in operating profit on revenue of nearly $16

billion -- a margin of 49%, compared with just under 30% for the

unit that sells chips for PCs.

"There is an awful lot of margin going to Intel," said Matthew

Eastwood, an IDC analyst. "Customers want alternate suppliers."

That is particularly true of large Web services such as Google

Inc. and Facebook Inc., major Intel customers that nonetheless have

encouraged other suppliers. Google, for instance, was one of the

original members of OpenPower.org, a group IBM helped establish in

2013 to promote use of its chip technology by other companies.

Big Blue hopes to accelerate that push with Power9, which comes

in two basic designs. One chip, with 24 processor cores, is

targeted for Web-type companies that break up jobs to be handled by

hundreds or thousands of machines. Another, with 12 cores, is aimed

at larger systems designed for running applications like corporate

databases.

IBM and others are partly motivated by the increasing popularity

of deep learning, a trend helping to fuel sales of servers and

server chips lately. The technique, a branch of a broader field

called artificial intelligence, allows computers to handle tasks

such as recognizing faces and speech by analyzing vast troves of

data rather than explicitly programming them to do so.

The Power9 chips, expected to begin arriving in the second half

of 2017, have communication links that are especially designed to

exchange data with graphics processing units sold by Nvidia Corp.

That company's chips are now used mainly with Intel processors for

deep-learning applications.

"The hot space is on these workloads," said Brad McCredie, chief

technology officer for IBM's Power line who also holds the title of

fellow.

The point hasn't been lost on Intel, which has moved to add

technology to satisfy server buyers. It paid $16.7 billion last

year for Altera Corp., whose programmable chips can be used

alongside Intel processors to accelerate particular computing

chores.

Intel earlier this month purchased Nervana Systems Inc., a

startup making artificial-intelligence chips and software. It also

used an annual developer conference last week to discuss plans to

use an existing chip line called Xeon Phi for deep-learning

applications.

"We take all competition very seriously," said an Intel

spokesman on Monday.

AMD expects to deliver a 32-core server chip based on its Zen

technology in the second quarter of 2017. Lisa Su, its chief

executive, estimated the company had spent nearly four years and

hundreds of millions of dollars on the development effort.

Analysts said the company still has to prove the final product

can perform in the field as well as in tests, but initial results

seem promising.

"They don't have to be faster than Intel," said Linley Gwennap,

an analyst with the Linley Group. "They just have to be close

enough so they can compete on price."

Write to Don Clark at Don.Clark@wsj.com

(END) Dow Jones Newswires

August 24, 2016 02:49 ET (06:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

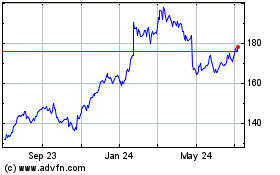

International Business M... (NYSE:IBM)

Historical Stock Chart

From Mar 2024 to Apr 2024

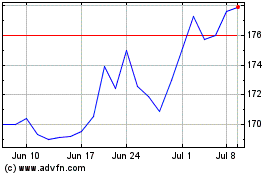

International Business M... (NYSE:IBM)

Historical Stock Chart

From Apr 2023 to Apr 2024