China's Wanda Group in Talks to Acquire Dick Clark Productions

September 26 2016 - 6:30PM

Dow Jones News

China's richest man is going for glamour with his latest

Hollywood blockbuster.

Billionaire Wang Jianlin is in discussions to acquire control of

Dick Clark Productions at a valuation of about $1 billion through

his Dalian Wanda Group Co., according to people with knowledge of

the situation. Dick Clark Productions would be the latest trophy in

an empire that includes theater chain AMC Entertainment Holdings

Inc. and movie producer Legendary Entertainment.

If completed, the deal would give China's Wanda the television

production company that stages some of Hollywood's glitziest and

most popular awards shows, including the Golden Globe Awards and

the American Music Awards.

One of the people cautions that the talks are still at an early

stage and there remains a valuation gap between the two sides.

Some of the people said that Wanda has been the leading bidder

for the company in discussions over recent weeks. However, the

talks could still fall apart, and it remains unclear if a competing

bid could emerge late in the game. The company has been shopped by

Dick Clark Productions' bankers to a number of Chinese buyers

including major companies and private-equity firms.

Wanda is known in China primarily as a commercial property

developer. But in recent years the company has become an aggressive

buyer of entertainment assets overseas—from movie theaters to a

production company to sporting events. At home, Wanda is building

theme parks to counter Walt Disney Co.'s push into mainland

China.

Dick Clark would be Wanda's biggest foray into U.S. television

assets and builds on its interest in Hollywood-related deals.

TheWrap previously reported that Dick Clark Productions was looking

to sell to a Chinese buyer at a $1 billion valuation.

Founded in 1957 by the late television personality, Santa

Monica-based Dick Clark Productions was sold to a group of

investors led by investment firm Guggenheim Partners in 2012 for an

undisclosed value. Late last year, Guggenheim sold Dick Clark

Productions and a couple of other media assets to a company

controlled by Guggenheim's then-president, Todd Boehly, who took a

step back from Guggenheim to man the newly formed company Eldridge

Industries. Mr. Boehly, now the CEO of Eldridge, remains on the

executive council at Guggenheim.

Wanda, a property-to-entertainment conglomerate, could bring to

China some of the world's most viewed live TV programs. The Golden

Globes attracted 18.5 million viewers this year, while the 2016

Billboard Music Awards drew about 9.6 million viewers and the 2015

American Music Awards drew about 11 million viewers. Beauty pageant

"Miss America," another event run by Dick Clark Productions, also

gets millions of domestic American viewers.

Betting on the brand of live event programming owned by Dick

Clark Productions holds some risks, given that big awards shows

like the Emmy Awards, Golden Globe Awards and Oscars experienced

ratings drops this year, along with a broader dip in TV ratings.

Viewership for the Golden Globes, for instance, slipped 4.2% this

year from a year ago.

Despite the recent declines, big television spectacles are still

coveted by advertisers looking to reach broad audiences.

The purchase comes after Wanda's failed pursuit this year of a

49% stake in movie studio Paramount Pictures, which is owned by

Viacom Inc. Viacom's newly expanded board announced last week that

it decided not to sell a stake in Paramount, a plan that had been

opposed by controlling shareholder Sumner Redstone.

Wanda's ambitions in Hollywood seemingly have no limits. Early

this year, Wanda paid $3.5 billion to take over Legendary

Entertainment, which has produced summer blockbusters including

"Pacific Rim," "Godzilla" and "Jurassic World."

Mr. Wang also owns the U.S.'s No. 2 movie-theater operator AMC

Entertainment, which it bought in 2012 for about $2.6 billion, and

is seeking to acquire the Carmike Cinemas chain, which would make

him the largest theater operator in the U.S. He also has agreed to

buy Europe's largest cinema chain, Odeon & UCI Cinemas Group,

for $650 million.

In another deal announced last week, Wanda said it was teaming

up with Sony Pictures Entertainment Inc. to help market its films

in China. Under the deal, Wanda would promote Sony films to Chinese

moviegoers through its ticketing platform and entertainment

venues.

Wanda could also showcase Sony films on its more than 2,000

screens in China, and, according to a person familiar with the

arrangement, it will have the option to buy a small stake in some

films it helps market, if Sony agrees.

Mr. Wang also is building a chain of entertainment theme parks

in China, including an Oriental Movie Metropolis in Qingdao that

will include film production studios.

Write to Shalini Ramachandran at shalini.ramachandran@wsj.com,

Rick Carew at rick.carew@wsj.com and Kane Wu at Kane.Wu@wsj.com

(END) Dow Jones Newswires

September 26, 2016 18:15 ET (22:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

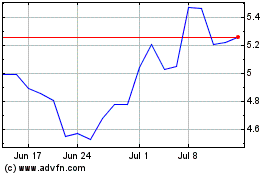

AMC Entertainment (NYSE:AMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

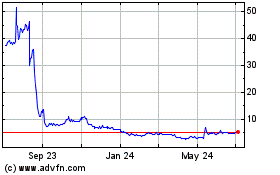

AMC Entertainment (NYSE:AMC)

Historical Stock Chart

From Apr 2023 to Apr 2024