Chinese Chip Giant Tsinghua Unigroup to Build Memory Factory

November 05 2015 - 1:00PM

Dow Jones News

BEIJING—Tsinghua Unigroup Ltd. plans to plow more than $12

billion into a new memory chip plant and semiconductor

acquisitions, as the Chinese state-owned company continues a drive

to build a globally competitive chip maker.

Months after an unsuccessful effort to acquire U.S. memory chip

maker Micron Technology Inc., Tsinghua Unigroup will build a memory

chip factory and make further acquisitions through a newly acquired

subsidiary, Tongfang Guoxin Electronics Co., according to a

Tongfang Guoxin filing on the Shenzhen stock exchange Thursday.

The investments will be Tsinghua Unigroup's latest in a buying

spree this year. They come as China's leaders have made it a

national priority to reduce the country's dependence on western

technology and build domestic technology champions.

"The integrated circuit sector has obtained strong support from

national policy," said Tongfang Guoxin in the filing, in discussing

its reasons for building the plant.

"Guoxin" means "national microchip" in Chinese.

Tongfang Guoxin said in the filing that it will raise 80 billion

yuan ($12.6 billion) in a private placement, with the majority of

the funds coming from Tsinghua Unigroup and an investment company

controlled by Tsinghua Unigroup's chairman Zhao Weiguo.

Unlisted Tsinghua Unigroup announced Monday it would buy a

controlling 36.4% stake in Tongfang Guoxin, a listed sister company

in the same influential state-owned conglomerate Tsinghua Holdings

Co. But Tsinghua Unigroup's and Mr. Zhao's combined share of

Tongfang Guoxin will climb to around 88% after the private

placement, just shy of the 90% threshold that would require

delisting from the Shenzhen stock exchange, two people familiar

with the deal said. The transaction consolidates two chipmaking

rivals within Tsinghua Holdings.

Of the new funds, 60 billion yuan will go toward a new memory

chip plant, and 16.2 billion yuan toward acquisitions "upstream and

downstream in the microchip supply chain." The remaining 3.8

billion yuan will go toward Tsinghua Unigroup's purchase of a 25%

stake in Taiwan's Powertech Technology Inc., which was announced on

Friday.

Tsinghua Unigroup has been active as of late. In October, it

hired Charles Kau, the head of Taiwan memory chip maker Inotera

Memories Inc., a joint venture between Micron and Taiwan's Nanya

Technology Corp. The company struck a deal in September to buy a

15% stake in U.S. disk drive maker Western Digital Corp. It

acquired a controlling stake in Hewlett-Packard Co.'s China

networking gear unit earlier in the year.

Write to Eva Dou at eva.dou@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 05, 2015 12:45 ET (17:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

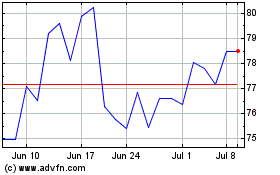

Western Digital (NASDAQ:WDC)

Historical Stock Chart

From Mar 2024 to Apr 2024

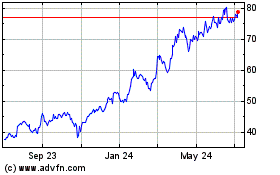

Western Digital (NASDAQ:WDC)

Historical Stock Chart

From Apr 2023 to Apr 2024