BEIJING—China's ride-hailing champion, after besting Uber

Technologies Inc., appears to be facing a tougher opponent in

domestic regulators.

Several major cities issued proposed industry regulations in

recent days that would restrict the types of vehicles that can be

used and who can drive them, potentially crimping a large chunk of

Didi Chuxing Technology Co.'s business. Meanwhile, the country's

antitrust regulators continued to investigate Didi's deal to

acquire U.S.-based Uber's China unit.

Didi issued a strongly worded protest over the weekend against

the draft regulations from Beijing, Shanghai, Shenzhen and at least

three other major cities. The company said the rules, if adopted in

their current form, would force "the vast majority" of its drivers

and cars off the road.

"Millions of online ride-hailing drivers may be about to lose

their jobs and paychecks, which would mean millions of families may

lose an important income source," Didi said in its statement.

Didi's open criticism of the government's plans marked a rare

departure from common practice for a Chinese company. Didi has

previously said it welcomed regulation of the evolving ride-hailing

sector, and the company, one of China's hottest startups with a

valuation of more than $33 billion, had been enjoying smooth going

in recent months.

China's national regulators this summer officially legalized the

sector, which had operated in a gray area. Didi's main rival, Uber,

ceded the market after a costly competition in which the companies

subsidized rides. Didi added Apple Inc., Foxconn Technology Group

and Baidu Inc. this year to its investor list, which already

includes Chinese internet majors Tencent Holdings Ltd. and Alibaba

Group Holding Ltd. In recent months, Didi began reducing subsidies

and raising fares.

Local Chinese traffic regulators have remained skeptical of

Didi, concerned about whether its drivers are adding to traffic

congestion and competing with established taxi companies. Antitrust

regulators also began scrutinizing Didi's pricing power after the

company said in August it agreed to acquire Uber's China unit. The

combined entity, in which Uber and other investors would have a 20%

stake, is likely to account for an overwhelming share of rides, if

Didi's and Uber's track records hold.

"We must maintain our strategy of prioritizing public

transportation to use the road resources reasonably, decrease the

use of motor vehicles and ease traffic congestion," Beijing's

municipal traffic authority posted on its Weibo social-media

account, in remarks similar to those issued by the other

cities.

The draft rules from Beijing, Shanghai and Shenzhen would limit

drivers to those with local residency permits, and require cars to

meet size restrictions and have Global Positioning System and

emergency alert devices installed. Some cities plan to require

ride-hailing vehicles to have a minimum wheelbase, which would rule

out some small compact cars.

The rules may be amended before being adopted. National

regulations for the ride-hailing sector were less restrictive when

adopted than they were in a first draft issued last year.

In their current form, the latest rules are likely to make Didi

a more expensive service, with fewer drivers and passengers,

analysts said. "The era in which ride-hailing services are

significantly cheaper than taxis or other special car services is

gone," said Xiaofeng Wang, a China internet sector analyst for

Forrester.

By requiring local residency permits, the rules take particular

aim at a mainstay of the 14 million drivers Didi relies on—migrant

workers who generally work for lower pay than local residents.

Didi said Saturday that only less than 2.4% of its drivers in

Shanghai were local residents. A spokeswoman didn't reply to

requests to explain why this percentage is far lower than the 69%

the company cited last year.

Some Didi passengers joked that the new rules would make the

company's drivers desirable dating prospects, with the pool limited

to those with good quality cars and sought-after big-city residence

permits.

For migrant drivers, however, the proposed regulations are

creating uncertainty. Ge Wanjiang, who works and lives in Beijing,

bemoaned that the might be forced back to his hometown, the eastern

city of Heze. The 43-year-old said he purchased a Volkswagen

Santana with his savings two months ago so he could work as a

driver for UberChina, which Didi is buying.

"If the policy does not allow us to drive as an Uber driver in

Beijing, how do I deal with my car?" Mr. Ge said. "I have to go

back to Heze, but it will be useless in my hometown."

Chinese experts have been divided on regulation of the sector,

with some arguing for a lighter touch to help boost new internet

businesses, while others urge caution.

"We have to understand that ride-hailing via the internet is

still a taxi service at some point," said Li Junhui, a scholar at

the China University of Political Science and Law. "This industry

should develop moderately instead of with great force."

Yang Jie and Kersten Zhang contributed to this article.

Write to Eva Dou at eva.dou@wsj.com

(END) Dow Jones Newswires

October 10, 2016 10:05 ET (14:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

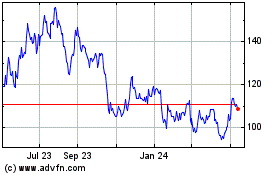

Baidu (NASDAQ:BIDU)

Historical Stock Chart

From Mar 2024 to Apr 2024

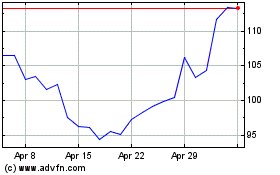

Baidu (NASDAQ:BIDU)

Historical Stock Chart

From Apr 2023 to Apr 2024