Chip Deal Would Shift Qualcomm -- WSJ

October 01 2016 - 3:02AM

Dow Jones News

By Don Clark

Qualcomm Inc. is best known for designing smartphone chips --

and leaving the production to others. Now, the San Diego-based

company is in talks to acquire chip manufacturer NXP Semiconductors

NV in a strategy shift that adds to the substantial risks of a

purchase.

Capturing Netherlands-based NXP likely will cost more than $30

billion, and lead to owning seven factories in five countries that

turn silicon wafers into chips. Besides those plants, known as

fabs, NXP operates seven facilities that package and test chips

before they are sold.

NXP, which became a bigger manufacturer through the purchase

last year of Freescale Semiconductor, churns out more than half of

its vast line of products from those factories. It is the No.1

supplier of automotive chips, a fast-growing market. Analysts

believe the potential to supply its chips for self-driving cars is

a major motivation for Qualcomm to pursue deal talks first reported

by The Wall Street Journal on Thursday.

Qualcomm pioneered what the semiconductor industry calls the

"fabless" business model. The company's popular wireless chips,

used in the smartphones of Apple Inc. and others, are mostly

manufactured by Taiwan Semiconductor Manufacturing Co. and firms

that build products to order for chip designers.

Analysts and industry executives say running factories requires

a different set of management skills than designing chips. Those

include tracking the age and performance of manufacturing

equipment, overseeing a supply chain of materials and managing

production workers, who are represented by labor unions in some NXP

locations.

"It's a very, very different thinking process," said Alex Lidow,

chief executive of chip designer Efficient Power Conversion

Corp.

He opted for a fabless model when co-founding the El Segundo,

Calif., startup after 12 years as CEO of International Rectifier

Corp., which operated a global network of factories with

similarities to NXP's. "I don't want to do that again, frankly," he

said.

The fabless model allows chip designers to avoid the cost of

operating and building advanced fabs, which can cost more than $10

billion each for facilities that can create the most advanced

chips. Qualcomm will continue to need that level of production

technology from partners to keep its wireless chips competitive

with rivals -- particularly Intel Corp., which both designs and

builds its own devices.

NXP, by contrast, has older factories that couldn't be easily

adapted to make Qualcomm's chips, analysts say. The company

inherited operations that began more than 60 years ago as part of

the Dutch giant Philips NV and Motorola Inc., which spun off its

chip business to create Freescale.

Mature plants like NXP's are maintained throughout the industry

to produce some kinds of chips, particularly those that use analog

rather than digital technology for applications such as radio. Dan

Hutcheson, an analyst at VLSI Research Inc., said NXP's fabs are

highly profitable, in part because their production gear was

written off years ago.

Mr. Hutcheson said Qualcomm executives have developed a

sophisticated understanding of manufacturing issues by overseeing

work handled at partners such as TSMC. "They won't understand how

you actually run a fab, " he said. "That could potentially trip

them up, but I don't think that is a big deal."

There are other management challenges to consider that are

associated with a deal for NXP, which people familiar with the

situation don't expect to be signed for two to three months. One

comes from NXP's sheer size. The Dutch company has about 45,000

employees, according to public filings, substantially more than the

33,000 Qualcomm disclosed last year in its most recent annual

report.

Another challenge concerns sales. Qualcomm gets most of its

revenue from a handful of smartphone makers, including Apple and

Samsung Electronics Co. NXP sells chips to thousands of companies

through a large sales team that couldn't easily be combined with

Qualcomm's, analysts say. Reducing the number of salespeople has

been part of the rationale for other semiconductor deals.

A deal for NXP also would substantially diversify Qualcomm's

business beyond mobile handsets. "You have significantly spread out

your revenues and you are less susceptible to a loss of one

critical customer," said Chanan Greenberg, a vice president at

Model N Inc., which makes software that chip makers use to manage

the sales process.

NXP has a broad set of technologies that could become

particularly valuable in connection with the Internet of Things, a

phrase that refers to adding sensors, communications and computing

capability to all kinds of everyday devices. It is a major supplier

of chips called microcontrollers, for example, that manage

calculating functions in many categories of office and industrial

equipment as well as cars.

NXP also has a leading position in chips for near-field

communications, or NFC, a short-range wireless technology used for

applications such as completing payments on smartphones and

unlocking car doors.

Write to Don Clark at don.clark@wsj.com

(END) Dow Jones Newswires

October 01, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

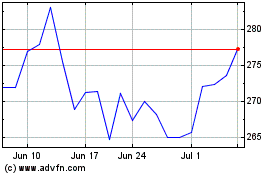

NXP Semiconductors NV (NASDAQ:NXPI)

Historical Stock Chart

From Mar 2024 to Apr 2024

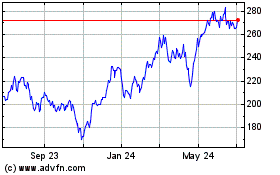

NXP Semiconductors NV (NASDAQ:NXPI)

Historical Stock Chart

From Apr 2023 to Apr 2024